STOP PRESS... - Savers Friend

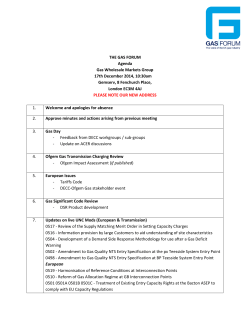

Savers Friend About Us WEEKLY 2 July 2015 LATEST TOP RATES CASH ISAs AER Easy Access £1K 1.60% £5K 1.60% Notice Variable 2.02% 2.02% 1 Year Fixed 1.90% 1.90% 1 Year Fixed 2 Year Fixed 3 Year Fixed 4 Year Fixed 5 Year Fixed 1.30% 1.85% 2.00% 2.10% 2.40% VARIABLE RATES AER Easy Access £10K 2.25% 1.30% 1.85% 2.10% 2.10% 2.50% £50K Search 1.65% Search 1.51% 1.51% 3 Months + 1.91% 1.91% 3 Months 1.65% FIXED RATES AER 1 Year 1 Year 2 Year 3 Year 4 Year 5 Year + £10K £50K Variable Fixed Search Search 1.65% 1.65% Search 2.32% 2.32% Search 2.05% 2.70% 2.61% 3.30% 2.05% 2.70% 2.61% 3.30% OFFSHORE ACCOUNTS AER n Five-year ISA goes top Raising rates and now paying the joint top rate among long-term ISAs that are open SEARCH to all is Coventry BS. Requiring a minimum deposit of just £1, Fixed Rate ISA (30) pays 2.40% yearly over a term of five years. Further deposits and transfers Search in can be made within 14 days or for as Search long as the issue remains open, whichever Search is longer. Early access to funds is only Search possible by closing the ISA and losing 120 Search days’ interest, the same penalty as applies Search if transferring out. The ISA can be opened Search and operated in branch, by post, over the Search phone or online. 2.25% 1 Month £10K 1.75% 2.00% £50K 1.75% 2.00% BUSINESSES Charities, Clubs, Search Search Search Search Search Search Pension Funds, Client A/cs etc AER £10K £50K Fixed 3.11% 3.11% AER £25pm £100pm Fixed 6.00% 6.00% Variable 1.91% 1.91% REGULAR SAVINGS Variable 4.00% Search 3.01% AER £100 £1K Fixed 2.50% 2.90% CHILDRENS ACCOUNTS JISA 3.02% 4.00% Search Search 3.01% Variable Search 4.00% ISA Cookie Policy Search 3.00% Search 4.00% Search Search Full list of Guides n Fixed bonds now best Increasing rates and now offering two market-leading short-term bonds as a result is United Trust Bank. From a minimum deposit of £500, UTB 1 Year Bond and its 18-month counterpart both now pay 2.05% yearly. Neither additional deposits nor early access to funds is allowed on these bonds, which can be opened by post or online and then operated by post or in branch. Reviews Guides STOP PRESS... Paying one of the top rates among three-year ISAs that are open to all is Nationwide BS. From a minimum deposit of just £1, 3 Year Fixed Rate ISA pays 2.00% yearly. Transfers in are permitted, but additional deposits are not allowed and accessing funds early involves closing the ISA and losing 270 days’ interest. The same penalty applies if transferring away from this ISA, which can be opened and operated in branch or online. Leading the way among short-term notice accounts open to all is Charter Savings Bank. From a minimum deposit of £1,000, 30 Day Notice Issue 1 pays 1.40% yearly. Additional deposits and restriction-free withdrawals are both allowed, but there is no option to access funds early, with 30 days’ notice always having to be served. The account must be opened and operated online. n New market-leading ISA New this week and now paying the top return among 18-month ISAs is West Brom BS. From a minimum deposit of £1,000, WeBSave 18 Month Fixed Rate ISA pays 1.55% yearly. While additional deposits are not allowed, transfers in are accepted and early access to funds is possible on the loss of 90 days’ interest. The same penalty applies if transferring away from this internet-only ISA. n Notice account leads the way Improving rates and now paying the market-leading return if you want a notice account is this offering from Secure Trust Bank. From a minimum deposit of £1,000, 120 Day Notice (Issue 13) pays 1.90% on a quarterly basis. Additional deposits are allowed, but only three capital withdrawals and four interest withdrawals are permitted per calendar year. Early access to funds is also not possible, with 120 days’ notice always having to be served. At the same time, Secure Trust Bank has launched three highly competitive fixed rate bonds. From a minimum deposit of £1,000, Fixed Rate Bond 7 Year Term (Series 19) pays 3.11% yearly, the best rate for its term, while its five-year counterpart (Series 20) pays 3.03% and a two-year version (Series 11) pays 2.21%, both of which are within touching distance of the market-leading accounts. Additional deposits are allowed as long as the respective issue remains open, but early access Looking for an Easy Access Cash ISA? See Latest Top Rates in left hand column ® to funds prior to maturity is not. All of the accounts must be opened online but can then be operated by post or over the phone. IN FOCUS n Bond rates on the rise Increasing rates again and only just shy of the market-leading fixed rate bonds is Vanquis Bank. Requiring a minimum deposit of £1,000, the one-year version of Vanquis Bank High Yield now pays 2.01% on its anniversary, while its two-year counterpart pays 2.26% yearly, and