INTERNATIONAL BUSINESS CASE JEUX DU COMMERCE 2013

INTERNATIONAL BUSINESS CASE JEUX DU COMMERCE 2013 Written by Geneviève Cleroux-Perrault and Valérie Larochelle for the Jeux du Commerce Data Sources: http://www.srgnet.com/pdf/DC%20SRG%20March%2016%20Release.pdf http://www.sk-ii.com/en/index.aspx http://www.pg.com/en_US/brands/beauty_grooming/skii.shtml http://www.pg.com/en_US/brands/beauty_grooming/olay.shtml http://www.ddfskincare.com/skin-care/skin-care-system/article-our-dermatologicapproach,default,pg.html?bc=true http://knowledgetoday.wharton.upenn.edu/2012/10/estee-lauders-new-skin-care-brand-inchina-the-potential-for-high-risk-high-reward/ AC Nielsen Market Track Data Canada, Skin Care Category, data ending 30 June 2012. http://www.cosmeticsdesign-asia.com/Market-Trends/Euromonitor-reveals-the-state-of-theAsia-Pacific-skin-care-market INTERNATIONAL BUSINESS CASE – JDC 2013 2 Congratulations! You have been selected as the consulting company to assess the current potential of Procter and Gamble (P&G) in targeting the fast growing segment of the Asian population, in particular in the Canadian skin care market. Procter & Gamble: the company Since the beginning of its activities in 1837, P&G has managed to grow itself around the world thanks to innovative product development and key acquisitions. Whether through the launch of such products as Tide®, Crest® and Pampers®, or more recently with Febreze® and Swiffer®, the disciplined innovation of P&G has allowed the company to commercialize high-value quality products and services that improve the quality of life of consumers around the world. Since the middle of the 1980s, diverse acquisitions have allowed P&G to refine and continue its mission. Brands such as Vicks®, Oil of Olay®, Tampax®, Clairol® and Pantene® are excellent examples of this continued growth. In 2005, P&G acquired Gillette® and adds Duracell® Gillette®, Oral-B® and Braun® to its brand portfolio. Procter & Gamble Canada distributes more than 100 brands, grouped into 2 divisions: 1) Beauty & Grooming and 2) Household Needs. With more than 138,000 employees working in 80 countries, P&G recorded sales of $82.6 billion in 2011. Democraphic overview: Asian population in Canada Asian population is the fastest growing ethnic group in Canada. We believe that understanding the ethnic media will help P&G target that white space opportunity that is the Asian population. What we mean by ethnic media is to target and design marketing especially for a specific minority ethnic group. “Ethnic media plays a much larger role in the lives of fast-growing groups than traditional media measurement would indicate.” 1 The largest and fastest-growing ethnic groups, Chinese and South-Asian Canadian segments, are particularly heavy consumers of mostly in-language ethnic media.1 75% of Chinese Canadians and 75% of South Asian Canadians aged 15 and over have used at least one ethnic radio, TV station, or newspaper in the last seven days. Among Hispanic Canadians, 55% have done so in the last week. Only 50% of Chinese Canadians and 57% of South Asian Canadians are reached by Englishlanguage newspapers. English radio reaches 44% of South Asian Canadians, and 53% of Chinese Canadians. English TV performs a little better in terms of reach, reaching 74% of South Asian Canadians and 65% of Chinese Canadians. More than half (52%) of the ethnic groups surveyed agree with the statement: “I rarely see advertising messages intended for me,” suggesting a significant lost opportunity.- Source Solutions research group” In language: in the mother tongue INTERNATIONAL BUSINESS CASE – JDC 2013 3 See appendix 1 for more details about media and other preferences for Asian population Skin Care market: Skin Care category definition: Products that focus on delivering improved overall appearance of the face, neck, and eye area. Includes products that cleanse, moisturize, prevent/treat skin conditions (such as wrinkles, age spots, blackheads, and wrinkles), regimen kits, and deep cleansing manual devices. It includes also anti-aging, complexion care and essentials. Skin Care Category in Canada Executive Summary by Euromonitor Trends The skin care category in 2011 consisted mainly of facial care (77% of value sales), followed by body care (20%) and then hand care (3%). These ratios have remained relatively stable throughout the review period. The market grew by 5% in current value terms to reach a size of C$1,597 million, comparing favourably to the value CAGR of 5% during