Views and News - Neil

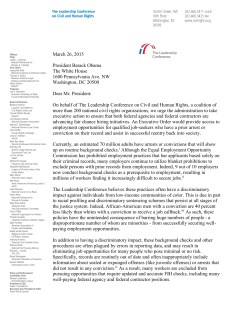

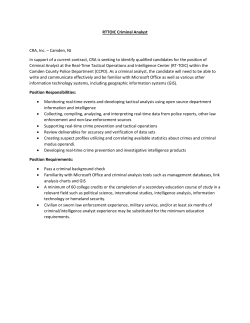

Spring 2015 VIEWS AND NEWS Changing Your Address Means Changing Your Insurance May is National Moving Month and every year more than 40 million Americans will move, according to the American Moving and Storage Association. As you pack up your belongings and move across town or across the country, make sure you don’t forget to “pack” your insurance coverage. Value is offered at no additional cost, but may only cover your belongings up to 60 cents on the dollar. If you opt for the Full Value, make sure you have an up-to-date estimated value for the belongings you’ll be moving. If you have an accurate and comprehensive home inventory, this shouldn’t be too difficult of a task. Home Sweet (New) Home When you move from an apartment to a house or house to house or apartment to apartment or condo to… well, you get the idea… your homeowners or renters insurance won’t follow on its own. Because a homeowners or renters insurance policy takes into account factors such as the building material used to construct your home, fire prevention systems like smoke detectors, sprinklers, etc., moving to a new home means that these factors could very well change, and as your risk changes, so should your insurance. If you’re renting a truck or a van for the move, the rental company may offer you some coverage. One argument for taking the coverage is that if something does go wrong and can be covered by the rental policy, a loss would not reflect on your own insurance coverage, but again, the coverage they offer may not be enough to replace or repair damaged or lost items. Talk to your agent about how your existing coverage would respond to a loss. Depending on whether your move is across the street or across the country it’s important that you discuss your move with your agent. Is my stuff covered during the move? Let’s say that you’ve got everything but the kitchen sink (which you’ve left for the people moving into your old home) packed into the truck for the big move, but there’s an accident with the truck and as a result antiques, carefully packed china and the 60” flat screen are all damaged beyond repair. Are you covered? Well, that depends on whether you’re moving the items yourself or have contracted with professional movers and where you’re moving to. If you use a professional moving company, under federal law interstate movers are liable for the replacement value of lost or damaged items, so if you’re moving from North Dakota to North Carolina the moving company is liable for your stuff. However, they may present you with different options for coverage, including Full Value or Released Value. According to the US Department of Transportation, Full Value is more comprehensive coverage but it may cost more out of pocket, whereas Released Mind the Gap You have coverage for the contents of your home under a standard homeowners or renters insurance policy, so the best option to protect those contents is to make sure that there is no gap of time between the expiration or cancellation of your policy on the home you’re moving out of and the effective start date for the policy for the home you’re moving into- one way to do this is to have the new policy start the day you are planning on moving. Not only would this help provide coverage for your contents, but it would also provide you with personal liability coverage during the time of the move. Because Trusted Choice agents have the ability to work with multiple insurance companies, they can work to help you find the coverage that’s right for your new place and for getting you and your stuff there. If you’re moving out of state, ask your insurance agent if they’re licensed in the state you’ll be moving to, and if they aren’t, ask them if they are able to refer you to another agency or use the Find an Agent locator for a Trusted Choice agent in your new hometown. Courtesy of INSIDE THIS ISSUE: Changing Your Address Means Changing Your Insurance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1 30th Anniversary of Neil-Garing . . . . . . . . . . . . . . . . . . .1 Employee Spotlight. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2 Celebrating 30 Years of Service: It’s been a pleasure to serve you. From the start of the agency in 1985, Neil-Garing has maintained the core values that John Neil and Roger Garing established 30 years ago. It is our dedication to taking care of our clients, staff and carrier partnerships that has provided longevity in an ever-changing industry. We believe it is not always about the bottom line, but meeting or exceeding the customers expectations. We stand behind our mission statement - Neil-Garing Insurance is dedicated to the highest degree of professionalism and ethics in the sales and service of insurance products. We are committed to providing a continuing role of leadership in the insurance industry while maintaining our sensitivity to the needs of our customers. We seek to foster a spirit of cooperation between our customers, companies, and employees realizing that our interests are not adverse, but common. Our primary goal is service. Attention Allied Customers . . . . . . . . . . . . . . . . . . . . . . .2 Ready for Summer Fun? . . . . . . . . . . . . . . . . . . . . . . . . . . .2 Negligent Hiring & the Importance of Criminal Background Checks . . . . . . . . . . . . . . . . . . . . . .3 Thermography Helps Business Prevent Loss. . . . . . . . .3 Protect Your Home and Community From Wildfire . . 3 Stress Relief Tips for the Workplace . . . . . . . . . . . . . . . . .4 Upcoming Events . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4 QUESTIONS OR COMMENTS? Editor: Angie Urban [email protected] Co-Editor: Lynn Stillings [email protected] Employee Earns Professional Designations Jenny Hughes, Commercial Lines Account Manager, successfully earned her Certified Insurance Service Representative (CISR) designation. This program covers Commercial and Residential Property, Personal Auto, Commercial Casualty and Agency Operations. Neil-Garing believes that the insurance profession is best served by those who acquire and maintain a high standard of professionalism by meeting the education requirements of the CIC, CISR, and ARM programs. Congratulations and good work to Jenny. Her commitment to education and career development serves our customers well! Attention Allied Customers Please note when making payments with Allied Insurance, your account number may have changed. Please check you’re billing statement to verify your account number, prior to making a payment. If you have questions, please contact your agent. Ready for Summer Fun? If you dropped coverage this winter on your car, motorcycle, camper or recreational vehicle be sure to call your agent to have your coverage reinstated, before you head out for summer fun. Negligent Hiring & the Importance of Criminal Background Checks Negligent hiring is defined as the failure of an employer to exercise reasonable care in hiring an applicant in light of the risk created by the position to be filled. The increase in the number of lawsuits based on the tort of negligent hiring has resulted in businesses being under a greater responsibility to use due care in selecting employees. A great deal of information, such as credit records, work history, military records, education records, and criminal history is available to employers willing to invest the time and resources in screening job applicants. The failure to check criminal records is the most common reason for employer liability in negligent hiring cases. Employers are not required, as a matter of law, to conduct an investigation into the criminal background of a job applicant. However, for employees who have close contact with persons due to a special relationship, current case law emphasizes the importance of a thorough investigation into their background. Employees in this “special relationship” category would include: workers in day-care centers or nursing homes; workers that have contact with the public, such as security guards and hotel personnel; and workers providing services in customers’ homes, such as cleaning or repair personnel or salespersons. For these employees, the investigation should include a criminal history check. Businesses that use contract services (or partners) to perform such “special relationship” job functions may be liable for the criminal actions of the contract agency’s workers. As such, they should require the contract services to perform the same background screening, including criminal history checks, which they perform on their own workers. Additionally, they should require a hold harmless and indemnification agreement in the contract with the service for the actions of the service’s employees. Employers may also be exposed to liability if, after hiring a worker, they subsequently learn that the worker has a criminal history, they take no actions against the worker after learning of the criminal past, and the worker assaults a third party. Under such circumstances, the employer may be subject to a lawsuit from the third party based on the tort of negligent retention. At the federal level, the Equal Employment Opportunity Commission (EEOC) has mandated that an applicant cannot be denied employment solely on the basis of a prior criminal record that is unrelated to job performance. The conviction’s nature and severity, as well as jobrelatedness, should be