2015-03-20 NEES Opposition to TGP Appeal of Procedural Order

ELECTRONICALLY FILED

STATE OF MAINE

Docket No. 2014-00071

PUBLIC UTILITIES COMMISSION

March 20, 2015

MAINE PUBLIC UTILITIES COMMISSION

Investigation of Parameters for Exercising

Authority Pursuant to the Maine Energy Cost

Reduction Act, 35-A M.R.S. § 1901

NORTHEAST ENERGY

SOLUTIONS,INC.'S STATEMENT

IN OPPOSITION TO TENNESSEE

GAS PIPELINE COMPANY, LLC' S

APPEAL OF PROCEDURAL

ORDER DENYING MOTION TO

ESTABLISH SCHEDULE

NOW COMES Northeast Energy Solutions, Inc. ("NEES"), and pursuant to Chapter 110,

§ 5(B) of the Rules of Practice and Procedure (the "Rules") of the Maine Public Utilities

Commission (the "Commission"), submits this Statement in Opposition to Tennessee Gas

Pipeline Company, LLC's ("TGP") motion to appeal the Procedural Order — Ruling on

Scheduling Motions issued by the Commission.

In support of its Statement in Opposition, NESS states as follows:

Background

1.

On February 21, 2015, the Industrial Energy Consumer Group ("IECG") filed a

letter with the Commission, requesting the Commission to expedite this proceeding.

Thereafter, the Commission received additional motions concerning whether the

Commission should continue with the Schedule in Place or establish an amended schedule

with accelerated dates for Phase 2 of this proceeding.

Page 1 of 5

On March 12, 2015, the Commission issued a Procedural Order — Ruling on

2.

Scheduling Motions denying the requests of IECG and TGP to establish an expedited

schedule for decision on the Phase 2 proposals by May or June of 2015.

On March 17, 2015, TGP filed a motion to appeal the Procedural Order, pursuant

to Chapter 110, § 11(D) of the Rules, and requesting the Commission to establish a

prompt schedule for the remainder of this proceeding ("TGP's Appeal"). TGP argues the

Commission is not acting with urgency and is acting against the legislative intent of the

Energy Cost Reduction Act.

Discussion

4.

NEES submits that the Commission continues to act with urgency and with

jurisdictional prudence. The mandate of the Act is quite clear: The Commission must

conduct a cost benefit analysis of the purported benefits of any proposed pipeline

expansion contract. That notwithstanding, TGP's Appeal accuses the Commission of

repeating "all of the aspects of the energy cost crisis the Legislature itself considered in

fashioning the Act..." Nothing could be further from the truth. The Commission is

currently reviewing capacity proposals within the context of the modern economics of the

global energy market. The Legislature did not have a single developer proposal formally

before them during its deliberations in adopting the Act; nor, did the Legislature have the

ability to foresee the current seasonal differentiations from then to now. The Commission

is not re-litigating any elements that were eventually embodied within the Act. The

Commission, quite simply, is implementing the Act.

Page 2 of 5

The TGP Appeal again pleads for the Commission to encourage the State of

Maine to become an economic partner to TGP's proposed Northeast Direct project.

However, the TGP Appeal does not include any legal authority under the Act to

authenticate their plea. In fact, the Act requires the opposite as noted in the Commission's

Procedural Order — Ruling on Scheduling Motions issued by the Hearing Examiners on

March 12, 2015: "...the Act gives authority to the Commission to do so only after it has

determined that the benefits of a pipeline expansion contract will exceed its costs. The

analysis of the costs and benefits of pipeline capacity expansions is a complex

undertaking, for which the Commission has engaged London Economics International

(LEI), an expert consultant. LEI will employ sophisticated econometric and regional

energy modelling to gain a full understanding of the likely effects of each of the project

proposals. The results of this detailed analysis will be critical to the Commission's

decision-making..."

6.

TGP's Appeal also provides some discussion regarding legislative intent by way

of quoting Senator Cleveland: "It is the goal of this legislation to accomplish the

following actions to address these cost increases and grid reliability threats.... Third,

with the newly created natural gas pipeline capacity purchase capability of the Public

Utilities Commission and through the participation in regional energy organizations by

public and utility officials, cause the development by 2017 of at least 2 billion

cubic foot per day additional natural gas pipeline capacity into southern New

England."

Notwithstanding whether two billion cubic feet per day of additional natural gas

pipeline capacity is required in our region to meet current and foreseeable, actual need,

sufficient capacity is being developed by way of other projects, both planned and.

