INVESTMENT PROPOSAL Active Gold Holding PLC –

–

Active Gold Holding PLC

INVESTMENT PROPOSAL

Active Gold Holding PLC

Investment Proposal

Table of Contents

1

EXECUTIVE SUMMARY ..........................................................................................................4

2

2.1

2.2

2.3

2.4

2.5

HISTORY, SITUATION AND OBJECTIVES ................................................................................5

HISTORY ..................................................................................................................................5

THE PRESENT SITUATION .......................................................................................................5

MINING RESULTS ....................................................................................................................6

COMPANY OBJECTIVES ..........................................................................................................6

INVESTMENT OFFER ...............................................................................................................7

3

3.1

3.2

3.3

3.4

3.5

3.6

GOLD MARKET ANALYSIS ......................................................................................................8

DEMAND AND SUPPLY ...........................................................................................................8

HOW DOES GOLD WORK? ......................................................................................................8

RELEVANT FACTORS – PRODUCTION ...................................................................................11

RELEVANT FACTORS - COMMODITY ....................................................................................12

RELEVANT FACTORS – SAFE HARBOR ..................................................................................13

PREDICTIONS ABOUT THE GOLD MARKET PRICE IN THE FUTURE .......................................14

4

4.1

4.2

4.3

4.4

4.5

4.6

4.7

4.8

4.9

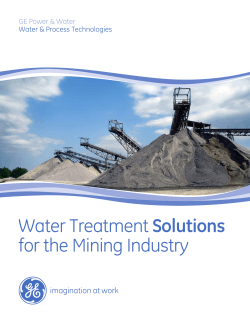

GOLD MINING ......................................................................................................................16

INTRODUCTION ....................................................................................................................16

ALLUVIAL GOLD ....................................................................................................................16

HARD ROCK GOLD ................................................................................................................17

GOLD MINING IN RUSSIA .....................................................................................................19

OVERVIEW – THE REPUBLIC OF ALTAI .................................................................................20

THE HISTORY OF GOLD MINING IN THE REPUBLIC OF ALTAI ...............................................21

CURRENT GOLD MINING IN THE REGION ............................................................................21

CLASSIFICATION IN THE WESTERN WORLD .........................................................................22

CLASSIFICATION IN RUSSIA ..................................................................................................23

5

5.1

5.2

5.3

5.4

5.5

ACTIVE GOLD DEPOSITS ......................................................................................................25

ACTIVE GOLD’S FOUR DEPOSITS ..........................................................................................25

THE CHUIKA AND MIDDLE KAINACH DEPOSIT .....................................................................26

THE ALBAS AND KAURCHAK DEPOSITS ................................................................................28

THE BRECCIA DEPOSIT ..........................................................................................................29

PROSPECT MINES .................................................................................................................34

a PRAVOBEREZHNY ............................................................................................................34

b MAISKO-LEBEDSKY AREA .................................................................................................35

c CHOISKAYA AREA.............................................................................................................35

d SYNZAS.............................................................................................................................36

e BOLSHAYA RECHKA .........................................................................................................36

6

DEVELOPMENT PLAN...........................................................................................................37

6.1 TIME SCHEDULE ...................................................................................................................37

6.2. INVESTMENT DETAILS ..........................................................................................................38

a ALREADY PURCHASED .....................................................................................................38

b EQUIPMENT TO BE PURCHASED .....................................................................................40

2

Active Gold Holding PLC

7

7.1

Investment Proposal

7.5

PRODUCTION, LOGISTICS AND LOCAL INTEGRATION ........................................................43

PRODUCTION .......................................................................................................................43

a ALLUVIAL MINES ..............................................................................................................43

b HARD ROCK DEPOSIT .......................................................................................................45

LOGISTICS .............................................................................................................................46

CONCESSIONS.......................................................................................................................48

GOVERNMENTAL SUPPORT AND LOCAL INTEGRATION ......................................................50

a National Agency ..............................................................................................................50

b Social Responsibilities .....................................................................................................50

ENVIRONMENT.....................................................................................................................50

8

SALES ....................................................................................................................................51

9

9.1

9.2

9.3

9.4

9.5

9.6

COMPANY ............................................................................................................................52

STRUCTURE ..........................................................................................................................52

ORGANIZATION ....................................................................................................................52

BOARD OF DIRECTORS .........................................................................................................53

MANAGEMENT TEAM GENERAL MANAGEMENT ................................................................54

GEOLOGICAL AND TECHNICHAL EXPERTS - SITE MANAGEMENT ........................................55

SHAREHOLDERS ....................................................................................................................57

10

10.1

10.2

10.3

10.4

10.5

10.6

10.7

10.8

10.9

FINANCIAL PROJECTIONS ....................................................................................................58

Revenues ..............................................................................................................................58

Cost.......................................................................................................................................59

Profit and Loss ......................................................................................................................60

Balance Sheet (Pro Forma March 31st 2011) ......................................................................61

Free Cash Flow .....................................................................................................................62

Sources & Uses Of Capital ....................................................................................................63

Investment Metrics ..............................................................................................................64

Exit multiples ........................................................................................................................65

Return Sensitivities...............................................................................................................66

7.2

7.3

7.4

11

11.1

11.2

11.3

11.4

RISK MANAGEMENT ............................................................................................................67

GOLD PRICE ..........................................................................................................................67

DIESEL ...................................................................................................................................67

POLITICAL .............................................................................................................................67

OPERATION ..........................................................................................................................67

a Work force .......................................................................................................................67

b Spare part ........................................................................................................................67

c Equipment Lead Times ....................................................................................................68

d Close Circuit Water Supply ..............................................................................................68

e Vegetation .......................................................................................................................68

11.5 RISK & PROBABILITY ESTIMATIONS......................................................................................68

11.6 ENVIRONMENT.....................................................................................................................68

12

DISCLAIMER .........................................................................................................................70

3

Active Gold Holding PLC

1

Investment Proposal

EXECUTIVE SUMMARY

Active Gold Holding PLC (“Active Gold”) was formed in 2004 and currently holds four gold

mining concessions in the Russian Republic of Altai, Siberia. Active Gold has concluded all the

preliminary research, license negotiations and initial drilling works. Active Gold started with

successful production in summer 2008.

The overall geological reserves and resources of Active Gold exceed 50 tons of gold and 150

tons of silver with an annual gold production of 1.4 ton. At current gold price levels of approx.

1’450$/ounce and a silver price level of 40$/ounce, this is estimated to result in revenues of

more than US$ 2.5 bn over the lifetime of the investment.

Many trustworthy gold market analysts project the price of gold to rise significantly in the

future, thus potentially further increasing revenue. However, after full development of its hardrock mine, the Company will break even at a gold price of about 600$/ounce.

During 2008, Active Gold has successfully achieved actual production of gold on its first alluvial

mining site at an average of 650 to 950 g of raw gold per day. In 2008 63.2 kg have been

produced. 2009 yielded 99.1 kg and 2010 79 kg, i.e. a total of 240 kg until 2010, which has

generated a positive cash flow.

Active Gold has been controlled by a small group of individual shareholders from Russia and

Switzerland ever since its incorporation. They combine investment know-how, local experience

and a good understanding of the political network in Russia. All operations are headed by

skilled professionals with extensive expert knowledge of the geographical region in which the

Company is active.

To expand operations, and to enable work on all four mines in parallel, Active Gold is seeking

US$ 16.2m as debt or equity in a first phase investment placement.

The current focus is on the operation of one additional identified hard-rock mine with

geological reserves of more than 50 tons of gold. For the acquisition of additional mining

concessions (“Phase 2”), no additional money will be required as it can be financed out of

operating cash-flows.

