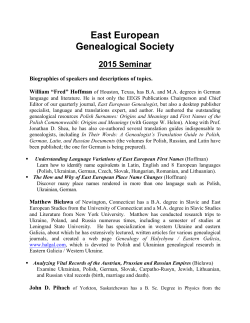

Our Experience â capital markets

Mergers & Acquisitions / Private Equity / Capital Markets Our profile For many years we have been involved with top international law firms, advising domestic and international banks and other financial institutions, corporates and governmental agencies We combine a thorough understanding of the local market with the skills necessary to complete sophisticated cross-border transactions. We are capable of coordinating and successfully managing complicated transactions of various types. Our law firm comprises of the team of experienced advisors. Our key lawyers have been recognized by top legal market rankings. We distinguish ourselves by a creative and mature approach to legal issues and a complex approach to transactions and our clients’ matters. Providing legal advice matching the standard of top international law firms, we also offer flexible remuneration schemes Mrowiec Fiałek i Wspólnicy / Confidential 2 Key Practices Our key practices include: M&A and complex legal advice concerning sales of businesses, including preparing of sale transactions Advising private equity funds Joint ventures Corporate law matters Public offers of securities and capital market transactions, including IPOs and listings on stock exchanges Acquisitions and disposals of blocks of shares (including controlling stakes) in companies listed on stock exchanges (public take – overs) Regulatory matters related to capital markets and concerning financial institutions Management contracts and options schemes Tax structuring and tax optimizations We also advise on real estate, labor law, public law, intellectual property rights, litigation and arbitration. Mrowiec Fiałek i Wspólnicy / Confidential 3 Our Experience - M&A / PE Experience of our lawyers in mergers and acquisitions gained during their careers to date includes, inter alia, advising: Montagu Private Equity on acquisition of Emitel, a leading Polish operator of radio and TV infrastructure TVN S.A., on strategic partnership between TVN and Ringer Axel Springer Media AG concerning Onet.pl S.A. Group TVN S.A. on the merger of two platforms of pay TV, TVN with Polish platform of Canal+ Krzysztof Gradecki on the sale of majority stake in Eko Holding S.A. Liberty Global Inc. on the acquisition of Aster, one of the largest Polish operators of integrated cable TV services (TV, internet, phone) and wireless (cellular phone) from funds managed by Mid Europa Partners LLP Liberty Global and UPC on divestment of Aster cable network Innova Capital on the acquisition of 70% shares in Marmite International S.A., leading European producer of bathroom ceramics from cast marble Innova Capital on take-over of Bakalland S.A. Advent International, on a successful public bid for 100% shares in Wydawnictwa Szkolne i Pedagogiczne S.A., the largest publisher of educational books in Poland Mrowiec Fiałek i Wspólnicy / Confidential 4 Our Experience - M&A / PE Société Générale Asset Management Alternative Investments on the acquisition of controlling stake in Konsalnet S.A., an entity operating in cash processing, security and monitoring Société Générale Asset Management Alternative Investments on the transfer of G1 Group sp. z o.o. as a part of internal restructuring of SGAM group Konsalnet Holding S.A. on the acquisition of a Romanian subsidiary Konsalnet Holding S.A. on the sale of selected business lines Konsalnet Holding S.A. on the acquisition of G4S Polska Enterprise Investors on the acquisition of Skarbiec TFI Enterprise Investors and Sfinks Polska S.A. on the acquisition of business of Grupa Chłopskie Jadło Enterprise Investors on the divestment of Medycyna Rodzinna S.A. to LuxMed Marek Stefański, on the sale of shares in POL-AQUA S.A. to Dragados Sociedad Anonima Mrowiec Fiałek i Wspólnicy / Confidential 5 Our Experience - M&A / PE Argus Capital on the acquisition of GTX Hanex Plastic Sp z o.o. Deutsche Bank (DWS) on the sale of DWS TFI Polska British Sugar (Overseas) Limited on the sale w British Sugar (Overseas) Polska sp. z o. o. to Pfeifer & Langen Polska S.A. KBC Private Equity, Krokus Private Equity on several private equity transactions PE fund on recapitalisation of a portfolio company Kulczyk Holding on the investment in oil fields in Sudan Unit 4 on the take-over of Teta S.A. Warsaw Stock Exchange on the acquisition of Polish Energy Exchange IPOPEMA Securities S.A. on the acquisition of Polish part of the asset management business of Credit Suisse Mrowiec Fiałek i Wspólnicy / Confidential 6 Our Experience – capital markets Experience of our