the review period. Growth during the review period however has been declining since 2005 (11%) to a low of 3% in 2009. The downturn in the economy affected growth in this category, but not as much as it did in other beauty and personal care categories. Skin care is an essential part of most women’s daily routines, and while most women are content to bargain shop for items such as shampoos, conditioners and toothpaste, they are fairly brand loyal to their skin care regimens. Competitive Landscape In 2011, L'Oréal Canada Inc ranked the highest in market value share with 18% (sales of C$292 million) due to the success of its Lancôme, Maybelline New York and L'Oréal Paris brands. L’Oréal Canada maintains a strong presence in both the mass and premium segments. The company was among the first to distribute its premium products through mass channels, primarily drugstores. The company’s key premium brands in skin care include Lancôme, Vichy, Biotherm and La Roche-Posay, while in the mass segment the company features L’Oréal Dermo-Expertise and other L’Oréal Paris subbrands. The company`s premium Biotherm line ranked fourth in the body care segment with 7% of market value share, while Lancôme, Biotherm and Vichy all were in top five positions in terms of premium face masks and premium facial moisturisers. L'Oréal`s La Roche-Posay brand was promoting its line of adult acne cream called Effaclar K, which is interesting as the industry has seen a sharp decline in commercially available acne creams as an increasing number of acne sufferers are moving to prescription acne medications. Prospects The skin care category is projected to post a 3% CAGR in constant value terms to reach a market size of C$1,840 million by 2016. Fairly modest growth will be driven by a slowdown in several areas, including anti-agers. This is due to the fact that the market is becoming more mature and saturated, and it is becoming difficult for manufacturers to continue the pace of new innovations and product launches. While product innovation will continue, marketing will become increasingly important to maintain a high INTERNATIONAL BUSINESS CASE – JDC 2013 4 level of consumer awareness of new and upcoming products. It will be necessary for manufacturers to communicate their benefits to customers in view of the multitude of products already on store shelves in all price ranges, many claiming technological breakthroughs in skin care.2 The Skin Care Category in Canada is worth $382 Million in Sales with a +4% growth over the past 12 months. This growth is driven by: Cleansers: $166 Million +2% vs. Year Ago (YA) Moisturizers and Treatments: $202 Million +2% vs. YA Facial Depilatories: $6 Million +188% vs. YA (Olay +60% of growth)* *Source: AC Nielsen Market Track Data in Canada, ending June 30 2012. 2 Euromonitor, July 2012 http://www.euromonitor.com/skin-care-in-canada/report INTERNATIONAL BUSINESS CASE – JDC 2013 5 Canadian Skin Care Category – AC Nielsen INTERNATIONAL BUSINESS CASE – JDC 2013 6 Source: AC Nielsen Canada, Market Track Data ending December 31 2011 P&G has a range of skin care brands in its global Portfolio that might meet the Canadian-asian population needs. Olay (available in Canada) Olay is a worldwide leader in skin care and has been trusted by women for 60 years. Olay has a promise to women everywhere. It continues to hold to the philosophy it was founded on: to maintain a deep understanding of women’s changing needs and to combine products that fit their needs with the latest advances in skin care technology. INTERNATIONAL BUSINESS CASE – JDC 2013 7 SK-II: Top Selling skin care brand in Asia For more than 30 years, SK-II has touched the lives of millions of women around the world by helping them to “Live Clear” through the miracle of crystal clear skin and life. Since its launch, SK-II with PiteraTM has become a special secret shared by celebrities such as Cate Blanchett and women around the world, transforming skin along the five dimensions of texture, radiance, firmness, spot control and wrinkle resilience critical to crystal clarity. A leading skincare brand in 13 markets, it continues to deliver the transformative power of crystal clear skin and life through well-loved products including Facial Treatment Essence SK-II is a prestige skin care brand not yet available in Canada SK-II is perceived as one of the most expensive skin care brand in the world DDF: derm-solutions In 1991, renowned New York dermatologist Dr. Howard Sobel founded DDF—Doctor’s