Active Gold strives to become a leading Russian gold producer which applies Western

Standards of production and management. Once the envisaged production level of approx. 1.4

ton per annum has been successfully reached, an IPO or trade sale will be targeted within a

timeframe of 3-5 years to provide an exit for the investors. According to the business plan, an

Internal Rate of Return of 28% per annum can be expected. Phase 2 will certainly provide for

additional up-side potential.

The IRR calculation is based on a gold price of 1’450 $/ounce. An important calculation element

is the exit valuation in 5 years. A conservative EV/EBITDA multiple of 5x has been applied, using

South African mining companies as a proxy for the Company. The world average EV/EBITDA

multiple is however currently above 8x.

Active Gold is proposing a share capital increase of US$ 16.2m which would provide investors in

this placement with 16.8% of its shares (post money). The remaining US$ 4.9m funding

requirement would be financed with equipment debt finance at an interest rate of 11% p.a. We

are proposing this investment to high net worth individuals with the desire to increase

exposure to an attractive gold mining stock. We reserve this opportunity to investors bringing a

minimum amount of US$ 1m.

4

Active Gold Holding PLC

Investment Proposal

2

HISTORY, SITUATION AND OBJECTIVES

2.1

HISTORY

7 years ago, in 2004, three entrepreneurs, two Russians and one Swiss decided to leverage a

unique opportunity to start a gold mining operation in Siberia.

One of the Russian partners is a mining engineer with relevant know-how and management

skills. The Swiss investor is fluent in Russian and has over 15 years of business experience in

Russia which goes back to the times of the iron curtain. Together with another Swiss, he

successfully manages a fish processing plant near St. Petersburg and is partner in the first

quality vinery on the Russian Black Sea coast. The other Russian partner, who joined them later,

brings a profound understanding of the political networks to the table.

In 2006 a second Swiss investor joined the team. He is not only the owner and chairman of a

Private Bank in Switzerland but also brings a broad network in the financial industry and

extensive Private Equity experience to the team.

All four investors financed, out of their own funds, the acquisition of the mining concessions,

the drillings to test and prepare the ground, the purchase of equipment and the employment of

professionals for the first mine.

In 2009 an investor from Spain and another Swiss investor became shareholders of the

company.

To bring this mining operation from the drawing board to operation has, at times, been quite a

challenge. Considerable effort has gone into finding the right mining professionals, into

obtaining all required mining licenses, and obtaining alignment and support from regional and

federal governmental instances.

By 2008, the company had successfully managed to overcome the start-up difficulties, brought

the first alluvial mine into operation and even obtained a rare gold export license.

Today, through its company Active Gold Holding PLC, St. Petersburg, the Company holds

concessions to exploit three alluvial and one hard rock mine in the Republic of Altai, Siberia,

Russia.

2.2

THE PRESENT SITUATION

The first alluvial mine started its operations in summer 2008 and yielded 63.2 kilograms of gold

within only 5 months of production. In 2009 the production volume increased by 57% totaling

99.1 kilograms. In 2010 79 kg of gold has been produced. The total amount of gold produced

within the period of mining operations since 2008 to 2010 is approximately 240 kg. This

relatively small quantity is due to the fact that the financial means have been concentrated on

exploration of the hard rock mine during the initial phase.

This first mining site is located near the village Chuika, about a 5 hours drive from Barnaul or a 8

hours drive from Novosibirsk, the capital of Siberia. A second alluvial mine is currently in

process of being made operational. All preparatory works have already been finalized. The total

5

Active Gold Holding PLC

Investment Proposal

gold reserves and resources under the current concessions and its extensions exceed 50 tons of

gold.

Presently, the gold is being refined in Novosibirsk and sold via Sberbank (Moscow) in the form

of 999.9 quality gold bars at London spot price. Active Gold envisions exporting part of the

production to a Swiss Bank. The required licenses for export of gold bars and nuggets have

already been obtained; based on a contract with a Swiss Private Bank (Bank Frey & Co AG in

Zurich) Active Gold was the first company to export gold nuggets from Russia.

2.3

MINING RESULTS

The first months of actual field operations have produced evidence that the gold content at

Active Gold’s first alluvial site is between 50% and 200% higher than that stated in the

geological data sheets on which the business plan was originally based.

The data used to establish Active Gold’s business plans comes from various sources. Some are

the results of Active Gold’s own drillings during recent times, others come from field tests and

historical documents that were executed and issued by Russian Governmental Institutions in

the 1970’s and later.

Based on the first results of Active Gold’s recent gold production it became obvious that the

historical data as found in Russian archives were too conservative. This is partly due to the fact

that the techniques utilized today are far more precise and efficient than those put to use

during the Soviet era; it is also due to the Soviet authorities who have applied a rather

conservative methodology and made their calculations accordingly.

In 2009 and 2010 extensive drillings have been conducted. 54 drill holes and more than 8000

meters of drillings have been conducted to comply with the 43-101 requirements of the

Toronto Stock Exchange to confirm the assumed reserves. Alone in the area of 300 x 400 m

more than 2.5 tons of gold have been confirmed. Further drillings will be executed in the course

of 2011.

2.4

COMPANY OBJECTIVES

Active Gold strives to become a leading Russian Gold Producer applying Western Standards for

production and management. It will utilize modern technologies to achieve highest efficiency

while preserving the environment and protecting its workforce.

The objective of Active Gold is to exploit all four mines in parallel, acquire new alluvial

concessions once the current alluvial mines are depleted and, if possible, to acquire the

concession for another hard-rock mine.

Active Gold has already been offered one hard-rock mine with more than 40 tons of gold

reserves and a second one with another 30 tons of gold reserves. Active Gold believes that

obtaining the opportunity to acquire additional mining concessions would not be a difficult task

– certainly not after having established itself as a trustworthy counter party with actual and

successful production in place.

6

Active Gold Holding PLC

Investment Proposal

As explained in more detail in the financial section, Active Gold only needs “bridge financing” as

it will be cash-flow positive from the beginning. This additional capital helps to operate all

mines in parallel within a shorter period of time.

Initially, an amount of US$ 21.1m is sought to purchase equipment and hire the necessary

employees to operate mines 2, 3 and 4. In Phase 2, a second hard-rock mine together with the

necessary mining equipment will then be acquired.

In 3-5 years Active Gold intends to obtain a listing at an appropriate exchange (IPO) or to sell

the business to a large international mining company.

2.5

INVESTMENT OFFER

Active Gold is proposing a share capital increase of US$ 16.2m which would provide investors in

this placement with 16.8% of its shares (post money). We are proposing this investment mainly

to high net worth individuals with the desire to increase exposure to an attractive gold mining

stock. This opportunity is reserved to investors bringing a minimum amount of US$ 1m.

7

Active Gold Holding PLC

Investment Proposal

3

GOLD MARKET ANALYSIS

3.1

DEMAND AND SUPPLY

Gold mine production increased significantly over the 1980s and 1990s from less than 1’300 t in

1980 to over 2’500 t by 1998. The increase has been fuelled by incremented production from

the majority of gold producing nations, offsetting decreasing production from South Africa.

From an industry perspective, gold is predominantly driven by global jewelry demand. The 2006

consumption was 3’400 t, 1’100 t more than the mine supply. The difference was made up of

scrap supply (1’100 t) and official sector sales (300 t), offset by producer de-hedging (400 t).

Gold touched an all-time high of $1496/oz in April 2011. Today, China is the world's largest gold

producer followed by Australia, USA and South Africa and Russia.

Gold price development 1975 -2011

1600

1400

1200

1000

800

600

Spot Price

400

200

3.2

01.04.2011

01.04.2008

01.04.2005

01.04.2002

01.04.1999

01.04.1996

01.04.1993

01.04.1990

01.04.1987

01.04.1984

01.04.1981

01.04.1978

01.04.1975

0

HOW DOES GOLD WORK?