lawyers in capital markets gained during their careers to date includes, inter alia, advising: Rubbermaid on the public bid and take-over of Dom-Plast S.A. (first take-over in CEE) and Kalon Group on the public bid and take-over of Polifarbu Cieszyn-Wrocław S.A. (first hostile take-over in Poland) PepsiCo Inc. on the de-listing of E. Wedel S.A., the first de-listing in Poland BA CA and CA IB Securities on the paralel listing of BA CA on stock exchanges in Warsdaw and in Vienna (first „dual listing” in Poland). BA CA was the first foreign company listed on WSE Giełda Papierów Wartościowych w Warszawie (Warsaw Stock Exchange – GPW, WSE) on the IPO and listing of WSE, and on financing of the acquisition of the Polish Power Exchange (Towarowa Giełdy Energii) by WSE, via public offer of bonds listed on the wholesale and regulated markets of WSE Citigroup, Goldman Sachs, J.P. Morgan, UniCredit on the IPO of Jastrzębska Spółka Węglowa S.A., the biggest European coke producer. It was the largest IPO of state owned company offer in 2011 and fourth largest IPO in the history of WSE UBS, J.P. Morgan, Citi, Bank of America Merrill Lynch, UniCredit and Espirito Santo Investment Bank on the IPO of Energa S.A. Citi and Dom Maklerski Banku Handlowego on the offer of shares and restructuring of share capital of BNP Paribas Polska S.A. Bookrunners and Global Coordinators (inter alia UniCredit, Deutsche Bank and Merrill Lynch) on the rights issue of PKO Bank Polski S.A. Citibank on the public bid and take-over of Bank Handloy w Warszawie S.A. as a part of the merger of the banks in Poland Mrowiec Fiałek i Wspólnicy / Confidential 7 Our Experience – capital markets Bank Zachodni WBK S.A. on its’ IPO and listing on WSE Issuers on IPO and listing on WSE: ASBISc Enterprise Plc. (fourth case within the EU, whereby the competent authority (Cypriot SEC) transferred the power to approve the prospectus to the competent authority of the host member state (Polish KNF), J.W. Construction Holding S.A., Polimex-Mostostal S.A. and ZREW S.A. (on the merger), KOPEX S.A. and ZZM S.A. (as a part of restructuring of the capital group) Investment banks on the public offer of shares in Kernel Holding, IPO of Petrolinvest S.A., public offer of shares in Bioton S.A., NFI Empik & Media & Fashion S.A. and on the merger of Vistula S.A. and Wólczanka S.A. Bank Przemysłowo - Handlowy S.A., on the merger with Powszechny Bank Kredytowy S.A. J.P. Morgan, Citigroup Global Markets, Goldman Sachs, Credit Suisse, UniCredit, KBC Securities, Societe Generale, PKO BP on the sale of 10% of shares in PGE Polska Grupa Energetyczna by the Ministry of State Treasury via accelerated bookbuilding Ministry of State Treasury and Bank Gospodarstwa Krajowego S.A. with respect to the sucessful finalization of Mennica Polska S.A. privatization via secondary offering of 40% of shares. Also the Ministry of State Treasury with respect to the secondary offering of shares in KGHM Polska Miedź S.A. via accelerated bookbuilding ING, Citigroup Global Markets oraz Detusche Bank with respect to the secondary offering of shares in Lotos S.A. via accelerated bookbuilding Consortium of banks, including BRE, PKO BP, Pekao SA, Nordea, ING, Citi wraz DM Banku Handlowego on the sale of 11,9% of shares in TAURON Polska Energia S.A. by the Ministry of State Treasury via accelerated bookbuilding Mrowiec Fiałek i Wspólnicy / Confidential 8 Our Experience - capital markets regulatory advice Our lawyers have unique experience regarding financial market regulations, especially capital markets regulations. Leading partner Zbigniew Mrowiec was on the first staff of the then newly created Securities and Exchange Commission. As the Deputy Chairman and General Counsel of the Securities and Exchange Commission, he led the reform process of the Polish capital markets legal framework, which was aimed at liberalization, improved supervision and market transparency. He coauthored the Polish investment fund law, Polish bond law and the package of legal acts which still regulate the Polish capital market today. Zbigniew has unique experience in advising clients on regulatory matters, including the performance of various regulatory obligations, in particular disclosure obligations, drafting and modifying the internal regulations of financial institutions, in particular adjusting rules and regulations to the new laws, and representing clients in disputes and dealings with regulatory authorities, in particular Polish Financial Supervision Commission (Komisja Nadzoru Finansowego). Our services include drafting and amending the internal regulations