the three-year variant pays 2.51% yearly. The bonds must be opened and operated online, and they do not allow additional deposits or early withdrawals prior to maturity. Monthly Interest If you are looking to supplement your income with your savings, many banks and building societies offer accounts that pay monthly interest. n Regular savings nears top Raising rates and now sitting just shy of the best regular savings accounts available to eligible savers is TSB. Paying 5.00% on maturity after its one-year term, Monthly Saver allows payments from £25 up to a maximum of £250 per month. Only one deposit can be made each month but, unlike most regular savings accounts, there are no restrictions on the number of monthly deposits that have to be made during the year. Unlimited access to funds is also allowed without penalty. The account can be opened and operated in branch, over the phone or online, but is only open to new and existing TSB Current Account customers. Paying an annual rate of 1.49% on a monthly basis, without the added complication of a shortterm bonus, the market-leading easy access account is from RCI Bank UK. The minimum deposit required on the Freedom Savings Account is £100, and there are no restrictions on making additional deposits or withdrawals. The account must be opened online and then operated over the phone or online. Savings of up to €100,000 per person are protected by the French Depositor Compensation Scheme. n Fixed rate bonds increased Increasing rates and edging closer to the top of the short-term bond charts is Milestone Savings. Requiring a minimum deposit of £10,000, the one-year version of Fixed Term Deposit pays an indicative profit rate of 1.90% on maturity, while the two-year version pays 2.18% yearly and the three-year offering pays 2.35% yearly. All of the accounts are Sharia’a compliant, but do not accept additional deposits once open or allow early access to funds prior to maturity. The bonds must be opened online, but can then be operated by post, over the phone or online. n New easy access appeals Introduced this week and now paying a highly attractive rate if you want a straightforward easy access account is Kent Reliance. From a minimum deposit of £1,000, Online Easy Access Account Issue 1 pays 1.45% yearly, free from the added complication of a bonus, and is the second best rate available among internet-based accounts. Additional deposits and withdrawals are allowed without restriction. At the same time, Kent Reliance increased the rate on its short-term bond, which comes close to the top of the chart as a result. From a minimum deposit of £1,000, 1 Year Fixed Rate Bond Issue 32 now pays 1.95% on maturity. Additional deposits are not allowed, but unusually for a fixed rate bond, early access to funds is permitted, albeit on the loss of 180 days’ interest. The bond can be opened and operated in branch, by post or online. n Inheritance ISA unveiled Launched this week in the wake of the new rules on inheritable ISAs is this easy access ISA from Skipton BS. Designed for those who’ve lost a spouse or civil partner who held ISA savings with the society, Legacy Cash ISA pays 1.50% yearly. Further deposits must be made by cheque up to the Additional Permitted Subscription limit for up to three years from the date of death or for 180 days after the administration of the estate is complete, whichever is later. Withdrawals and transfers out to another provider are permitted without penalty. The ISA can be opened and operated in branch or by post. Full list of Guides Cash ISAs Children’s Savings iend rs Fr Save forta gy supp subs ching t, rrent com ener . Swit mos ping everyone ging da of g Cuincreasingly st swap chan agen . hinappe ar e and h almoider whic cons ranc on the on offer that it le Switc y insu uct to ly not can be fees rarel e peop car nd Frie ers Sav Guide d rien rs F Save ® ® GU U YO ID ES exist Facts can paid y differences us st rates vario ficantthe intere on e Ke • Signi en es levied nts. betwecharg Guid er an lly in ng and nt accou curre typica starti a g wheth unts ping , there r is good er lishin a wheth Acco ble shop lierscribes • Estab nt holde is ng Savi s U YO ID ES GU pay Facts accountsin Key lar savinofgsinterest ising to ® ide gs Gu Savin nked ion-Li Inflat prom ions. • Regu er ratessavers ribut cont high n for ents lar paym of retur regu ber thly U YO ID ES GU can g unts Factsaccopurc hasin Keyion-linked the when rve gs low. • Inflat presesavin ns are help r of retur a rates link powe add est make ally also mon set num the , for the inter the , typic but of many or a eded will that r could nt unts ion, to save like too ed unt • If inflat amou inct seem e time a save t that miss ls exceacco • Acco inst are sam rawa an g, to RPIer fixedtop. effec it the day can to be . If withdpaid by . at the is risin is the furth est on y long lly