The Financial Advisor Opportunity at Edward Jones THE FINANCIAL ADVISOR OPPORTUNITY

THE FINANCIAL ADVISOR OPPORTUNITY The Financial Advisor Opportunity at Edward Jones To help you determine whether becoming a Financial Advisor with Edward Jones matches your personal career objectives, we urge you to carefully review the following information. This summary describes the position and the activities of a successful Financial Advisor during the first year of his or her career. Table of Contents Page 2: The Financial Advisor Opportunity Page 4: The Selection Process Page 5: Financial Advisor Compensation and Benefits Page 7: New Financial Advisor Training Page 9: Family Support If you have any questions regarding this or other information pertaining to becoming an Edward Jones Financial Advisor, please call our Talent Acquisition department at 800-999-5650. Visit www.careers.edwardjones.com. THE FINANCIAL ADVISOR OPPORTUNITY The Financial Advisor Opportunity People from a variety of backgrounds – including those with prior financial services or sales experience, military veterans and influential people in the community – have found new success at Edward Jones. In the midst of this great diversity, those individuals who succeed here share common traits of personal drive and outstanding relationship skills. Come begin a new career with us and find an environment ready to match your ambitions with limitless potential. As a Financial Advisor at Edward Jones, you’ll have the opportunity to run your own professional practice while helping people work toward their personal and financial goals. You’ll have the support of one of the most respected financial services firms, as well as a network of Financial Advisors and a dedicated branch administrator who are committed to your success and doing what’s right for clients. Our award-winning training teaches you the skills to run your business your way, providing you opportunities for unlimited earnings potential, which is directly tied to the energy and effort you put forth. About Edward Jones Founded in 1922, Edward Jones is a financial services leader with branches across North America. We’ve always taken a more personal approach to business that starts with a face-toface meeting between a client and a Financial Advisor. We believe that building long-term relationships with our clients and always putting their best interests first are essential to our success. Our mission is to help individuals achieve their serious, long-term financial goals by understanding their needs and implementing tailored solutions. Why Edward Jones? When you join Edward Jones, you are joining an organization of devoted, enthusiastic, diverse and highly driven individuals. Our business is a very personal one where the needs of our clients come above all else. Perhaps the most defining characteristic of our culture is the fact that we are a partnership and have remained one all these years. To us, a partnership is a great deal more than a legal contract – it’s the foundation that fortifies our organization. As members of the largest financial services firm to maintain a partnership structure, Edward Jones associates have the potential to earn ownership in the firm. In fact, nearly 15,000 Edward Jones associates are limited and general partners. Who are we looking for? • Individuals who have a track record of professional success •P eople motivated by challenge and reward • Individuals who are comfortable with autonomy and independence •P eople dedicated to self-development who can lead a branch team •P ositive, sociable people who can effectively handle rejection or hesitation Why are Edward Jones Financial Advisors consistently ranked the most satisfied in the industry? • Your compensation reflects your efforts, resulting in unlimited earnings potential. •Y ou have the autonomy to select clients and set your schedule. •Y ou are prepared for success, thanks to a comprehensive training and support program. Change your life and make a difference in the lives of others. • Get paid while you study and receive all the support necessary to pass industry-regulated exams. •R eceive business-building and financial training. Training magazine, FORTUNE magazine and numerous states across the country have recognized Edward Jones for career excellence. Visit www.careers.edwardjones.com for a complete list of awards and accolades. • Identify and cultivate prospective clients from your own local office. • Work one-on-one with clients to determine and help meet their financial and investment needs. •E njoy opportunities to give back to your community. This is a unique and exciting opportunity for the right person. The financial possibilities can be great – but it takes a dedicated individual to capitalize on the potential. Visit www.careers.edwardjones.com to read success stories of current Financial Advisors and submit your résumé. Edward Jones does not discriminate