Q1 2015 Soft Goods Market Update

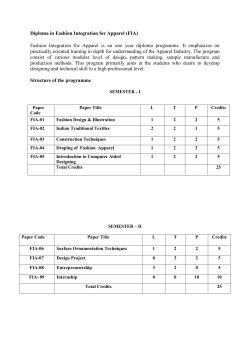

MARKET UPDATE l Soft Goods Q1 2015 The newsletter for the Consumer Soft Goods sector 140% +36.5% 130% +23.8% 120% +16.8% 110% +9.7% 100% +0.6% -0.9% 90% -9.2% 80% Apr-14 Jul-14 Market Trends Source: S&P Capital IQ, Industry Research Reports Market Intelligence 8.0x 12.1x 12.1x 13.7x 15.4x 11.6x 11.5x 12.0x 11.5x 10.8x 10.0x 11.4x 11.1x 8.7x 8.2x 9.4x 9.4x 10.8x 10.4x 11.5x 11.5x 10.0x 6.0x Q1 '15 Q4 '14 Q3 '14 Q2 '14 Q1 '15 Q4 '14 Q3 '14 Q2 '14 Q1 '15 Q4 '14 Q3 '14 Q2 '14 Q1 '15 Q4 '14 0.0x Q3 '14 2.0x Q2 '14 4.0x Q1 '15 continued on its upward trajectory due (in part) to sustained discretionary consumer shopping and spending patterns across North America and strong organic sales growth in key emerging markets 12.0x Q4 '14 The Other Accessories segment has 14.0x Q3 '14 index upturn is driven by the LVMH’s weighted stock price performance which has benefited from both strong sales in China and a shift to high margin products 16.0x Q2 '14 Lincoln’s Bags and Luggage stock price Other Accessories Bags and Luggage 18.0x 13.1x 13.0x 13.9x 13.5x improved outlook on cotton prices but was partially offset by foreign exchange pressure and a weaker macro environment, particularly in Europe Jan-15 Small Cap Apparel Home Décor Historical Enterprise Value / EBITDA Valuation Performance(1) Q2 '14 The Apparel segment has benefited from an Oct-14 Mid and Large Cap Apparel Retail S&P 500 Q1 '15 Lincoln International’s annual Consumer Conference will take place on May 14th, 2015 at Hotel Nikko in San Francisco. Leaders within direct-to-consumer and social media, including Andy Dunn, CEO of Bonobos, and Randi Zuckerberg, best selling author, founder and CEO of Zuckerberg Media and former Head of Marketing at Facebook, will present at the event. Presentations will also feature 36 consumer products companies. LTM Relative Stock Price Performance Q4 '14 Lincoln’s 2015 Consumer Conference Lincoln International Consumer Soft Goods Index Q3 '14 Soft Goods Group Update Mid and Large Cap Small Cap Apparel Retail Home Décor Bags and Luggage Other Accessories Apparel Note: (1) Based on quarterly average values; previous Lincoln market updates based on quarterly median values M&A Transaction Recap Announced Target Target Date Company Description Acquiring Company 31-Mar-15 The J. Jill Group, Inc. Retails w omen's apparel, accessories and footw ear Tow erBrook Capital Partners L.P. Implus Corporation, a leading provider of 23-Mar-15 Louisv ille Slugger Manufactures baseball bats and accessories Wilson Sporting Goods Co. (Amer Sports) consumer products, has been acquired by Berkshire Partners for $600m 20-Mar-15 Alliance Apparel Group Inc. Manufactures apparel Eminent, Inc. Coach has signed a definitive agreement to acquire Stuart Weitzman Holdings from private equity firm Sycamore Partners Adidas has agreed to sell Rockport to Berkshire Partners and New Balance for $280m J. Jill, a leading multi-channel fashion retailer of women's apparel, accessories