PDF of Top 10 Fastest Growing Canadian Industries

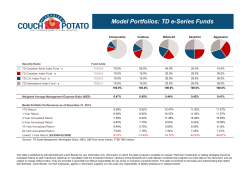

WWW.IBISWORLD.COM January April 2015 1 2014 1 Top 10 on Follow fastest headgrowing on Master Canadian page Aindustries April 2015 Top 10 fastest growing Canadian industries By Ibrahim Yucel While some industries have merely recovered from the economic downturn, others have flourished due to longer-term consumer trends The fastestgrowing Canadian industries represent a variety of sectors The Canadian economy’s recovery from the recession has had wideranging impacts on domestic industries over the past five years. The ten fastest-growing industries over the past five years, measured by average growth in sales per year and compiled from IBISWorld’s 424 Canadian industry reports, feature industries from a variety of sectors, including heavy manufacturing, wholesaling and professional business services. While each industry exhibited strong revenue growth, some have experienced cyclical growth while others have grown due to more secular trends. For example, the Nonferrous Metal Foundry Products Manufacturing industry has merely recovered from poor performance during the economic downturn and is unlikely to reach prerecessionary revenue levels. In contrast, up-andcoming industries, such as recycling facilities, have flourished due to longer-term shifts in consumer preferences. Similarly, industries such as fertilizer manufacturing have experienced wildly fluctuating demand, while others, such as the Beauty, Cosmetics and Fragrance Stores industry, have grown steadily over the five-year period. Nonferrous Metal Foundry Products Five-year annualized growth rate: 12.7% Unlike the broader metal manufacturing sector, the Nonferrous Metal Foundry Products industry has outperformed the economy as a whole during the past five years, although its high growth rate is mostly due to a quick postrecessionary recovery. Despite recent growth, the industry faces intense import competition, which has forced many companies out of the industry in recent years. Remaining domestic manufacturers have increasingly offered value-added services such as design support, custom-made castings and metallurgical testing to compete more effectively against imports. Nonetheless, foreign competition is expected to slow the industry’s growth considerably during the next five years. However, successful Canadian metal foundries will continue to work with domestic customers to design high-precision, customized castings. Recycling Facilities Five-year annualized growth rate: 9.6% Recycling facilities have flourished during the past five years because of rising environmental consciousness among www.ibisworld.com | 1-800-330-3772 | info @ibisworld.com WWW.IBISWORLD.COM April 2015 2 Top 10 fastest growing Canadian industries Canadian households and favourable regulatory conditions. Furthermore, rapid technological advances, such as automated trommels and eddy current separators, have allowed recycling companies to separate, sort and reclaim recyclable materials more effectively and efficiently than ever before. These improvements have reduced operating costs, attracted new industry entrants and boosted industry employment an average 10.4% per year. Over the next five years, the prices of glass, aluminum and other reusable materials are expected to increase, boosting demand for reclaimed materials from downstream nondurable goods manufacturers. In addition, ongoing government initiatives such as the Waste Diversion Act and the Policy on Green Procurement will continue to drive demand for recycling services. Fertilizer Manufacturing Five-year annualized growth rate: 9.4% Although the Fertilizer Manufacturing industry has grown overall in the past five years, its performance has been particularly volatile because of fluctuating input prices and erratic demand from downstream agricultural markets. For example, in 2013, a worldwide drop in the price of potash, a key fertilizer input, led to a massive 9.2% decline in industry revenue; however, Manufacturing sector vs. Fertilizer manufacturing rebounding prices helped boost revenue by 12.9% in 2014. During the next five years, the industry is expected to outperform the overall economy, although growth will depend heavily on the world prices of potash and agricultural commodities such as soybeans and wheat. Strong demand from the United States, particularly for fertilizers used in corn production, will likely drive rising exports. Beef and Pork Wholesaling Five-year annualized growth rate: 8.7% The Beef and Pork Wholesaling industry has undergone a strong postrecessionary recovery during the past five years. Rebounding demand from the industry’s key markets, which include grocery stores and food service establishments, has helped propel the industry since 2010, when decreased consumer spending and low red meat prices reduced industry revenue to just $6.0 billion. However, revitalized