on the basis of race, color, gender, religion, national origin, age, disability, sexual orientation, pregnancy, veterans status, or any other basis prohibited by applicable law. ITEM# 8036 TAL-7466D-A EXP 31 MAY 2015 THE FINANCIAL ADVISOR OPPORTUNITY The Edward Jones Selection Process Being an Edward Jones Financial Advisor is a rewarding career that’s full of opportunity – for the right person. It’s a challenging role that requires outstanding relationship skills and personal drive. But if this type of role suits you, we enthusiastically support you with abundant resources and training to help you achieve longterm success. Edward Jones Financial Advisor candidates must submit a résumé to the Financial Advisor Talent Acquisition department for review. If qualified, the candidate then completes an employment application and progresses through a series of phone and face-to-face interviews and a virtual day-in-the-life assessment. Our evaluation process is thorough and is designed to provide you with a realistic view of the work required to build a successful practice. The process takes approximately 30 to 45 days from résumé review to selection. The selection process can move quickly, but a lot of the time frame depends on your schedule as you move through the process. Steps in the Process Candidate Submits Résumé Résumé Reviewed Invitation to Apply Application Reviewed by Recruiter Phone Screen Financial Advisor Interview Business Plan Who are we looking for? • Individuals who have a track record of professional success Phone Interview • People motivated by challenge and reward • Individuals who are comfortable with autonomy and independence • People dedicated to self-development who can lead a branch team Virtual “Day in the Life” Assessment • Positive, sociable people who can handle rejection or hesitation effectively Selection Decision • Hard workers who have demonstrated self-discipline NOTE: Licensed candidates may have a different selection process depending on individual experience. All prospective Financial Advisors of Edward Jones are required to undergo a drug screening test. Edward Jones will not disclose information obtained through the drug screening test except: 1) When such information is needed by persons involved in the employment decision; and 2) When such disclosure is required by law. If you decide to accept our offer of employment, you will receive a Form U4 or Form 4 questionnaire to complete. The Form U4 is a very important document that must be filed with the Financial Industry Regulatory Authority (FINRA) to begin your securities licensing process. Our offer of employment is conditional upon your complete and accurate Form U4 or questionnaire, and responses that indicate you would not be disqualified by FINRA. Edward Jones does not discriminate on the basis of race, color, gender, religion, national origin, age, disability, sexual orientation, pregnancy, veterans status, or any other basis prohibited by applicable law. ITEM# 8032 TAL-5933C-A EXP 30 APR 2015 © 2014 EDWARD JONES. ALL RIGHTS RESERVED. THE FINANCIAL ADVISOR OPPORTUNITY Financial Advisor Compensation and Benefit Fact Sheet Competitive Compensation1 Bonuses We know what drives you – we’ve tailored an awardwinning career experience around it. Compensation is a huge part of your professional satisfaction, and we’re proud to say that at Edward Jones, your earning potential is without limit. Our performancebased compensation program is designed to support Financial Advisors as they transition careers and build their professional practices. You have the potential to receive several bonuses throughout the first few years while you build your professional practice, including: Compensation may include: • New asset bonuses paid monthly, based on the accumulation of new assets. • Trainee pay • Salary • Commissions • Bonuses • Profit sharing • Travel program Trainee Pay and Salary While studying for your licenses and training, you will be paid on an hourly basis. As you begin building your professional practice, Edward Jones provides a salary to help create stable earnings in the early stages of your career. Your starting salary as a new Financial Advisor is determined by your experience and income prior to joining the firm. Your salary amount will adjust as you move toward compensation based more on commissions and bonuses. Salaries are adjusted based on performance standards for the first two years. By the third year, you typically have built a steady book of business and will transition away from a salary.2 Commissions During your first three years as a Financial Advisor, commission payouts will vary based on years of experience, the state in which your branch is located and the type of product. Commission payout ranges are generally as follows: Year 1 Year 2 Year 3 Year 4 and beyond 18%–20% 22%–25% 27%–30% 36%–40% • Bonuses for obtaining licenses and completing training. •M