BSN DANA DIVIDEN AL-IFRAH

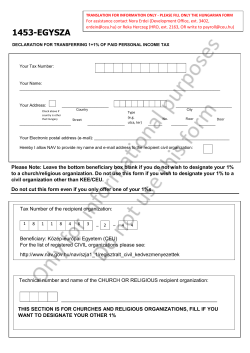

YTD High: 0.2469 24 Apr 2015 BSN DANA DIVIDEN AL-IFRAH YTD Low: 0.2272 07 Jan 2015 Fund Objective The Fund seeks to provide consistent income by investing in Shariahcompliant equities with attractive dividend yield and/or potential dividend yield. Dana Dividen Al-Ifrah Since Investment 20% Market Review & Outlook 15% 10% 5% 0% -5% Fund Details Launch Date : 12 September 2012 Approved Fund Size : 800 million units Current Fund Size : 241.95 million units Trustee : Amanah Raya Berhad Min. Initial Investment : RM500.00 Sales Charge : Up to 4.5% of NAV/unit Annual Management Fee : 1.5% p.a of NAV Annual Trustee Fee : 0.06% p.a of NAV Redemption Fee : Currently None Switching Fee : Currently None Price as at 30 Apr 2015 (RM): 0.2453 Fund Performance (as at 30 April 2015) YTD 3 Months 6 Months Since Inception* Since Investment** AL-IFRAH (%) 6.61 4.65 1.70 16.44 16.39 Benchmark (%) 4.53 1.73 -2.04 17.59 13.87 *Starts from 12 September 2012 **Starts from 12 October 2012 Source: All performance figures have been verified by Novagni Analytics and Advisory Sdn Bhd Jan-15 Mar-15 Nov-14 Jul-14 Sep-14 May-14 Jan-14 Mar-14 Nov-13 Jul-13 Sep-13 May-13 Jan-13 Dana Dividen Al-Ifrah FTSE BM EMAS Shariah Asset Allocation as at 30 April 2015 May has traditionally been a decent month for the KLCI with an average 4 years monthly return of 1.31%. The market could see a repeat if global markets remain buoyant and oil prices continue to firm further. The key event to watch out for in May is the tabling of the 11th Malaysia Plan in Parliament. The plan will set the pace for the last five years before Malaysia achieves developed nation status by 2020. On the technical front, the 6-year rally off the 2008 low has likely ended in July 2014 and is now undergoing a multi-month correction. The recent rebound to 1,810 suggests that there is a chance for the KLCI to form a larger Head and Shoulders pattern that has a neckline at 1,660-1,671. A breach of 1,660 would confirm a downside target of 1,424-1,400 for the rest of 2015. On late April, prices moved above the November high of 1,858 but it fell back and formed a bearish pattern. This bearish reversal candlestick pattern could signal that the rebound from the December low is at the tail end. Therefore, we could see a fall towards 1,774 low. This bearish forecast for 2015 is incorrect if the KLCI can rally above the all time high of 1,896. Minor resistance is at 1,880 and 1,896. Mar-13 Nov-12 -10% Sep-12 April started off on a strong note for Malaysia as the KLCI rose to 7month highs on the back of a stabilizing ringgit and oil prices. Buoyant regional markets and the Invest Malaysia 2015 event also help boost interest in the market. However, all of the gains were given up towards the end of the month on the back of heavy profit taking. For the month, the KLCI eased 0.7% or 13 points to close at 1,818 points. The broader market outperformed the KLCI, with the FBM Emas edging lower 0.2% month on month to 12,539 points. Small caps were mixed, with the FBM Small cap index gaining 1.4% to 16,522 points while the FBM ACE fell 1.9% month on month to 6,988 points. Average daily value traded on Bursa in April eased 0.5% month on month to RM2.11bn. 18.56% 81.44% Equity Liquidity Top 5 Holdings (as at 30 April 2015) 1. 2. 3. 4. 5. Protasco Tenaga SPSetia DiGi F&N %NAV ` Asset Allocation (as at 30 April 2015) Trading & Services Consumer Construction Property Industrial Oil & Gas Technology Plantation Finance Liquidities 5.28 4.42 3.81 3.80 3.43 %NAV 24.52 11.75 11.37 9.94 9.48 7.34 2.60 2.42 2.02 18.56 Dividend Distribution History Year Gross Distribution/Unit (sen) 2012 2013 2014 n.a 2.30 2.07 Disclaimer: Neither the information nor any opinion expressed constitutes an offer, or an invitation to make an offer to buy or sell any securities. Investors are advised to read and understand the contents of the prospectus before investing. There can be no assurance that the investment objectives of the Fund will be realized. Prices of units and distribution payable, if any, may go down as well as up. Past performance is no indication of future performance. There are fees and charges involved and you are advised to consider them before investing in the Fund. Information has been obtained from sources believed to be reliable and Permodalan BSN Berhad does not warrant its completeness or accuracy. Opinion and estimates constitute our judgment as of the date of this material and are subject to change without notice.

© Copyright 2026