Babson Capital Facts At A Glance

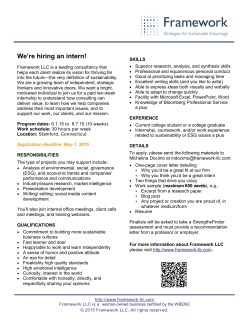

BABSON WHO WE ARE Babson Capital is a global investment management organization that manages $212.8 billion1. With offices on four continents, we offer clients access to investment opportunities around the globe and across the investment universe, providing uniquely tailored investment strategies and an open door to our talented professionals. FACTS AT A GLANCE Fourth Quarter 2014 ASSETS UNDER MANAGEMENT1 AS OF DECEMBER 31, 2014 Total Firm AUM ($B) $212.8 Total No. of Institutional Separate Accounts 184 Total No. of Funds 100 Tax-exempt AUM ($B) $46.6 HISTORICAL ASSETS UNDER MANAGEMENT1 PERIODS ENDING DECEMBER 31 $212.8 $192.7 200 WHAT WE DO $160.1 150 In Billions FIXED INCOME Babson Capital Management is an institutionally-focused global fixed income manager with $165.4 billion2 in assets under management. Our capabilities include investment grade, global high yield, structured products, and middle market finance. 100 $60.1 $65.5 Cornerstone Real Estate Advisers is one of the largest global real estate investment managers with $45.4 billion in assets under management4. Cornerstone is one of the most diverse real estate investment organizations providing expertise in real estate equity and debt in both public and private markets. REAL ASSETS Wood Creek Capital Management, LLC is an investment manager with $2.0 billion 3 in assets under management, at the forefront of real assets investing. Our mission is to address the challenges faced by institutional investors by offering asset-based investments within a defined investment horizon. Wood Creek constructs portfolios of tangible and intangible asset exposures for its clients, who are themselves global leaders in institutional investing. $73.9 $81.9 $92.2 $95.8 $95.5 2004 2005 $104.1 $108.2 $117.8 50 0 REAL ESTATE $133.1 $139.0 2000 2001 2002 2003 2006 2007 2008 2009 2010 2011 2012 2013 2014 BABSON CAPITAL MANAGEMENT INVESTMENT PLATFORMS3 Market leading Global Fixed Income investment platforms One of the largest global real estate investment managers A leading asset manager in next generation alternative investments AUM AUM AUM $165.4 Billion $45.4 Billion4 $2.0 Billion Investment Professionals Investment Professionals Investment Professionals 253 171 Core Capabilities Investment Grade, High Yield, Structured Products & Middle Market Finance Core Capabilities Commercial Real Estate: Public & Private Equity & Debt 15 Core Capabilities Real Assets: Tangible & Intangible Providing customized solutions for a diverse client base: • Financial Institutions • Pensions • Insurance Companies • Superannuation Funds • Sovereign Wealth Funds • Family Offices • Foundations & Endowments • Wealth Advisory 1. Asset figures include Babson Capital Management LLC and its subsidiaries Babson Capital Management (UK) Limited, Babson Capital Australia Pty Ltd, Cornerstone Real Estate Advisers and Wood Creek Capital Management as of December 31, 2014 2. As of December 31, 2014. Includes Babson Capital Management LLC and its subsidiaries Babson Capital Management (UK) Limited and Babson Capital Australia Pty Ltd 3. As of December 31, 2014 4. Includes subsidiaries PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Numbers may not add due to rounding. 15/472_2015/117 FOR INVESTMENT PROFESSIONALS ONLY 1 BABSON FACTS AT A GLANCE | Fourth Quarter 2014 EMPLOYEE INFORMATION Total No. of Staff: EXTERNAL AUM BY CLIENT TYPE 1,115 Mutual Funds Sub-advised Number of Investment Professionals: 439 Number of Portfolio Managers: Superannuation Funds 89 Number of Analysts: 34% Corporate/Corporate Pensions 22% 329 Public Funds 15% InsuranceFunds Structured 14% Number of Traders: 21 Insurance Average Years of Experience: 19 Superannuation Funds 3% Mutual Funds 2% Structured Funds Public Funds REPRESENTATIVE CLIENTS 8% Endowments & Foundations 1% Family Offices/HNW Corporate 1% Family Offices Sub-advised Financial Services Foundations & Endowments Insurance Companies EXTERNAL AUM BY CLIENT REGION Multi-employer (Taft Hartley) Public & Corporate Qualified Plans Sovereign Wealth Funds Superannuation Funds INVESTMENT OFFICE LOCATIONS Charlotte New Haven Chicago Springfield Hartford Sydney United States/N. America 68% EMEA 22% Asia Pacific 10% London EXTERNAL AUM BY ASSET CLASS REGIONAL OFFICE LOCATIONS Amsterdam Melbourne Investment Grade 35% Boston New York Senior Secured Loans 31% Chicago Newport Beach Real Estate 13% Dallas Rotterdam Glastonbury Santa Monica Helsinki Stockholm Hong Kong Los Angeles High Yield Bonds 8% Structured Credit 7% Tokyo Real Assets 2% Washington D.C. Quantitative Equity 2% Private Credit 1% Alternatives & Private Equity <1% As of December 31, 2014. Asset figures include Babson Capital Management LLC and its subsidiaries, Cornerstone Real Estate Advisers and Wood Creek Capital Management. External AUM excludes the MassMutual general investment account. 1. Structured funds are distributed via intermediaries to a global investor base and may be traded in the secondary market Lear n more at babsoncapital.com or 1-87 7-766-0014. 