Pakistan Textiles - BMA Capital Management

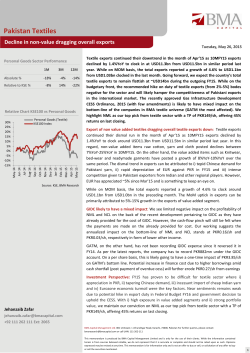

Pakistan Textiles Value added exports going from strength to strength Personal Goods Sector Performance 1M 3M 12M Absolute % ‐10% ‐12% ‐1% ‐2% ‐9% ‐18% Relative to KSE % Relative Chart KSE100 vs Personal Goods Personal Goods (Textile) KSE100 Index 40% 30% 20% 10% 0% ‐10% Mar‐15 Jan‐15 Feb‐15 Dec‐14 Oct‐14 Nov‐14 Sep‐14 Jul‐14 Aug‐14 Jun‐14 Apr‐14 May‐14 ‐30% Mar‐14 ‐20% Source: KSE, BMA Research Thursday March 26, 2015 Textile exports reported a dismal trend in Feb’15 where the country’s exports declined by ~3%YoY during the month to clock around USD1.09bn as against USD1.12bn in corresponding month last. While on cumulative basis, the country’s textile exports for 8MFY15 remained flattish at USD9.2bn as against USD9.1bn, thereby posting a nominal increase of 0.5%YoY during the period. Value added textile categories such as Knitwear, Bed‐wear, Garments and Home Textiles posted decent growths during 8MFY15, increasing by 5%‐14% while non‐value added items raw cotton, yarn and cotton cloth have posted double digit declines over the same period, keeping the overall exports in check. Going forward, we expect the exports of value added segment to remain robust as seasonal uptick in demand kicks in during 2HFY15. The yarn margins have remained flattish MoM during the month of Mar’14 as the yarn prices have stabilized around PKR1,311/kg in the local market. In our BMA Universe, we continue to prefer NML over NCL and GATM due to its concentration in higher end of value chain and lower dependence on gas. On last closing, NML offered upside of 47% at our TP of PKR161/sh. Exports posting 3%YoY decline in Feb’15: SBP recently published exports numbers for the month of Feb’14 where the textile exports dropped by 3%YoY. As per the report, textile exports clocked in at USD1.09bn in Feb’15 vs USD1.12bn in the corresponding period last year. Exports of cotton cloth, bed‐wear and towels all registered a decline of 5%YoY‐ 15%YoY during the month while the yarn exports remained flattish (down 1%YoY), due to 17%YoY lower yarn prices. While on the other hand, the exports of higher value added segments such as Knitwear, Garments and Home Textiles all reported robust growths of 4%YoY‐13%YoY which supported the total textile exports. Cumulatively, the country’s total textile exports remained stable and clocking around USD9.01bn in 8MFY15, compared to USD9.06bn in 8MFY14. Again, the total exports were mainly supported by the value added textile segment, which grew by 7%YoY during the period due to uptick in exports of Knitwear, Bed Wear, Ready‐made Garments and Made‐ups articles. However, yarn exports recorded decline of 13%YoY during 8MFY15 exports due to tapering dynamics and sagging retention ratio. Super abundance of commodity weighing in on the prices: On back of i) strong production data from India, Pakistan and US, ii) higher opening inventory and iii) limited demand of cotton as China rolled back its aggressive procurement policy, the current stock to use ratio of the world for the commodity stands at 99% as per USDA’s latest reports. Resultantly in 2015 ‐ 16, cotton is likely to be much less attractive to plant due to falling cotton prices. On the demand side, USDA expects the global consumption to remain flattish in 2015/16. However, prices for polyester have also fallen much faster than cotton prices for much of the season, eroding the price attractiveness of cotton. On back of the said reasons, we expect the prices to remain range bound in the next cotton season and prevent a free fall similar to the one we saw in 2014 ‐ 15 season where the cotton prices declined by ~20%. Moving up the value chain, the yarn margins have remained flattish during the month of Feb’14 and Mar’14 as the yarn prices have stabilized somewhat around PKR1,311/kg in the local market. Jehanzaib Zafar [email protected] +92 111 262 111 Ext: 2062 Gas price hike coming in effect from Apr’15: The proposed increase in gas prices is likely to squeeze the margins of textile sector further and thereby spoiling the investor sentiments. The ministry has proposed a 53% increase in gas tariffs for the industrial sector (up PKR262/mmbtu). We expect the textile players in South (GATM) to be the biggest losers of this development due their higher dependence on gas for their BMA Capital Management Ltd. 801 Unitower, I.I.Chundrigar Road, Karachi, 74000, Pakistan For further queries, please contact: [email protected] or call UAN: 111‐262‐111 This memorandum is produced by BMA Capital Management Limited and is only for the use of their clients. While the information contained herein is from sources believed reliable, we do not represent that it is accurate or complete and should not be relied upon as such. Opinions expressed may be revised at any time. This memorandum is for information only and is not an offer to buy or sell, or solicitation of any offer to buy or sell the securities mentioned. 1 production. Players in the North, due to their diversified energy mix, will likely have their impact mitigated. In this regard, we expect the proposed hike in gas tariffs to have annualized impacts of PKR0.59/sh (6% of FY15E EPS), PKR0.48/sh (7% of FY15E EPS) and PKR1.42/sh (18% of FY15E EPS) on the bottom‐lines of NML, NCL and GATM, respectively Investment Perspective: Robust growth in export of value added goods coupled with lower FO prices is going to keep the margins of upstream textile players strong during 2HFY15. However, impending hike in gas tariffs is likely to remain the key downside risk. We earmark NML as the potential outperformer in our BMA Universe given i) its concentration in higher end of value chain and ii) lower dependence on gas, On last closing, NML offered upside of 47% at our TP of PKR161/sh. BMA Capital Management Ltd. 801 Unitower, I.I.Chundrigar Road, Karachi, 74000, Pakistan For further queries, please contact: [email protected] or call UAN: 111‐262‐111 This memorandum is produced by BMA Capital Management Limited and is only for the use of their clients. While the information contained herein is from sources believed reliable, we do not represent that it is accurate or complete and should not be relied upon as such. Opinions expressed may be revised at any time. This memorandum is for information only and is not an offer to buy or sell, or solicitation of any offer to buy or sell the securities mentioned. 2

© Copyright 2026