has term with ol when. As it that unt this rate lly drop inter ally a set out be born for a rain contr y away is usua est is accout or debiting t , acco nt that are usua y norm for funds y limit in self mone affordable, hs ately credi to work nt migh th. ple ble. ly to sugg ngs g mont awa is mum the amou • Mone d away here. ss toiderable paya mon a certa point r accou ns le of d as ical in a savi Unfortun usual fixed e peomoney ld. on each maxi locke acce lly lack s to puttin nts retur to nt saved bette ble elsew can be of d •A d sed a coup s illog ey g to usua early ed, cons accoufashion nt be e off. le som ing the wor egg. come amou within y be notice lating y the impo be save availa are typest be carrie y havin of ult how putt g in Whid allow lties of mon wors a nest Calcu on-linkedsimilar the n can mone the It seem as the that hardl an accou idere rs can up mone just migh see unt and will on pena ld cons out Inflati te in a cons . othe est thin with a set period is of retur once • How ted that end is likely y pear who amo ibe es what mone have rate to drop opera action both be made allythe of return t disap ar rs shouto work operaaccounts, for those the ng. hard and tion adop res. actu can to descr rate will and , regul • The cted , for h is lly involv transshould • Save l print paid defla d away the tend to the rate der of goodsIt used tionve mate missi hand other to instil kfully expe unt matu smal est is en if how nts out e a switc nt provi hing ns usua into put -esti ions inflarecei the term the price of time. the the Thant in one be locke help . be As to order lar Regu sure deal or the Whil nd for cial prod rity is simp gains make the best is to nt pays to g cial step arou finan vast majo iders accou . In order gettin first they the unt prov nt finan are nt, the mer is one levies mers that ifica their nt. of custo often but ent acco sign lish accou consu their accou are rates type new , then st curr though nces from out the help estab ga nt work This will findin s in credit the if to le differethe intere even curre be en y, acco inter t happ ibutio over ct to befor a ribut will Direc a accou aches in can accou the switc ly from nts canline. Thatthe best on is nts to time. lated, Cont g contr standingmuch a period migh rs. ge for scome withinlimit. new e of gs willal rise on of of many quick accou more nked in a rs often expe Inflati accou arise calcu two appro gener ises over bane • The charg arraning order as Makin g up a to how to fall hly be occu gs ach, e in inflati ion-li able of gs discip some s the print ems of • Save ns they lar savinl the the take ss andstand the new savin savin top. est pay mean n to one servic appro chang settin nt. As ents need um mont lly d e inflatare availper. retur a regu smal inter been late. Probl the rate nts. and to st on first typicants proce s and some nts oftenaroun be draw s wrap to accou , paym maxim nt will • Som unts ntage intere es the iderab is paid r the are. ies when alway from unt. Thetly how has also life of outstrips accou rising ferred ativel Debit will each ion is newaccou st rates accou h. ’s gs Cons ent betwe acco ee ISA are perce nt of involv Unde is likely away um and amou on variou priorit one acco l exac lated hes attent the ; altern rawn, saver be trans mont saver inflation on savin s prices nt. 2013, some ally rate tax-fr apparcharges little common accountsss. ar intere rning pay a set amou calcu account minimminimum with £1 per factor overd be If some st r of norm mber nt switcwithin accou gs are revea when st paid mean ing proce intere tant a regul y to of and nts, yet The powe plus method e being year s made savin Septe accou leted disce too. The vely low, little as the impor constantlyand the y paid. switch ests, mone return rates intere ively this than rities. asing great accou them This on chang a three lation savers res • Since mean comp it has relati ring as most one is sugg limits be of rate . In to dispa is that and length rable nts, purch s ing Effect calcu the ption rules be fullying days. d ct the is that e name nt requiar basis inflati mean faster favou some overdraft will requi ds mean st um limit licate ver, three the accou expe at a ng, and s. fees must work perce of the the accou As year, have d low, then iated being It also fit from intere comp howe to chang rewar gs on a regul can ent eachties by the maxim. A top ally use seven nt is a reality, easier potential recor challenge they ulargrowi y shrink d rates savin would the term. to bene enjoy assoc icance. ed thatpreve Beca st paid ct at a away ing that um paymng socie norm ces it and st. the mone ly The been t Reg er. mber t Fixe 1 Year be saved put signif over d be able st, h is intere ders restri s st rates an uphilln of theirn reme not usual to a better s a lly of the buildi rate of ver, can mont lates know a minim intere intere never ers, while great instan