Gulf States - Panhandle Eastern Pipe Line Company, LP

BUSINESS SESSION I • Welcome • Energy Transfer Update Beth Hickey – Sr. Vice President, Interstate Pipelines • Commercial Update Joey Colton – Sr. Director, Marketing & Optimization • Interconnect Update John Reid – Sr. Director, Business Development • Market Services Brad Holmes – Vice President, Market Services 2 IMPORTANT DISCLOSURES This communication is based on information which Panhandle Eastern Pipe Line Company, LP, Sea Robin Pipeline Company, LLC, Trunkline Gas Company, LLC and Trunkline LNG Company, LLC (collectively, “Company”) believes is reliable. However, Company does not represent or warrant its accuracy. The statements and opinions expressed in this communication represent the views of Company as of the date of this report. These statements and opinions may be subject to change without notice and Company will not be responsible for any consequences associated with reliance on any statement or opinion contained in this communication. Company disclaims any intention or obligation to update any statements or opinions contained in this communication. This communication is confidential and may not be reproduced in whole or in part without prior written permission from Company. 3 ENERGY TRANSFER UPDATE Beth Hickey, Senior Vice President – Interstate Pipelines ENERGY TRANSFER ASSETS ETP Assets SXL Assets Development Projects Marcus Hook Eagle Point Nederland Lake Charles LNG Rover Pipeline Dakota Access Pipeline Lone Star Express Pipeline Crude Conversion Pipeline REGENCY MERGER ETP Assets Regency Assets Lone Star Pipeline ETP Storage ETP Plant Facility Lake Charles LNG Regency Plant Lone Star Storage Facility Lone Star Fractionator 6 REGENCY MERGER PEPL/Trunkline and Rover pipelines are highly complementary to Regency’s asset position Capitalize on ETP’s unique franchise and broad capabilities with SXL’s “Mariner East/West” franchise Ability to replicate in this region: Utica - Integrated Midstream / NGL business model - Existing Mariner South NGLs export model with SXL at Marcus Hook ETP Assets Marcus Hook Regency Assets Eagle Point SXL Assets SXL Storage SXL Inkster Cavern Marcellus 7 NEW ADDITIONS TO OUR INTERSTATE FAMILY Midcontinent Express Pipeline • Placed in service in 2009 • 500 miles; 1.4 Bcf/day capacity • Access to supply from the Midcontinent region and the Barnett Shale • Interconnects with multiple interstates (1) • 50/50 joint venture between Energy Transfer and Kinder Morgan (operator) Gulf States Perryville Gulf States Transmission • 10 miles from East Texas processing plants to just across the Louisiana border (interconnect with RIGS) (1) ANR, CenterPoint, Columbia Gulf, Destin, NGPL, Sonat, Tennessee, Texas Eastern, Texas Gas, Transco 8 INTERSTATE COMMERCIAL TEAM Beth Hickey Senior Vice President Market Services Panhandle / Trunkline / Sea Robin Transwestern / Tiger / FEP / Gulf States Regulatory Affairs Florida Gas Transmission Marketing and Business Development Marketing and Business Development Marketing and Business Development Gas Control and Facility Planning Gas Control and Facility Planning Gas Control and Facility Planning 9 COMMERCIAL UPDATE Joey Colton, Senior Director – Commercial Marketing & Optimization ROVER PIPELINE Dawn Rover - New Build Rover – Firm Capacity on Vector Rover is a new 3.25 Bcf/day interstate pipeline designed to transport from processing facilities in the prolific Marcellus and Utica Shale areas to market hubs that can reach Midwest, Gulf Coast, Canadian, and U.S. Northeast markets. 