According to UBS Investment Research (March 10, 2009), gold is almost unique in a commodity

context. It is unique (and from an investor perspective often maligned) because over the past

several decades there has been no clear societal need for the metal. It could be (and often is)

argued that while other commodities are required to directly support the inner workings and

advancement of human civilization, gold is not. Gold’s primary applications have, throughout

history, been consigned to two primary (and often interlinked) uses: as a medium of exchange

or currency, and for jewelry.

8

Active Gold Holding PLC

Investment Proposal

Is gold money?

In our view, gold can best be characterized as being “mostly” money. This is not a perverse way

of saying that it both is and is not money; we would instead describe gold as having the most

important characteristics of money without having the explicit authority to be money. Gold’s

role as a form of money is largely a function of its physical and geological properties; the more

important of these are described below:

– Scarcity: Gold is reasonably scarce, so there is not likely to be a loss of confidence

from supply growth; and mine-supply growth over time is reasonably predictable.

– Utility: Gold is divisible, indestructible and transportable; furthermore, it can be

stored indefinitely, all of which makes it unique as a convenient agent of exchange.

– Acceptability: Gold has been a widely accepted and used form of currency for much of

human history.

Given gold’s financial links, the usual supply/demand dynamic often does not apply for the

metal. Gold prices generally respond quite peripherally and temporarily to the waxing/waning

of jewelry demand, or oscillations in mine output or central bank selling. If selling or buying

surges, then of course prices will respond; however, this is usually short-lived. The evidence

does suggest, that gold meaningfully responds as a financial instrument that competes with

other stores of value, i.e. other currencies and other asset classes.

Over time, gold trades like another form of money

As such, over the past several decades, with confidence in paper money having fluctuated (the

US dollar in particular, as this is still the default global reserve currency), the performance of

gold has responded largely as a response to changing inflationary and deflationary

expectations.

Gold and deflation

UBS believes that gold, given the contention that it acts as a currency, will usually outperform

other assets in this type of environment. Gold acts as an effective hedge against deflation. The

chart below illustrates the performance of silver from 1925, highlighting the 1927-34

deflationary period, a period of out-performance of silver versus other important asset classes.

In this instance, we use silver as a proxy for gold given the price controls and restrictions on

gold from 1933.

9

Active Gold Holding PLC

Investment Proposal

Silver (proxy for gold) performance relative to other assets (from 1900)

Source: UBS estimates

Gold and inflation

Inflation also erodes the value of key asset classes, particularly of equities and debt, given that

it generally coincides with greater volatility of inflation, which leads to greater uncertainty and

increased risk perceptions. But before making further comments on how gold performs in

periods of inflation, it is necessary to clarify that we also believe that one needs to consider the

source of inflation, as this may have a bearing as to how gold could perform.

For example, inflation during the 1970-80s was due to a combination of two things: (1)

stimulative monetary policy during the 1960s; and (2) a spike in oil prices which occurred as a

consequence of supply restraint. These two factors led to a strong performance in commodities

as an asset class and a mixed performance by gold versus some of the other commodities.

It is also possible, in our view, for inflation to emerge in another manner, and one which may

be more applicable to the current financial environment; that is the potential for currency

debasement as governments spend vast quantities of money, and potentially start the printing

presses to produce more currency and avoid deflation. In such environment, we would argue

that prices rise as a direct consequence of growing availability of money (the velocity of money

being key factor). Given the non-fiat characteristics of gold, we would expect that in this macro

environment gold could perform in-line with inflation. In summary, gold can well act as a hedge

against inflation, particularly if the source of that inflation is a loose monetary policy.

The chart below illustrates the performance of gold from 1975, highlighting the 1972-83

inflationary periods, and the period of inconsistent performance of gold versus other important

asset classes. We would note that there was some distortion in the gold market from 1975 to

1980, as the US Treasury and IMF had selling programs during this time.

10

Active Gold Holding PLC

Investment Proposal

Gold performance relative to other assets (from 1975)

Source: UBS estimates

3.3

RELEVANT FACTORS – PRODUCTION

The main relevant factors influencing the price of gold is the production capacity, the current

need for gold as a commodity, and the use of gold as a safe harbor.

Production has a lesser impact on price of gold than on the price of other commodities. Annual

production has now leveled off at approx. 2500 t per annum.

Gold Production 1980-2014 (World Gold Mine Production)

$ 1,400

2,500

Tonnes of Production

1,000$

1,500

800

$ 600

1,000

GOLD SPOT $ US/OZ US/OZ

$1,200$

2,000

$ 400

500

$200

ource 0GFMS,

and CIBC

World

Markets

Inc.Asia

AfricaCompany

Northreports

America Europe

Europe

Lattin

America

Oceania Other Countries

Gold

The total volume of gold ever mined in history is estimated at some 155’000t which compares

to an annual production of approx. 2.500 tons. The average grade of the mined ore is also

declining globally. The higher average mines have been depleted and the market has been

forced to turn to mines that deliver a lower grade of ore, which means that the gold exploration

expenditures have risen sharply in recent years.

11

Active Gold Holding PLC

Investment Proposal

Global Average Mine Grades Q1 2005 – 2008

Global Average Yield (g/t)

1,7

1,6

1,5

1,4

1,3

1,2

1,1

1,0

Source: Bloomberg and CIBC World Markets Inc.

3.4

RELEVANT FACTORS - COMMODITY

Gold is subject to hoarding and dishoarding based on financial investors’ sentiment. This, rather

than industrial applications or even jewelers demand, is the key determinant of the gold price.

Gold price fluctuations are not really a function of supply and demand fundamentals.

Demand Drivers:

Above Ground, world gold holdings are concentrated on jewelry

Gold supply failed to grow

12

Active Gold Holding PLC

3.5

Investment Proposal

RELEVANT FACTORS – SAFE HARBOR

The price of gold has surged in the past seven years fuelled by political and economic

uncertainty, rising oil prices and the decline of US investors investing in gold as soon as the

economic climate is worsening - at times viewed as a "recession hedge". As the confidence in

the financial market's ability to preserve economic value is being shaken, for example by a

weakening US Dollar and rising oil prices, gold is, again, gaining credibility among investors as

the ultimate “store of value”.

The increasing role of gold as the currency of last resort can be seen in the increasing

correlation between gold prices and measures of financial distress from the credit-default swap

(CDS) markets. Specifically, the recent divergence between gold prices and the fair value

currency basket is largely explained by the rising CDS spreads of financials and sovereigns (see

illustration 1). Augmenting the fair value currency basket with these measures of financial and

sovereign risk suggests that gold is priced consistently with increased sovereign default risks

(illustration 2).

(Illustration 1)

(Illustration 2)

Source: COMEX, CME and GS Global ECS Research.

Source: COMEX, CME and GS Global ECS Research.

lt is also important to emphasize that the recent strong demand for gold has not been irrational

but rather in line with the probabilities of financial and sovereign default. Specifically, the

strong rise in gold ETF demand is a reflection of default risks as measured by the financial and

sovereign CDS spreads (illustration 3). Such strong demand for investment reasons is likely

more than offsetting the declines in gold demand for jewelry use.

(Illustration 3)

Financial + Sovereign CDS

Indes

(right axis; bp)

Gold ETF Holdings

(left axis; min oz)

(left axis; min

(

13

Active Gold Holding PLC

3.6

Investment Proposal

PREDICTIONS ABOUT THE GOLD MARKET PRICE IN THE FUTURE

Although it is notoriously difficult to make firm predictions about future geopolitical events, it is

clear that stocks and gold work in opposition to each other. Certain analysts make the

prediction that the gold price will even reach 4,000 US$ in the not too distant future.