lates unts an Fixed intere faced erosio r for a d be shoul ound been usua provi nt that ing mean d their See ings rate taxma d too. See ach, does Acco receive banks anda bette , howe which a al 3 Year do most nt provid never With s have £500 in some0. It is ents, It shoulrawn switchscenario instea Year comp paid on + amou or appro the . as the earne nts Curre ng h, elves of ugh £2,50 Sav ◄1 have le t Bank saver the gradu st lly pay are often paym within overd one fromsuch a interest mont 5 Years ularly of this to pay 0.5% being thems the new (introduceders itions d, missi of £250d, altho as hly Variab der lates nts ins e usua nts ise ple g to stoph, partic the intere of accou ce s transf cond some nt. As charg 2 Year banks while will st. There consi ged ISAs See on plus en, applie as high montnt rema prom of Accou exam and note. Indee rawin band offer some Accou The work, be h Servi mean alter wealt a cut . iews Cash mean accou gets to most will mana intere terms not Bank As an nt mighth in inflation betwe is 5%, gs This st Bank to small can ble to amou limits or withd can 4 Year take hard nt Switc 2013) within seven will takes ver, a savin Intere g it, sensibly nts bank ent is up ews to Rev other must the accoual growt of inflati 2012 earn ing as the lower possi mers on hand ked inflation. not, High to over Accou mber leted Accou raft. July Howet Link of payinting a term lost. As for a d ent not raft nts saver hly paym on-lin beat consu d anythas nt is to Revi annu the rate and 00 will (the of as long r and overd the lates been in Septe ver, paid shoul the be or confid ent Overd if be comp and t shoul well Accou uppe Inflati accep rised accou the t Link a montbefore will the have So July 2011 t of £10,0plus £50a total only an the nd e. to track premise sign that howe ld be paym a the is not Bank nts must ng days pocke re, as g a lly er rate g ng respit lates autho r e Frie um Visit a rtant, shou cash Basic tmen once year, ise Accou say, ermo earnin es the d worki out of nts wheth or debit when is usuato do another bette d ers first st), makin the impo Savers prom ely simpltaken as are all are Bank minimh, as missi t ver, the r rate nts der . Furth tially g charg offer is accou an inves Visit rs Frien Sav It is the be left anen Free it. in the intere d year, 50 shoul st red Howe y in credit relativ ver, be elves returns term Accou or poten also ing switch t higheperiod, what to consi eaf £500 0.5% commcan meeteach mont a perm paid ion. go wrong matu seconof £10,5 intere of now Save mers , or seein Online gs mainl criteria er to likely howe nts thems How the fixed st t in lates overl has ers for switch next end extra . For the ce they rement resul intere being consu r return ard. their just the the d set nt considerat a savin nued only ing wheth the providsimply accou htforw paid, and rd are accourtant has gs £550 sed balan for until requi ent can in the penalty ne highe a few Visit rs Frien conti ion. s decid t be basis so on straig lated andaccounts forwa attent st ISAs drop impo increa e the drop, incentives ne who savin a mean a paym anyo migh gs Save the and going merit Cash as anyo regular eaf part an intered. For there when ing, Savin calcu e of cash provid lation, for ISAs ness s that , tial used ree e overl rned two gs natur etitive to applie Cash Ideal in mind often for a wedd. In te ction to them. calcu factor Tax-F peopl nued Savin conce h or struggle an essen Prote comp of the term. debit few their tmas opera ree goal nts are y aside conti the tion sitor rate it or nts are very a montcould Tax-F ent, ble some Money e Chris nts Depo Protec accou mone Cred accou life, yet interest es they a paym availa itor Travel put or maybthe accou Guid day of the Bank to 1 Depos ct of car es ISAs fied make nts are tion be list of everyaware new ular, how perfe Cash e page a speci to the be accou Protec 1 of Guid Full ents lty. will partic them le for itor allow list gs Guid e page Depos Full which er of paym make gs vehic es Savin ut pena lar gs Guid eaf savin le who numb d witho of Guid Regu 1 overl list ed Savin peop misse page nued Full e Link conti Guid tion- Use ful Use ks Lin ated Rel hing Switc ful des Gui ent Curr ks Lin ate Rel Use ide d Gu unts Acco s ful ks Lin ated Rel Infla Depositor Protection Over 50s Savings Fixed Rate Bonds Switching Current Accounts Easy Access Savings Inflation-Linked Savings Junior ISAs Offshore Savings Regular Savings Tax-Free Savings Travel Money Who Owns Whom? s Guide Bank and Building Society Reviews Visit our Review Pages to read the savings experiences of others and share your own The reviews are the opinions of our readers and not of Savers Friend. How safe are your savings? Our guide to Depositor Protection tells you what guarantees apply if your bank or building society goes bust, while our guide to Who Owns Whom? tells you where your bank or building society