Know More - HDFC Securities

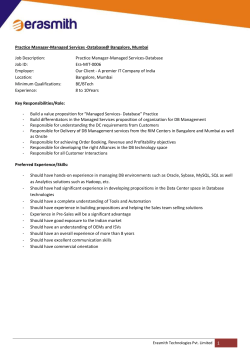

SECTOR UPDATE 15 APR 2015 MCHI Exhibition Dream home remains a dream? We attended MCHI Navi Mumbai & Mumbai - Apr’15 exhibition and interacted with about 50 developers showcasing 3,500 properties across Navi Mumbai & Mumbai. The general mood amongst developers was that of optimism, which reflected in average Navi Mumbai price increase of 10% across location’s and 20-25% in some key pockets of Ulwe & Kharghar whilst Mumbai projects saw muted price increase of 0-3%. Old projects continue to be marketed at 1030% higher prices on average (vs Oct-13 MCHI Navi Mumbai exhibition, Oct-14 Mumbai MCHI exhibition) there was pick up in newer launches with pricing at par with under construction projects. Obviously, at these prices there was limited buying interest. Checks with 4-5 housing finance companies suggest that mortgage rates range between 9.85.110.25% for new housing loan, which is a cut of 25bps. With such high appreciation in Navi Mumbai & Mumbai, Thane seems to be better placed to capture incremental housing demand. Oberoi Realty (OBER IN, Mkt cap Rs99bn, Not Rated) & Kolte Patil (KPDL IN, mkt cap Rs17bn, Not rated) remain our top sectoral picks amongst Western India developers. Parikshit D Kandpal [email protected] +91-22-6171-7317 Price appreciation 5-25% across Kharghar & Ulwe, 510% rest of Navi Mumbai, 3% average in Mumbai & Suburbs : We have seen maximum price appreciation across Kharghar (5-18%) & Ulwe (5-25%) on expectation of upcoming infrastructure projects (new Airport, Suburban rail & Trans harbor link). Dronagiri the node closest to the Trans-harbour link is witnessing higher volume of new launches with prices ranging Rs4,200-5,000/sqft, despite not having any infrastructure in place. One developer (which commands high premium) is expecting to launch Dronagiri project at Rs6,000/sqft. In case of Mumbai, average prices increase was ~3% with highest price appreciation in Mulund (~5%). Ulwe & Panvel still in the affordable zone, despite 525% hike, Mumbai new supply largely concentrated in Mulund & Thane : With the Navi Mumbai Airport getting final approvals, the project seems to be back on track and with Environment Clearance for transharbour link in place, the property price in Ulwe has seen a 5-25% price appreciation. The average price now ranges Rs5,200-8,000/sqft (Rs6,000/sqft), still Ulwe remains the only affordable market in the entire Navi Mumbai Realty. Mulund is witnessing high supply ~10mn sqft of new launches, despite this the average prices have moved higher by 5%. Rest of Navi Mumbai – witnessed 3-10% price appreciation : Panvel saw some new projects going on ground, 42 acres new township by Paradise at launch price of Rs6,500/sqft. India Bulls Green Phase Greens price has corrected by 12% for Phase 1 to base price of Rs5,555/sqft. There was exhibition offer with free club membership, no floor rise, no preferred location charge etc. Mumbai new launches were Oberoi projects (~3mnsqft) at base price of Rs12,250/sqft whilst in Thane 3-4 townships of more than 100 acres are in various launch phases. HDFC securities Institutional Research is also available on Bloomberg HSLB <GO> & Thomson Reuters MCHI EXHIBITION After such price increase, some developers offered free-bies : Few developers (4-5 only) offered schemes viz (i) 10:80:10 (ii) free registration & stamp duty (iii) free Honda city & Activa (iv) free Iphone & (v) waiver of club, floor rise, preferred location & golf club membership charges. Couple of developers offered 05% base price discount ranging in Rs100-200/sqft for spot booking. Overall, 6-10% was the price discount being offered by 