Domestic Partner Affidavit - Cedars

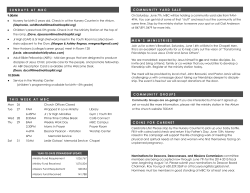

® YOUR CHOICE BENEFITS DOMESTIC PARTNER BENEFITS Cedars-Sinai offers benefits to our employees’ domestic partners. You may enroll your eligible domestic partner and their children for medical, dental and voluntary vision benefits and for voluntary life insurance and voluntary accidental death & dismemberment insurance. Domestic Partner Benefits Eligibility Children Benefits Eligibility Domestic partners are 2 adults (same or opposite sex) who reside together, sharing their lives in an intimate and committed relationship with a mutual obligation of support. For your domestic partner to be eligible for benefits, you must either: 1 – Be legally registered as domestic partners, or 2 – Meet all of the following criteria: You can cover children under age 26 who are your or your domestic partner’s: • Have been sharing a common residence* for at least 6 months and intend to do so indefinitely • Are not related by blood to a degree of closeness that would prohibit marriage • Have assumed mutual responsibility for basic living expenses • Are at least age 18 and capable of consenting to the domestic partnership • Are not married to anyone else or in a declared domestic partnership with anyone else. *Although you don’t have to show proof of common residence to enroll, Anthem Blue Cross or MetLife may require it before paying claims. Domestic partners do not include roommates, siblings, parents or other similar relationships. Any plan restrictions, provisions, coordination of benefits or evidence of good health conditions in the Cedars-Sinai benefit programs apply to domestic partner (and children) coverage in the same manner as for all covered persons. • Biological children • Stepchildren (the children of your current domestic partner) • Adopted children • Children placed with you or your domestic partner for adoption • Children for whom you or your domestic partner are the legal guardian or children a court has ordered you or your domestic partner to cover under your healthcare plan (QMCSO). In addition to meeting the eligibility requirements above, children age 26 and older can be covered if: • A doctor certifies in writing that they are incapable of getting a self-supporting job because of a physical or mental condition (and the certification is approved by the insurance company), and • They are unmarried and chiefly dependent on you or your domestic partner for support and maintenance, and • They have 6 months of creditable coverage or were already covered under Cedars-Sinai benefits on their 26th birthday. You must submit the doctor’s certification to the insurer/ benefit provider within 30 days of request (or a later deadline, if provided by the insurance company). To continue coverage, you may have to provide the doctor’s certification once a year. BENEFIT QUESTIONS? Ask the HR/Employee Benefits Help Desk Phone: 888-302-3941 Fax: 206-299-3158 Email: [email protected] Web: Cedars-Sinai.MyBenefitChoice.com Hours: Open Monday – Friday 6 AM to 5 PM PT (Closed major holidays) The MBC Service Center YOUR Domestic CHOICE Partner BENEFITS – 09/2013 1 YOUR CHOICE BENEFITS Not Eligible for Coverage You cannot enroll the following family members, even if they otherwise meet the eligibility requirements: • Other family members (parents, aunts, etc.) even if they are legal dependents • Foster children • Family members in active service of the armed forces of any country or subdivision of any country • Stepchildren from a previous marriage, unless you or your (current) domestic partner are their legal guardian or a court order (QMCSO) requires you to cover them • Grandchildren, unless you or your (current) domestic partner are their legal guardian • Family members living outside the United States (outside the 50 states, the District of Columbia, the Commonwealth of Puerto Rico, the US Virgin Islands, the Northern Mariana Islands, Guam and American Samoa) • Family members who are already covered – No double coverage is allowed. If you, your domestic partner and/or child work at Cedars-Sinai and enroll as an employee, you cannot be enrolled as a dependent at the same time (or vice versa); children can be enrolled as a dependent under only 1 parent’s coverage. When You Can Enroll Your Domestic Partner You may enroll your domestic partner (and/or children) who meets the eligibility requirements on page 1 (including living together for at least 6 months): • Within 30 days of being hired or first becoming eligible for benefits (when you enroll yourself) • During Annual Enrollment, held in May for benefits starting July 1 • Within 30 days of a qualified life event, such as receiving your state domestic partnership registration or living together for 6 months and meeting the requirements for domestic partnership (see page 1), your domestic partner involuntarily losing his or her healthcare coverage or upon an eligible child joining your family. Qualified life events are described in more detail in the Your Choice Benefits booklet or in the Qualified Life Events brochure, posted on Cedars-Sinai.MyBenefitChoice.com. If you miss the enrollment deadline, you’ll have to wait until Annual Enrollment (in May) to enroll for coverage starting July 1. How to Enroll New employees or during Annual Enrollment – Enroll on the enrollment website: Cedars-Sinai.MyBenefitChoice.com Qualified life event, including a new domestic partnership – Contact the HR/Employee Benefits Help Desk (MBC Service Center) at 888-302-3941 or [email protected] Documentation Required to Enroll To cover your domestic partner (and/or children) under your benefits, you are required to provide evidence of their eligibility. Documents accepted are listed below. You have 30 days from the date you enroll to provide evidence of eligibility documentation to the HR/Employee Benefits Help Desk (MBC Service Center). If not provided by the due date, your domestic partner’s (and/or children’s) coverage will not become effective (or will be canceled). DOMESTIC PARTNER EVIDENCE OF ELIGIBILITY CHILDREN EVIDENCE OF ELIGIBILITY Provide either: In addition to the Domestic Partner’s Evidence of Eligibility, any one of the following: • Copy of state-issued domestic partnership registration/ certificate, or • Cedars-Sinai Domestic Partnership Affidavit signed by you and your domestic partner and • To enroll for medical benefits – Domestic partner’s Social Security Number or Federal Tax ID Number (or complete the Centers for Medicare & Medicaid Services’ opt-out form). 