consumer spending and rising livestock prices beginning in 2011 helped drive industry revenue to over $8.9 billion in 2014. Although per capita red meat consumption is expected to fall slightly during the next five years, consumers will be more likely to purchase premium meat products, such as grass-fed or organic varieties. Since distributors can sell these Administrative services sector vs. Recycling facilities 30 45 Fertilizer manufacturing Manufacturing sector 15 0 -30 Administrative services sector 10 0 -15 Year Recycling facilities 20 Revenue Revenue 30 07 09 11 13 15 SOURCE: IBISWORLD -10 Year 07 09 11 13 15 SOURCE: IBISWORLD WWW.IBISWORLD.COM April 2015 3 Top 10 fastest growing Canadian industries products at higher margins, this trend will likely become a primary driver of industry growth. Truck, trailer and motor home manufacturing Five-year annualized growth rate: 8.6% Despite strong recovery during the past five years, annual revenue for the Truck, Trailer and Motor Home Manufacturing industry remains well below prerecessionary levels. The industry is highly cyclical in that demand for recreational vehicles (RVs) depends heavily on shifts in consumer incomes and preferences, while demand for trucks and trailers depends on downstream demand from freighting companies. Since retirees are the largest market for RVs and motor homes, industry operators have benefited from an aging domestic population. During the next five years, strong demand from freight operators will likely drive revenue from the industry’s commercial market. However, competition from imported trucks and trailers will continue to pose a threat to domestic manufacturers. five years, growth is expected to slow as the world price of gold remains relatively stable and the costs associated with environmental compliance continue to rise. Beef Cattle Production Five-year annualized growth rate: 7.0% The Beef Cattle Production industry, which raises cattle for food inputs, has benefited in the past five years from rising livestock prices, strong export volume to the United States and rebounding demand for red meat from domestic households and food service establishments. While per capita meat consumption in Canada has declined during the past five years, rapidly rising cattle prices and strong demand from foreign markets have nonetheless helped drive strong recovery. In particular, cattle prices have increased an annualized 13.9% in the five years to 2015, while exports to the United States, the largest consumer of beef products, have grown 12.0% per year on average. However, beef cattle production has slowed in recent years, and in the next five years the industry is expected to underperform the overall economy. Gold and Silver Ore Mining Real Estate Investment Trusts Five-year annualized growth rate: 7.9% Five-year annualized growth rate: 6.7% The Gold and Silver Ore Mining industry performed very well during the first half of the five-year period as the world prices of gold and silver skyrocketed in 2010 and 2011. As a result, industry revenue spiked a whopping 22.9% in 2010 and another 9.0% the following year. However, gold and silver prices have fallen in recent years, including a decline of 15.4% in 2013. Industry operators are expected to continue suffering from higher extraction costs and reduced profitability as the price of gold falls a projected 8.3% in 2015. Accordingly, revenue is expected to increase only 0.5% in 2015. During the next Like mutual funds, real estate investment trusts (REITs) use pooled capital to purchase, licence or finance incomebearing real estate. Unlike the US market, the Canadian housing market did not crash during the recession, and has actually continued to bloom during the past decade. Despite some speculation of a looming housing bubble, REITs have performed well during the past five years as the value of Canadian real estate has remained relatively high, and the values of both residential and nonresidential construction have risen. However, rising long-term interest rates since 2012 have shifted the WWW.IBISWORLD.COM April 2015 4 Top 10 fastest growing Canadian industries About IBISWorld Inc. Recognized as the nation’s most trusted independent source of industry and market research, IBISWorld offers a comprehensive database of unique information and analysis on every US industry. With an extensive online portfolio, valued for its depth and scope, the company equips clients with the insight necessary to make better business decisions. Headquartered in Los Angeles, IBISWorld serves a range of business, professional service and government organizations through more than 10 locations worldwide. For more information, visit www.ibisworld.com or call 1-800-330-3772. investor market from REITs to alternative investments that yield higher returns. Accordingly, industry revenue has waned during the latter half of the five-year period. During the next