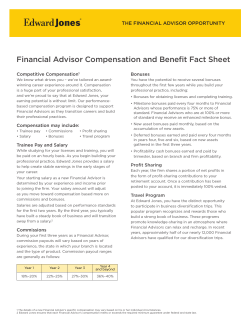

Advisor Succession Planning Managing the retirement of Baby Boomer advisors

Wealth and Asset Management Service Spotlight Advisor Succession Planning Managing the retirement of Baby Boomer advisors 1 As few as 29% of advisors have a succession plan in place or are ready for implementationi “Cutting a check” for a retiring financial advisor is a common practice that many wealth management firms employ to retain client assets during advisor succession. The current operating model enables this practice and allows advisors to sell their books to the highest bidder without fully considering the impact to their firms. Advisors are being presented with compelling book monetization options that could influence the outcome of succession for their current clients and their current firms. The practice of trying to sway retiring advisors is not new; most firms have processes in place to help minimize asset loss. Nevertheless, these processes will be significantly tested by an imminent demographic reality: A large population of Baby Boomer advisors is nearing retirement. These advisors manage a significant amount of assets, and are often the most profitable advisors within a firm. This demographic shift will challenge firms that do not have effective strategies to manage and mitigate the risks of advisor succession. Accenture believes that there is an opportunity for firms to not only address the issue of Baby Boomer advisors retiring, but also to transform their businesses to manage succession in a more effective and sustainable way. By aligning the interests of clients, advisors, and the enterprise, wealth management firms can develop a succession model that is less disruptive to clients, aligns with advisors’ motivations, and is more beneficial for firms. 2 Dimension 1 The Advisor Operating Model The current advisor operating model is a critical factor underlying the challenges related to advisor succession. Most firms maintain an entrepreneurial model, which allows advisors to freely manage client relationships. This model presents certain difficulties to firms, including: 1. Sell and Move On • Advisors with an entrepreneurial mindset are motivated to monetize the value of their client relationships 2. Merge and Stay Involved • Advisors with deep client relationships have significant influence over their clients’ decisions • Firms usually have limited insight into advisors’ client business plans While these factors have an impact across the advisor-client lifecycle, they pose particular challenges as advisors near retirement. Recent findings from Fidelity’s Inside Track Conference reinforced this facti, and summarized advisors’ retirement options into three general categories: 3 An advisor monetizes his or her book of business by selling to another advisor who may or may not be within the same firm. This could be disruptive for clients who are not fully informed of the transition. An advisor partners with a complementary practice, which could mean that the firm loses the client through an external merger or it could result in a lower level of service for the client. Figure 1. Moss Adams: Advisor Succession Plans Moss Adams - 2010 Financial performance study of advisory firms 29% 71% 3. Internal Transition An advisor grooms members of his or her practice to take over, which may appear to be the most positive option for the firm. However, this could lead to a loss of momentum in client growth. Exacerbating the advisor succession challenge is the fact that firms have limited visibility into the retirement plans of their advisors, particularly where advisors have not fully developed their own strategies. Defined or implemented a succession plan No defined or implemented a succession plan Studies show that in most cases advisors are not planning for succession. According to a Moss Adams Studyii, only 29% of advisors have defined or implemented a succession plan. Furthermore, even with a basic succession plan in place, advisors may not know who will inherit their books. A recent Cerulli study indicated that 59% of advisors who are within five years of retirement don’t know who will purchase their practicesiii. Although firms are aware of the challenges inherent to the current operating model and the threats posed by limited and undeveloped advisor succession plans, the majority have not put a comprehensive or deliberate strategy in place to cultivate internal successors beyond reactionary strategies like “cutting checks.” Figure 2. Cerulli: Projected buyer of practice by years to retirement, 2011 Nearly 40% of advisors either do not have a solidified buyer or will have their clients reassigned Buyer <5 5 to 10 11 to 20 > 20 All advisors 59% 22% 17% 15% 21% Junior employee