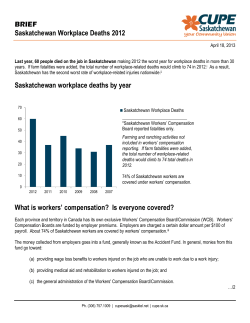

Document 167395