five years, industry performance will continue to depend on the overall state of the Canadian housing market and other macroeconomic factors. Beauty, Cosmetics and Fragrance Stores Five-year annualized growth rate: 6.6% Beauty, cosmetics and fragrance stores sell a variety of personal care products to households and professionals, including hair stylists and makeup artists. During the past five years, industry growth was primarily driven by favourable consumer trends, although broader economic factors such as rising disposable income and increased consumer spending have also helped boost industry performance. Historically, consumers turned to department stores for premium skincare and cosmetic products, but in recent years have increasingly visited specialty beauty stores that offer a wider range of premium products. This trend is likely to continue in the coming years, although brick-and-mortar beauty stores will face intensifying competition from Top Canadian Industries [email protected] IBISWorld Sales & Subscriptions Phone: 1-917-267-0351 www.ibisworld.com Corporate Wellness Services Five-year annualized growth rate: 6.4% Corporate wellness services provide workplace programs designed to evaluate and improve the well-being of employees, reduce health-related costs and increase workplace productivity. A widening talent gap in the labour market has encouraged businesses to invest in wellness programs that attract the most talented candidates. Accordingly, demand for industry services has increased in line with rising healthcare costs, increased corporate profit and a stabilizing labour market during the past five years. However, the industry has experienced a massive surge of new entrants, which has heightened competition among operators. Furthermore, corporate wellness providers are increasingly competing with in-house wellness programs and similar services provided by fitness clubs and large health insurance companies. Despite these potential challenges, the industry is expected to continue outperforming the overall economy during the next five years. 2015 Revenue 2010-15 2010-15 ($ million) Revenue growth* Employment growth* Nonferrous Metal Foundry Products 1,815.7 12.7% 5.3% Recycling Facilities Fertilizer Manufacturing 1,032.2 9.6% 10.4% 5,081.7 9.4% 3.8% Beef and Pork Wholesaling 9,121.9 8.7% 1.5% Truck, Trailer and Motor Home Manufacturing 4,679.2 8.6% 0.2% Gold and Silver Ore Mining 7,374.3 7.9% 2.6% Beef and Cattle Production 9,612.1 7.0% -2.7% Industry Contact: Media Relations online beauty retailers. Overall, the industry is expected to outperform the overall economy during the five years to 2020. Real Estate Investment Trusts 8,853.5 6.7% 6.7% Beauty, Cosmetics and Fragrance Stores 1,256.6 6.6% 4.9% 153.4 6.4% Corporate Wellness Services 7.9% *ANNUALIZED; SOURCE: IBISWORLD www.ibisworld.com | 1-800-330-3772 | info @ibisworld.com At IBISWorld we know that industry intelligence is more than assembling facts. It is combining data with analysis to answer the questions that successful businesses ask. Identify high growth, emerging and shrinking markets Arm yourself with the latest industry intelligence Assess competitive threats from existing and new entrants Benchmark your performance against the competition Make speedy market-ready, profit-maximizing decisions Who is IBISWorld? We are strategists, analysts, researchers and marketers. We provide answers to information-hungry, time-poor businesses. Our goal is to give you the real-world answers that matter to your business in our 700 US industry reports. When tough strategic, budget, sales and marketing decisions need to be made, our suite of Industry and Risk intelligence products give you deeply researched answers quickly. IBISWorld Membership IBISWorld offers tailored membership packages to meet your needs. Join and become an industry expert! Disclaimer This product has been supplied by IBISWorld Inc. (‘IBISWorld’) solely for use by its authorized licensees strictly in accordance with their license agreements with IBISWorld. IBISWorld makes no representation to any other person with regard to the completeness or accuracy of the data or information contained herein, and it accepts no responsibility and disclaims all liability (save for liability which cannot be lawfully disclaimed) for loss or damage whatsoever suffered or incurred by any other person resulting from the use of, or reliance upon, the data or information contained herein. Copyright in this publication is owned by IBISWorld Inc. The publication is sold on the basis that the purchaser agrees not to copy the material contained within it for other than the purchasers own purposes. In the event that the purchaser uses or quotes from the material in this publication – in papers, reports, or opinions prepared for any other person – it is agreed that it will be sourced to: IBISWorld Inc. © Copyright 2015. IBISWorld Inc.

© Copyright 2026