considered along with the applicant’s age at the time of conviction. Furthermore, an employer may not inquire about misdemeanor convictions, which are more than five years old, or arrest records. The following actions should be taken into consideration when evaluating potential hires: • Conduct a complete criminal and background check on all potential hires. • Background check should include federal and state check, as well as a county check in the place of employment. • Do not hire people whose past behavior and reputation can be used against them in a court of law. Even if the business and the employee are innocent, a successful defense may be impossible. • Do not allow information, e.g., having a gun permit, to become a shortcut for a full background and criminal records check. • Perform periodic background checks on all employees in sensitive positions. • Employment agreements with key employees should include a clause that allows for termination if the employee is convicted of a criminal activity. In the State of Colorado, state and county level records are available by mail, phone, or fax from the Colorado Bureau of Investigation: http:// www.colorado.gov/cs/Satellite/CDPS-CBIMain/ CBON/1251622108363 It is often more efficient and cost-effective to utilize a third party screening agency to provide criminal background checks. There are a wide variety of security screening agencies to choose from. Neil-Garing clients who are also Fireman’s Fund Insurance policyholders are eligible for a discount on screening services through Aurico Reports: https://www.auricosecure.com/aurico/ loginffic.asp Courtesy of Thermography Helps Businesses Prevent Loss In 2014, Fireman’s Fund risk services consultants began using thermal imaging technology to help identify potential risks for commercial clients. Forward Looking InfRared (FLIR®) cameras can read the intensity of infrared radiation given off by an object and convert it to a digital temperature reading. Using the cameras, our risk consultants can detect temperature anomalies that may signal hazardous conditions that could be mitigated before a loss occurs. The infrared technology greatly advances the value of loss control surveys. Risk consultants can now look more deeply into and behind the structure of building materials. They can also review the operating conditions of electric/ mechanical systems to reveal a potential risk of fire or other damage. Additional applications include inspecting buildings for excess moisture caused by blockage or leaks in piping and equipment. Although the use of infrared technology is not new to the insurance industry, companies like Fireman’s Fund are now using it more and more to add better service and greater protection to their policyholders. “Using thermal imaging cameras in our risk mitigation surveys, we can offer powerful risk management insights and expertise that ultimately impacts the customer’s bottom line,” says Scott Steinmetz, Commercial Lines AVP, Risk Services. Circuit Overload During a recent inspection at Power & Telephone Supply Company in Memphis, Tennessee, Risk Consultant Jim Pippin scanned a breaker panel with the FLIR camera. The digital readout displayed 113°F for one particular breaker, causing concern because it was 31° warmer than the other breakers. Two additional breakers in a separate panel read 39° and 45° degrees warmer. Jim also found a damaged electrical outlet in another area of the building. “When breakers operate at temperatures above adjacent ones in the panel box, it may indicate an overloaded circuit, a loose connection or a bad breaker,” Jim explains. “This can lead to disruption in electrical service or even cause a fire.” The photo shows the temperature difference between the “hot” breaker and the others in the panel box. A hot reading stands out well against cooler backgrounds and may indicate an electrical hot spot, which may be a potential fire hazard. Cooler temperatures may indicate a wet area from a leaking water pipe or water intrusion from a roof leak. Since the two buildings Jim surveyed contained over $33 million in property and contents, these problems required immediate attention. The policyholder hired a qualified electrician who confirmed the issues and repaired the electrical components. Advanced Technology Enhances Service Infrared surveys are a value-added service for current and prospective commercial policyholders with property-driven programs such as Historic Trust, real estate and manufacturing. Fireman’s Fund risk services consultants provide customers with a detailed survey report that includes thermal and digital images of any problems detected, and a recommended course of action for addressing them. Mitigating risk not only saves the