ilestone bonuses paid every four months to Financial Advisors whose performance is 75% or more of standard. Financial Advisors who are at 100% or more of standard may receive an enhanced milestone bonus. •D eferred bonuses earned and paid every four months in years four, five and six, based on new assets gathered in the first three years. • Profitability cash bonuses earned and paid by trimester, based on branch and firm profitability. Profit Sharing Each year, the firm shares a portion of net profits in the form of profit-sharing contributions to your retirement account. Once a contribution has been posted to your account, it is immediately 100% vested. Travel Program At Edward Jones, you have the distinct opportunity to participate in business diversification trips. This popular program recognizes and rewards those who build a strong book of business. These programs promote knowledge-sharing in an atmosphere where Financial Advisors can relax and recharge. In recent years, approximately half of our nearly 12,000 Financial Advisors have qualified for our diversification trips. 1 The details of a new Financial Advisor’s specific compensation may vary based on his or her individual circumstances. 2 Edward Jones ensures that each Financial Advisor’s compensation meets or exceeds the required minimum guarantee under federal and state law. Benefits The Partnership Opportunity Edward Jones provides access to a comprehensive package of benefits. Standard benefits, which are provided by the firm at no cost to you, include basic life insurance, basic accidental death and dismemberment insurance, income continuation plan for short-term disability, profit sharing and tuition reimbursement. Optional benefits include medical coverage (with an opportunity to fund out-of-pocket medical costs via a Health Savings Account), as well as: In addition to your compensation package, Financial Advisors in the past have had the opportunity to invest in Edward Jones’ parent company, The Jones Financial Companies, L.L.L.P., a partnership. Historically, limited partnership offer selection has been based on the minimum requirements of running a profitable and ethical branch. After meeting these basic criteria, other considerations are leadership and your assistance to others in your region and the firm. Today, nearly 15,000 Edward Jones associates are limited or general partners. • Dental plans • Long-term care insurance • A vision plan • Health care reimbursement account • Long-term disability • Supplemental accidental death and dismemberment insurance • Dependent life insurance • Dependent day care reimbursement account For more compensation details, visit www.careers.edwardjones.com. • 401(k) plan • After-tax plan and investment savings plan The Financial Advisor bears a portion or all of the costs of optional benefits. Sample Compensation Schedules (based on previous annual income of $90,000) Based on historical production of top 33% of new Financial Advisors Years Salary* Milestone Bonus New Asset Bonus Commission Cash Compensation (earned & paid in years 1, 2 & 3) Deferred Bonus (calculated based on years 1, 2 & 3) 1st Year $49,500 $7,000 $6,000 $20,000 $82,500 $12,000 (earned & paid in year 4) 2nd Year $34,650 $12,000 $9,000 $45,800 $101,450 $18,000 (earned & paid in year 5) 3rd Year $0 $18,000 $12,000 $76,100 $106,100 $24,000 (earned & paid in year 6) Total $84,150 $37,000 $27,000 $141,900 $290,050 $54,000 Based on historical production of middle 33% of new Financial Advisors Years Salary* Milestone Bonus New Asset Bonus Commission Cash Compensation (earned & paid in years 1, 2 & 3) Deferred Bonus (calculated based on years 1, 2 & 3) 1st Year $44,550 $4,000 $3,000 $9,000 $60,550 $6,000 (earned & paid in year 4) 2nd Year $21,450 $6,000 $4,500 $25,400 $57,350 $9,000 (earned & paid in year 5) 3rd Year $0 $9,000 $6,000 $47,600 $62,600 $12,000 (earned & paid in year 6) Total $66,000 $19,000 $13,500 $82,000 $180,500 $27,000 *Schedules are based on a previous annual income of $90,000. Earnings do not take into account profit-sharing contribution and FICA contribution. Notes on calculations: Net commissions for each Financial Advisor are for the end of each year as a licensed Financial Advisor. For instance, in year 1, Financial Advisor net commissions are from the first 12 months as a licensed Financial Advisor. In year 2, net commissions are from months 13–24 as a licensed Financial Advisor. Edward Jones is an equal opportunity employer, committed to developing an inclusive culture. We believe that diverse ideas, opinions and perspectives are essential to building a strong business. ITEM# 8033 TAL-7298E-A EXP 30 SEP 2014 © 2014 EDWARD JONES. ALL RIGHTS RESERVED. THE FINANCIAL ADVISOR OPPORTUNITY New Financial Advisor Training at Edward Jones Becoming a successful Financial Advisor requires comprehensive training and your concentrated efforts to succeed. Edward Jones is committed to