4-5 developers only. Whilst in case of Mumbai developers the offers were largely limited to 20:80, 10:80:10 schemes only. Mortgage rates seeing correction after RBI push for transmission, 25bps of cut passed on to mortgage subscribers : Most of the banks were offering mortgage rates in the 9.85-9.9% range depending on the loan amount. Lowest interest rate was offered by SBI & HDFC at flat ~9.9% whilst LIC Housing & Kotak Bank was offering 10-1-10.15%. Other charges remained same for bankers which include Rs10,000+ST as processing fee, 0.2% franking charges and Rs1500 as other charges. Our channel check with mortgages financiers suggest subdued market sentiments in Mumbai & Suburbs with further slowdown expected during the upcoming Monsoon session. EXHIBIT 1 : FLOATING MORTGAGE RATES – 20YRS % Bank Axis Bank HDFC ICICI Bank Kotak Bank LIC Housing SBI Apr'15 Oct’14 9.95 10.25 9.9 10.15 9.9 10.15 10.15 10.15 10.1 10.1 9.85*-9.9# 10.1-10.15 Our view We don’t expect any sharp correction in the property prices in the Navi Mumbai owing to scarce land availability and limited stock. Whilst the high property prices have left limited price differential (10-15%) between Vashi & Kharghar. Ulwe, Dronagiri & Panvel remain the lowest price point markets and will see future price appreciation depending on progress on infrastructure projects. Navi Mumbai prices are now equivalent to their Western Suburbs counterparts and hence the projects in Goregaon, Mulund, Kandivali region would see renewed traction for being better developed alongside strong social infrastructure. The way prices have moved the neighboring markets of Pune would witness renewed Mumbai investor’s activity. Kolte Patil developers will be key beneficiary of likely shift in investors demand from Mumbai to Pune. With regards to Mumbai markets, prices will see a longer cycle time correction & muted (0-10%) near term absolute price correction. We remain bullish on prospects of Oberoi Realty, being the beneficiary of consumer shift from high price point Navi Mumbai market to Oberoi Mulund & Oberoi Goregaon projects and also having the highest quality inventory in lowly rated current supply (largely with low quality highly leveraged private developers). Source: Company, * for female borrowers, # for male borrowers Page | 2 MCHI EXHIBITION EXHIBIT 2: MUMBAI DEVELOPERS AVERAGE PRICE INCREASE OF ~3% S.NO. Developer Project Name Location 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 Ackruti City (Hubtown) Acme Group Acme Group Acme Group Acme Group Acme Group Ahuja Group Ahuja Group Ajmera Realty Ajmera Realty Ajmera Realty Ajmera Realty Ajmera Realty Ajmera Realty Dosti Group Dosti Group Dosti Group Ghatkopar (E) Kandivali (E) Goregaon (E) Kandivali (W) Andheri (E) Thane (W) Goregaon (W) Ambernath (E) Wadala (E) Wadala (E) Wadala (E) Borivili (W) Borivali (W) Kalyan (W) Thane (W) Wadala (E) Thane (W) 18 Dosti Group 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 Dosti Group Ekta Group Ekta Group Ekta Group HDIL HDIL HDIL Kalpataru Developers Kalpataru Developers Kalpataru Developers Kalpataru Developers Kalpataru Developers Kalpataru Developers Kanakia Developers Kanakia Developers Kanakia Developers Rising City Acme Oasis Acme Hills Acme Avenue Acme Boulevard Acme Ozone L'Amor Prasadam Ajmera Aeon Ajmera Zeon Ajmera Treon Ajmera Pristine Ajmera Regalia Yogi Dham Dosti Vihar Dosti Ambrosia Dosti Imperia Dosti Planet North (Centerio) Dosti Landmark Parksville Tripolis Bhoomi Garden III Majestic Towers Premier Exotica Whispering Towers Kalpataru Avana Kalpataru Sparkle Kalpataru Solitaire Kalpataru Crest Sunrise Grande Kalpataru Riverside Kanakia Sevens Kanakia Rainforest Kanakia