policyholder from business disruption caused by a large loss, it also saves the time and expense to get their business back on track. If you are interested in learning more about this technology, or arranging a thermo graphic review for your business, please contact your agent. Courtesy of Protect Your Home and Community From Wildfire With the lack of moisture this spring, the likelihood for a wildfire could escalate earlier this year. Please see these helpful hints from the FEMA: • Remove pine needles and dry leaves from within 5 feet of your home. • Sweep porches and decks to clear pine needles and leaves. • Keep wood piles 30 feet from your home. • Develop and practice a home evacuation plan, and create a family communication plan. This will help everyone know what and resources: to do if there is a fire. www.usfa.fema.gov Remember with winter weather and snow comes early spring runoff and the threat of flooding. A typical homeowners policy does not include flood insurance, and many flood insurance policies require a 30 day waiting period prior to becoming effective. Please call your agent today for more information on obtaining a flood insurance policy. For More Info www.usfa.fe and resources: www.usfa.fema.gov For more information refer to these resources: www.usfa.fema.gov/citizens/focus www.usfa.fema.gov www.usfa.fema.gov for more information www.usfa.fema.gov PLEASE DON’T BE CAUGHT WITHOUT COVERAGE We all get busy. It’s easy to set a bill aside and remember to pay it at the last minute. Unfortunately, sometimes the mail can be slower than we expect, and premiums don’t reach the insurance company on time. The result? Cancellation! 201 Centennial, 4th Floor Glenwood Springs, CO 81601 Phone: 970-945-9111 or 800-255-6390 Fax: 970-945-0576 Email: [email protected] Be sure to allow enough time for potential mail delays and for the company to post your payment well in advance of the due date. Mail your payment using the billing stub or invoice copy, and the envelope provided by the company so it reaches the correct address. PRSRT STD U.S. POSTAGE PAID GLENWOOD SPGS, CO PERMIT NO. 90 Visit Us On The Web: www.neilgaring.com The insurance policy forms the contract between the insured and the insurance company. The policy may contain limits, exclusions, and limitations that are not detailed in this newsletter. Stress Relief Tips for the Workplace - Part 2 Stress is something that every person deals with. In our last issue, we gave four stress relief tips for the workplace. Below are the five remaining tips to help lower your stress levels at the workplace. 5. Exercise Whether at home before work, or on a break, make sure to get time in for exercise. Getting exercise is an essential part of ridding your body of stress. Try to find some time during your day to get in some exercise. The University of Maryland conducted a study in 2012 showing that exercise not only helps reduce current stress, but may help stave off future stress as well. 6. Eat Stress-Reducing Food Even if you already eat well, consider taking an orange with you to work. A 2002 study at the Center for Psychomatic and Psychobiological Research, University of Trier, Germany found that a dose of vitamin C helps the body cope during stressful situations. Upcoming Events 7. Think Ergonomics Take an outsiders look at your workspace. Is your seating arrangement comfortable? Is it healthy for your body? Ask your employer about bringing in an exercise ball to sit on. While it may not be proven to help your posture, it won’t hurt it - and encourages core movement during the workday. 8. There’s an App for That There are many de-stressing apps available on your phone. Download a few and use them when you feel the stress levels rising. 9. Organize Your Day If you feel distracted or overwhelmed, write down a to-do list or a general schedule for your day. The act of actually writing down the list by hand will help you remember tasks more than typing them on a computer, and will help you organize and focus your thoughts, which will decrease stress, according to Patrick E. McLean’s “Defense of Writing Longhand.” Courtesy of Neil-Garing is offering a free ERISA COMPLIANCE SEMINAR on Tuesday May 19th, 2015. If you provide any company sponsored benefits plans, ERISA does apply. This free seminar will be held at the Glenwood Springs Community Center, 100 Wulfsohn Rd, Glenwood Springs, CO. We will be offering morning and afternoon sessions. Seminar will include presentation by ERISA consultant Chris Martie and will include time for questions and answers. Morning Session: 10:30 am to 12:00 pm Afternoon Session: 1:30 pm to 3:00 pm Refreshments will be served. For more information please call our benefits department at 970-945-9111.

© Copyright 2026