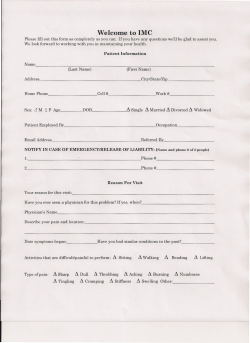

Wellbeing Health insurance policy document