âOne Belt and One Roadâ: Forging A New Vision For

“One Belt and One Road”: Forging A New Vision For Shared Economic Growth Executive Summary China’s growth model based on its role as the world’s manufacturing powerhouse is now considerably more challenging. The slowest GDP growth in 24 years last year, demonstrates that China faces a “new normal” where growth may be slower and the most important economic drivers will change. The “One Belt and One Road” policy framework could provide a new driver of economic growth for China by boosting cross-border trade along the reimagined land and maritime Silk Roads. However, success depends on meaningful economic benefits being generated in every market along the trading corridors. To operationalize this policy framework three pillars are required with a special focus on Small and Medium Sized Enterprises (SMEs). SMEs will likely drive most of the economic innovation along these revitalized trade corridors. The three critical pillars are: 1. Trade System Innovation: Building “fit-for-purpose” systems and supporting processes that reduce the cost and friction of cross-border trade along the “One Belt and One Road”. Trade system innovation to enhance financial supply chain efficiencies and provide easier access to low-cost working capital are both critical. Improving these two areas will benefit businesses end-to-end along their cross-border supply chains. Innovative companies like Basware are partnering with innovative network companies like MasterCard and banks to create new solutions in this area. 2. Interoperable Innovation: Driving a compatible set of standards, frameworks and trade systems along the trade corridors. An “Inside the System” approach will yield better results by adapting existing global processes and enhancing them for the betterment of all trading partners rather than attempting to create, implement and debug proprietary new processes. Example: Apple, after years of speculation that it was building its own payments system, launched Apple Pay in 2014 which is built with prevailing payments systems and standards. Apple is leveraging existing Near Field Communications (NFC) , existing data encryption protocols, MasterCard’s and other networks’ card tokenization technology and the customer relationships of existing bank card issuers. 3. Open Market Innovation: Allowing free market principles to dictate the business landscape in China and in countries along the corridors. This will ensure that the most efficient and effective businesses flourish which will maximize total trade/benefits. This will also ensure that benefits are shared equitably amongst participants. The UK government’s “Supply Chain Finance (SCF)” program illustrates how a government used market participants to develop an innovative platform to enable SMEs to access efficient working capital financing when selling to large corporations or governments. Introduction Over the past three decades, China’s economic growth has been driven by its role as the world’s manufacturing powerhouse. However, this model poses risks as reflected by China’s slowest GDP growth last year in 24 years [1]. China faces a “new normal.” Growth will likely be slower and the drivers 1 of economic growth will change. China’s leadership recognizes this shift. It is placing a greater emphasis on domestic consumption and developing new opportunities in cross-border trade. The “One Belt and One Road” initiative, an innovative policy framework focused on boosting crossborder trade along the revitalized Silk Road Economic Belt (land trade corridors connecting China with Europe, the “Belt”) and "21st Century Maritime Silk Road (water trade corridors connecting China with Europe, the “Road”), presents a potential growth opportunity. These trade corridors could be one of the key pillars of China’s future economic growth. However, success depends on enabling cooperation and economic benefits for all partners along the trading corridors from end-to-end. Let’s consider a line from one of the great ancient Chinese philophers Confucius: It says: “Now the man of perfect virtue, wishing himself to be established, sees that others are established, and, wishing himself to be successful, sees that others are successful.” President Xi Jinping emphasized the same spirit of cooperation and sharing when he said “Economic relations would not enjoy sustained, rapid growth if they were not based on mutual benefit or if they failed to deliver great benefits.” That philosophy lies at the very heart of the “One Belt and One Road” model. The shared benefits and cooperation required for its success depend on the manner in which policy framework is operationalized. This paper suggests the types of innovation that China could undertake to put this policy into action. Business-to-business and business-to-consumer cross-border trade are both essential growth drivers, but this paper will focus on trade between businesses. At the 2013 China Development Forum meeting, MasterCard highlighted the important role of SMEs in driving innovation and boosting economic growth (domestic as well as cross-border). In China, SMEs account for 70% of cross-border trade [2].SMEs account for over 50% of Germany’s economic output [3]. 