and footwear, has been acquired by Towerbrook Capital Partners Source: Mergermarket, Bloomberg and Reuters Q1 2015 www.lincolninternational.com 9-Mar-15 LogoSportsw ear, Inc. Retails customized uniforms and apparel Gladstone Inv estment; Digital Fuel Capital 26-Feb-15 GoRun Wichita, LLC Retails running footw ear and apparel Fleet Feet Sports 24-Feb-15 Knights Apparel Inc. Supplies sports and collegiate apparel Hanesbrands Inc. 3-Feb-15 L'Amour Des Pieds Manufactures shoes for w omen Remac, L.P. 28-Jan-15 Blondo Inc. Designs and manufactures footw ear Stev en Madden, Ltd. 27-Jan-15 Boston Boot Company LLC Manufactures shoes for men Shoebuy .com, Inc. 23-Jan-15 The Rockport Company , LLC Manufactures footw ear and accessories Berkshire Partners; New Balance Athletic 16-Jan-15 Designer Apparel Group, LLC Manufactures priv ate label and branded apparel Global Fashion Technologies, Inc. 6-Jan-15 Stuart Weitzman Holdings LLC Designs and manufactures w omen's lux ury footw ear Coach, Inc. 6-Jan-15 Anthony Enterprises, Inc. Designs and manufactures neckw ear Wolfmark Neckw ear, Inc. 5-Jan-15 Rey n Spooner Inc. Designs and retails apparel and accessories Aloha Brands LLC Consumer Soft Goods D E A L R E A D E R Lincoln International 1 Lincoln International Consumer Soft Goods Index (Continued) Selected Consumer Soft Goods Public Comparables Stock Price Company Name Mid and Large Cap Apparel Adidas AG Hanesbrands Inc. Nike, Inc. PVH Corp. Ralph Lauren Corporation Under Armour, Inc. V.F. Corporation Small Cap Apparel Columbia Sportswear Company Deckers Outdoor Corp. G-III Apparel Group, Ltd. Oxford Industries Inc. Perry Ellis International Inc. Rocky Brands, Inc. Wolverine World Wide Inc. Zumiez, Inc. Retail Abercrombie & Fitch Co. American Eagle Outfitters, Inc. Bed Bath & Beyond Inc. Express Inc. Francesca's Holdings Corporation The Gap, Inc. Kirkland's Inc. L Brands, Inc. Pier 1 Imports, Inc. Restoration Hardware Holdings, Inc. Tuesday Morning Corporation Urban Outfitters Inc. Williams-Sonoma Inc. Home Décor Dorel Industries Inc. Ethan Allen Interiors Inc. La-Z-Boy Incorporated Leggett & Platt, Incorporated Ralph Lauren Corporation Select Comfort Corporation Tempur Sealy International Inc. Bags and Luggage Coach, Inc. LVMH Moët Hennessy Louis Vuitton SA Samsonite International S.A. Tumi Holdings, Inc. Vera Bradley, Inc. VIP Industries Limited Other Accessories Columbia Sportswear Company Jarden Corp. Newell Rubbermaid Inc. % of 52-week High Market Cap Enterprise Value LTM Revenue EBITDA YoY Revenue Growth EBITDA Margin EV / LTM Revenue EBITDA $ 79.40 33.51 100.33 106.56 131.50 80.75 75.31 93% 96% 97% 80% 70% 98% 97% $ 16,224 $ 13,431 86,679 8,786 11,482 17,399 32,044 16,356 $ 15,175 82,569 11,853 10,751 17,090 32,521 17,592 $ 5,474 30,247 8,241 7,602 3,248 12,282 1,485 886 4,796 953 1,360 437 2,109 (10% ) 15% 12% 6% 8% 30% 8% 8% 16% 16% 12% 18% 13% 17% 0.9x 2.8x 2.7x 1.4x 1.4x 5.3x 2.6x 11.0x 17.1x 17.2x 12.4x 7.9x nmf 15.4x $ 60.90 72.87 112.65 75.45 23.16 21.60 33.45 40.25 98% 73% 98% 96% 