Forecast of selected financial institutions (gold price in 2011 in USD per 1 ounce)

Institution

Low

High

Credit Suisse

1100

1600

UBS

980

1550

Goldmann Sachs*

960

1690

*source Wall Street Journal

Gold is not at extreme values compared to house prices

Gold is not overvalued compared to US equities

14

Active Gold Holding PLC

Investment Proposal

Inflation Adjusted gold price still below the past peak

Production costs justify the rise in the gold price

15

Active Gold Holding PLC

4

GOLD MINING

4.1

INTRODUCTION

Investment Proposal

Alluvial or “placer” gold comes from eroded hard-rock sources. Rivers and glaciers flowing over

gravels have washed and sorted them, concentrating the heavy metal gold in specific layers.

This often makes placer gold deposits much richer than their hard-rock sources.

While "hard rock” gold is usually mined by means of mining hardware, using explosives and

"cyanidation", alluvial gold can be mined by the process of digging it up and washing with

special equipment. Therefore, alluvial deposits usually have a lower mining and exploration

costs than hard-rock deposits.

4.2

ALLUVIAL GOLD

Typical locations for alluvial deposits are on the inside bends of rivers and creeks, in natural

hollows, at the base of a waterfall, within sand dunes, beach profiles or in gravel beds.

Alluvial “placers” are formed by the deposition of dense particles at sites where water velocity

remains below that which is required to transport them further.

To form a placer deposit, the particles sought after must show a marked density contrast with

the surrounding material, which is transported away from the trap site. Only if the deposit is

winnowed in this way can the minerals be concentrated to economic levels.

All methods of placer deposit mining use gravity as the basic sorting force. The mining process

uses a drum which is composed of a slightly-inclined rotating metal tube (the “scrubber

section”) with a screen at its discharge end. Lifter bars, sometimes in the form of bolted-in

angle irons, are attached to the interior of the scrubber section. The mineral containing sand

that passes through the screen is then further concentrated in smaller devices such as sluices

and jigs. The larger pieces of sand that do not pass through the screen are carried to a dump by

gravity flow over a discharging chute.

The sand is then further concentrated in smaller devices. The placer gold is finally obtained,

containing gold and fine mineral granules. It is sent to the refining plant, where the gold is

melted out by using high temperatures.

Gold washing plant, Active Gold Holding Plc,

Chuika mine

Gold-bearing sand being moved to the crushing facility,

Chuika mine

16

Active Gold Holding PLC

Placer gold on a shaking table,

Chuika mine

4.3

Investment Proposal

Native nugget of 456.2 grammes,

Chuika mine

HARD ROCK GOLD

“Hard-rock” gold differs from “placer” gold in its occurrence. It usually occurs in fissures and

fraction zones, where it has been deposited in quartz veins, which are not destroyed by nature

and which form pillar massifs. Very often the ores also contain other precious metals like silver

and copper.

Gold can be deposited near the earth's surface (epithermal gold) and at greater depths

(mesothermal gold). Heavy equipment and thus higher investments are normally required for

hard-rock deposit mining.

The first stage of the ore mining is usually the blasting of the rock massif. Then, the ore is

crushed. After crushing, the gold (and any other metals that are found) can be recovered in two

different ways.

The first recovery method is called “cyanidation”. It involves using chemicals to separate the

gold from its contaminants. In this process, the ground ore is placed in a tank containing a weak

solution of cyanide. Zinc is added to the tank, causing a chemical reaction of which the end

result is the precipitation (separation) of the gold from its ore. The gold precipitate is then

separated from the cyanide solution in a filter press.

The second approach is mechanical extraction through gravitation and flotation. The

combination of water and mechanical action frees the valuable minerals from the ore.

Depending on what recovery scheme is chosen, the plant (crusher, mill, and centrifugal

concentrator and flotation cell) and metallurgical department (pumps, adsorbing devices) have

to be constructed at the location of the deposit.

Hard-rock deposits are much larger than alluvial ones and, accordingly, also have longer mine

lives which justifies the more extensive and costly mining and exploration.

The main product is the concentrate containing the gold. This concentrate is being sent to the

refining plant where it is cleaned and shaped into bullions by using high temperature to melt

the gold.

17

Active Gold Holding PLC

Ore breccia from the Breccia site

Investment Proposal

Visible gold in core, quartz-hematite veinlet,

Breccia site

Visible disseminated gold,

core sample from the Breccia site

18

Active Gold Holding PLC

4.4

Investment Proposal

GOLD MINING IN RUSSIA

In the last few years, Russia took the 5th place in the world gold mining rankings. The world

leaders in gold-mining are China, The Republic of South Africa and Australia. In 2010 Russia

produced 175.2 tons, i.e. 1.7% less than in 2009.

Gold is mined in 23 regions of the Russian Federation. Krasnoyarsky Krai is the leader in goldmining among the Russian regions. In each one of the regions, situated in the Eastern part of

the country, more than 10 tons of gold are mined per annum. The total volume of mining in

these regions is approximately 80% of the entire production in Russia.

Gold mining in the main gold-mining regions (in tons)

Federal Subjects

Krasnoyarsk Krai

Chukotka Autonomous Okrug

Amur Oblast

Sakha (Yakutia) Republic

Irkutsk Oblast

Magadan Oblast

Khabarovsk Krai

2010, ton

36,0

25,0

19,8

18,6

16,0

15,4

15,2

2009, ton

33,8

31,2

22,0

18,6

15,0

13,7

14,7

Source: Gold Mining Union of Russia

Gold mining in the Republic of Altai has started only recently and already exceeds a level of 1

ton of gold per annum. It is believed to have a great future potential.

Gold mining in Russia in 2010 (tons)

Polyus Gold

Chukotskaya GGK

43.1

44.1

Severstal

Petropavlovsk

Polymetal

Uzhuralzoloto

3.6

3.9

19.6

6.4

Highland Gold Mining

Vysochaishy

6.7

Susumanzoloto

13.8

18.3

15.7

Other companies

Source: Gold Mining Union of Russia

19

Active Gold Holding PLC

Investment Proposal

The leader among Russian gold-mining companies is Polyus Gold Mining Company ZAO.

International mining companies are present in Russian gold mining, with the following

companies invested in the sector: Kinross Gold Corporation (USA), Petropavlovsk Plc (UK),

Highland Gold Mining Ltd (UK), Leviev Group (Israel), Angara Mining Plc (UK), Central Asia Gold

AB (Sweden), High River Gold Mines Ltd (Canada) and Bema Gold Corporation (Canada).

4.5

OVERVIEW – THE REPUBLIC OF ALTAI

The Republic of Altai is a federal subject of Russia and covers 92'600 Km2, which is roughly

twice the size of Switzerland, and has 203'000 inhabitants.

The Republic is situated at the very center of Asia at the junction of Siberian taiga, the steppes

of Kazachstan and the semi-deserts of Mongolia. The most striking geographical aspect of the

Republic of Altai is its mountainous terrain which is rich in mineral resources.

The Republic of Altai is one of the Russian Federation’s many subsidized regions. Federal grants

account for 90% of its budget. The main industrial sectors in the Altai Republic are non-ferrous

metallurgy, food processing and timber.

The name Altay means Golden in Turkic and Mongolic languages, and this area was always

referred to as “Golden Mountains” in the Chinese language.

20

Active Gold Holding PLC

4.6

Investment Proposal

THE HISTORY OF GOLD MINING IN THE REPUBLIC OF ALTAI

Gold has been mined in the mountains of Altai since the first half of 3,000 BC, and in modern

history, since the first half of the 18th century (Koluvano – Voskresensky, Demidov plant). The

area is located between two world-unique mining regions – the polymetallic South-West

Rudno-Altaisky region and the ferrum-and-coal dominated North Kuznetsky region.

