use of mobile platform - Rendez-vous de Casablanca de l`assurance

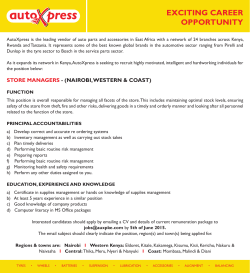

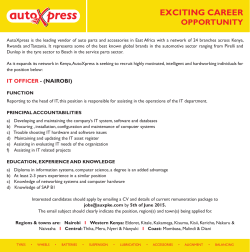

INSURANCE ON MOBILE PLATFORM Date: April 2015 Venue: Hyatt Regency, Casablanca, Morocco Presented by: Mr. Patrick Tumbo WWW.JUBILEEINSURANCE.COM USE OF MOBILE PLATFORM Little more than a decade ago, mobile technology at insurance companies was limited to mobile devices for executives. Today it is for whoever can – from the youth to the old folk. The use of technology has put an array of mobile technologies and services into the hands of both insurers and their policyholders, changing the way they interact and shining a spotlight on customer service. Mobile is enabling insurers to reach current and potential customers in new ways with new offerings. Not only can mobile make communication more convenient and frequent, it now supports a new paradigm. USE OF MOBILE PLATFORM Insurers can become trusted partners that provide policyholders with valuable new services that help them identify and assess risks and take action to protect them based on their individual needs. As mobile technologies continue to be more and more widely adopted, they are also improving the efficiency and responsiveness of employees at insurance companies and their many partner companies. Kenya has the highest rate of mobile penetration in East Africa and mobiles have become one of many the channels that insurers must support. MOBILE MONEY PENETRATION IN KENYA As at Sept 2014, Kenya has 32.2 million mobile subscribers, up from 31.3 million in Dec 2013. MOBILE PLATFORM PROVIDERS 1. Safaricom is the largest mobile network in Kenya with 67.8% market share and 21.2 million mobile subscribers. 2. Airtel is the second largest mobile network in Kenya with 16.5% market share and 5.2 million mobile subscribers. 3. YU is the third largest mobile network in Kenya with 8% market share and 2.6 million mobile subscribers. 4. Orange (Telkom Kenya) is the fourth largest mobile network in Kenya with 7.7% market share and 2.3 million mobile subscribers. MOBILE MONEY MARKET IN KENYA For Kenyan consumers and businesses, mobile money is rapidly becoming the payment channel of choice. Mobile capabilities are vital for insurers seeking to serve customers in the channel of their choice, whether for research, purchases, supplying policy information changes or handling billing, payment issues and claims 6 MOBILE MONEY MARKET IN KENYA Growth trends show that smartphone penetration in Africa will double within the next three or four years. This is hard to discount if you consider the ever increasing presence of mobile device distributors on the continent and the falling prices on entry level to midrange devices. Kenya continued to enjoy fast penetration of mobile money in the country with its impact felt across all sectors of the economy. 7 MOBILE MONEY MARKET IN KENYA Kenya is the highest ranked mobile money country in the world, followed by Tanzania. The pioneering mobile-based money transfer service (MPESA) launched in Kenya in 2007 by telecoms company Safaricom, has become internationally renowned. 8 Safaricom’s M-PESA and Competition Today 15 million subscribers use the M-Pesa service in Kenya, transacting daily amounts estimated to be close to 60% of Kenya’s GDP. In April 2014, the Communications Commission of Kenya licensed three new Mobile Virtual Network Operators (MVNOs). These operators allow companies to provide mobile money services without building new mobile infrastructure by working with existing mobile network operators. Equity Bank (one of Kenya’s largest banks) was one of the three to receive the license to be hosted by Airtel Kenya. This is expected to soon increase competition in the mobile money market. 9 INDUSTRY USE OF MOBILE PLATFORM i) Banking. This is the leading sector in the economy for mobile money transactions with a fast ascending trend in number of customers using mobile banking. Equity bank is the leading bank in Kenya under the mobile banking channel with other banks showing similar fast growing trends for mobile banking usage. ii) Insurance The proliferation of mobile and other remote devices is rapidly reshaping the insurer-customer relationship, making it more personal and enabling insurers in Kenya to be more “one-on-one” with their clients. Today, 80% of clients in Kenya reach insurers through brokers and agents. In three years’ time, mobile, online portals and social media will take on much larger roles with mobile expected to take up the larger piece of the pie. 10 INDUSTRY USE OF MOBILE PLATFORM iii) Consumer Goods Trading Mobile money has further made it convenient and easy for Kenyans to buy and have goods delivered across the country. Companies in the Kenyan market such as Jumia, Cheki and OLX have spread their tentacles across the region, getting mobile and internet The great advertising campaigns that these companies have conducted over traditional media, has educated the public on e-trading and this is expected to boost e-commerce in Kenya. iv) Other Trades Payment of TV subscriptions, tickets booking for travel & cinema, utility bill payments, municipal county payments and many more mobile money services available in the Kenyan market. 11 KENYA INSURERS USE OF MOBILE PLATFORM 1. Jubilee - Tumaini ya Jamii Policy holders pay Premiums through M-Pesa annually for a cover for death and disability following an accident. 2. Jubilee - Jubilee Msafiri This is medical cover, covers travellers on long distance bus journeys within East Africa and is part the travel tickets. In case of an accident, Kenya Red Cross Society evacuates passengers to the nearest accredited hospitals and Jubilee pays the bill. 3. Jubilee - Baada ya Campo This is aLife insurance policy that enables university and college students build a fund over a period of 4 to 6 years depending on the duration of the course. In addition it provides a savings opportunity that ensures the student enjoys a life assurance cover equivalent to the sum assured on graduation or in the event of untimely death 12 KENYA INSURERS USE MOBILE PLATFORM 4. BRITAM - Linda Jamii This micro-insurance health cover is established through partners Britam, Safaricom Limited and Changamka Micro-insurance. Premiums are paid in installments through M-Pesa 5. APA – Kopa Bima This personal accident cover is available for mobile phone subscribers, both the Airtel and Safaricom networks with an annual cover 6. CIC - M-Bima Jijenge Savings Plan It is a 12-year savings plan with monthly minimum installment , minimum life cover and an additional family insurance cover of US$1000 payable on death of a listed family member. tworks with an annual cover 7. Jubilee YUcover 13 MOBILE PENETRATION IN MOROCCO Morocco has 43.38 million mobile subscribers at the end of March 2014, 9.78 percent up compared to 2013, according to telecommunications regulator in Morocco. The mobile penetration rate grew to around 132% from 129% over the same period. The country's mobile market is more developed than its fixed-line market 14 MOBILE PENETRATION IN MOROCCO Morocco's telecom market is one of the most developed markets in Africa. It has one of the highest overall telecom penetration rates compared to other countries in the region. The telecom sector offers plenty of scope for growth, primarily because of the government's focus on increasing network coverage, encouraging e-commerce and adopting new technologies. Morocco's mobile sector is there ripe for mobile money and insurance business. Besides voice services, messaging is also very popular and successful and Morocco has one of the highest SMS rates across the countries of North Africa. 15 FUTURE OF MOBILE PLATFORM FOR INSURANCE INDUSTRY Alternative way to for insurance customers connected – customer experience at all times to stay Cost effective method of transacting insurance business acquisition & administration costs Alternative channel to access the mass market instead of traditional brokers & agents Flexible premium collection and claims payment platform directly with the customers 16 17 18

© Copyright 2026