11 ROVER – SOUTHBOUND PATH Defiance to Trunkline To Trunkline Zone 1A Rover Pipeline Panhandle Eastern Trunkline Gas 12 ROVER SUPPLY ZONE CAPACITIES (MMCF/D) Fox 1,000 Cadiz 1,250 Majorsville 400 Seneca 800 Clarington 750 Sherwood 800 13 ROVER TIMELINE July 2014 FERC PreFiling Request February 2015 Filed FERC Certificate Application November 2015 – January 2016 Anticipated Issuance of FERC Certificate 1Qtr 2016 Construction Authorization Anticipated December 2016 In Service to Midwest Hub June 2017 In Service to Market Zone North For more information visit www.roverpipelinefacts.com 14 TRUNKLINE ABANDONMENT July 2012 Initial FERC filing for Abandonment April 2013 FERC issued EA November 2013 FERC Approved Abandonment January 2014 February 2014 December 2015 Abandonment TC Filed to be FERC Approved Implementation Implementation Completed no Plan Later than Plan 12/31/2015 15 LAKE CHARLES LNG • Liquefaction transforms Lake Charles LNG into a bi-directional facility capable of importing and exporting LNG • Second largest liquefaction facility planned in U.S. after Cheniere’s Sabine Pass • BG responsible for design, construction management, operations and off-take – Will utilize ETP’s pipeline network to deliver gas to the facility – Minimum 25yr firm transportation contract • DOE FTA & non-FTA approval conditionally granted • Final investment decision expected by 2016 • Train 1: commissioning & start-up no later than Q2 2020 • Trains 2 & 3: subsequent in-service at ~6 month intervals 16 LAKE CHARLES LNG TIMELINE July 2011 DOE FTA Approval August 2013 DOE Non-FTA Approval October 2013 March 2014 2016 2020 FID PDA FERC Filing Construction Anticipated to begin in 2016 Train 1 Inservice Anticipated Q1/Q2 17 WHAT’S NEXT? Trunkline Sea Robin 18 INTERCONNECT UPDATE John Reid, Senior Director – Business Development PANHANDLE – NEW SUPPLY CONNECTIONS More than 800 MMcf/d of recent supply additions with an additional 140 MMcf/d possible by 1st Quarter 2016 20 PANHANDLE TENAWA HAVEN PROCESSING PLANT • 1.3 Bcf/day straddle plant - will process the entire gas stream going through PEPL’s Haven, Kansas compressor station • Fully operational May 2015 Haven 21 PANHANDLE &Assets TRUNKLINE Interstate Pipeline MARKET AREA SUPPLY Marcellus/ Utica PEPL / REX PEPL / TETCO TGC / REX • TETCO Gas City (PEPL) – receipt capacity of 425,000 Dth/d; Q4 2015 • REX Putnam (PEPL) – increase to 275,000 Dth/d; Q3 2015 • REX Douglas (TGC) – increase to 275,000 Dth/d; Q3 2015 22 TRUNKLINE – CREOLE TRAILS DELIVERY POINT Trunkline New 1 Bcf/d delivery meter 23 MARKET SERVICES Brad Holmes, Vice President – Market Services INTERSTATE MARKET SERVICES TEAM Brad Holmes Vice President Lindy Donoho Contract Admin Richard Moreno Panhandle / Trunkline / Sea Robin Points Nominations Capacity Release M+ Support NAESB Kathy Washington Transwestern / Tiger / FEP/Gulf States Cynthia Rivers Florida Gas Transmission Customer Service Noms & Scheduling Customer Service Noms & Scheduling Accounting Accounting Transfer Support Transfer Support Accounting 25 INTERSTATE SYSTEM MIGRATION 2015 PEPL TGC SER PEPL TGC SER Gulf States 2016 PEPL TGC SER Gulf States Rover 2017 PEPL TGC SER Gulf States Rover FGT 2018 PEPL TGC SER Gulf States Rover FGT Transfer FGT TW FEP Tiger Transfer FGT TW FEP Tiger Transfer FGT TW FEP Tiger Transfer TW FEP Tiger TW Tiger FEP 26 MESSENGER + 27 MESSENGER + 28 FERC INITIATIVE ON GAS & ELECTRIC COORDINATION • In February 2012, FERC issued a notice (Docket AD12-12) for comment on gas-electric interdependence • Five regional technical conferences were held through the summer of 2012. The conferences explored scheduling and market structures; communications, coordination and information sharing; reliability concerns • Regional conferences spurred further technical conferences in 2013: – February 13th – Improving communications and data sharing – April 25th – Gas and electric trading day differences and scheduling – May 16th – RTO and ISO update on winter operations • Communications NOPR (Docket RM13-17) – July 2013 – Provide authority for interstate pipes and utilities that transmit electricity to