50% of financial institutions’ cross-border business comes from SMEs [4]. Operationalization of the policy framework cannot ignore SMEs and they will be an important focus of this paper. Innovation along three pillars is critical for operationalization To quickly create a collaborative trading environment along the trade corridors, operationalization of the policy framework should be built on three pillars: 1. Trade System Innovation: Building “fit-for-purpose” systems and supporting processes that accelerate cross-border trade along the “One Belt and One Road”. Two key areas must be a focus– 1) Efficiency of financial supply chain and 2) Access to low-cost working capital. Addressing these two areas will benefit all businesses end-to-end along the cross-border supply chains. 2. Interoperable Innovation: Driving a compatible set of standards, frameworks and trade systems across borders and globally. Focus must be on ensuring fairness by adopting the best standards across markets and on maximizing outcomes through collaboration. 3. Open Market Innovation: Allowing free market principles dictate the business landscape in China and in the countries along the corridors. This will ensure that the most efficient and effective 2 businesses flourish which will maximize total trade/benefits and ensure that benefits are shared equitably among all participants. Trade System Innovation – Address financial supply chain and working capital issues Efficient financial supply chains and easy access to low-cost working capital benefit all businesses endto-end along cross-border supply chains. However, all businesses are not on equal footing with respect to these two areas. For example, globally, some companies (e.g., SMEs) pay interest rates for working capital that are 2-4 times higher than the rates paid by other companies (e.g. large corporates). Compared to domestic trade, cross-border trade is much more complex and involves the coordination of value chain participants and systems that cross national boundaries. Traditional systems of cross-border trade such as “Letters of Credit” (an important and almost completely paper-based cross-border payment type) and “Open Accounts” have not evolved to accomodate the new global world. In the current world, the pace and volume of cross-border trade have made old world systems less suitable. Opportunities to innovate trade systems can optimize working capital requirements and financial supply chains for businesses engaged in cross-border trade. Chinese leadership is in a unique position to contribute to this innovation. It is taking a holistic and end-to-end view of cross-border trade as part of its “One Belt and One Road” framework. This section will discuss some of the innovations that are underway around the world and can serve as starting points for Chinese leadership. While these innovations benefit all businesses, they are especially beneficial for SMEs as they face the biggest pain points. Efficient financial supply chains throughout the new Silk Roads Businesses face huge inefficiencies in their financial supply chains, specifically in their end-to-end purchasing and invoicing processes (procure-to-pay processes). At the root of the inefficiencies is their inability to benefit from the traditional electronic payments methods because of lack of scale, access or expertise. This results in higher working capital requirements because of the lower velocity of capital flowing through the supply chain, as well as higher operational costs. Electronic payments can be a key driver in reducing the costs and duration of procure-to-pay processes. The largest cost drivers in the financial supply chain are not the actual payments themselves. For example, 86% of costs related to a check transaction in US are for activities, such as approvals, reconciliation and repair [5]. For “Letters of Credit” the actual funds transfer represents a tiny fraction of the total cost. Unfortunately for some businesses, their small scale, fledgling expertise and limited access make them less suited to traditional electronic payments solutions that lend themselves better to automation. This leads to higher costs and slower procure-to-pay processes. For example, based on research conducted by CFO Research services these inefficiencies were ranked as a top five concern held by finance professionals [6]. Innovative payments solutions that are developed with cross-border trade in mind can address the issues. Basware is one such solution. It automates the procure-to-pay process through its digital payments and invoicing solution. Buyers receive their invoices electronically and instantaneously pay 3 them to their suppliers, many of whom are SMEs, by approving them. For payments, Basware has partnered with network companies like MasterCard