Based on the state of gold exploration in the region, and also taking into account the

prospecting experience from Active Gold’s site at the Chuika River, it is clear that, compared to

other gold-mining regions in Russia, except maybe for the Kemerovo region, the territory is at

the initial stage of exploration both regarding hard-rock and placer gold.

The search and proper assessment of the deep gold placers (8-10 m and deeper), including

more productive buried ones, in these more complex mining and geological conditions, is

performed with the help of modern technical and technological equipment.

Searches for hard-rock gold deposits have been performed mainly for two industrial and

genetic types – vein gold-quartz and scarified gold. Geological surveys on the 1:50 000 scale

have been carried out by all exploration companies in the region, except for those that have

specialized in coal, ferrum and poly-metals. In the 1960s- 1980s, thousands of places with

native mineralization were found in the area but their potential in terms of industrial hard-rock

gold reserves has not yet been fully estimated.

Regular surveys for gold deposits in modern times were started as late as in 2003 by GornoAltaiskaya Ekspeditsiya PLC. Active Gold performed geochemical prospecting on the 1:200 000

scale within the North-Altai gold-bearing belt and obtained very positive results in the

Novofirsovskaya and Kuriinskaya areas during the second year.

4.7

CURRENT GOLD MINING IN THE REGION

30-35% of the hard-rock gold mining in the region is performed by a single enterprise (Rudnik

Vesyoly PLC). This company performs surface and underground mining of ore, which is

processed at a gold recovery plant. Rudnik Vesyoly PLC has doubled its sales volume over the

last 15 years without attraction of external investments.

The peculiarities of the geological structures in the region, and the occurrence of direct and

indirect criteria and features of gold deposits, confirm definite possibilities to identify industrial

gold deposits of all genetic types, including large and very large deposits (like Kupol, Karlin and

Bukurchik). This fact is mentioned by all leading Russian specialists of gold metallogeny, who

have performed research in the region for the last 15 years (Borisenko A.S., 1995-1999 and

Scherbakov U.G., 1997-2004, IG SO RAN [Institute of Geology, Siberian Department, Russian

Academy of Science]; Schepotiev U.M., 2003, CNIGRI [Central Scientific and research Geological

Prospecting Institute of Non-ferrous and Precious Metals]). It has also been confirmed by Altai

Gold’s own drilling for the 43-101 application.

Hence, the identification and exploration of industrial reserves of hard-rock gold in the area is

only a matter of time. A conservative estimate of the region’s total potential made by Active

Gold’s specialists is 2,750 tons of hard-rock gold, including the most prospective metallogenic

taxons:

21

Active Gold Holding PLC

Investment Proposal

– North-Altai gold-bearing belt: 2’ 000 tons

– Salair Range: 500 tons.

On February 1, 2006, the Head of the Russian Administration for the Geology of Hard Minerals,

B.K. Mikhailov, named the surveying of the North-Altai gold-bearing belt as one of the eight

major achievements of the Russian Geological Survey during the last 3 years and said it was

going to “totally change all traditional views on the poly-metallic specialization of this region”.

For alluvial placer gold, the situation is somewhat different. In the three constituent territories

of the Federation, only 18% of the resource potential is at the present disposal of subsurface

users. The open acreage includes the placer grading 500-600 mg/m3 and lower. According to

calculations, the use of proper technical means, technologies of extraction and processing of

sands at the present gold price will make the operation of placers with this grade quite

profitable.

More than half of the subsurface users that have obtained mining licenses do not produce

more than 20 kg of gold per annum - or do not start operations at all. Since 2008, the managers

of Active Gold Holding PLC were approached seven times with the suggestion to acquire various

rights of subsurface usage.

The main causes of failure of the enterprises in the region are on the one hand the obsolete

equipment, requiring expenditures for their repair and maintenance as well as an insufficient

professional approach. On the other hand, there is also an application of traditional power- and

material intensive technological schemes of overburdening, extraction and processing of sands,

which ignores certain mining and geological peculiarities of deposits which lead to unduly

excessive gold losses.

Finally, the low attention to the mineral base, conditioning instable work, additional costs and

excessive gold losses take place, mostly due to the absence of qualified engineers, technicians

and employees, who can determine and eliminate the above drawbacks.

4.8

CLASSIFICATION IN THE WESTERN WORLD

Australia's Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves

("JORC") has been widely adopted by the global mining industry. Other Western World

Standards exist and are broadly comparable to JORC. The JORC classification is based on

geological knowledge and confidence; it uses “Resources” versus “Reserves” as a function of

"availability" vs. "commercial viability".

Measured Resources

Tonnage, density, shape, physical characteristics, grade and mineral content can be estimated

with a high level of accuracy. Supported by extensive drilling and sampling, shape and

characteristics of the ore body can be firmly established.

Indicated Resources

Where the estimates can be provided with a low level of confidence.

Inferred Resources

Where the estimates can only be provided with an even lower level of confidence. They cannot

be converted directly to reserves.

22

Active Gold Holding PLC

Investment Proposal

Proven Reserves

Normally the economically mineable part of a Measured Resource.

Probable Reserves

Normally the economically mineable part of an Indicated and in some cases Measured

Resources where there are uncertainties over some of the Modifying Factors.

Resources

(«Availability»)

Increasing

level of

geological

knowledge

and

confidence

Reserves

(«Commercial Viability»)

Measured

Proven

Estimated with high level of

accuracy, supported by extensive

sampling, leading to firm

establishment of characteristics

Normally the economically mineable

part of a Measured Resource

Indicated

Probable

Estimated with a low level of

confidence

The economically minable part of

and Indicated Resource with some

unclear modifying factors

Inferred

Estimated with lowest level of

confidence – need to be upgraded

first to be converted to reserves

Consideration of modifying

factors:

===========

Mining, metallurgical, economic, marketing, legal, environmental, social and

governmental

4.9

CLASSIFICATION IN RUSSIA

In Russia, an alternative system (“GKZ”) is used to classify reserves and resources which is not

directly comparable with Western World Standards.

Mining companies in Russia report reserves and resources to the State Authority (GKZ) under

the Russian code of reporting in a Russian Gold context; the terminology is also not always

applied consistently. What is technically a “resource” is often referred to as a “reserve”. Thus,

the comparison of GKZ reserves and resources with JORC is, at times, an art - and not a science.

C1

Good understanding of the mineralized zone, including geometry, grade continuity,

physical and metallurgical properties.

C2

Preliminary assessment of the mineralized zone's properties. Tonnage, grade, geometry

and grade continuity are not always certain. In general suitable to use in mine plans, but

often requires more drilling to be proven.

23

Active Gold Holding PLC

Investment Proposal

P1

Little understanding of the geometry of the mineralized zone exists. Not suitable for use

in mine plans. Market experience suggests that, in practice, 70-80% of P1 resources

normally get converted into a "C" category.

P2

Based on very limited drill hole and/or sampling data. The results are considered to be a

highly unreliable measure of the potential upside of the relevant deposit.

P3

Based purely on geophysical and geochemical data and is a purely speculative and

subjective measure.

Importantly, the standards for P1 Resources can vary considerably. Thus, it is important to

understand which and how much data was used to generate the P1 resource assessment.

Generally, drilling and underground channel sampling is obviously favorable compared to

surface sampling.

«Resources»

Unclassified

Inferred

Indicated

Measured

After Feasibility Study

А+В

Normally after Pre-feasibility Study

С1

Varying confidence

level

P1

No drilling

С2

C1 – Good understanding of mineralized zone properties.

C2 – Preliminary assessment of properties. Can require more drilling.

P1 – Little understanding of properties. 70-80% normally converted «C».

P2 – Based on very limited data. Highly unreliable measure of potential.

