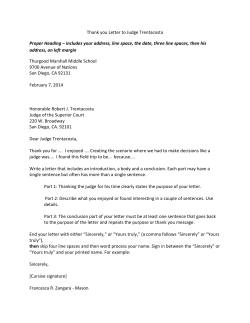

Document 177192