2 Domestic Partner – 09/2013 • Copy of child’s birth certificate showing you or your domestic partner as parent(s) • Copy of child’s legal adoption paperwork or paperwork showing child has been placed for adoption with you and/or your domestic partner • Copy of your previous year’s tax return; children don’t have to be tax dependents to enroll, but if so, tax returns can be used as evidence • Copy of any Qualified Medical Child Support Order in effect (see page 1). Termination of Relationship If your domestic partnership ends, your domestic partner and his or her children are no longer eligible for coverage under the Cedars-Sinai plans and their benefit coverage ends the last day of the month your domestic partnership ends. To cancel domestic partner coverage, you’ll need to provide either of the following documents to the HR/Employee Benefits Help Desk (MBC Service Center) within 30 days of the date the domestic partnership ends: • A state-issued termination of domestic partnership certificate, or • A completed Cedars-Sinai’s Affidavit of Termination of Domestic Partnership form, which must be signed by both you and your (former) domestic partner. Your domestic partner (and children) will be eligible for 36 months of COBRA continuation of medical, dental and voluntary vision coverage if: • They are covered under these plans when the domestic partnership terminates, and • Cedars-Sinai (or the MBC Service Center) is notified within 60 days of the domestic partnership termination. Offering COBRA to domestic partners is not legally required – but something Cedars-Sinai chooses to offer. Our COBRA administrator will send the COBRA forms to the last address on file with the MBC Service Center. Please be sure to give the MBC Service Center new addresses for you and/or your former partner. Keep in mind that you are responsible for notifying the MBC Service Center within 30 days of the partnership’s dissolution. It is considered fraud to continue coverage after loss of eligibility and the insurance companies could refuse to pay claims after loss of eligibility, even if you’ve paid the premiums. Need Forms? The Cedars-Sinai Affidavit of Domestic Partnership and the Termination of Domestic Partnership forms are available to download and print from the Cedars-Sinai.MyBenefitChoice.com website (on the left bar, click Benefit Booklets, then Forms, under “Other Information”). If you have questions or need assistance, contact our HR/Employee Benefits Help Desk (the MBC Service Center) at 888-302-3941 or [email protected]. Legal Issues Before enrolling in domestic partner coverage through Cedars-Sinai, you may wish to consult with an attorney about the legal consequences of filing the Affidavit of Domestic Partnership. If the domestic partnership ends, the Affidavit may lead a court to treat the relationship as the equivalent of marriage when establishing and dividing community property or for ordering payment of support. Marriage You pay additional taxes on domestic partner benefits – taxes that are not charged for spousal benefits. Don’t pay these taxes if you don’t have to. If you and your domestic partner marry, notify the MBC Service Center within 30 days of marriage to change your marital status in your personnel record. If you marry and don’t notify the MBC Service Center within 30 days of marriage, you’ll have to continue to pay the additional taxes until the next July 1. (See Tax Issues for a more detailed explanation.) BENEFIT QUESTIONS? Ask the HR/Employee Benefits Help Desk Phone: 888-302-3941 Fax: 206-299-3158 Email: [email protected] Web: Cedars-Sinai.MyBenefitChoice.com Hours: Open Monday – Friday 6 AM to 5 PM PT (Closed major holidays) The MBC Service Center YOUR CHOICE BENEFITS 3 YOUR CHOICE BENEFITS Tax Issues The IRS definition of “dependent” does not recognize domestic partners, which has the following tax implication: the premium that you and Cedars-Sinai pay for your domestic partner’s coverage is considered taxable income. This is called “imputed income.” Imputed income is added to your paycheck to determine your federal and state income and Social Security and Medicare taxes. Cedars-Sinai is required to collect Social Security and Medicare taxes from employees, and will withhold these taxes on this imputed income. Imputed income will not show as a line item on your paycheck. You’ll see only the increase in your Social Security and Medicare withholding. Although Cedars-Sinai automatically withholds Social Security and Medicare taxes on imputed income, it does not withhold state or federal income taxes on imputed income. You may want to have Cedars-Sinai withhold extra money for the federal and state income taxes you will owe; you’ll need to complete IRS W-4 and state withholding forms to change your tax withholding amount(s). Download tax forms from the Cedars-Sinai intranet. From the Administrative tab, click on the Human Resources link, then the Forms link. Complete the forms