or employees 0 19 31 7 20 Existing partner 0 31 9 16 20 Designated non-partner successor 30 9 13 16 13 My firm will reassign my clients and i will receive compensation 9 3 13 24 11 Family member 0 3 4 14 5 My firm will reassign my clients and i will not recieve compensation 0 10 <1 1 5 Other 0 0 8 5 4 Known outside buyer 2 1 5 2 2 Unknown outside buyer 4 Dimension 2 The Demographic Impact Intensifying the challenges presented by the current wealth management operating model is the reality of an impending demographic shift in the advisor workforce: a large number of Baby Boomer advisors are approaching retirement age. Recent research shows that the average age of advisors is approximately 50 years oldiv in the US, and: • 21% of the workforce is over 60 years oldv • Less than 25% are under 40vi • Only 5% of advisors are under 30 years oldvii. The demographics of the workforce are not only a problem for the U.S. wealth management industry. According to Advisor.ca, the average age of an advisor in Canada is 54 years oldviii. The impact of this demographic trend is exacerbated by the reality that firms have to manage a retiring workforce while also building their next generation of advisors. A Pershing Advisor Solutions study finds that of the 315,000 advisors and brokers currently working in the U.S., 12,000 to 16,000 will retire every year for the next decade. The result is that the financial advisory business will need 237,000 new advisors in the next ten years to maintain its current headcount.ix Figure 3. Cerulli, Advisor age by age range, 2012 Advisor age by range 4% 17% 18% The impact of a large number of older advisors is further amplified by the fact that advisors over the age of 60 manage a majority of firms’ client assets. According to Cerulli, advisors over 60 control $2.3 trillion of assets.x Not only do the advisors facing retirement manage the majority clients’ assets, but they also often manage the most valuable books. 4% 32% 25% <30 <40-49 <60-69 <30-39 <50-59 >69 Figure 4. Cerulli: Quantifying succession, 2Q 2012 Cerulli estimates the assets controlled by advisors who are older than 60 years of age at $2.3 trillion Channel Advisors approaching retirement Assets per advisor ($ millions) Assets in transition ($ millions) Team/Ensemble Bank 1,070 $31.0 $33,183 41.70% Wirehouse 13,237 94.2 1,246,929 72.7 Regional 3,272 48.0 157,070 57.9 IBD 29,443 17.7 521,137 72.2 Insurance 11,140 4.8 53,473 60.0 Dually registered 2,948 63.7 187,763 69.1 RIA 5,084 63.0 320,314 58 All advisors 66,212 34.8 2,304,163 64.6 5 Accenture’s “Advisor Lifecycle” model, shown in Figure 5, demonstrates the relationship between tenure and competency. It shows a positive correlation between the time an advisor has spent at a firm and the value of the advisor to the firm. As such, the pending demographic shift will have significant results, as firms are at risk of losing their most valuable advisors – those that have passed the inflection point and produce maximum value for their firms. Figure 5. Accenture Advisor Lifecycle Advisor lifecycle Current vs. Potential performance curve Exhibited job proficiency in % Potential performance Current performance This trend is not only problematic for firms; it is also extremely disruptive for clients. There is a greater risk of clients leaving the firm when advisors leave or retire. Wealth management business models and advisor succession plans will not change overnight – the current advisor model is largely entrenched within the industry and is reflected in performance management and compensation practices. However, to retain client assets and protect firm profitability, it is critical that firms address this demographic shift and put plans in place to effectively manage advisor succession. Time Recruit Time to proficiency Enhance performance Retain top talent 6 Addressing the Issues There is No “One-Size-Fits-All” Solution for Firms Firms are generally aware of the problems around advisor succession; yet, many have not enacted a deliberate strategy to tackle the issue. The methods commonly employed are reactionary and not comprehensive. While these tactics may retain assets in the short-term, long-term client attrition remains a risk. Furthermore, considering the scale of the upcoming transition, firms cannot realistically afford to stick to traditional methods. Firms can begin to address advisor succession challenges with some simple and pragmatic strategies, such as: • Having candid discussions with advisors nearing retirement age to understand their options and goals for their client books • Presenting advisors with retirement options that meet their goals, while still being beneficial to the firm • Helping advisors navigate the various choices and then assisting with implementing the most suitable options. 