P3 – Based purely on geophysical and geochemical data. Speculative and

subjective.

P2 + P3

Increasing level of geological knowledge and confidence

24

Active Gold Holding PLC

Investment Proposal

5

ACTIVE GOLD DEPOSITS

5.1

ACTIVE GOLD’S FOUR DEPOSITS

The deposit of alluvial gold in the Turochack region at the Chuika and Middle Kainach rivers are

currently the focus of the activities of Active Gold. In 2011-2012 production at the alluvial

deposits of Kaurchack and Albas is scheduled to be started. The forth and most important mine

– the hard-rock deposit of Breccia - will be prepared during 2011. It is intended to start

procution in 2012 with actual mining operations producing finished products in 2013.

This territory is covered with taiga vegetation and abundant forests and the river valleys are

waterlogged. Logistically, all 4 mines are close to main roads. Tashtagol and Barnaul offer

resources for the workforce, including an airport and all the necessary infrastructure.

Active Gold PLC (Holding). Total expected gold (“Reserves” and “Resources”)

Hard-rock

gold

Total

Total

Breccia

Total

Breccia

126

523

2‘850

3‘373

8‘900

550

200

950

2‘000

2‘950

10‘000

0

0

0

0

5’000

5’000

15‘000

P3

0

0

0

0

40‘000

40‘000

120‘000

Total

400

748

326

1‘473

49‘850

51‘323

153‘900

Category of

reserves

(resources)

Chuika

Albas

Kaurchack

С1+С2

200

198

Р1

200

Р2

Alluvial Gold

Silver

25

Active Gold Holding PLC

5.2

Investment Proposal

THE CHUIKA AND MIDDLE KAINACH DEPOSIT

This locality is characterized by mid mountain relief with sea-level marks of 500-1’200m and a

local difference in elevation of 200-600m. The Chuika River is the left inflow of the Kluk River,

flowing in the Lebed River of the Biya River system. The valley of the Chuika River is of

trapezoid shape with the well-marked flood plain, with depth changes from 200-1’000m. The

River depth is near 1.5m and its width is 10m. The water level depends on the amount of

precipitation; season fluctuations do occur.

26

Active Gold Holding PLC

Investment Proposal

Drilling Scheme

To prospect for gold reserves and define gold grades in the placer by the Chuika river, 112

drillholes totaling 1’109 line metres were completed in 2009-2010. Prospecting operations

resulted in the increase of reserves equal to 121 kilograms of gold. After the 2008-2010

production period there is sufficient evidence to increase the total reserves at the Chuika mine

to 196 kilograms.

27

Active Gold Holding PLC

5.3

Investment Proposal

THE ALBAS AND KAURCHAK DEPOSITS

The Albas deposit is located by Albas River, which is the left inflow of the Lebed River, located

five kilometers below the mouth of the Kaurchak River. The extent of the valley is 12 km.

Drilling Scheme

To estimate the production sites and gold potential of the deposit along the Shirokyi brook, the

left inflow of the Albas river, 65 drillholes totaling 346 line metres were completed. Total

reserves at the Albas river are 198 kg, including 36 kg in the C1 category.

28

Active Gold Holding PLC

Investment Proposal

The Kaurchak deposit is situated in the area of the Small Kaurchak basin. It has a rather complex

geological structure, conditioned by its location at the joint of Gorny Altai, Gornaya Shriya and

Western Sayan.

The main reason for the high perspectives of the area is its location in the Western part of the

North-Altai “gold belt” characterized by high gold productivity. Approximately 16 tons of placer

gold and 18 tons of hard-rock gold have been mined here in the past.

The valley of the Small Kaurchak River has a trapezoid profile, its width varies from 100 to 300

m. Along the river extension, there is an erosive and accumulative socle terrace at the level of

20-30 m, predominantly along the right slope. The terrace bedrock is covered by alluvium,

which is overlaid by eluvial trains of brown loam close to the valley slopes.

In the mouths of the side inflows, there are distinct detrital cones which significantly increase

the thickness of the sediments. The terrace declines from the slope to the brow. The alluvial

placer has a distinct productive stratum, lying at the basement of river sediments. The reserves

are explored both in the flood plain (a flood plain deposit) and terrace (terrace deposit) valley

parts.

5.4

THE BRECCIA DEPOSIT

The Breccia mine is located in the Turochack region of the Altai Republic, some 13 km from the

Artubash settlement. It is well connected by a highway and is close to the Biysk railway station.

As of February 2011, the drilling programme and laboratory work at the Breccia site have been

completed. Rock mechanics of ores and hosting rocks as well as technological properties of ores

are being currently studied. Fifty-two drill holes have been completed totalling 7’682.5 meters.

29

Active Gold Holding PLC

Investment Proposal

Twenty trenches totalling 7’178 cubic meters and 150 line meters of pits have been dug, and

laboratory work has been completed in preparation of a 43-101 application.

The central part of the site, which is 300x400m, has been explored by drilling operations. On

some prospecting lines the ore bodies have been traced to the depth of 200-300 m.

The ore bodies are formed by silicified volcanic explosive breccias intersected by veins and

stockworks of quartz veins, disseminated with limonite, pyrite and free gold. Visible free gold

was observed in core from five drill holes. It became clear from the results of the assay tests

that the ore bodies are in the column shape. The gold occurs in pockets. Maximum gold values

range from 78 to 145 g/t. Within the mineralized zone of higher gold grades (0.1-0.9 g/t) six ore

bodies have been delineated at 1 g/t cut-off grade.

The thicknesses of the ore bodies range from 1.0m to 35m. The strike extension is 35 to 134 m.

The ore bodies were traced to a depth of 75-350m. Gold grades in ore vary from 1.0 g/t to 145

g/t; silver grades ranges between 1.0 g/t and 675 g/t. The average grades in the ore bodies are

1.81 to 4.26 g/t of gold and 1.7 to 27.7 g/t of silver.

Micromine geostatistical modelling of the Breccia site has shown the following preliminary

estimate of ore, gold and silver reserves: 1’199’944 tons of ore; 2’849 kilograms of gold grading

2.37 g/t; 8’924 kg of silver grading 7.44 g/t. The major portion of ore and metal reserves (74%)

are hosted by ore body 1.

Ore body 1 extends along the strike for 210m. It has been traced to a depth of 300m. The ore

body has not been delineated to the west and to the depth. The thickness of the ore body

ranges from 2.0m to 35.1m averaging 8.4m. The average gold grade in the ore body is 3.30 g/t

and the silver grade is 22.1 g/t.

The other ore bodies are smaller but similar to ore body 1.

In 2011, it is scheduled to continue geological exploration of the Breccia site and the

Churinskaya gold area. The following scope of work is planned to be carried out: core drilling –

5’000 line metres; mechanical trenching (excavator and bulldozer) – 20’000m3 and geological

traversing – 50km.

In the report on scientific research – the Feasibility Study of the “Provisional Exploratory

Parameters for Estimation of Reserves” at the Hard-rock Gold Breccia site, a method of openpit mining was placed under consideration. The stripping ratio is optimized. At 1 g/t Au cut-off it

varies greatly from 2.7 to 12.6. The average strip ratio is quite high - 7. As practice shows, the

estimated volume of stripping increases 15-20% while mining. The open-pit mining at such

deposits reduces the base ore quality control. Shallow ore bodies occurring at a depth of more

than 30m are characterized by a high ore dilution factor, lower grades and high yield of dradges

if mined by open-pits. Economic calculations of gold production in the report show that the

open-pit mining method is not profitable for this type of deposit. If the open-pit mining method

is used, dumping, blasting operations on the surface, industrial noise of mining machinery and

exhaust fumes of internal combustion engines (ICE) affect negatively the environment of the

ecologically clean area of the Teletskoye Lake.