Dermatologic Formula—to enable his patients to care for their skin at home. Inspired by dermatologic approach and expertise, the DDF skin care system is designed with advanced protocols targeting one or more of the specific skin concerns below. DDF targets root causes with: o Antioxidants to help neutralize surface free radicals o Cleaning formulations to help remove excess sebum o Surface-penetrating hydration to help strengthen the skin’s moisture barrier DDF is a prestige skin care brand not yet available in Canada What is currently happening in Asia: According to Euromonitor, Asia Pacific region has some of the highest numbers of new product launches. Industry experts believe that the anti-aging category is where most of the growth will come from. In the article “Euromonitor reveals the state of the Asia-Pacific skin care market”, industry analyst Irina Barbalova notes: “Asia Pacific has set the trend from creams to skin lightening, and premium antiagers are to be one of the strongest performing categories with a 7.7 percent global value growth”. INTERNATIONAL BUSINESS CASE – JDC 2013 8 As consultant you are allowed to consult publicly available information on internet. We suggest you consult the full-article on Asia-Pacific skin care market. The link is : www.cosmeticsdesignasia.com/Market-Trends/Euromonitor-reveals-the-state-of-the-Asia-Pacific-skin-care-market The Challenge P&G Canada is trying to expand its portfolio vertically in Canada to meet new and growing consumer needs in the skin care category. The Asian market in Canada seems to be a very interesting white space that could be targeted. As our lead preferred consulting firm we are expecting you to provide us with a recommendation. Based on the information below, what strategy should P&G Canada follow to address this white space opportunity? We believe that 3 options exist, feel free to suggest any other if we forgot an alternative. Should you recommend P&G to: o o o Develop a new brand for the Asian population in the Canadian market? Take an existing brand and adapt it to make it more appealing to this segment? Introduce a global or Asian brand from the existing portfolio into the Canadian market? In order to make this project sustainable and implementable you should consider the following elements: 1. 2. 3. 4. 5. A good return on investment Consumer needs and preferences An eye-level timeline for the overall project A detailed description of short-term assignments and objectives for the chosen Possible risks and their mitigations INTERNATIONAL BUSINESS CASE – JDC 2013 9 APPENDIX 1 For Immediate Release STUDY EXPLORES MEDIA USE AMONG GROWING ETHNIC GROUPS TRADITIONAL MEASUREMENT SHORTCHANGES ADVERTISERS TORONTO (March 16, 2006) As Canada’s population becomes more diverse, traditional media measurement tools are becoming inadequate in their ability to provide an accurate read of audiences, according to a new study by Solutions Research Group, a Toronto-based market research firm. The study, the first of its kind in Canada, examines six major population groups in Toronto, Vancouver and Montreal, including Canadians of Chinese, South Asian, West Asian, Hispanic and Italian backgrounds, as well as Black Canadians. Among the findings: Internet is a vital media option and a communications tool for all ethnic groups surveyed – and they are more likely to have broadband in the home. o 88% use the Internet, slightly above the market benchmark (market benchmark being the general population of Toronto, Montreal and Vancouver). Average time spent with Internet per day is 1.8 hours per person among the major ethnic groups surveyed, slightly ahead of the market benchmark of 1.7 hours. o Chinese Canadians are particularly active users of Internet averaging 2.4 hours a day – about the same amount of time they spend with television – and significantly higher than time spent with radio. 80% of Chinese Canadians use Internet at home (vs. 68% market average). Major ethnic groups in Toronto, Vancouver and Montreal are somewhat lighter users of traditional radio, TV and newspapers. INTERNATIONAL BUSINESS CASE – JDC 2013 10 o o o 5-day readership of daily newspapers – in any language – is 16% lower among major ethnic groups surveyed than it is among the market benchmark. Radio tuning among major ethnic groups is 9% below the market benchmark, while TV is 4% below average. While they tend to spend less time watching TV, ethnic Canadians are more likely than the market benchmark to have digital cable or satellite TV (41% vs. 39%). Black and Chinese Canadians lead on this measure (47% and 44%, respectively). Ethnic media plays a much larger role in the lives of fast-growing groups than traditional media measurement would indicate. The largest and fastest-growing ethnic groups, Chinese and South-Asian Canadian segments, are particularly heavy consumers of mostly in-language ethnic media. 