share non-public, operational information for the purpose of promoting reliable service or operational planning for either party 29 FERC NOPR AND INITIATIVES Issued March 20, 2014 • • RM14-2 – Start of the Gas Day to 4:00 a.m. – Timely Nomination deadline to 1:00 p.m. – Two additional Intraday cycles – Multi party transportation contracts for aggregated firm service FPA Section 206 – • ISO’s and RTO’s must file to adjust the posting of day ahead energy market and reliability unit commitments NGA Section 5 Show Cause – Interstate pipelines must make compliance filings by May 19th to revise their tariffs to provide for the posting of offers to purchase capacity 30 CURRENT NAESB NOMINATION AND SCHEDULING TIMELINE Nomination Cycle Nomination Deadline (CCT) Notification of Schedule (CCT) Nomination Effective (CCT) Bumping of Interruptible Transmission (IT) Timely 11:30 a.m. 4:30 p.m. 9:00 a.m. Next Day N/A Evening 6:00 p.m. 10:00 p.m. 9:00 a.m. Next Day Yes Intra-Day 1 10:00 a.m. 2:00 p.m. 5:00 p.m. Current Day Yes Intra-Day 2 5:00 p.m. 9:00 p.m. 9:00 p.m. Current Day No 31 NAESB SCHEDULE GAS ELECTRIC HARMONIZATION (GEH) FORUM - 2014 • April 3rd - NAESB Board of Directors Meeting – GEH recommendations to change the annual plan and identify standards that would require changes to support the Rule Making • From April 4th to June 5th - GEH Forum Meetings • June 4th – BOD review and vote on Alternative Consensus Proposal • June 9th – Status report to FERC if no consensus is reached • July 18th – Complete recommendation to support consensus standards • August 22nd – WGQ review of recommendations • September 29th – NAESB files Consensus Standards with FERC • November 27th - Comments on NOPR Due At FERC 32 NOMINATION AND SCHEDULING TIMELINE BY CONSENSUS AT NAESB Nomination Cycle Nomination Deadline (CCT) Notification of Schedule (CCT) Bumping of Interruptible Transportation (IT) Timely 1:00 p.m. 5:00 p.m. N/A Evening 6:00 p.m. 9:00 p.m. Yes Intra-Day 1 10:00 a.m. 1:00 p.m. Yes Intra-Day 2 2:30 p.m. 5:30 p.m. Yes Intra-Day 3 7:00 p.m. 10:00 p.m. No No consensus was reached on the Start of the Gas Day 33 ORDER 809 (Issued April 2015) • Start of the Gas Day remains at 9:00 AM • Tariff records to be filed February 1, 2016 • Implementation on April 1, 2016 34 QUESTIONS? 35 BUSINESS SESSION II • Welcome • Market Outlook Shannon Spencer – Manager, Market Analysis • Guest Speaker Michelle Bloodworth – MISO, Executive Director, External Affairs 36 MARKET UPDATE Shannon Spencer, Manager – Market Analysis MARKET SPECULATIONS BECOMING REALITY • Oil and gas supply boom: led to plummeting prices – How have producers responded? • Demand renaissance: still on the horizon but the view is clearer • Pipeline re-plumbing: in service or underway 38 RIGS DROP BUT PRODUCTION MARCHES ON U.S. Rig Count 1,800 • Marcellus is up 3.3 Bcf/d from last April despite the lowest rig count in the play in four years • Utica production increased 26% Oil 1,600 1,400 1,200 1,000 (Q414 vs. Q413) 800 600 Gas 400 • 200 Oklahoma production up 0.5 Bcf/d in 2014 Source: Baker Hughes May-15 Apr-15 Mar-15 Feb-15 Jan-15 Dec-14 Nov-14 Oct-14 Sep-14 Aug-14 Jul-14 Jun-14 May-14 Apr-14 Mar-14 Feb-14 Jan-14 0 – averaged 6.3 Bcf/d in 2014, the highest since 1990 – Jan-Feb ‘15 averaging 0.5 Bcf/d higher than the same period last year 39 PRODUCER RESPONSES • Drilling but not producing (waiting on price or infrastructure) • Refrac of existing wells • Longer laterals • Faster drilling times • High grading • Pad drilling 40 SUPPLY READY TO REBOUND Uncompleted well backlog by play Well backlog inventory has grown from 3,000 at the beginning of the year to nearly 5,400 now* Baker Hughes estimates that up to 20% of new wells being drilled this year have not been completed Draw-down of these uncompleted wells supports supply growth later this year and