Levels Apr 15 Oct 14 Saleable Rate Saleable Rate (INR/sft) (Rs/sf) 13,100 12,600 13,500 13,500 12,500 12,000 11,500 10,900 14,200 13,999 10,500 10,000 12,750 12,100 3,750 3,500 20,000 19,800 19,500 19,500 19,000 18,900 14,500 14,040 13,750 13,500 5,500 5,310 10,500 10,500 18,500 19,500 10,500 10,050 Price Change (%) Possession Apr 15 4.0 4.2 5.5 1.4 5.0 5.4 7.1 1.0 0.5 3.3 1.9 3.6 (5.1) 4.5 Jun-18 Dec-17 Dec-17 Dec-16 Oct-18 Dec-16 Dec-17 Jun-16 Jun-16 Jun-17 Dec-17 Jun-16 Jun-15 Dec-15 Dec-15 Jun-15 Jun-15 Dombivali (E) 4,950 5,600 (11.6) Dec-15 Thane (W) Virar (W) Goregaon (W) Borivali (E) Nahur (W) Kurla (W) Mulund (W) Parel Bandra (E) Juhu Bhandup (W) Thane (W) Panvel Andheri (E) Andheri (E) Malad (E) 7,500 4,585 15,545 13,545 10,250 12,500 12,500 30,870 43,000 45,000 12,645 8,826 7,920 13,900 14,250 12,750 New Launch 5,190 15,570 13,000 10,250 12,500 12,250 New Launch New Launch New Launch 11,750 7,500 7,500 13,500 13,500 12,400 NA (11.7) (0.2) 4.2 2.0 NA NA NA 7.6 17.7 5.6 3.0 5.6 2.8 Dec-18 Jun-15 Dec-17 Jun-15 Dec-16 Dec-15 Dec-16 Dec-17 May-16 Apr-17 Apr-17 Jun-18 Mar-17 Dec-17 Jun-18 Dec-17 Page | 3 MCHI EXHIBITION S.NO. 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 Developer Project Name Location Kanakia Developers Lalani Group Lalani Group Marathon Group Marathon Group Marathon Group Mayfair Housing Nirmal Lifestyle Nirmal Lifestyle Nirmal Lifestyle Nirmal Lifestyle Nirmal Lifestyle Nirmal Lifestyle Nirmal Lifestyle Rajesh Lifespaces Rajesh Lifespaces Rajesh Lifespaces Rajesh Lifespaces Rajesh Lifespaces Rajesh Lifespaces Rajesh Lifespaces Rajesh Lifespaces Rajesh Lifespaces Romell Group Romell Group Romell Group Romell Group Runwal Group Runwal Group Runwal Group Runwal Group Runwal Group Runwal Group Runwal Group Kanakia Arohi Grandeur Valentine Marathon Nexzone Marathon Nextown Nexworld Mayfair Hillcrest Sports City US Open Apartments Nirmal Turquoise Nirmal Olympia Nirmal Panorama Nirmal Omega Lifestyle City Raj Infinia Raj Altezza Raj Grandeur Raj Trinity Raj Spectrum White City Raj Tattva Raj Torres 92 Bellevue Romell Aether Unmiya Grandeur Romell Diva Romeel Peyton Runwal Anthurium My City Eirene Runwal Greens Runwal Forest Runwal Bliss Runwal Pearl Borivali (E) Goregaon (E) Goregaon (E) Panvel Dombivali (E) Dombivali (E) Vikhroli (W) Thane (W) Mulund (W) Mulund (W) Mulund (W) Mulund (W) Mulund (W) Kalyan (W) Malad (W) Mulund (W) Powai (W) Powai (W) Sion (E) Kandivali (E) Thane (W) Thane (W) Borivali (W) Goregaon (E) Goregaon (E) Malad (W) Santacruz (E) Mulund (W) Dombivali (E) Thane (W) Mulund (W) Kanjur Marg (W) Kanjur Marg (E) Thane (W) Apr 15 Oct 14 Saleable Rate Saleable Rate (INR/sft) (Rs/sf) 12,900 12,500 13,000 12,500 14,500 14,000 6,091 5,591 4,991 4,991 4,291 4,191 15,500 15,500 12,345 12,006 12,137 11,304 12,500 12,006 12,568 11,007 10,965 10,800 12,250 12,204 5,750 5,598 14,150 14,000 12,330 11,700 25,000 23,000 19,000 18,000 15,000 14,809 12,330 12,200 9,630 9,500 9,160 9,500 18,000 18,000 14,500 13,900 14,500 14,000 14,000 13,500 18,000 New Launch 12,500 11,750 4,950 4,802 7,750 7,794 13,000 12,500 12,500 11,750 12,000 New Launch 9,299 8,500 Price Change (%) Possession Apr 15 3.2 4.0 3.6 8.9 2.4 2.8 7.4 4.1 14.2 1.5 0.4 2.7 1.1 5.4 8.7 5.6 1.3 1.1 1.4 (3.6) 4.3 3.6 3.7 NA 6.4 3 (1) 4.0 6.4 NA 9.4 Jun-17 Jun-15 RFP Dec-15 Dec-16 Dec-17 RFP Dec-17 Oct-18 Dec-17 Oct-18 Oct-18 Dec-17 Oct-17 Jun-17 Jul-16 Jun-15 Dec-17 Dec-18 Dec-17 Dec-17 Dec-17 Dec-17 Oct-16 Oct-16 Jun-15 Dec-16 Dec-17 Dec-18 Jun-18 Dec-16 Jun-18 Dec-18 Dec-16 Source: MCHI Mumbai exhibition Page | 4 MCHI EXHIBITION EXHIBIT 3: NAVI MUMBAI PROJECTS AVERAGE PRICE INCREASE OF ~10% S.No. Developer 1 2 3 4 5 6 7 8 9 10 11 12 Arihant