75% of Chinese Canadians and 75% of South Asian Canadians 15+ have used at least one ethnic radio or TV station, or ethnic newspaper in the last seven days. Among Hispanic Canadians, 55% have done so in the last week. Only 50% of Chinese Canadians and 57% of South Asian Canadians are reached by Englishlanguage newspapers. English radio reaches 44% of South Asian Canadians, and 53% of Chinese Canadians. English TV performs a little better in terms of reach, reaching 74% of South Asian Canadians and 65% of Chinese Canadians. More than half (52%) of the ethnic groups surveyed agree with the statement: “I rarely see advertising messages intended for me,” suggesting a significant lost opportunity. “Rapid population change in major markets is a serious challenge to traditional media measurement – and this issue is not going away. Current measurement tools such as BBM, Nielsen or NADBank either ignore or severely underrepresent millions of people in major markets, resulting in a waste of advertiser dollars,” said Kaan Yigit, Study Director for Diversity in Canada. The information for this release comes from the Media Use section of Diversity in Canada, an independent syndicated research study. To maintain an unbiased perspective, Solutions Research Group funds its own syndicated research studies. Diversity in Canada delivers a one-of-a-kind perspective on Canada’s fastest-growing population groups in Toronto, Vancouver and Montreal. A total of 3,000 respondents (age 15+) were interviewed in 9 languages: English, French, Cantonese, Mandarin, Punjabi, Hindi, Urdu, Spanish and Italian. This is the second of a series of data releases from Diversity in Canada. Upcoming releases will cover subjects such as social attitudes, sports, communications and technology. Contacts Kaan Yigit, [email protected] 416.323.1337 x 22 David Ackerman, [email protected] 416.323.1337 x 25 2200 YONGE STREET, SUITE 910 TORONTO, ONTARIO CANADA M4S 2C6 TEL 416 323 1337 FAX 416 323 0338 WWW.SRGNET.COM INTERNATIONAL BUSINESS CASE – JDC 2013 11 To give after the first hour of the case: Our marketing department just gave us this article. It looks like Estée Lauder is also going after this market and thinking about it with an interesting angle. It is now giving us even more thought around if P&G should leverage a similar approach for the Asian population in Canada? We hope this article will help continue you work around analyzing our different alternatives. Estee Lauder’s New Skin Care Brand in China: The Potential for Highrisk, High-reward Posted on October 15, 2012 Can Estee Lauder Companies make “Osiao” a household word in China’s luxury skin care market? The New York-based manufacturer of skin care, makeup, fragrance and hair care products is banking that Chinese women will buy a new high-end brand tailored specifically for them, designed to promote what Estee Lauder’s scientists say Asian women want most in a skin care product — “natural radiance.” Already known for such brands as Bobbi Brown, Clinique, MAC, Origins and La Mer, among others, Estee Lauder’s decision to launch a whole new brand — rather than simply a new product — suggests the company is confident that an initiative begun more than five years ago will expand Estee Lauder’s footprint not just in China, but throughout Asia. The Osiao product line is expected to sell for between US$45 and US$190. The venture is not without risk. Osiao — which is being introduced this month in only two department stores in Hong Kong and on some Cathay Pacific Airways Hong Kong flights – already faces competition from other Asian skin care products. In addition, its success depends to some extent on continuing strength in the high-end luxury market, despite weakening in the Chinese economy overall. And some observers question whether a hybrid product like Osiao will appeal to Chinese women. According to a New York Times article, Osiao will use English labels but its formulas will contain such ingredients as ginseng, Asiatic pennywort and ganoderma. INTERNATIONAL BUSINESS CASE – JDC 2013 12 Wharton faculty familiar with the Chinese market are