of financial institutions, including adjustments to the new laws and regulations, and also representing clients in proceedings initiated by various regulators, in particular the Polish Financial Supervision Commission. We also advise clients on the disclosure obligations of listed companies, the obligations of shareholders in listed companies, and the board members of such companies. Mrowiec Fiałek i Wspólnicy / Confidential 9 Our Experience - capital markets regulatory advice Our lawyers have advised on regulatory matters numerous financial institutions and corporates, in particular: Bank Pocztowy S.A. mBank S.A. (former BRE Bank S.A. ) BZ WBK S.A. Citibank, Bank Handlowy w Warszawie S.A. Deutsche Bank AG London Branch, Deutsche Bank Polska S.A. Dom Maklerski Banku Handlowego S.A. Giełda Papierów Wartościowych w Warszawie S.A. ING NV J.P. Morgan Securities J.W. Construction Holding S.A. Ministerstwo Skarbu Państwa PKO Bank Polski S.A. Pol-Aqua S.A. TVN S.A. Mrowiec Fiałek i Wspólnicy / Confidential 10 Mirosław Fiałek Founding partner, legal advisor Practices: mergers and acquisitions Private Equity / Venture Capital corporate and company law Mirosław Fiałek has over fifteen years of experience in advising clients on transactions and on on-going matters. He has broad experience in PE/VC and M&A market and specializes in structuring and management of transactions. His practice encompasses also supporting of the management activities of PE fund managers toward the portfolio companies and also advising the portfolio companies on various corporate and commercial matters. He has thorough understanding of practical aspects of corporate and commercial law, including establishment and liquidation of various companies, drafting agreements and legal memoranda, as well as litigation and arbitration. He participated in many highly innovative transactions and has advised largest telecoms and media companies in Poland. Mrowiec Fiałek i Wspólnicy / Confidential 11 Mirosław Fiałek He advised several Private Equity fund managers on their transactions, including: Montagu Private Equity; Innova Capital; Société Générale Asset Management Alternative Investments; Value 4 Capital; Enterprise Investors; Argus Capital; KBC Private Equity; Krokus Private Equity. Mirosław is an expert in media and telecom transactions. He has advised largest players in these sectors, including: TVN, on the strategic partnership between TVN and Ringer Axel Springer Media AG regarding Grupa Onet.pl S.A.; TVN, on the merger of two Polish digital platforms of pay TV - TVN and Polish Canal+; Montagu Private Equity, on the acquisition of TP Emitel; Liberty Global Inc. on the acquisition of Aster from funds managed by Mid Europa Partners LLP and in respect to divestment of Aster cable network. Mrowiec Fiałek i Wspólnicy / Confidential 12 Mirosław Fiałek - awards Miroslaw Fialek continues to build his reputation in the private equity market. Chambers Europe 2013 Miroslaw Fialek is praised for his "strong attention to detail and ability to see the broad picture. He is one of the most promising lawyers in private equity market." Chambers Europe 2012 Mrowiec Fiałek i Wspólnicy / Confidential 13 Zbigniew Mrowiec Founding partner, legal advisor Practices: issues of debt and equity instruments, listings on the Warsaw Stock Exchange, public take–overs and mergers of listed companies; capital market regulatory matters advising investment banks, issuers and shareholders in listed companies capital markets and securities law Zbigniew Mrowiec has over 24 years of experience in advising clients on transactions and on on-going matters, and also in public administration. He has broad experience in capital markets, including most innovative, sophisticated cross-border and multijurisdictional transactions. He has also a thorough understanding of regulatory matters concerning trading in securities and other financial instruments. He specializes in capital markets transactions, including public take-overs, initial public offerings (IPOs) and placements of debt and equity financial instruments on domestic and foreign markets. Mrowiec Fiałek i Wspólnicy / Confidential 14 Zbigniew Mrowiec He has structured several „first of a kind” transactions on the Polish stock market. He advised on: first take-over on the Warsaw Stock Exchange (WSE); first hostile take-over; first de-listing; first dual listing of a foreign issuer on WSE; fourth case within the EU, whereby the competent authority (Cypriot SEC) transferred the power to approve the prospectus to the competent authority of the host member state (Polish