providing every Financial Advisor with a high level of continual training throughout his or her career. In addition, field training programs and other assistance within your region are available to help you succeed as an Edward Jones Financial Advisor. The Edward Jones Practice Management training model is based on best practices we have learned from the experiences of our top branch teams at Edward Jones as well as other organizations. Through these best practices, we identified key Financial Advisor competencies – the same competencies we look for in our selection process – that the training program is designed to develop. Training Program Edward Jones’ training program for new Financial Advisors typically lasts 17 weeks, depending on individual circumstances. Upon completion of an eight-week study-at-home program in which you prepare for your securities licenses, you will move into training programs designed to teach you how to: • Create clients • Serve clients • Develop your branch team • Improve your branch’s efficiency Financial Advisors who demonstrate and develop these competencies provide ideal client experiences. Our training courses are designed to foster aspects of these competencies. In its 14th consecutive year on the list, Edward Jones was named a top company for training, ranking No. 24 on Training magazine’s 2014 Training Top 125 list. Edward Jones was the highest-ranking financial services firm. Training and Support for New Financial Advisors Below are the steps you will take with Edward Jones to prepare yourself for the Financial Advisor career. Profitability Development Program Evaluation/ Graduation Field Foundations Know Your Customer Study Program 5 Days Training Class 8 Weeks Study at Home •L earn from trainers and veteran Financial Advisors about client needs, investments and the history of the firm •S tudy and take Series 7 and Series 66 exams with the help of Study Specialists • Develop and •B ecome practice client acquainted presentation skills with local market • Prepare for and Financial face-to-face Advisors, and phone including your conversations mentor, regional with potential leader and field clients trainer 5 Days Training Class 7 Weeks Trainee’s Market •D evelop and practice presenting • Concentrate on financial making proactive solutions to face-to-face prospective contacts with clients via potential clients phone calls • Observe veteran • Begin offering Financial Edward Jones Advisors with products and clients and services to continue new clients to practice investment presentations First 120 Days 2.5 Days Training Class 17 Weeks Financial Advisor’s Market •R efine and expand investment knowledge • Begin to build • Practice client your business creation skills in your local and develop a market by business plan meeting with to continue prospective to grow your clients and practice offering financial solutions to them •C ontinue to receive training and feedback from field trainer to help with the success of your business Five Critical Activities of a New Financial Advisor 1. Make 25 quality contacts per day (125 per week). 2. Ask open-ended questions to obtain financial needs and goals. 3. Present an appropriate solution and ask for the order. 4. A ssess each contact, document the contact and indicate next action. 5. Contact each prospective client at least every two weeks. The training information displayed is for illustrative purposes and is subject to change. Additional training may be provided, depending on your situation, to help you get your Edward Jones business up and running as quickly as possible. Please check with a member of our Talent Acquisition team should you have specific questions about the details and timing of your training. Studying for Your Series 7, Series 66 and Insurance Licenses You will spend the first few months at Edward Jones studying for and taking your Series 7, Series 66 and insurance license exams. Preparation for these exams is challenging and must be taken very seriously. You will need to dedicate 100% of your working hours to studying. You have one chance to pass the Series 7 exam; failure to pass it is generally caused by insufficient preparation. Trainees typically commit a minimum of 45 hours of study each week over a twomonth period. With an organized and committed study plan, you should find the information manageable. You must pass these tests to become an Edward Jones Financial Advisor. There is a wealth of information on our website regarding Edward Jones’ training program. Visit www.careers.edwardjones.com for additional information. Edward Jones does not discriminate on the basis of race, color, gender, religion, national origin, age, disability, sexual orientation, pregnancy, veterans status, or any other basis prohibited by applicable law. ITEM# 8039 TAL-7469E-A EXP 30 APR 2015 © 2014 EDWARD JONES. ALL RIGHTS RESERVED.

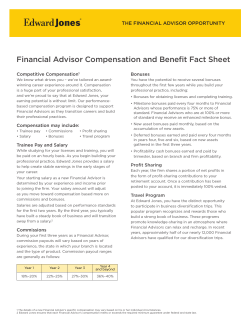

© Copyright 2026