generally optimistic about Estee Lauder’s venture, while also noting the challenges that any new brand faces. “As part of the Estee Lauder family, Osiao can and should leverage the high brand equity of Estee Lauder in the Chinese market, at least in the initial stage,” says marketing professor Qiaowei Shen. “Brand name is still a very important element when Chinese consumers are choosing their skincare products.” While it probably won’t be hard “to convince some consumers to try the new brand, the difficult part [will be] to convert them to loyal customers. The true quality of the product is ultimately the key.” The concept of using Chinese herbs as ingredients in skincare products is not new, Shen adds. “A brand that claims to specifically cater to Chinese or Asian skin types does not necessarily win market share. Many brands originating from Korea and Japan, which are designed for Asian skin by nature, already have products with ginseng or other Chinese plants as ingredients. How is Osiao different from these?” The market “is there *and+ the brand will enjoy a glow from the *reputation+ of the parent company,” says Shen. “But in the end, whether consumers are going to repeat their purchase and spread positive word of mouth depends on whether the product quality lives up to their expectations.” A More Sophisticated Market Estee Lauder, founded in 1946, is experiencing strong growth in China. The company reported a rise in fiscal fourth quarter earnings of 25% and a 9.2% increase in revenue, to $2.25 billion. According to an article in The New York Times, fiscal 2012 is the first year that sales in the Asia Pacific region exceeded $2 billion. The company sells its products in more than 150 countries and territories mainly through limited distribution in, for example, high-end department stores and perfumeries, and specialized retail stores. China, with sales of $500 million, is its third largest market, behind the U.S. and Japan. Wharton marketing professor Barbara Kahn gives Estee Lauder high marks for “understanding how important skin care is to the Chinese consumer. One of the key differences between China – and Asia, in general — and the U.S. is the importance of skin care products. If you look at a typical drugstore, even a Sephora in Asia versus one in the U.S., you will see a larger percentage of the store devoted to [those items+.” Kahn also points out that Chinese consumers think of the skin care process “as a multi-step regime, and they take it very seriously. They are generally more sophisticated in this category than the typical American consumer.” Given the importance of the skin care category “and the amount of money consumers are willing to spend, this strategy of developing a new local brand makes a lot of sense.” Estee Lauder’s initiative is “brilliant *as well as+ risky,” according to Wharton marketing professor David Reibstein. In China, he says, a number of trends come into play: “A strong desire to be beautiful, with a heavy concern about skin care; a desire to be on the leading edge of fashion and skin care [as shown by] designer clothes, shoes and cosmetics all coming from other parts of the world; and a desire for, and intrigue with, foreign brands *as shown by+ the popularity of some of the most visible fashion brands.” The fact that Estee Lauder understands “the Chinese market, the skin care needs of the market, premium positioning and branding, and how to gain distribution” suggests the new brand will be a INTERNATIONAL BUSINESS CASE – JDC 2013 13 “winner,” Reibstein adds. The risk for Estee Lauder is that “it’s a crowded market…. The big question is whether there is room for both La Mer [another premier skin product from Estee Lauder+ and Osiao.” Wharton operations and information professor Marshall Fisher – who was in China recently teaching a global supply chain management course — breaks the scenario into two questions: Will a high-priced product sell in China, and how much should the company adapt the product to Chinese tastes? The answer to the first question “is clearly ‘yes,’ if you look at the number of successful luxury brands that have entered the country,” Fisher says. “The reason is that even though average disposable income in China is below [that in] the West, it is such a big country that the top of the income pyramid is huge. This has made China a prime target for luxury brands.” Products entering China have adapted to varying degrees, Fisher adds. “Nike changed little, but KFC changed almost everything; their comment was, ‘All we brought from the U.S. was the picture of the Colonel.’ Both have been highly successful in China. Evidently, people who buy Nike buy it in part because it is a Western brand, and adapting it too much would destroy that value. I would guess that Estee Lauder is more like Nike than KFC.” At a dinner on the last day of their course, Fisher discussed this second question with the head of Starbucks in China. The Starbucks executive noted how the company eventually “tweaked Starbucks’ menu and flavors enough to make them appealing to Chinese consumers,” says Fisher. “His remark was that they finally figured out that consumers in China who buy Starbucks are looking for a Western experience, but one that is tuned to their taste buds.” Competition from Other Brands Fisher’s co-instructor in the global course was Edwin Keh, CEO of the Hong Kong Research Institute for Apparel and Textiles. He recalls a presentation at Wharton earlier this year in which he learned two things: First, that “Chinese consumers like lightly scented products and think a lot of Western products are too strong and overpowering. And second, that the Asian market sells [more] skin protection, skin tone lightening and moisturizers than the West, probably because the Chinese market is dominated by urban professionals who work in crowded and polluted environments.” Also, he noted, “light skin tone is considered a sign of beauty.” Osiao “looks to be a very exclusive high-end niche brand” being launched at a top Hong Kong department store that is equivalent to Saks or Neiman Marcus in the U.S., Keh says. “The line can command a higher price point and probably will have fairly small volumes for the immediate future. This may be a good way to test the market and tweak the product.” But Keh, like others, points to the “significant brand competition from Japanese and Korean beauty brands, *which+ align very well with the Chinese consumer and have near-market advantages.” Beauty products and next-to-skin apparel “are tough to sell and expensive to market, especially in China,” Keh adds. “So a new brand will be high risk, high return. It will be interesting to see how this plays out.” INTERNATIONAL BUSINESS CASE – JDC 2013 14 Although some observers express concern that Osiao could cannibalize Estee Lauder’s other brands in China, Shen does not see this as likely. “Given its pricing and positioning, it is targeting a different consumer segment from the average consumers of Estee Lauder and Clinique,” its two best-known brands in China. Instead, “the introduction of Osiao seems to explore the market opportunity with the ever-growing wealthy class in China. There is a segment of affluent Chinese consumers who are willing to spend a lot on skincare products. The economic downturn of China has little impact on the behavior of this segment.” Keh concurs: “The timing of the release could have been better, given the recent doom and gloom, but the rich Chinese consumer is still spending and there are still lots of rich Chinese. So I don’t see *the current economy+ as an issue.” Wharton marketing professor John Zhang describes why he thinks Osiao represents “a very far-sighted strategy. Up to this point, Chinese consumers worship anything Western, especially in cosmetics. However, at some point in the future, Chinese customers will become more rational, they will want to go back to their roots, they will value their own heritage and they will want the things that are good specifically for them. When that day comes, pure Western brands will lose their luster,” but Osiao may not. Building a new brand from scratch is clearly expensive, he adds. “For that reason, starting in Hong Kong is a good way to test the water. In addition, it is also a good way to establish the high-end positioning. I believe that the success of the brand will depend on two things. First, there has to be solid science behind the new formulation. Without it, the brand will not succeed in China for long, and ginseng alone will not carry the brand for sure. Second, good marketing must balance modernity, tradition and science, especially in cosmetics.” o o http://www.nytimes.com/2012/09/25/business/estee-lauder-develops-a-brand-justfor-china.html?pagewanted=all&_r=0 http://knowledgetoday.wharton.upenn.edu/2012/10/estee-lauders-new-skin-carebrand-in-china-the-potential-for-high-risk-high-reward/ INTERNATIONAL BUSINESS CASE – JDC 2013 15

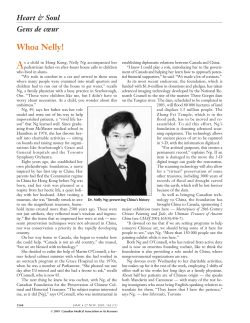

© Copyright 2026