Arihant Arihant Arihant Arihant Arihant Arihant Arihant Bhairaav Bhairaav Bhairaav Enkay Homes 13 Indiabulls Real Estate 14 Indiabulls Real Estate 15 Indiabulls Real Estate 16 Juhi Developers 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 Juhi Developers Juhi Developers Juhi Developers Juhi Developers Lakhani Developers Lakhani Developers Lakhani Developers Lakhani Developers Marathon Group Marathon Group Marathon Group Neelsidhi Neelsidhi Neelsidhi Neelsidhi Neelsidhi Neelsidhi Project Name Location Amodini Aarohi Aloki Anmol Anshula Arshiya Amisha Akansha Signature Palm View Garden view Enkay Garden Indiabulls Greens Ph 1 Indiabulls Greens Ph 2 Golf City - Ph I Bhumika Residency Juhi Lawns Juhi Greens Juhi Pride Niharika Reisdency Orchid Woods La Riveria Prestige Skyways Nexzone - Ph I Nexzone - Ph II Nextown Amarante Balaji Garden Neelsidhi Morya Atlantis Neelsidhi Joya Neelsidhi Gloria Taloja Kalyan Shil Road Karjat Badlapur Taloja Khalapur toll naka Taloja Palaspe Belapur Ghansholi Ghansholi Taloja Apr 15 Oct 13 Price increase Saleable Rate Saleable Rate % (Rs/sf) (Rs/sf) 5500 5100 3555 3350 4250 3050 3400 5500 9500 8730 8550 3200 3,000 6.7 Possession – Apr 15 May-15 Dec-16 May-18 Dec-16 May-18 May-17 May-17 May-19 Dec--15 Dec--18 Dec--18 Oct-15 Panvel 5555 6,299 (11.8) Dec-15 Panvel 5555 5,199 6.8 Dec-18 Savroli 5555 5,499 1.0 Dec-16 Kalamboli 6100 5,500 10.9 Ready Nerul Nerul CBD Belapur Kharghar Khopoli Panvel Ulwe Ulwe Panvel Panvel Dombivali (E) Kalamboli Dombivali (E) Titwala Nerul Ulwe Ulwe 10100 11500 10500 7500 3500 7100 6700 6700 6091 6091 4991 5500 5500 3150 12500 6000 5500 9,500 10,500 9,000 7,000 3,200 6,500 4,951 5,151 4,191 4,900 6,000 2,900 11,000 5,000 4,750 6.3 9.5 16.7 7.1 9.4 9.2 23.0 18.2 19.1 12.2 (8.3) 8.6 13.6 20.0 15.8 Mar-15 May-17 Ready May-17 Dec-16 Mar-17 Mar-17 Dec-15 Dec-16 Ready Page | 5 MCHI EXHIBITION S.No. Developer 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 Paradise Group Paradise Group Paradise Group Paradise Group Paradise Group Paradise Group Paradise Group Paradise Group Paradise Group Paradise Group Paradise Group Paradise Group Paradise Group Paradise Group Paradise Group Paradise Group Paradise Group Paradise Group Patkon Lifespaces Patkon Lifespaces Patkon Lifespaces Patkon Lifespaces Patkon Lifespaces Patkon Lifespaces Prajapati Satyam Developers Satyam Developers Satyam Developers Satyam Developers Satyam Developers Satyam Developers Satyam Developers Satyam Developers Satyam Developers Shikara Constructions 69 Shikara Constructions Project Name Location Sai Jewel Sai Moksh Sai Mannat Sai Crystals Sai Solitaire Sai Miracle Sai Spring Sai Symphony Sai Wonder Sai Sapphire Sai Harmony Sai Fortune Sai Sahil Sai Ganga Sai Riverdale Sai Gems Sai Divine Sai World City Vishwamukha Apramit Avaneesh Sumukha Avighna Haridra Magnum Empress Mayfair Majestic Aura Harmony Pride Imperial Heights Exotica Paradise Shikara Estates Shikara Palace Gardens Kharghar Kharghar Kharghar Kharghar Kharghar Kharghar Kharghar Kharghar Kharghar Ulwe Ulwe Ulwe Ulwe Ulwe Taloja Dronagiri Lonavala Panvel Nerul Nerul Roadpali Kharghar Ulwe Kharghar Dronagiri Kharghar Kharghar Ulwe Ulwe Panvel-Matheran Rd Kalamboli Kalamboli Ulwe Ulwe Panvel Panvel Apr 15 Oct 13 Price increase Saleable Rate Saleable Rate % (Rs/sf) (Rs/sf) 8500 7,200 18.1 9100 7,500 21.3 9700 8,400 15.5 8500 7,200 18.1 8500 7,200 18.1 8500 7,200 18.1 8500 7,200 18.1 8500 7,200 18.1 8500 7,200 18.1 5850 5,650 3.5 5850 5,650 3.5 5850 5,650 3.5 6200 5,800 6.9 5850 5,650 3.5 5850 5,100 14.7 NA 4,250 7000 7,000 0.0 6500 5,500 18.2 10500 11000 5800 6550 5700 6850 4850 8500 6500 6000 6000 4350 5850 5850 6000 5700 4800 4,500 6.7 3999 3,750 6.6 