7 These strategies help to ensure visibility into advisors’ succession plans and control over the entire succession process which will minimize risk to the overall client experience. Firms that have developed loyalty and “stickiness” with their clients and advisors over the lifecycle of their relationships, and not just at the advisor succession milestone, will be best positioned to have meaningful retention success. Prioritizing advisor satisfaction and addressing the reasons that advisors leave a firm, either during or before succession, will also help firms come out ahead during the impending demographic shift. According to Accenture’s Generation D Advisor survey, advisors cited these top three reasons for leaving their firms: 1. “Needed better marketing support” 2. “Didn’t have the tools needed to meet clients’ needs” 3. “Losing clients to other firms that provided better resources” Each of these reasons indicates that a firm was unable to build a strong enough relationship with its advisors or did not provide sufficient foundational support for its advisors to grow their businesses. Correcting these issues will not only increase advisor satisfaction, but also result in a better overall client experience. Both are critical components of a longterm strategy that is focused on aligning the interests of firms, advisors and clients. This multifaceted alignment is not easily achieved. However, we believe that wealth management firms can proactively address advisor retention and better position themselves as advisors near retirement by addressing the following levers: 1) Capabilities, 2) People, and 3) Branding. Plan today for the assets you want to retain tomorrow Capabilities: Building a compelling value proposition Wealth management firms operate within a highly competitive environment. However, a firm’s positioning and the strength of its advisor workforce can be greatly enhanced by best-in-class capabilities. These foundational elements empower advisors to grow their clients’ books and enhance the overall value proposition for both clients and advisors and contribute greatly to their loyalty and “stickiness” to their firms. For example, building comprehensive analytics capabilities can distinguish a firm from its competitors. The firm is seen as innovative and uniquely positioned within the industry. Comprehensive Customer Relationship Management (CRM) tools, such as data management and mining capabilities, are an example of technological capabilities that enable an advisor’s business and differentiate a firm from its competitors. These tools, when adopted by the advisor sales force, provide actionable customer insights and dynamic portfolio performance analytics which help advisors tailor solutions to their clients. They also allow the firm to have deeper insights into their clients’ preferences which can increase the likelihood of retaining their assets. Clients also benefit from their firm’s focus on superior technological capabilities in the form of sophisticated self-servicing options that enable them to effectively manage their money directly. People: Enabling collaboration and teaming for stronger client relationships A critical strength of any successful wealth management firm is its people. In the current advisor-centric operating model, one of the most important people components is the independent advisorclient relationship. However, in response to the upcoming demographic shift, it makes sense for firms to reframe this dynamic. Firms can seek to recast the advisor as a member of a comprehensive team. In this scenario, clients benefit from the support of multiple advisors in the firm while retiring advisors are also provided with monetization options for their books of business. This team-centric model better positions the next generation of advisors and builds a stronger link between the firm and the client through multiple relationships and touch-points. For example, in the private banking industry, the client receives additional services in parallel to that of the financial advisor, such as estate planning, tax planning and legal support. Supplemented by investments in scaling up these teaming capabilities, firms will be better positioned to meet the needs of their clients. When effectively employed, this approach can drive both advisor and client stickiness to the firm. From the advisor perspective, the team-centric model has the potential to support the entrepreneurial interests of advisors, while simultaneously enabling them to more efficiently, effectively and profitably serve their clients’ needs and best interests. From the client’s perspective, the likelihood that a client stays with the firm upon his/her advisor’s retirement would increase