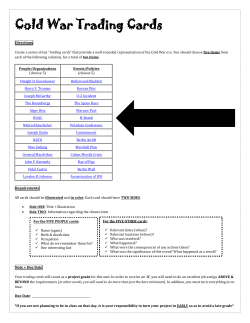

Circular & Notice