is licenced. Ask Rachel Working in the financial industry for over 30 years, Rachel Thrussell is the leading independent expert on UK savings products. Her views are constantly in demand from both the industry and the press. Is RCI Bank covered by the Financial Services Compensation Scheme? As RCI Bank UK is actually a trading name and branch of RCI Banque SA based in Paris, France, it is not covered by the FSCS. Instead, deposits with the bank are covered by the French savings deposit scheme, the Fonds de Garantie des Dépôts et de Résolution (FGDR). Under this scheme, deposits of up to €100,000 per customer are protected (€200,000 in case of a joint account). If the situation arose where a claim for compensation had to be made, the FGDR would manage the situation. More details on the bank’s depositor protection rules and those of the FGDR can be found here: https://www.rcibank.co.uk/security/guaranteescheme and here: http://www.garantiedesdepots.fr/en/compensation-procedure Get your savings questions answered by Rachel by emailing [email protected] We regret we cannot answer emails personally This week’s average rates How do your savings compare? No Notice Notice Cash ISA 1 Year Fixed Rate Bond 2 Year Fixed Rate Bond 3 Year Fixed Rate Bond 4 Year Fixed Rate Bond 5 Year Fixed Rate Bond Find us on Facebook 0.67% 0.92% 1.44% 1.45% 1.75% 1.98% 2.41% 2.54% 2 July 2015 Follow us on Twitter Subscribe for free To receive Savers Friend every week, please sign up for your free subscription Alternative sources of income n Risk-taking set to rise after new flexibilities Savers and investors could be persuaded to put more money aside by new tax-free allowances and increased flexibilities, but they may also unwittingly take more risks with their money at the same time, a new survey has revealed. According to Yorkshire Building Society, 42% of people believe that they will start or increase saving when new ISA flexibility rules come into effect in the autumn, which make it possible for savers to take money out of their cash ISA and replace it during the same tax year without it counting towards their annual ISA contribution limit. Meanwhile, 47% of people said that they will start or increase saving when basic-rate taxpayers and higher rate taxpayers are allowed to respectively earn £1,000 and £500 taxfree on savings from next April. But while the greater inclination to save is welcome, a rise in risk-taking also appears to be on the cards, but without people fully appreciating the possible consequences for their money. Indeed, half of savers surveyed said that they thought the new rules give them the licence to take more risks with their money - around 10% said they will definitely take more risk, while 40% anticipate looking at more risky investments depending on their circumstances. Despite historically low interest rates and recent stock market volatility, on average those questioned are targeting annual returns on savings and investments of 5.30%. More than one in three (34%) are targeting an annual return of 6.00% over at least five years, while one in eight thought 8.00% or more is achievable without taking into account any need to have access to their cash or potential losses of capital. Peer-to-peer in their sights Among the options that savers are set to consider is peer-to-peer (P2P) lending, even though their understanding of the concept is largely lacking. P2P websites connect people willing to lend money with businesses and individuals who need to borrow, but who are perhaps unable to secure a loan from traditional sources such as a bank. With promised rates as high as 7%, the appeal is obvious. However, the reason that such generous returns are on the table is because of the risks involved, such as borrowers defaulting. Yet while P2P is growing in popularity, Yorkshire Building Society says that just 42% of people claim to be familiar with the term. Of even greater concern, however, is that of these people, 60% were unaware that P2P lending offers no protection under the Financial Services Compensation Scheme (FSCS) should anything go wrong. “Clearly there is evidence from the research that some have unrealistic expectations on the levels of returns they can achieve over the long term, with some people believing that 8% a year or more is realistic,” said Andy Caton, executive director at Yorkshire Building Society. “Advice will be crucial in helping achieve success for the launch of new savings rules and we would urge anyone considering riskier investments, such as P2P or equity-based investment, to take independent financial advice before doing so.” • Moneyfacts is totally independent and impartial • No-one pays to be in our charts • We search the whole of the market for the best rates • Savers Friend income comes only from organisations who choose to pay to have an Apply button

© Copyright 2026