to create Basware Pay, which uses MasterCard’s virtual card technology. A unique virtual account number is issued for each transaction to ensure maximum security. Figure 1 shows the end-to-end Basware process. Traditionally, the average time it takes to pay a B2B invoice is 55 days; with Basware Pay, suppliers can receive payment within as little as a day [7]. Basware connects close to 1 million businesses across 100 countries globally and is processing over 80 million transactions per year [7]. Daimler, a leading Basware client with more than 70,000 suppliers, uses Basware to process millions of invoices per year across borders and in multiple currencies [7]. Figure 1: How Basware Pay Works Source: Basware Company website Earthport is another innovative company that provides a more efficient alternative to correspondent banking and SWIFT for high-volume, low-value cross-border payments. To lower the cost and simplify the process, Earthport executes funding from the sender and payment to the receiver as local in-country bank transfers and settles across borders by netting many such transactions. Financial institutions can facilitate cross-border payments across 63 countries [7]. Earthport serves a total of 33 clients and powers the payments channels behind HSBC, Western Union and Xoom, among others [7]. Earthport can reduce cross-border payment fees by over 50% [7]. 4 Access to low-cost working capital Working capital is the necessary life blood required to make trade flourish and prosper along the new Silk Roads. Businesses have difficulty getting working capital because they lack the information banks require for traditional lending methods, such as substantial capital and an earnings track record. As a result these businesses are forced to turn to expensive financing companies or consider “grey lending” by so-called “shadow banks.” Access to working capital for businesses in every market along the Silk Roads can be created with acceptable risk using innovative lending companies that leverage nontraditional data sources. These companies could either offer financing directly or partner with banks to enable them to lend. Let’s look at three examples of such companies. LendingClub is the world’s largest peer-to-peer lending network connecting small business and consumer borrowers with investors. The company has developed its own propriety technology and algorithms that combine non-traditional online data with traditional data, such as personal credit scores, to evaluate creditworthiness. The system assigns ratings and interest rates to borrowers and investors then select appropriate loans to invest in. As of September 2014, LendingClub had facilitated over $6 billion in loans [7]. Entrepreneurial Finance Lab (EFL) focuses on SME lending and has developed a computerized credit application that utilizes psychometrics to analyze aspects of entrepreneurship. For example, selfperception of one’s own strengths and problem-solving abilities indicate the capacity to overcome hurdles as they arise and repay the loan. EFL’s test takes 40-45 minutes to complete and follows a "question and answer" format. Applications scored by EFL are available to the lender in as little as 30 minutes. EFL has launched in 27 countries across Africa, Asia, and Latin America, helping financial institutions disburse $265 million through more than 50,000 loans. EFL has also reduced default rates by 40% and tripled loan volumes [7]. It has also partnered with network companies like MasterCard to provide its significant international issuer base in developing markets with new tools to help issuers improve their credit underwriting practices for unbanked small businesses. Kabbage analyzes data from services like eBay, Square, Intuit Quickbooks or Amazon that SMEs may be using to run their business. The company has built APIs into these services and uses metrics including seller history, customer ratings and average revenues to determine creditworthiness. Kabbage has supported more than 100,000 small businesses with total funding exceeding $500 million, and daily funding surpassing $2 million [7]. The “One Belt and One Road” framework must ensure that the right environment is created for these solutions to prosper. Some success factors that must be kept in mind include: • Privacy laws that strike the right balance between protecting privacy and encouraging lenders to develop innovative lending solutions. A supportive regulatory environment that enables both traditional and non-traditional innovative players to thrive. 