into next year… * As of April 2015. Per Wood Mackenzie 41 SHORT-TERM PRODUCTION OUTLOOK 80 70 60 Northeast 50 Gulf of Mexico 40 Gulf Coast 30 Mid-Con 20 Permian 10 San Juan Rockies/West - Source: Wood Mackenzie North American Gas Markets ST Outlook, April 2015 42 WE’RE NOT RUNNING OUT OF GAS ANYTIME SOON Source: Potential Gas Committee, released April 8, 2015. EIA Proved Reserves latest update (2013): 333.8 Tcf. 43 OFFSHORE SUPPLY: OVER? DID YOU SAY OVER? • Gulf of Mexico activity has been remarkably resilient with several new developments and more expected within the next 18 months • Recent major developments: • Delta House (LLOG Exploration1/) in Mississippi Canyon • • • • First production on April 17th Estimated 350 Bcf of gas Targeting peak rate of 154 MMcf/d by 2017 Hadrian South (ExxonMobil2/) in Keathley Canyon • • • First production on March 30th Estimated 612 Bcf of gas Targeting peak production of 300 MMcf/d by 2016 1/ Joint venture partner is Blackstone Energy Partners, co-owners are Ridgewood Energy, Red Willow Offshore, LLC, Calypso Exploration, LLC and Deep Gulf Energy II, LLC, 2/ Petrobras and ENI have ownership interest. 44 WHAT ABOUT DEMAND? Power • • MATS - went into effect April 16th Clean Power Plan - EPA to issue final rules this Summer Industrial • Final Investment Decisions being made • Dow Chemicals: “We’re putting $6 billion here in the U.S. Gulf Coast, betting that the gas advantage maintains for us to get a suitable return on that investment, which is into the next decade” 1/ • Raymond James: “we project a total of 6 Bcf/d in incremental demand over the 2014-2019 timeframe”. – Energy Stat of the Week, May 4, 2015 LNG • We are no longer years away, but months away • Other projects are further along with contracting, FERC, DOE 1/ Doug May, Dow’s business president of olefins, aromatics, and alternatives, during the Kellogg School of Management Energy Conference at Northwestern University. 45 MEXICO POWER AND PIPELINE GROWTH • Mexico is in the midst of one of the largest pipeline construction periods in its history • The country has dozens of new gas-fired power plants to support growth and replace fuel oil • Sempra announced plans to make Costa Azul an export facility 46 MEXICO INDUSTRIAL GROWTH • Major car manufacturers are moving assembly operations to Mexico • Production has doubled in the last five years • The country is currently the fourth largest exporter of cars and trucks and the 8th largest producer • • Cheap labor • Free Trade Agreements More than $20 billion in new investment as of mid-2014 • Nissan has 21 million square foot factory • Announcements last year included BMW, Kia, Mercedes, Infiniti, Audi • Announced last month: • Toyota - $1 billion to make Corollas in Central Mexico • Ford - $2.5 billion to expand existing plant and build another • Jaguar/Land Rover - considering a plant to build Land Rovers 47 MEXICO EXPORT FORECASTS US Net Exports to Mexico Forecast Comparison 6 5 ICF Bcf/day 4 Simmons WoodMac 3 Mexican exports are averaging 2.4 Bcf/d so far this year • 0.6 Bcf/d higher than the first four months of 2014 Another 3 Bcf/d of pipeline exit capacity is coming online through 2017 EIA Source: PointLogic 2 Consensus 2.5 – 3.5 Bcf/d (avg.) by 2016 1 2014 2015 2016 2017 2018 2019 2020 Sources: North American Gas Markets Long-Term Outlook 2H14 (Wood Mackenzie), Annual Energy Outlook 2014 (EIA), Range Resource’s investor presentation (Simmons & Co.); FERC presentation (ICF). 48 INFRASTRUCTURE • First wave of projects – get out of the Northeast • Second wave of projects – get to the export points ~25 Bcf/d* of exit capacity planned to the West or South * Represents announced projects; does not include backhauls using existing capabilities 49 THANK YOU! WE APPRECIATE YOUR BUSINESS.

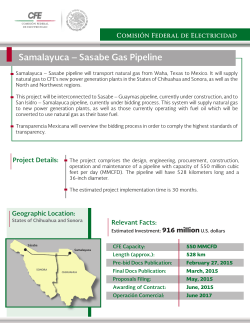

© Copyright 2026