Ellerston Global Equity Managers Fund â GEMS C

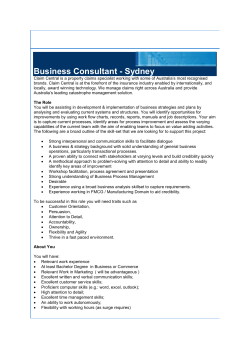

Ellerston Global Equity Managers Fund – GEMS C PERFORMANCE REPORT March 2015 Fund performance^ Investment Objective The investment objective is to generate superior returns for Unitholders with a focus on risk and capital preservation. Global long/short equity Overlays fundamental stock selection with macroeconomic outlook Bias toward Australia Key Information Class Inception Date 1 Dec 2009 Fund Net Asset Value A$130M Liquidity Monthly Application Price A$1.6457 Redemption Price A$1.6375 No Stocks 107 Gross Exposure 160 Net Exposure 68% Management Fee 1.5% p.a Buy/Sell Spread 0.25% Performance Fee 16.50% Firm AUM A$4,096M Ellerston Capital Limited ABN 34 110 397 674 AFSL 283 000 3 Months 1 Yr 3 Yr p.a Class Since Inception p.a 3.58% 10.46% 20.79% 13.26% 11.43% Commentary Investment Strategy GEMS C Net 1 Month After coming close to breaching the 6,000 point barrier several times during March, the local S&P/ASX 200 finished largely unchanged (-0.06%) by month end, printing its strongest first quarter (+10.3%) in 24 years to end at 5,891. Global markets sold off initially as speculation around an imminent rate hike in the US mounted. Subsequent more dovish-than-expected commentary in the Fed’s March statement alluded to a delay in the muchanticipated rate hikes, which ignited a relief rally midway through the month and caused global indices to reclaim some lost ground. Despite this, the MSCI World index (-1.6%), the S&P500 (-1.6%) and the FTSE 100 (-2.5%) all ended lower. Europe, as measured by the Euro Stoxx 50, outperformed (+2.7%), led by Germany’s DAX up 5.0%, with QE purchases kicking off from the outset, as did Japan with the Nikkei 225 posting a 2.2% gain. Chinese shares were the clear outlier during the month, with the Shanghai 300 rallying 13.4%. They were helped by comments from PBOC governor Zhou Xiaochuan stating that growth had slowed “a bit too much” and that policy makers had scope to respond with interest rates and other quantitative measures following a below-trend February growth print of 6.3% y/y. Long-term bond yields continued to fall globally, supported by abundant central bank liquidity and weak commodity prices. European bonds rallied strongly with the commencement of the ECB’s monthly purchase of 60 billion in bonds. We remain constructive on equity markets as they are supported by easy global monetary policy and the low level of interest rates currently. While equity markets are expensive relative to historical levels based on P/E ratios, they are undervalued relative to bonds. The highest yielding bond markets in the developed world are Australia at 2.35% and the United States at 1.9%. The majority of European bond markets yield under 1%, with the German 10 year bond yielding 10 basis points and the 10 year Swiss bond yielding negative 20 basis points. Overall, 16% of global bonds have a negative yield currently. Level 11 179 Elizabeth Street Sydney NSW 2000 Tel: 02 9021 7797 Fax: 02 9261 0528 [email protected] www.ellerstoncapital.com APIR Code: ECL0006AU The portfolio is positioned towards Australia, Europe and Asia on a net basis. Our Australian positions results from our bottom up analysis, finding a number of attractively valued companies, with positive long term growth outlooks. Prominent among these would be Aristocrat Leisure, Bellamy’s and Blackmores. European markets are supported by quantitative easing and the associated currency weakness that typically accompanies it. Low rates and a weak currency are starting to come through in a better economic outlook for Europe. Asian markets are supported by economic growth and attractive valuations. We have a low net exposure to the U.S., as valuations are full and monetary conditions are expected to tighten later in the year. The Fed is expected to start raising interest rates in September. This has led to a significant strengthening of the U.S. dollar, which impacts U.S. corporate earnings, as 50% of earnings are sourced offshore. Consensus is now expecting S&P earnings to be flat to down in 2015. A recent addition to the portfolio is Elis SA, the European