KNF). Zbigniew co-authored the Polish capital market regulation. He was a member of the first team of the Polish SEC. As the Deputy Chairman of the Polish SEC (2004-2005) worked on new capital markets legal framework aimed on liberalisation and increased transparency of the Polish market. Co-authored: Polish investment fund law; Polish act on bonds; Current capital market law governing the Polish market since 2005. Mrowiec Fiałek i Wspólnicy / Confidential 15 Zbigniew Mrowiec He advised the largest Polish and international investment banks, including Bank of America Merrill Lynch, Espirito Santo Investment Bank, Citi Global Markets together with Dom Maklerski Banku, Handlowego, Deutsche Bank, ING together with ING Securities, J.P. Morgan, Goldman Sachs, Morgan Stanley, PKO Bank Polski, UniCredit together with UniCredit CAIB Poland, UBS. He participated in largest transactions on the Polish capital market, including: IPO of Bank Austria Credit Anstalt (BA CA) in Poland together with dual listing in Warsaw and Vienna. BA CA was the first foreign company listed on WSE; Rights issue of PKO Bank Polski S.A.; IPOs of PGE Polska Grupa Energetyczna, Warsaw Stock Exchange, Jastrzębska Spółka Węglowa and Energa; Largest accelerated bookbuildings on shares of largest companies listed in Poland, including PGE Polska Grupa Energetyczna, PKO Bank Polski, Bank Pekao, Lotos, KGHM or Tauron. Mrowiec Fiałek i Wspólnicy / Confidential 16 Zbigniew Mrowiec - awards Zbigniew Mrowiec has earned an enviable reputation for his equity capital markets prowess, and is highly recommended by clients and peers alike. Chambers Europe 2014 Leading lawyer in Capital Markets. IFLR 1000 2014 Recommended Lawyer in Capital Markets. Rzeczpospolita 2013 Zbigniew Mrowiec is unequivocally recognized as one of the leading equity capital markets advisers in Poland. He heads the equity capital markets team and recently represented the Ministry of Treasury in the PLN1.3 billion sale of 11.9% of Tauron Polska Energia. Market commentators confirm: "He has fantastic experience and expertise." Chambers Global 2013, Chambers Europe 2013 Zbigniew Mrowiec heads the team at Allen & Overy, A. Pedzich sp. k., which advised several financial institutions as joint bookrunners of the rights issue by Globe Trade Centre and also advised the Warsaw Stock Exchange on a public offering of PLN75m series B notes arranged by five Polish banks. Legal 500 2013 Clients have expressed their satisfaction with the quality of service received from Zbigniew Mrowiec and the firm. “They’re among the top 4-5 players in Poland,” one client says. “They’re definitely good value in terms of the ratio of price to quality.” IFLR 1000 2013 Allen & Overy, A. Pedzich sp. k. advised the state treasury on the accelerated book-building process for the joint sale by the state treasury and Bank Gospodarstwa Krajowego of shares in Powszechna Kasa Oszczędności Bank Polski held by the treasury. The firm also advised PHZ Baltona on its move from AIM to the Warsaw Stock Exchange. Practice head Zbigniew Mrowiec is “a brilliant lawyer”. Legal 500 2013 Mrowiec Fiałek i Wspólnicy / Confidential 17 Zbigniew Mrowiec - awards The masterly Zbigniew Mrowiec is recommended as "a great equity capital markets adviser; he is extremely competent and knowledgeable." Chambers Global 2012, Chambers Europe 2012 Zbigniew Mrowiec’s “strengths are the quality of advice, project management, and knowledge of the regulatory environment”. Legal 500 2012 Zbigniew Mrowiec is unequivocally regarded as among the leading advisers on equity capital markets. He is an "extremely knowledgeable expert," say sources. Chambers Europe 2011 Zbigniew Mrowiec recently acted for the joint bookrunners and joint lead managers in the global rights issue by PKO Bank Polski. Legal 500 2011 Leading lawyer in Capital Markets. IFLR 1000 2011 Leading lawyer in Capital Markets. PLC Which Lawyer?, 2010 Leading lawyer in Capital Markets. Chambers Europe, 2009 Leading lawyer in Capital Markets. PLC Which Lawyer?, 2009 „Other lawyers mention his experience and deep knowledge of functioning of the Polish Financial Supervision Commission (Komisja Nadzoru Finansowego), which he gained during his career in this institution.” Chambers Europe, 2008 Mrowiec Fiałek i Wspólnicy / Confidential 18 Contact details Mrowiec Fiałek i Wspólnicy sp.j. 134 Chmielna Street 00-805 Warszawa +48 22 206 02 20 www.mrowiecfialek.com Mrowiec Fiałek i Wspólnicy / Confidential Mirosław Fiałek Partner +48 608 209 904 [email protected] Zbigniew Mrowiec Partner +48 504 055 401 [email protected] 19

© Copyright 2026