The business plan considers the possibility of underground production at the deposit. This

method allows effective monitoring of base ore quality and excludes negative factors affecting

the ecological environment. The terrain of the area determines the adit stripping for accessing

the underground ore and the chosen method determines locations for the major openings,

surface constructions and size of the mine site.

30

Active Gold Holding PLC

Investment Proposal

Due to high strength of rocks blasting will be carried out and drilling equipment with downhole

hammers is required to be used as its efficiency in strong rocks is very high in comparison with

rock bit drilling.

30m level interval between benches was determined by the following factors: geological –

dimensions (thickness, strike length and depth down the dip), shapes and slope angles of ore

bodies; geotechnical - mining methods, order of production, maintenance conditions of mine

openings, conditions and safety of mining operations, terms of preparation and development of

a level; technical and economic - ore reserves in a level, value and grade of metal in ore; scope,

terms and costs of development and production mining; costs of maintenance of mine

workings – transport, drainage, staff transportation and equipment.

The business-plan provides for a simple method of digging adits in a level at +740; +710, +680,

+650, +620 and +590. Down the dip the level is limited by an airway and an air-out adit and

along the strike - by the boundaries of the mine site. Opposite the adits, there are 30m air

raises which are also used as an emergency exit.

Based on recommendation of IRGIREDMET (2006), gold will be recovered from ores by heap

leaching. A heap leaching system includes the following facilities and devices: crushing facility;

heap leaching facility with drainage and spraying systems; service and emergency capacities for

gold-bearing and barren solutions; pump station; hydrometallurgical department; storehouses;

administrative and household facilities, including bar melting department and laboratory;

processing facility for cyanide solutions; power and heat supply equipment as well as drinking

and technical water supply.

After the major preparation work is completed, the cash cost of one ounce produced at the

Breccia site is expected to be approximately US$515.

Drilling Results

31

Active Gold Holding PLC

Investment Proposal

32

Active Gold Holding PLC

Investment Proposal

Au reserves

C2

P1

P2

P3

2’850 kg

2’000 kg

5’000 kg

40’000kg

LOCATION OF ORE BODIES AT THE BRECCIA SITE (3D MODELLING)

Ore body 1 – red

Ore body 2 – violet

Ore body 3 – light blue

Ore bodies 4,5 and 6 – green, gray

and orange correspondingly

Surface - gray

33

Active Gold Holding PLC

5.5

Investment Proposal

PROSPECT MINES

Several hard-rock mines have been offered to Active Gold to expand its operation during Phase

2.

a

PRAVOBEREZHNY

The site is located in the central part of the Kaurchackskaya paleocaldera formed by a

volcanogenic sedimentary stratum of the Sadrinskaya suite. Gold mineralization is confined to

linear lenticular steeply dipping mineralized zones of metasomatites composed of quartz,

albite, chlorite and sericite which were altered by sulfidization. The depth of estimation is

210m; total length of blocks is 3.7 km.

Gold resources in the P1 category are 25 tons. The average grade of gold is 3.43 g/t and the

average thickness is 4.7 metres. The resources were assayed by the TNIGRI commission (Central

Scientific and Research Exploration Institute of Non-ferrous and Precious Metals, Moscow) Minutes No.5 dated 10.06.2008 г. as well as by GornoAltaisknedra.

34

Active Gold Holding PLC

b

Investment Proposal

MAISKO-LEBEDSKY AREA

A 50 km2 area located in Turochack region at the upstream of the river Lebed hosts a complex

iron copper gold ore mineralization. Besides the iron gold Maisky deposit, promising ironcopper-molybdenum-gold ores of the Andobinskoye deposit are found there. Five ore-bearing

zones are defined and estimated in the area - Andobinskaya, Maisko-Lebedskaya, MagalakskoSemenovskaya, Perspectivnaya zones and the zone of Talonsky thrust.

In the Andobinskaya zone, the Andobinskoye deposit hosting complex iron-coppermolybdenum gold-bearing ores was estimated. Thickness of ore bodies is as follows: iron

(magnetite) ores – 20 to 33m; copper and molybdenum ores – 4.0 to 15.0 (up to 50) m and

gold-bearing ores – 2 to 15.0m. Average contents are as follows: 36.6 % of iron, 0.57 % of

copper (0.37 to 0.92 %), molybdenum -0.031 % (up to 0.51 %) and gold – 0.6 to 6.2 g/t.

Inferred resources of metals in the Andobinskoye area including the Andobinskoye deposit are

the following:

С2+Р1 categories: gold - 40 tons, iron – 20.5 million tons, copper – 357.4 thousand tons,

molybdenum – 18.8 thousand tons;

Р2 category: iron – 107.1 million tons, copper – 151.7 thousand tonnes /Platonov,

2004f/.

At the flanks of the Maisky gold hard-rock deposit inferred resources of hard-rock gold in the P1

category total 2.5 tons grading 8.82 g/t, copper -350 thousand tons grading 0.5%, iron – 25

million tons grading 36%; thickness of gold-bearing ore bodies is 8.7m and copper-iron ore

bodies – 2 to 12m.

Resource potention of the Maisko-Lebedsky area is estimated at 50 tons of hard-rock gold, 0.82

ton of crustal gold and 138 million tons of magnetite ores in the P2 category (Minutes No. 0711/0347-pr of the Ministry of Natural Resources dated 12.08.2003).

c

CHOISKAYA AREA

The Choiskaya area is located in the Turochack region of the Altai Republic 5km north-west

from Verkh-Byika village. It is confined to the south wing and west closure of the Ainskaya

syncline. An unconformable contact of Cambrian terrigenous-carbonate and Ordovician

terrigenous strata with slightly eroded intrusives of the Yugalinsky and Kyzyltashsky complexes

influences the location of the mineralization.

Inferred resources of gold, bismuth and tellurium in the Central part of the area were estimated

in the Р2 category /Nikolenko, 2003f/ applying the method of direct calculations based on the

results of previous operations at the Choiskoye deposit. The ore zone in the Central part is

2’200 metres along the strike and 300 metres down the dip. Р2 inferred resources in the Central

part are as follows: 3.8 million tons of ore, 10.6 tons of gold, 2.8 thousand tons of bismuth and

1 thousand tons of tellurium.

35

Active Gold Holding PLC

Investment Proposal

Given the value per length in the Central part of the ore zone (10.6 tons : 2.2 kilometre = 4.8

t/km), P3 inferred resources were estimated in the 800m Western part and 1’600m Northern

part. P3 Inferred resources hosted by the Choiskaya area total 12 tons.

d

SYNZAS

A placer by the Synzas river - the right tributary of the river Kabyrza - is located in the basin of

the river Mrassu, Gornaya Shoria, Kemerovo Oblast. Reserves of placer gold in the С1+ С2

categories are 254 kg at the average grade of 593 mg/m3. Thickness of overburden is 2.6m and

thickness of sands is 0.53m. P1 inferred resources at the river Synzas are 1’500kg.

e

BOLSHAYA RECHKA

A placer is located by the Bolshaya Recka river – the left tributary of the river Mrassu, Gornaya

Shoria, Kemerovo Oblast. Reserves of placer gold in the С1+ С2 categories are 392 kg at the

average grade of 650 mg/m3 and thickness of sands of 0.52m. P1 inferred resources in the basin

of the river Bolshaya Rechka are 900 kg.

36

Active Gold Holding PLC

Investment Proposal

6

DEVELOPMENT PLAN

6.1

TIME SCHEDULE

Deposit

Chuika

Albas

Kaurchack

Breccia

New alluvial deposit

New hard-rock deposit

2011

2012

2013

2014

2015

2016

MINING

DRILLING

asda

PREP.

sdf

as

43-101

asda

da

sdf

sd

f

д

MINING

MINING

PREP.

asdasdf

MINING

asasdasdf

asdasdf

PREP.