Page 3 of 5

underway, as of March 16, 2015, in the northeast as shown in Exhibit A to this Statement

in Opposition. Moreover, none of the projects listed in Exhibit A —but for Northeast

Direct —are pleading to the State of Maine for financial viability.

7.

TGP's Appeal also discusses purported ECRC "off ramps" being "ignore[d]" by

the Commission. However, TGP's analysis of their proposal's "flexibility" comparative to

Spectra's proposal only serves the Commission as an optimal example of why the

Commission must continue with detailed analysis.

According to TGP's Appeal, Spectra's flexibility is based upon developer

confidence in Spectra's proposed project proceeding solely "based on market support

irrespective of a Maine ECRC." In other words, Spectra will be building its proposed

capacity without the Commission endorsing any particular project as a result of this

proceeding.

Also according to TGP's Appeal, TGP's flexibility is based upon "exit

strategies... entered into at the conclusion of this proceeding." TGP goes onto quote its

own proposal in order to explain that the purported "exit strategies" would only be the

State of Maine's ability to sell the very capacity it had secured from TGP.

There is great need to examine these proposals in detail, and for the Commission

to not rely on any particular developer's unqualified assertions made at any time during

this proceeding.

8.

TGP's Appeal asserts that NESCOE is stalled. Conversely, NESCOE's Annual

Report, dated March 11, 2015, states: "In 2015 and beyond, NESCOE will continue to

advance proposals and support market modifications that recognize the imperative that

regional planning and wholesale market mechanisms find an appropriate balance to

enable the states to execute the requirements of state energy and environmental laws,

Page 4 of 5

reflect consumer investment in local energy resources, and consider wholesale market

concerns. It is critical that federal regulators and the entities they regulate respect state

energy and environmental laws and reflect consumer investment in local energy

resources. These may include but are not limited to state renewable energy requirements,

implementation of microgrids, sustained aggressive investment in energy efficiency and

small local generation resources, and other means to enhance grid reliability and continue

progress to reduce the region's reliance on higher emissions fuel sources."

Further, according to a March 10, 2015 WBUR, a NPR news station, report by

Bruce Gellerman, As Winter Electricity Prices Jump, Mass. Debate Over Natural Gas

Pipelines Heats Up: "In the coming weeks, Massachusetts Gov. Charlie Baker is planning

to host fellow New England governors for an energy summit. Topic one for the Boston

gathering will be the soaring cost of electricity."

NESCOE may be retying up, not stalled.

Conclusion

Wherefore NEES respectfully urges the Commission to deny TGP's Appeal and uphold

the Procedural Order dated March 12, 2015.

Respectfully submitted on this 20t~' day of March, 2015.

i~..~ ~{ V

BY: Northeast Energy Solutions, Inc.

Vincent Devito, Esq.

Bowditch &Dewey LLP

One International Place, 44th Floor

Boston, Massachusetts 02210

(617) 757-6500

vdevito(a,bowditch.com

Page 5 of 5

Exhibit A

{Client Files/REA/308841/0004/B0519295.DOCX;I }.docx;l )

Tennessee Gas Pipeline

Fa112015

Nov. 2015

Nov. 2015

Nov. 2015

15` qtr. 2015

EST.

IN-SERVICE

STATUS

Authorized by FERC, 12-18-14.

Filed with FERC, Feb. 2014. Approved

by FERC, Feb. 2015.

Filed with FERC, March 2014.

Approved by FERC, Feb. 2015.

Jointly filed with FERC, March 2014.

Approved by FERC, March 2015.

Precedent agreements signed June

2009. Filed with FERC, 1-13. FERC

issues final EIS, 2-14. Approved by

FERC, 5-14. Under construction.

Prepared by Northeast Gas Association, March 2015. Based on publicly-available information; details may change.

Columbia Gas

Transmission

Proposed capacity of 158,000 dekatherms per day of

natural gas. Seneca will serve as the foundation shipper

for TGP's Niagara Expansion Project, which is designed

to provide transportation from the prolific Marcellus

Shale in Pennsylvania to TGP's interconnect with

TransCanada Pipeline in Niagara County, N.Y.

The project will involve the installation of two natural

gas pipelines with approximately 9.5 miles of pipeline in

Chester County, PA and 9.5 miles of pipeline in

Gloucester County, NJ. The project will also include

modifications and upgrades to certain station facilities.

National Fuel Gas Supply

Northern Access

2015

Niagara

Expansion

East Side

Expansion

Capacity of 140,000 Dth/day. Capacity lease to TGP

from Ellsbury to East Eden.