15/472_2015/117 FOR INVESTMENT PROFESSIONALS ONLY 2 BABSON FACTS AT A GLANCE | Fourth Quarter 2014 OTHER RESTRICTIONS: IMPORTANT INFORMATION Babson Capital Management LLC, Babson Capital Securities LLC, Babson Capital Management (UK) Limited, Babson Capital Australia Pty Ltd, Wood Creek Capital Management, LLC, Babson Capital Cornerstone Asia Ltd. and Cornerstone Real Estate Advisers LLC, each are affiliated financial service companies (each, individually, an “Affiliate”), together known as “Babson Capital” and members of the MassMutual Financial Group*. Each Affiliate may act as introducer or distributor of the products and services of the others and may be paid a fee for doing so. ADDRESSEE ONLY: This document is issued to investment professionals, institutional investors and accredited investors only. It is intended for the addressee’s confidential use only and should not be passed to or relied upon by any other person, including private or retail investors. This document may not be reproduced or circulated without prior permission. NO OFFER: The document is for informational purposes only and is not an offer or solicitation for the purchase or sale of any financial instrument in any jurisdiction. The material herein was prepared without any consideration of the investment objectives, financial situation or particular needs of anyone who may receive it. This document is not, and must not be treated as, investment advice, investment recommendations, or investment research. Unless otherwise mentioned, the views contained in this document are those of the Affiliate producing it. These views are made in good faith in relation to the facts known at the time of preparation and are subject to change without notice. Parts of this presentation may be based on information received from sources we believe to be reliable. Although every effort is taken to ensure that the information contained in this document is accurate, Babson Capital makes no representation or warranty, express or implied, regarding the accuracy, completeness or adequacy of the information. Any forecasts in this publication are based upon the Affiliate’s opinion of the market at the date of preparation and are subject to change without notice, dependent upon many factors. Any prediction, projection or forecast is not necessarily indicative of the future or likely performance. Past performance is not a guarantee of future results or a reliable indication of future performance. The investment results, portfolio compositions and examples set forth in this document are provided for illustrative purposes only and may not be indicative of the future investment results, future portfolio composition or investments. The composition, size of, and risks associated with an investment may differ substantially from the examples set forth in this document. No representation is made that an investment will be profitable or will not incur losses. Where appropriate, changes in the currency exchange rates may affect the value of your investment. In making an investment decision, prospective investors must rely on their own examination of the merits and risks involved and before making any investment decision, it is recommended that prospective investors seek independent investment, legal, tax, accounting or other professional advice as appropriate. 15/472_2015/117 The distribution of this document is restricted by law. No action has been or will be taken by Babson Capital to permit the possession or distribution of the document in any jurisdiction, where action for that purpose may be required. Accordingly, the document may not be used in any jurisdiction except under circumstances that will result in compliance with all applicable laws and regulations. Any service, security, investment, fund or product outlined in this document may not be generally available or be suitable for a prospective investor or available in their jurisdiction. It is the responsibility of the prospective investor to ensure that any service, security, investment, fund or product outlined in this document is accordant with any jurisdiction specific guidelines/regulations before any approach is made regarding that service, security, investment, fund or product. INFORMATION: Babson Capital Management LLC is a registered investment adviser with the Securities and Exchange Commission under the Investment Advisers Act 1940, as amended. Babson Capital Management LLC is registered as a Commodity Trading Advisor (CTA) and Commodity Pool Operator (CPO) with the Commodity Futures Trading Commission under the Commodity Exchange Act, as amended. Babson Capital Securities LLC is a registered limited purpose broker-dealer with the Financial Industry Regulatory Authority, Inc. Babson Capital Management (UK) Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom (Ref No. 194662) and is a Company registered in England and Wales (No. 03005774) whose registered address is 61 Aldwych, London, WC2B 4AE. Babson Capital Australia Pty Ltd (ACN 140 045 656), is authorized to offer financial services in Australia under its Australian Financial Services License (No: 342787) issued by the Australian Securities and Investments Commission. Babson Capital Cornerstone Asia Limited is licensed with the Securities and Futures Commission of Hong Kong to carry on regulated activities Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) in Hong Kong in accordance with the requirements set out in the Securities and Futures Ordinance (Cap 571). Wood Creek Capital Management, LLC is a registered investment adviser with the SEC specializing in investments in real assets. Cornerstone Real Estate Advisers LLC is a registered investment adviser with the SEC specializing in real estate related investments. COPYRIGHT Copyright in this document is owned by Babson Capital. Information in this document may be used for your own personal use, but may not be altered, reproduced or distributed without Babson Capital’s consent *MassMutual Financial Group is a marketing name for Massachusetts Mutual Life Insurance Company (MassMutual) and its affiliated companies and sales representatives. FOR INVESTMENT PROFESSIONALS ONLY 3

© Copyright 2026