and mail or fax them to the Payroll Department: Mail: Cedars-Sinai Medical Center Attn: Payroll Department 8700 Beverly Blvd. Los Angeles, CA 90048 Fax: 323-866-8833 Imputed Income Formula and Example Mary is covering her domestic partner for medical coverage under the HMO plan. Here’s how the imputed income is calculated: IMPUTED INCOME FORMULA EXAMPLE AMOUNTS Total monthly premium for employee plus domestic partner $1,272.16 – Total monthly premium for employee only - $578.25 = Monthly imputed income = $693.91 x 7.65%* Social Security and Medicare tax = Monthly amount withheld from your paycheck for Social Security and Medicare x 0.0765 = $53.08 *6.2% of pay (up to $114,000 in 2013) Social Security tax and 1.45% of pay (under $200,000) Medicare tax. This example shows only the amount of withholding attributable to the cost of a domestic partner’s medical premium. Depending on tax filing status, if pay plus imputed income is more than $150,000, the Medicare tax rate may be higher. Mary owes taxes on an additional $693.91 of “income” for each month her domestic partner is enrolled. The second paycheck each month, Cedars-Sinai will add this additional income to Mary’s taxable income and collect the FICA (Social Security and Medicare) taxes. Exception If Your Domestic Partner Is a Tax Dependent The imputed income requirement may not apply if your domestic partner qualifies as your tax dependent. If you want to claim your domestic partner as a tax dependent, please consult with your tax advisor, and then notify the HR/Employee Benefits Help Desk (the MBC Service Center). They will send you a Declaration of Domestic Partner Tax Status to complete and return. This is a summary of the Domestic Partner enrollment process meant to accompany the Domestic Partner Affidavit. In case of discrepancies between information presented here and the plan documents, the plan documents will govern. Cedars-Sinai hopes to continue these plans indefinitely, but reserves the right to amend, suspend, or terminate these plans in whole or in part any time and for any reason, including the plan provisions as they are represented in this summary. 4 Domestic Partner – 09/2013 AFFIDAVIT OF DOMESTIC PARTNERSHIP Declaration: WE EACH SEPARATELY DECLARE, UNDER PENALTY OF PERJURY, UNDER THE LAWS OF THE STATE OF CALIFORNIA, THAT THE STATEMENTS BELOW ARE TRUE AND CORRECT. 1. That the partnership between: and Print or type name Print or type name commenced on or about: _________________________, 20 ___________. (This date must be at least 6 months ago.) That the above-named persons are either legally registered as domestic partners, or: 2. That the above-named persons been sharing a common residence* for at least 6 months and intend to do so indefinitely 3. That the above-named persons are not related by blood to a degree of closeness that would prohibit marriage 4. That the above-named persons assumed mutual responsibility for basic living expenses 5. 6. That the above-named persons are at least age 18 and capable of consenting to the domestic partnership That the above-named persons are not married to anyone else or in a declared domestic partnership with anyone else. I understand that the total contribution for my domestic partner’s coverage is taxable to me as imputed income. The nd imputed income will be added to my 2 paycheck each month and result in Social Security and Medicare taxes being withheld for that income. I understand I also owe state and federal income taxes on my imputed income. The imputed income will be included on my W-2 at year end and will be included as part of my taxable income for state and federal income tax calculation. Employee’s signature and date Print or type name and employee ID number Domestic Partner’s signature and date Return the completed form to: Domestic Partnership Packet 2013-09 #602B Print or type name Cedars-Sinai C/O MBC Service Center P.O. Box 91109 Seattle, WA 98111-9209 AFFIDAVIT OF TERMINATION OF DOMESTIC PARTNERSHIP Declaration: WE EACH SEPARATELY DECLARE, UNDER PENALTY OF PERJURY, UNDER THE LAWS OF THE STATE OF CALIFORNIA, THAT THE STATEMENTS BELOW ARE TRUE AND CORRECT. That the partnership between: and Print or type name Print or type name terminated on: _________________________, 20 ___________. We understand that domestic partner (and children) healthcare coverage will end on the last day of the month the domestic partnership terminates, as listed above when this form is returned within 30 days of the date of termination. If the domestic partnership terminated more than 30 days ago, then domestic partner’s (and children) coverage will end on the last day of the month in which this affidavit is returned. Premiums paid when domestic partner (and/or children) was not eligible for coverage will not be reimbursed. We also understand the domestic partner (and children) will be eligible for up to 36 months of extended medical, dental and/or voluntary vision coverage on a self-pay basis through COBRA if: 1) They are covered under these plans when the domestic partnership terminates and 2) Cedars-Sinai or the HR/Employee Benefits Help Desk (MBC Service Center) is notified within 60 days of the domestic partnership termination. EMPLOYEE: at Signed on (date) (City and state where signed) Employee’s Signature Print or type name and employee ID number DOMESTIC PARTNER: at Signed on (date) (City and state where signed) Domestic Partner’s Signature More on back Domestic Partnership Packet 2013-09 #602C Print or type name Update addresses: Employee’s new address: Return the completed form to: Domestic Partnership Packet 2013-09 #602C Domestic partner’s new address (for COBRA notices): Cedars-Sinai C/O MBC Service Center P.O. Box 91109 Seattle, WA 98111-9209

© Copyright 2026