86% 93% 99% 96% $ 4,257 $ 2,519 2,533 1,243 359 163 3,448 1,184 3,844 $ 2,188 2,405 1,347 478 195 4,130 1,034 2,101 $ 1,588 2,117 998 890 286 2,761 812 256 249 185 122 35 24 325 107 25% 11% 23% 11% (7% ) 11% 3% 12% 12% 16% 9% 12% 4% 8% 12% 13% 1.8x 1.4x 1.1x 1.3x 0.5x 0.7x 1.5x 1.3x 15.0x 8.8x 13.0x 11.1x 13.7x 8.2x 12.7x 9.6x $ 22.04 17.08 76.78 16.53 17.80 43.33 23.75 94.29 13.98 99.19 16.10 45.65 79.71 48% 98% 96% 94% 89% 92% 89% 99% 72% 97% 70% 97% 94% $ 1,533 $ 3,331 14,250 1,393 753 18,145 407 27,570 1,258 3,957 705 5,957 7,325 1,356 $ 2,920 14,571 1,318 714 17,983 308 30,655 1,444 4,182 651 5,699 7,104 3,744 $ 3,283 11,881 2,165 377 16,435 508 11,454 1,866 1,867 899 3,323 4,699 410 349 1,793 222 71 2,635 48 2,391 182 208 21 497 657 (13% ) (3% ) 2% (3% ) 13% 1% 9% 6% 3% 26% 6% 8% 9% 11% 11% 15% 10% 19% 16% 9% 21% 10% 11% 2% 15% 14% 0.4x 0.9x 1.2x 0.6x 1.9x 1.1x 0.6x 2.7x 0.8x 2.2x 0.7x 1.7x 1.5x 3.3x 8.4x 8.1x 5.9x 10.1x 6.8x 6.5x 12.8x 8.0x 20.1x nmf 11.5x 10.8x $ 27.78 27.64 28.11 46.09 131.50 34.47 57.74 83% 85% 99% 98% 70% 99% 93% $ 902 $ 800 1,439 6,361 11,482 1,816 3,520 1,391 $ 810 1,330 7,005 10,751 1,694 5,072 2,678 $ 760 1,403 3,782 7,602 1,230 2,990 167 90 122 431 1,360 161 344 10% 4% 6% 9% 8% 26% 21% 6% 12% 9% 11% 18% 13% 12% 0.5x 1.1x 0.9x 1.9x 1.4x 1.4x 1.7x 8.3x 9.0x 10.9x 16.3x 7.9x 10.5x 14.7x $ 41.43 176.34 3.48 24.46 16.23 1.49 81% 94% 96% 99% 54% 72% $ 11,428 $ 88,493 4,895 1,660 647 211 10,383 $ 95,052 4,858 1,607 534 211 4,494 $ 37,085 2,351 527 509 163 1,140 8,394 365 112 83 14 (11% ) (7% ) 15% 13% (5% ) 5% 25% 23% 16% 21% 16% 9% 2.3x 2.6x 2.1x 3.0x 1.0x 1.3x 9.1x 11.3x 13.3x 14.4x 6.5x 14.6x $ 60.90 52.90 39.07 98% 97% 97% $ 4,257 $ 10,186 10,490 3,844 $ 14,080 12,788 2,101 $ 8,287 5,727 256 805 924 25% 10% 2% 12% 10% 16% 1.8x 1.7x 2.2x 15.0x 17.5x 13.8x Source: Bloomberg, Capital IQ and company filings, as of 3/31/2015 About Lincoln International Officer Contacts Chris Stradling Managing Director [email protected] +1-312-580-8325 Contributors Mark Jones-Pritchard Vice President [email protected] +1-312-506-2724 Alberto Sinesi Associate [email protected] Tyler Shankel Analyst [email protected] Lincoln International specializes in merger and acquisition advisory services, debt advisory services, private capital raising and restructuring advice on mid-market transactions. Lincoln International also provides fairness opinions, valuations and pension advisory services on a wide range of transaction sizes. With sixteen offices in the Americas, Asia and Europe, Lincoln International has strong local knowledge and contacts in key global economies. The firm provides clients with senior-level attention, in-depth industry expertise and integrated resources. By being focused and independent, Lincoln International serves its clients without conflicts of interest. More information about Lincoln International can be obtained at www.lincolninternational.com Q1 2015 www.lincolninternational.com Consumer Soft Goods D E A L R E A D E R Lincoln International 2

© Copyright 2026