National Fuel Gas Supply

&Empire Pipeline

Tuscarora

Lateral

The project involves a proposed 3.2-mile 26-inch lateral,

consisting of approximately 2.9 miles of offshore

pipeline and approximately 03 miles of onshore

pipeline. Designed to provide approx. 647,000 Dth/d of

natural gas delivery capacity to National Grid's gas

distribution system in Brooklyn and Queens, NY.

Planned capacity of 95,000 Dth/d. 17 miles of pipeline

plus storage wells and lines. Market is on-system utilities

DESCRIPTION

Williams /Transco

COMPANY

Rockaway

Lateral

PROJECT

The Northeast Gas Association (NGA) has prepared this summary based on publicly-available information.

NGA will strive to keep the information as updated as possible and notes that

this information may change pending project developments. May not include all projects.

PLANNED ENHANCEMENTS, NORTHEAST NATURAL GAS

PIPELINE SYSTEMS (as of3-76-75)

Cabot/Williams

Iroquois Gas Transmission

National Fuel Gas Supply &

Empire Pipeline

Dominion Pipeline

Algonquin Gas Transmission

/ Spectra Energy

Tennessee Gas Pipeline

Constitution

Pipeline

Wright

Interconnect

Project (WIP)

Northern Access

2016

New Market

Project

AIM

Connecticut

Expansion

Capacity of 72,100 Dth/d. Pipeline looping on TGP

200 and 3001ines. Market is CT natural gas utilities.

Adds 175,000 Dth/day of incremental capacity. 23

miles of 24" pipeline and additional horsepower at

Mercer (TGP Sta. 219).

Approx. 120-mile Constitution Pipeline is being

designed to extend from Susquehanna County, PA, to

the Iroquois Gas Transmission and Tennessee Gas

Pipeline systems in Schoharie County, N.Y.

Proposed capacity of 650 MMCf/d. Cabot and

Southwestern are shippers.

WIP will enable delivery of up to 650,000 Dth/d of

natural gas from the terminus of the proposed

Constitution Pipeline in Schoharie County, NY into

both Iroquois and the Tennessee Gas Pipeline under a

15 year capacity lease agreement with Constitution.

Capacity of 350,000 Dth/day. Deliveries to

Chippawa, with new interconnect at TGP 200 Line.

] 00+miles of 24"/30" pipeline and Empire

compressor station.

Planned for customers in upstate NY (National Grid).

Will include the addition of 2 new compressor

stations along DTI's existing transmission pipeline;

and increased compression at an existing station.

Capacity of 112 MMcf/d.

Providing 342 MMcf/d of additional capacity to move

Marcellus production to Algonquin City Gates.

Shippers are 6 gas utilities in New England.

DESCRIPTION

Nov. 2016

2"a half 2016

Nov. 2016

Nov. 2016

2016

Late 2016

Nov. 2015

EST.

IN-SERVICE

STATUS

Open season held, fall 2012. Filed

with FERC, 2-14. FERC issues draft

EIS, 8-14. FERC issues final E1S, 115. Approved by FERC, 3-15.

Open Season held July 2013. Filed

with FERC, 7-14.

Filed with FERC, June 2014.

In FERC pre-filing process, July 2014.

Announced 1-13. Filed with FERC, 613. FERC issued final EIS, 10-14.

Authorized by FERC, 12-2-14.

Announced spring 2012. Filed with

FERC, 6-13. FERC issued final EIS,

10-14. Authorized by FERC, 12-2-14.

Filed with FERC, Feb. 2014.

Approved by FERC.

Prepared by Northeast Gas Association, March 2015. Based on publicly-available information; details may change.

National Fuel Gas Supply

COMPANY

West Side 2015

Expansion

PROJECT

PLANNED ENHANCEMENTS, NORTHEAST NATURAL GAS

PIPELINE SYSTEMS (as oF3-76-75), page 2

Millennium Pipeline

PNGTS

Iroquois Gas Transmission

Spectra Energy

Corning to

Rockland

Continent to

Coast (C2C)

Expansion

South-to-North

("SoNo") Project

Atlantic Bridge

&

The project has been designed to provide up to 180,000

dekatherms per day of natural gas service in two phases

to a new delivery point with New Jersey Natural Gas in

Burlington County, N.J. The project will include the

installation of a new compressor station, meter and

regulating station on land located in Burlington County,

N.J. It will also require modifications and the addition of

compression at an existing compressor station. No

expansion of the pipeline is required.

Company looks to expand capacity along its natural gas

pipeline that extends from Corning, New York to

Rockland County, New York to meet customer demand.

