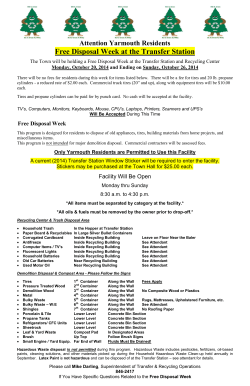

Document 170130