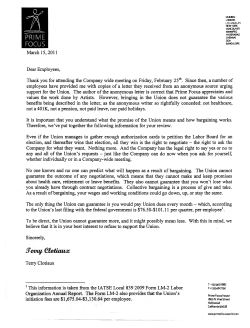

Price Negotiation and Bargaining Costs