leader in the rental and maintenance of textile and hygiene articles and well-being items. The business should grow at around 3-4% organically and another 2-3% per annum through bolt on acquisitions. There are significant opportunities for the company to grow outside of France. Ellerston Global Equity Managers Fund – GEMS C Monthly Newsletter 2 Market Exposure as a % of NAV GEMS C Fund Performance & Volatility ^ 16% 180% 160% 14% Gross 120% Since Inception Return % p.a. 140% Net 100% 80% 60% 40% 20% 0% -20% GEMS C Fund Europe Australia & NZ Asia Emerging North Markets America Grand Total S&P/ASX 200 Accum Index (AUD) S&P 500 US Accum Index (USD) MSCI World Accum Index 12% 10% 8% 6% MSCI Europe Accum Index 4% 2% MSCI Asia Pacific Accum Index 0% 0% 5% 10% 15% Standard Deviation (Since Inception) % p.a. # GEMS C has achieved returns with a lower risk than all of the indexes over the same time period. Top Holdings (Alphabetical, Long only) • • • • • Aristocrat Leisure Bellamy’s Australia Bentham IMF Blackmores Comcast • • • • • Enel SpA Medtronic Orion Engineered Carbons Reckitt Benckiser Verizon Key Service Providers - Registry: Link Market Services Limited Auditor: Ernst & Young Prime Broker: Morgan Stanley Intl & Co PLC & Goldman Sachs International Administrator: Citco Fund Services (Australia) Pty Ltd Custodian: State Street Australia Limited Material Matters During the month there were no material changes to the Fund in terms of its risk profile, investment strategy or changes to investment staff which would impact this strategy. There have been no changes to the key service providers described above. Disclaimer ^ Actual performance for your account will be provided in your periodic statement which may vary from that set out in this newsletter and will vary for investments made in different classes, or at different times throughout the year. Some performance data is estimated and preliminary and subject to change. The returns and risk of the Fund and the relevant Indices are net of taxes, fees and expenses and assuming distributions are reinvested. The performance figures presented are for the Ellerston Global Equity Managers Fund GEMS C Units. The one month return figure may be an estimate and not the final return. This estimate also impacts other performance information provided. Estimated performance figures are preliminary and subject to change. Returns for other classes may differ slightly. Past performance is not indicative of future performance. Ellerston Capital Limited ABN 34 110 397 674 AFSL 283 000 is the responsible entity of the Ellerston Global Equity Managers Fund ARSN 118 887 095 (Fund). This newsletter has been prepared by Ellerston Capital Limited without taking account of the objectives, financial situation or needs of investors. Before making an investment decision you should consider your own individual circumstances and obtain a copy of the Product Disclosure Statement for the Fund dated 31 January 2014 which is available by contacting Ellerston Capital. This material has been prepared based on information believed to be accurate at the time of publication. Assumptions and estimates may have been made which may prove not to be accurate. Ellerston Capital undertakes no responsibility to correct any such inaccuracy. Subsequent changes in circumstances may occur at any time and may impact the accuracy of the information. To the full extent permitted by law, none of Ellerston Capital Limited, or any member of the Ellerston Capital Limited Group of companies makes any warranty as to the accuracy or completeness of the information in this newsletter and disclaims all liability that may arise due to any information contained in this newsletter being inaccurate, unreliable or incomplete. # The standard deviation is often used by investors to measure the risk of an asset. The standard deviation is a measure of volatility: the more an asset’s returns vary from the average return, the more volatile the asset. A higher standard deviation means a greater potential for deviation of return from the average return of the asset. Ellerston Global Equity Managers Fund – GEMS C Monthly Newsletter 3

© Copyright 2026