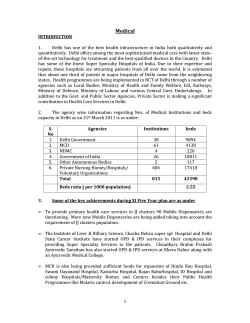

2008 IFA (BORDER ROADS) MANUAL