5 • Widely available digital infrastructure that reaches the broader population and that is highly secure resulting in high levels of usage and confidence. Interoperable Innovation – Take an “Inside the System” approach At the 2012 China Development Forum, MasterCard recommended that China take an “Inside the System” approach as opposed to an “Outside the System” approach to lead the global economy. An “Outside the System” approach is one which circumvents existing international systems, frameworks, governing economic orders and creates new proprietary systems. China-centric systems, by definition, would appear to subordinate trading partners to these new rules rather than to multilateral, global rules. On the other hand, an “Inside the System” approach is one which adapts existing global systems and frameworks, enhancing them for the betterment of all trading partners. Since the policy innovation of “One Belt and One Road” is to share economic benefits and drive cooperation along the entire Silk Road trading corridor, an “Inside the System” approach will yield the desired results. The right approach will drive ‘interoperability’ of Chinese businesses with their crossborder trading partners and drive trade. There are also three strategic advantages to an “Inside the System” approach for China: Advantage 1 – Avoiding entrenched conflicts. As Martin Wolf, Chief Economics Commentator at the Financial Times, suggested at the 2011 China Development Forum, “such an (outside the system) approach would, I fear, lead to unmanageable conflicts with the other great powers”. Advantage 2 – Driving changes within an existing system is usually easier than establishing a new system and can accelerate innovation. Advantage 3 – The “Inside the System” approach makes it easier to achieve the leadership prerequisite - global leaders must being seen as delivering “global public goods”. Perhaps the best way to demonstrate the benefits of an “Inside the System” strategy is by analyzing some prominent history lessons. The failed leadership attempt in international trade of Germany in the first half of the 20th century is a good example. In the 1890’s, rising Germany took many “Outsider” actions in international trade: aggressive export tactics, tariffs and dumping to gain global market share from free-trade Britain, and the creation of German-centric systems and trade blocs. As a result, Germany’s rise as a global trade partner was resented and resisted by the status quo powers, which saw Germany as an outsider challenging their vested interests. In contrast, the United States rose to global preeminence in international trade peacefully, thanks to its “Insider” approach. This was achieved by developing its vast domestic market in a way that did not pose a threat to the global financial and trading systems built by previous leaders such as the United Kingdom. Systems include for example free trade and free movement of capital, central banking and 6 sterling as global reserve currency linked to the Gold Standard. In fact, the UK came to perceive the US as a fantastic investment opportunity for its large surplus capital. Several prominent recent global examples support an “Inside the System” approach. Apple, after years of speculation that it was building its own payments system, launched its payments solution called Apple Pay in 2014 that is built on existing payments systems and standards. Instead of launching a payments platform built on Bluetooth and a proprietary payments engine, Apple is leveraging existing Near Field Communications (NFC) standards, current data encryption protocols, MasterCard’s and other networks’ card tokenization technology and the customer relationships of existing bank card issuers. Early signs of success support Apple’s “Inside the System” approach. For example, in just a few months after launch, Apple Pay already supports a credit cardholder base that captures 90% of US credit card volume [8]. The evolution of Six Sigma provides another example of companies taking an “Inside the System” approach to enhance an existing standard rather than develop a new one. The Six Sigma quality standard was originally developed by Motorola in the 1980s. However, since then hundreds of companies around the world have adopted Six Sigma and helped shape its evolution; today it is a way of doing business around the world. Square and iZettle are other examples of companies that are taking an “Inside the System” approach to transform acceptance of electronic payments by small merchants. Their innovative acceptance solutions seamlessly insert themselves in the current payment card value chain and enable customers to shop at SME merchants by using the payment cards they already own. Despite launching in the US market with high traditional merchant card acceptance, Square is a successful case study. Since starting in 2010, it has expanded globally (e.g., Canada, Japan), processes $100 million payment volume daily and has over 1 billion customer visits every year [7]. Similarly, iZettle, headquartered in Sweden, has expanded to Netherlands, Norway, Denmark, Finland, UK, Germany, Spain, Mexico, and Brazil since its launch in 2011. Japan’s FeliCa technology is an example of how an “Outside the System” approach can impede progress. Although Japan led the world initially on contactless and mobile contactless payment implementations, its FeliCa technology failed to join the ISO standards later. The end result was that Japan’s standards are not