Pakistan Economy

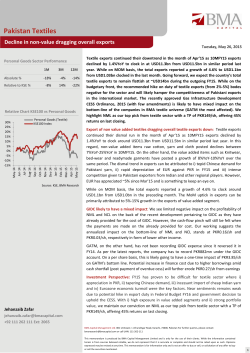

Pakistan Economy MPS: Monetary easing to augment economic growth! Select Economic Indicators CPI Inflation Feb‐15 YoY 3.2% SPI Inflation 12‐Mar‐15 YoY NFNE Inflation Feb‐15 YoY 6.2% Reserves 13‐Mar‐15 USD16.2bn Remittances 8MFY15 USD11.8bn Trade Balance 8MFY15 USD(12.8)bn Current A/c deficit 8MFY15 USD(1.6)bn ‐1.9% 6 Month KIBOR (Offer Rate) 20‐Mar‐15 8.12% 10 Year PKRV 20‐Mar‐15 9.19% Discount Rate 8.0% WPI NFNE Inflation YoY CPI % SPI 20 15 10 5 Feb‐15 Oct‐14 Dec‐14 Jun‐14 Aug‐14 Apr‐14 Feb‐14 Oct‐13 Dec‐13 Jun‐13 Aug‐13 Apr‐13 ‐5 Feb‐13 0 Source: PBS, SBP, BMA Research Tuesday March 24, 2015 State Bank of Pakistan (SBP), in its bi‐monthly Monetary Policy Statement (MPS) announced on 21Mar’15, reduced benchmark policy rate by 50bps to 8.0% for next two months, a third consecutive DR cut since Nov’14. At the same time, secondary market bond yields have already reflected market anticipation of a 50bps cut. Prime reasons underscored by the SBP for monetary easing include i) soft inflation outlook (SBP expectation: 4.0%‐5.0% for FY15), ii) expected improvement in BoP position due to strong remittances and lower oil import bills and iii) consolidating monetary aggregates. With 50bps cut in the discount rate, we potentially see upward revision in valuation by ~3%‐4% of BMA Universe. Key beneficiaries of DR cut includes levered plays including Cements, Textiles and selective Fertilizers. Inflation to stay below 5.0%: Lowest inflation reading of 3.2%YoY in Feb’15 since Jul’09 on the back of receding food and fuel index led 8MFY15 inflation to clock in at 5.5%, considerably lower than 8.7% registered in 8MFY14. The notable improvement in inflationary environment is primarily due to depressed international oil prices leading to persistent deceleration in fuel index by 24.1%YoY in Feb’15. At the same time, moderation in core inflation became more evident as average Non‐food Non‐energy (NFNE) and trimmed core recorded at 7.3% and 5.9% in 8MFY15, respectively declining from 8.3% each in 8MFY14. Moving forward, we expect inflation to remain low in remaining FY15 on account of i) subdued global oil prices due to increasing supply glut and ii) depressed commodity prices. Consequently, SBP now expects average inflation to remain in range of 4.0%‐5.0% (BMA estimates: 4.6%) for FY15. On the flip side, upward revision in gas tariffs (expected from 1Apr’15) and expected increase in aggregate demand on account of lower commodity prices have possible inflationary repercussions, moving forward. Improving external account stability: The country’s external account position looks comfortable despite witnessing contraction in exports. During 8MFY14, exports declined by 3.5%YoY to USD16.0bn primarily due to weak global demand and receding global commodity prices. However, lower international oil prices reduced domestic oil imports to USD8.9bn (down by 11.8%YoY), reducing total import bill to USD27.7bn (down 0.5%YoY). Moreover, strong remittances of USD11.8bn (up 14.7%YoY) coupled with ~USD1.4bn CSF payment in FYTD led further improvement in CAD to USD1.6bn (down 34.2%YoY), translating into 0.8% of GDP. In addition, continued fx inflows from bilateral partners further augmented SBP forex reserves to USD11.2bn, translating into a 4.0month import cover as against USD9.1bn (3.3month import cover) in Jun’14. Going forward, we expect CAD to clock in at USD1.9bn (0.7% of GDP) with SBP fx reserves reaching to ~USD13.9bn by Jun’15. Economic activity to further expand: With 200bpsYoY reduction in the policy rate to 8.0% in Mar’15 compared to 10% in Mar’14, the manufacturing sector is likely to gain traction on the back i) lower borrowing costs, ii) reduced fuel/power cost and ii) lower raw materials cost. At the same time, lower DR will also boost private sector credit demand, thus providing an impetus to economic growth, going forward. Iqbal Dinani [email protected] Investment Perspective: Given prolonged bearish market sentiments (KSE100 index down by 5.5% MTD), the materialization of consensus expectation is likely to bode well for equities. With 50bps cut in the discount rate, we potentially see upward revision in valuation by ~3‐4% of BMA Universe. Key beneficiaries of DR cut include levered plays Cements, Textiles and selective Fertilizers. We re‐iterate our preference for FCCL, MLCF, NML, EFERT, PSO and POL. +92 111 262 111 Ext: 2059 BMA Capital Management Ltd. 801 Unitower, I.I.Chundrigar Road, Karachi, 74000, Pakistan For further queries, please contact: [email protected] or call UAN: 111‐262‐111 This memorandum is produced by BMA Capital Management Limited and is only for the use of their clients. While the information contained herein is from sources believed reliable, we do not represent that it is accurate or complete and should not be relied upon as such. Opinions expressed may be revised at any time. This memorandum is for information only and is not an offer to buy or sell, or solicitation of any offer to buy or sell the securities mentioned. 1

© Copyright 2026