since he/she now has a relationship with a team at the firm rather than with just an individual advisor. Firms that have proactively invested in their people are more likely to come out ahead during the advisor succession process. Branding: Building reputation and affinity Both innovative capabilities and a comprehensive teaming model contribute to, and are reinforced by the strength of a wealth management firm’s brand. A comprehensive and effective branding strategy can differentiate one firm from another as well as increase client and asset retention opportunities. Developing and effectively communicating a firm’s brand or unique value proposition – likely grounded in best-in-class capabilities and people – can help a firm end up on the winning end of any transition. Brand is especially important when advisors look outside the firm to monetize their books as well as when firms rely on a defensive strategy to retain or regain assets. Strong brand affinity can ease this process, encouraging clients to maintain loyalty to the firm, independent of their advisors. In addition, the digital domain and social media provide firms with an opportunity to reach diverse customers and communicate their unique value proposition. Digital tools can also enhance the connection between advisors and their clients while providing consistent and compelling messaging about the firm’s value proposition. By providing alternatives to traditional channels of communication between firms and their clients – which hinge on the advisor as intermediaries – firms are able to build stronger direct relationships and affinity with their clients. 8 Conclusion Wealth management firms will take different approaches to managing advisor succession and client retention Wealth management firms today face changes in their workforce that must be addressed. They will be challenged by the reality that a large number of an aging demographic, their most high-value advisors, will be nearing retirement. In addition, their traditional advisor operating model is grounded in advisors owning direct exclusive relationships with their clients. In light of these conditions, all firms will have to make some level of investment in addressing advisor succession. Some will be more proactive, while others will take a “wait and see” approach. To begin addressing the advisor succession challenge, firms should take some immediate action; this includes having candid discussions with advisors who are close to retirement to gain a better understanding of their objectives, and developing succession plans and processes that are beneficial to clients, advisors, and firms. However, some firms will use advisor succession as an opportunity to address some structural issues in their operating models. By adopting an approach that balances strategies related to people, capabilities, and branding, firms can create a more robust operating model that produces sustained business outcomes in the face of the looming shift in the advisor workforce. 9 Notes i. http://www.fidelity.com/inside-fidelity/ using-an-advisor/fidelity-successionplanning-program ii. Developing a Sustainable Business and Succession Plan: An Independent advisor’s guide iii. The Cerulli Edge: 3Q 2012, Issue #36 iv. http://www.fa-mag.com/fa-news/5932advisory-industry-faces-talent-shortage. html v. http://www.fa-mag.com/news/tibergienold-advisors-driving-young-out-of-thebusiness-10936.html vi. http://www.fa-mag.com/fa-news/5932advisory-industry-faces-talent-shortage. html vii. http://www.fa-mag.com/news/ tibergien-old-advisors-driving-young-outof-the-business-10936.html viii. http://www.advisor.ca/my-practice/ succession-planning-securing-yourfuture-1579 ix. http://www.fa-mag.com/fa-news/11229tibergien-old-advisors-driving-young-outof-the-business.html x. The Cerulli Edge: 3Q 2012, Issue #36 10 Contacts About Accenture Alex Pigliucci Accenture is a global management consulting, technology services and outsourcing company, with approximately 259,000 people serving clients in more than 120 countries. Combining unparalleled experience, comprehensive capabilities across all industries and business functions, and extensive research on the world’s most successful companies, Accenture collaborates with clients to help them become high-performance businesses and governments. The company generated net revenues of US$27.9 billion for the fiscal year ended Aug. 31, 2012. Its home page is www.accenture.com. [email protected] +1 917-452-4978 Kendra Thompson [email protected] +1 416-641-4004 Contributors Karime Abdel-Hay Alistair Clark Farah Lalani Kathryn Whitelaw Copyright © 2013 Accenture All rights reserved. Accenture, its logo, and High Performance Delivered are trademarks of Accenture. 13-0486_lc / 11-6143

© Copyright 2026