compatible with the rest of the world, and Japan’s FeliCa standard operators are now looking for ways to support open loop standards and move away from FeliCa and migrate to international standards (ISO 14443) for seeking cost effectiveness and global compatibility. To achieve this, NTT DoCoMo, one of Japan’s largest telecom operators, announced to partner with network companies like MasterCard to integrate open-standard based contactless technology in their mobile wallet solutions. China’s own history has proven that the “Inside the System” position is a beneficial one. A case in point is China’s economic development in the years after joining the WTO in December 2001. Looking back, we can see that China demonstrated the value of the “Inside” approach. In 2013 China surpassed the US to become the world’s biggest trading nation as measured by the sum of its exports and imports. 7 Pascal Lamy, ex-director-general of the World Trade Organization said, "It is a success story for China and also a success story for the rest of the world." Similarly recent suggestions by the Chinese leadership to allow eligible global network companies to participate in the domestic payments switching market is another step in the right direction. This will drive standardization of payments end-to-end along the trading corridors and make cooperation and sharing of benefits much easier. As Chinese leadership continues with an “Inside the System” approach, the following two factors will be important for success – Take bigger roles in established international institutions and through those institutions achieve its purposes. Continue the opening up and reform efforts to adopt the best practices and standards globally, instead of creating China-specific standards that do not interoperate with the global standards. Open Market Innovation – Let free market principles dictate the business landscape Open market innovation implies letting free market principles dictate the business landscape in China and in countries along the corridors. This will ensure that the most efficient and effective businesses flourish. This will maximize total trade/benefits and will ensure that benefits are shared equitably amongst the participants. Three aspects related to openness must be put into practice as part of the operationalization of “One Belt and One Road” policy framework. The first aspect is ensuring that there is a level playing field for all businesses (e.g., State Owned Enterprises (SOEs), private companies, small businesses) within China and in all countries along the Belt. This implies that market forces should be allowed to determine the competitive landscape within countries with no individual business receiving an unfair advantage. In China, SOEs today have significant structural advantages compared to private companies and SMEs. There are several examples of countries that have made this transition without resulting in political instability. For example, prior to 1980, the UK possessed one of the largest SOE sectors in Europe, but in the 80s embarked on an extensive privatization program. The result, employment in the UK’s public sector dropped from around 8% of domestic employment in 1979 to less than 2% in mid 1990s [9]. There are two lessons to be learned from how the UK achieved its privatization goals and countries throughout Europe, from France to Germany and Eastern Europe benefited from the UK model. The first lesson is that the UK used a phased approach starting with smaller enterprises, such as in the housing sector, that also operated in private markets and then moving to larger, more complex monopolistic enterprises, such as public utilities. The second lesson was that the UK used a two-pronged approach for privatization that included a) selling (full enterprise or shares) to the private sector and b) subjecting the SOEs to the same market discipline demanded of private enterprises. 8 China has made some significant progress in reducing the role of SOEs, but more can be done. SOEs still account for close to 30% of GDP which although significantly lower than the 90% share in the 1970s is still higher than the developed countries [10] (UK’s SOE contribution to GDP was about 10% before its privatization program [9]). The UK government’s “Supply Chain Finance (SCF)” program is a good example of how the government used market based principles to create an innovative solution to close the gap in working capital financing between large corporations and small businesses. Launched by the UK government in 2012 by partnering with several large companies, such as BAE Systems, Boeing, BP and British Airways, the program is an innovative way for large companies to help SMEs within their supply chain access working capital financing at a much lower cost. With Supply Chain Finance a bank is notified by the large company that an invoice has been approved for payment; the bank is then able to offer a 100 percent immediate advance to the supplier at lower interest rates based on the payment