C2C will access natural gas supplies from key North

American natural gas basins via TransCanada Pipeline.

Atlantic Canada markets can then transport on PNGTS to

an interconnect with Maritimes and Northeast Pipeline at

Westbrook, ME. Shippers interested in moving natural

gas further south into New England can transport on

PNGTS to interconnects with other NE natural gas

pipelines. May raise PNGTS' current capacity of

168,000 Dth/d to approx. 300,000 Dth/d.

Reverse flow on Iroquois offering physical transport to

U.S./Canada border. The Soho project would transport

up to 300,000 Dth/day from Iroquois' existing

interconnects with Dominion Transmission in

Canajoharie, NY and Algonquin Gas Transmission in

Brookfield, CT, as well as the proposed Constitution

Pipeline in Wright, NY.

Incremental expansion on Algonquin and Maritimes

Northeast, to serve New England and Canadian

Maritimes. Capacity of 220,000 Dth/d.

DESCRIPTION

2017

Nov. 2017

Nov. 2017

2017

/

Nov. 2016

Nov. 2017

EST.

IN-SERVICE

STATUS

—

—

Announced, Feb. 2014. Open season

held, Feb.- March, 2014. In pre-filing

with FERC, Feb. 2015.

Open season held, Dec. 2013 —Jan.

2014. Relaunch of open season, Jan.

Feb. 2015.

Open season, April 1 to June 28, 2013.

Open season re-convened, Dec. 2013

Jan. 2014. Relaunch of open season,

Jan. —Feb. 2015.

Open season announced March 2015.

Filed with FERC, Feb. 2015.

Prepared by Northeast Gas Association, March 2015. Based onpublicly-available information; details nzay change.

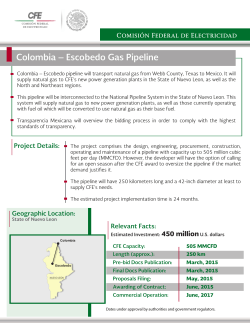

Williams/Transco

COMPANY

Garden State

Expansion

Project

PROJECT

PLANNED ENHANCEMENTS, NORTHEAST NATURAL GAS

PIPELINE SYSTEMS (as of3-76-75), page 3

Access Northeast

Northeast

Energy Direct

(NED) Project

PennEast

Project

PROJECT

DESCRIPTION

EST.

Nov. 2018

Nov. 2018

2017/2018

IN-SERVICE

STATUS

Announced 9-14. Solicitation of

interest held, fa112014.Open season

announced, 2-18-15 to run till May 1,

2015.

Open season held, Feb.-March, 2014.

In July 2014, Kinder Morgan

announced that 9 gas utilities in region

have committed to project as initial

shippers, at level of approx. 500,000

dekatherms per day (Dth/d). In FERC

pre-filing process as of 9-14. Updated

routes announced, 12-8-14.

Announced Aug. 2014. Open season

held August 2014.

Prepared by Northeast Cas Association, March 2015. Based on publicly-available information; details may change.

AGL Resources, NJR Pipeline 100-mile pipeline intended to bring lower cost natural

Company, South Jersey

gas produced in the Marcellus Shale region to homes

Industries, UGI Energy

and businesses in Pennsylvania and New Jersey.

Services, Spectra Energy and Designed to provide natural gas service. to the

PSE&G Power LLC

equivalent of 4.7 million homes, up to 1 Bcf per day.

PennEast is investing nearly $1 billion to build the

pipeline with the costs split among the four entities.

Construction of the pipeline could begin in 2017

pending regulatory approvals.

Tennessee Gas Pipeline /

This project is a combination of TGP's proposed

Kinder Morgan

Pennsylvania to Wright, NY and Wright, NY to

Dracut, MA projects. Proposes construction of

greenfield pipeline, additional meter stations and

compressor stations, and modifications to existing

facilities in Pennsylvania, New York, Massachusetts,

Connecticut, and New Hampshire. Scalable capacity

from 1.2 (30") to 2.2 (36") Bcf/d. Approximately

90% co-located along existing utility corridors /

adjacent to TGP mainline.

Spectra Energy, Eversource

The gas pipeline expansion project will enhance the

Energy, National Grid

Algonquin and Maritimes pipeline systems and

market area storage assets in New England to deliver

up to one billion cubic feet of natural gas per day for

electric generation markets. Alliance with Iroquois

Gas Transmission announced, 12-14.

COMPANY

PLANNED ENHANCEMENTS, NORTHEAST NATURAL GAS

PIPELINE SYSTEMS (as of3-76-75), page 4

© Copyright 2026