Car Loan Checklist: Prepare for Financing

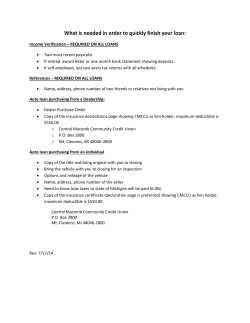

Check List: Getting Ready for a Car Loan Many people start the car purchase process by first looking for a car and then looking for financing. By reversing the process and looking for a loan first, your client will be confident that the loan fits their budget and that the car they buy is within their budget. Start at your credit union or bank. Before you start shopping for a car, stop by or call your credit union or bank and get information about their auto loan requirements. Check the Asset Platform Credit Union Locator to find a credit union. The worst place to finance a car is on a car lot. You will get a better deal on a loan if you are not shopping for a car at the same time. Learn about your bank or credit union’s loan terms and requirements. Next, do your research. Again, before you shop for a car, know the year, make and mileage of the car you want to buy. Many credit unions will only finance cars that are with a certain age and/or that have a certain number of miles on them. Make sure the car you choose meets these requirements. Make sure the car you choose meets the space requirements of your family. Check Edmunds for reviews of the car and to learn about performance and gas mileage. Finally, use a calculator to make sure you can afford the car you want. http://www.edmunds.com/car-loan/how-much-car-can-you-afford.html Know your credit score. The rate you will get on your loan is dependent on your credit score. Typically, the higher the credit score, the better the interest rate on your loan. Banks and credit unions have different underwriting criteria, and you should always check with your financial institution. Have a down payment equal in value to 20 percent of the total value of the car. A car down payment may be comprised of both the trade-in value of an old car and cash. Aim for the largest cash down payment possible to decrease your payment. Car Loan Calculator Estimate a total monthly car payment using this calculator: http://www.edmunds.com/calculators/car-loan.html © 2011 The Aspen Institute and The Center for the Study of Social Policy Page 1 Auto Loan Rates Use this document to see sample comparison loan rates among credit unions, banks and auto dealers: http://www.edmunds.com/car-loan/how-to-get-an-auto-loan-during-the-credit-crunch.html © 2011 The Aspen Institute and The Center for the Study of Social Policy Page 2

© Copyright 2026