guarantee. The program could make up to £20 billion in new cheaper financing available to SMEs [11]. M-Pesa the world’s most successful mobile money solution is a good example where a government let a mobile network operator, Safaricom, innovate and grow in the remittance/financial services market that is traditionally a stronghold of financial institutions. Today over 85% of Kenya’s adult population own M-Pesa and it accounts for 80% of all electronic transactions in the country [12]. The second aspect of openness is making cross-border trade and investment bi-directional. Chinese businesses should be able to invest and sell their products/services across the borders, but foreign businesses should also be able to do the same in China. The US became the world’s largest economy using this approach combined with its “Inside the System” approach discussed earlier. It was one of the first countries to emulate Britain’s industrialization and the US economy overtook the UK economy in size around 1879 largely without arousing fear or envy in the UK. As mentioned earlier, a key to US success was that the development of its vast domestic market didn’t pose a challenge to the global financial and trading system built up by Britain but was perceived as a fantastic growth investment opportunity for surplus UK capital. Chinese leadership can take tangible steps toward full transparency regarding the intent of its global initiatives. It needs to consider developing a level of proactivity and capability to state its purposes openly and visibly when making a key move on the global stage. It also needs to consider proactively and clearly communicating its actions in its attempt to improve foreign perceptions of its domestic market openness and competition, which often undermine China’s global credibility. The third aspect of openness centers on applicability. Because it is impossible to predict the specific businesses that will be best positioned to suit the different needs, the policy framework should apply to all businesses in China and all businesses in countries along the corridors (not just to businesses along the corridors). 9 Summary The “One Belt and One Road” policy framework can serve as a new model of economic growth for China in the “new normal” by boosting cross-border trade along the reimagined Silk Roads. However, its success depends on enabling cooperation and unlocking economic benefits in every market along the trading corridors. Operationalization of the policy framework along three pillars is critical for success. Special focus should be placed on SMEs because they will drive most of the economic innovation along these revitalized trade corridors. The three pillars are: 1. Trade System Innovation that builds “fit-for-purpose” systems and supporting processes that accelerate cross-border trade along the “One Belt and One Road”. Financial supply chain inefficiencies and lack of access to low-cost working capital are the most important issues here. Policies should encourage digital innovations that ease the flow of goods and capital. 2. Interoperable Innovation that ensures standards, frameworks and trade systems developed are common/compatible across borders and globally. Policies that support an “Inside the System” innovation approach are needed. This approach which adapts existing global systems and frameworks, enhancing them for the betterment of all trading partners will yield desired results more rapidly. 3. Open Market Innovation that allows the right free market principles to dictate the business landscape in China and in the countries along the corridors. This will require policies that level the playing field for all businesses within China and in countries along the belt, encourage bi-directional cross-border trade and investment and ensure application of the “One Belt and One Road” policy framework to all businesses in China and in countries along the corridors. The outcome will be that the most efficient and effective businesses will flourish, which will maximize total trade/benefits and will also ensure that benefits are shared equitably amongst the participants. Based on global examples, we recommend that Chinese leadership encourage measures that operationalize their policy framework quickly and effectively. These recommendations will enable cooperation and economic benefits for all partners along the trading corridors and boost cross-border trade. 10 Sources 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Wall Street Journal Chinese Academy of Social Sciences and China Association of Microfinance Germany’s, Federal Ministry of Economics and Technology(BMWi) Glenbrook 2010 Purchasing Card Benchmark Survey, RPMG Research CFO Research Services, 2012 Company website, MasterCard Advisors analysis 2015 New York Times Institute for Development Policy and Management, University of Manchester China’s National Bureau of Statistics Gov.UK website MasterCard Advisors analysis 2015 11

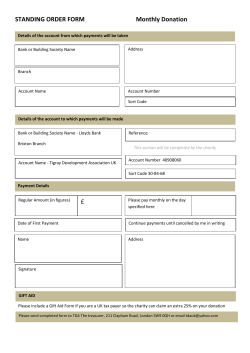

© Copyright 2026