MINING

DRILLING

d asda 43-101

asdasdf MINING

PREP

as sdf a з8 as asdasdf

df

s ш d

d

asmine and during 2009-2010

In 2008, Active Gold Holding started its operations with Chuika

a

df 2011, Kaurchack will be

prepared the sites at Albas, Kaurchak and Breccia. As of spring

s

operational. In parallel, Breccia will be further prepared so that

operation can start in 2012. As

d start in 2011 with full operation

Chuika will be depleted in 2012, preparation work at Albas will

f

scheduled for 2012.

.

In order to make the best use of the already purchased heavy equipment, new alluvial

concessions will be acquired which allow the start of additional mining operations from 2014

onward. At the moment, it is rather easy to obtain such additional licenses at favorable

conditions.

In the course of Phase 1, a concession for a second hard rock mine will be acquired. It is

intended to start the operation of such a mine in 2014.

37

Active Gold Holding PLC

6.2.

Investment Proposal

INVESTMENT DETAILS

The following equipment has been already acquired or is planned to be purchased.

a

ALREADY PURCHASED

Equipment and hardware as of 01.01.2011

Items

1

Office equipment

Equipment for land surveying GPS TRIMBLE

Communication and video equipment

Dwelling trailers

Dwelling trailers for staff ( with heating system) - 8 trailers per 8 persons each

Office dwelling trailer ( сwith heating system) for management

2 dwelling trailers (with undercarriage)

Dwelling trailer ( with heating system) for engineers and technicians

Car wash facility

Gas filling station

Banya/sauna

Kitchen-canteen (tent-wooden)

Gold room

House-office-canteen

5 storehouses for inventories

Hangar for hardware storage

3

4 tanks for fuel and lubricants,10 m

Bulldozers

Tractor with bulldozing devices B 10 MB 0121-2V4

Tractor with bulldozing and ripper devices B10M.0111-EN

Bulldozer B10M.0111-1E

Bulldozer Т-130

Bulldozer CAT D9R (serial number WDM01162)

Bulldozer CAT D6R

Trucks

2 dump trucks Ural 55571

2 cargo high-sided trucks KIA FRONTIER

Automobile URAL-4320, high-sided

Cars

Land Cruiser 150 Prado 3.0

Toyota Avensis

Mitsubishi Pajero

Special Hardware and Facilities

Autocrane MKT-25.5 t, chassis URAL 4320

Excavator HITACHI ZX330L-3 HCM1V700L0003288

Fuel-servicing truck - 11,5 t, chassis URAL 4320-1912-40

Tanker trailer8602

Automobile GAS66

Automobile UAZ-396254

2 automobiles UAZ-390944

Automobile Kamaz 740u31-240 2300741

Gold-mining complex

Amount, rub

2

1‘ 185’964,00

1’750’000,00

2’191’529,98

5’734’484,99

1’200’000,00

200’000,00

878’500,00

150’000,00

65’984,99

300’000,00

480’000,00

200’000,00

700’000,00

730’000,00

600’000,00

160’000,00

70’000,00

48’400’904.38

2'907’070,00

2'938’000,00

3’350’359,50

300’000,00

15'962’825.92

22’942’649.96

4 ‘405’000.00

3’190’000,00

865’000,00

350’000,00

5’476’627.00

2’526’627.00

950’000.00

2 000 000,00

14’833’200.00

5’250’000,00

5’725’600,00

1’830’000,12

169’000.00

150’000,00

305’300.00

810’300.00

728’000,00

31’494’872.92

38

Active Gold Holding PLC

Investment Proposal

Items

1

Hoist 3 LS 55

Gold-washing plant OZK-70M "Zolotoy Poloz"

Hydro-gold-washing facility PPG-30

Washing complex КОS-1

Portable processing equipment POY-4-3m

Shaking table SKO-1

Sand pump

Concentrator KCP-1000, stainless steel

2 concentrators KCP -1000

3 concentrators KCP-6

Laboratory POY-1

2 Ainlay bowls

8 magnetic starters

Gold washing facility GGM 3

Pump station 8NDV

Drill rig UBR-2M

UPI-120-2 (set) (furnace)

Double-roll crusher DVG 200х125

Jaw crusher ShD10

Rail saw K960 (for channel samples)

Stone-cutting machine Volga-130

Other machines and equipment

3 pump stations

Pump with counter

Generator AIRMAN SDG 400S

Generator AIRMAN SDG 100S

Diesel generator

Diesel generator 30 (DES)

Generator United Power DG 3600 E

Electric motor 110kWх1500 revolution per minute

Aggregate 1D800/56B with electric motor

Separator SWK 2000/40 М

Hammer HМ 1801/Makita

Hammer drillHR 5211 c/Makita

Heat gun Sial 28 kW

2 chain saws ECHO CS-680

Total machines and equipment in rouble

Total machines and equipment in dollar

Dollar rate

Amount, rub

2

450’000,00

12'411’338.00

1’000’000,00

2’600’000,00

757’000,00

355’000,00

45’000,00

1’140’000,00

1’ 083’000,00

1’893’000,00

997’500,00

180’000,00

148’000,00

3’827’663.32

1’449’957,00

2’500’000.00

89’680.00

294’019.90

151’217.70

59’697.00

62’800.00

3’691’203,57

550’000,00

39’000,00

2’010’800,00

589’500,00

41’939,56

30’000,00

25’011,00

42’151,41

157’848,60

35’000,00

64’606,00

34’018,00

19’499,00

51’830, 00

120'613’743.84

4’020’458.128

30

39

Active Gold Holding PLC

b

Investment Proposal

EQUIPMENT TO BE PURCHASED

Equipment for the alluvial mines

No.

1

I

Item

2

Washing and processing facility

Hydromechanical screen GGM-3

Pump station

Num

ber

Price, $/unit

3

4

Amount, $

2

2

120’000.00

24’000.00

5

288’000.00

240’000.00

48’000.00

1

2

4

1

1

40’246.9

376’000

500’000

418’000

820’000

4’030’246.88

40’246.88

752’000.00

2’000’000.00

418’000.00

820’000

1

1

1

1

90’000

8’750

3’593.75

5’537.19

107’880.94

90’000.00

8’750.00

3’593.75

5’537.19

12

5’312.5

105’625.00

63’750.00

2

2

1

1

3’125

2’656.25

13’125

17’187.5

6’250.00

5’312.50

13’125.00

17’187.50

II

1

2

3

4

5

Mining hardware

Scraper ramp with scraper hoist 3LS55S

Excavator САТ 336 DL ME, Caterpillar

Dump truck САТ

СAT-D6R Caterpillar

СAT-D9 Caterpillar

III

1

2

3

4

Power supply equipment

Diesel generator station (DGS)

Distribution substation

Reserve while washing DGS - Honda 5 kW

ADD-4004П+VG diesel welding set

IV

1

2

3

4

5

Auxiliary equipment

Modular portable camp for 40 people

Portable storehouse for fuel and lubricants (capacity - 50

3

m)

Storehouse for inventory, 40t container

UAZ 452

Servicing vehicle for wheeled and tracked machinery

V

Computers and digital equipment, communications

26’390.63

VI

Life necessities

26’906.25

VII

Exploration and laboratory equipment

38’281.25

Total

Contingency reserve

Total with VAT

Transport expenses

TOTAL

4%

5%

4’623’330.95

184’933.24

4’808’264.19

240’413.21

5’048’677.40

40

Active Gold Holding PLC

Investment Proposal

Equipment for the hard-rock deposit

No.

Hardware and equipment

Number

Price, $/unit

1

I

1

2

3