Possession – Apr 15 Ready Ready May-17 Oct-15 Dec-15 May-16 May-19 May-19 May-19 Dec-16 Dec-16 Jul-15 Jul-15 Ready Ready Dec-16 May-16 Ready Aug-15 Oct-15 Dec-15 Ready Dec-17 Page | 6 MCHI EXHIBITION S.No. Developer 70 71 72 73 74 75 76 77 78 79 80 81 Shikara Constructions Tejas Group Vishwa Green Vishwa Green Vishwa Green Vishwa Green Vishwa Green Xrbia Xrbia Xrbia Xrbia Xrbia Project Name Location Platinum Parishma Vishwa Siyona Vishwa Hans Vishwa Abha Vishwa Nidhi Vishwa Spandan Atria Aman Villas Eiffel City II Edge Water Abode Panvel Ulwe Ulwe Kharghar Dronagiri Dronagiri Kharghar Madap Madap Chakan Neral Talegaon Apr 15 Oct 13 Price increase Saleable Rate Saleable Rate % (Rs/sf) (Rs/sf) 4999 5200 4,500 15.6 8000 6,000 33.3 8100 8,100 0.0 4300 4,200 2.4 4300 4,300 0.0 8500 8,000 6.3 4223 5000 3487 2990 3284 - Possession Apr15 May-19 Dec-17 Mar-16 Apr-18 Nov-17 Apr-18 NA NA NA NA NA Source: MCHI Navi Mumbai Exhibition Page | 7 MCHI EXHIBITION Disclosure: I, Parikshit Kandpal, MBA, author and the name subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. Research Analyst or his/her relative or HDFC Securities Ltd. does not have any financial interest in the subject company. Also Research Analyst or his relative or HDFC Securities Ltd. or its Associate may have beneficial ownership of 1% or more in the subject company at the end of the month immediately preceding the date of publication of the Research Report. Further Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any material conflict of interest. Any holding in stock – No Disclaimer: This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have been compiled or arrived at, based upon information obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. This document is for information purposes only. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments. This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any locality, state, country or other jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HDFC Securities Ltd or its affiliates to any registration or licensing requirement within such jurisdiction. If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may not be reproduced, distributed or published for any purposes without prior written approval of HDFC Securities Ltd . Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HDFC Securities Ltd may from time to time solicit from, or perform broking, or other services for, any company mentioned in this mail and/or its attachments. HDFC Securities and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions. HDFC Securities Ltd, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any action taken on basis of this report, including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the dividend or income, etc. HDFC Securities Ltd and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report, or may make sell or purchase or other deals in these securities from time to time or may deal in other securities of the companies / organizations described in this report. HDFC Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months. HDFC Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. HDFC Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither HDFC Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. HDFC Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the subject company. We have not received any compensation/benefits from the subject company or third party in connection with the Research Report. HDFC securities Institutional Equities Unit No. 1602, 16th Floor, Tower A, Peninsula Business Park, Senapati Bapat Marg, Lower Parel, Mumbai - 400 013 Board : +91-22-6171 7330 www.hdfcsec.com Page | 8

© Copyright 2026