How to rationalise auction sales

How to rationalise

auction sales

Jean-Jacques Laffont

Thanks to the Internet in particular, auctions have become widespread.

Modelling these sales processes makes it possible to determine their

rules and the optimal strategies for using them.

a

uctions, as a means

of buying or selling, have

become widespread. This

is, in particular, the case

on the Internet, as testified by the striking success of sites such as eBay

where goods of all kinds

- from books to cars,

including art objects and

household appliances are bid on. As a method

for allocating scarce

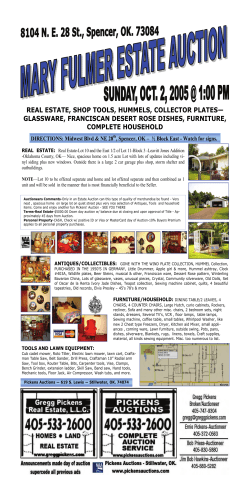

resources, auctions are An auction at Christie's of works of artists of the 20th century. Each potential buyer behaves according

traditional in the live- to what he believes the others will do. Game theory analyses such situations and helps in finding optistock markets and for mal strategies (Photo Gamma Connection/Jonathan Elderfield)

agricultural produce

(fish, flowers, etc). They have recently been describes the marriage market in Babylon as

extended to more expensive goods, such as an auction which started with the most beauapartments, and to much more complex tiful young women who were sold to the

objects, such as licences for third generation highest bidder (i.e., the highest offer gets the

mobile telephony.

``object'' to be sold). In Asia, the oldest account

The use of the system of bidding is very old, of bidding relates to the sale of the effects of

and goes back to Antiquity. Thus, Herodotus

dead monks in the 7th century.

How to rationalise auction sales

The first ideas about auctions were

inadequate because they were too

simplistic

If auctioning goes back almost to the dawn

of humanity, their conceptualisation is much

more recent. The first important academic

work devoted to the subject is a 1955 thesis,

whose author was the American L. Friedman.

It was one of the first theses on operations

research. It was devoted to developing auction strategies by companies on the occasion

of the sale of the petroleum drilling rights in

the Gulf of Mexico. These auctions were ``firstprice sealed-bid auctions'': in this procedure,

the offers are not made public

and it is the highest offer which

wins the auction.

The strategy adopted by

Friedman consisted simply in

maximising what is called profit

expectancy. If he wins the bid, the

bidder makes a profit equal to

the difference (v - b) between his

valuation v of the object put up

for sale and the price b which he

proposes to pay for it. The profit

expectancy is thus this difference

multiplied by the probability P(b)

of winning the bid at this price,

that is to say (v - b) P(b). The probability P(b) is a priori unknown;

but by making a statistical analysis of past biddings, one can discover ways of outbidding the

competitors; that makes it possible to determine an approximation to the function P(b) and

thus find the bid b* which maximises profit expectancy, i.e., such

that (v - b*)P(b*) is maximum

57

This method, which is widely used and has

been refined in many ways, is however extremely na{\"\i}ve. Indeed, it implicitly supposes

that the other bidders have not worked out

a strategy and that their future behaviour can

be easily deduced from their past behaviour.

In 1961, the Canadian William Vickrey (who

received the Nobel Prize for Economics in 1996,

two days before his death) posed the problem

differently, by using game theory.

The home page of the Internet auction site eBay-France.

58

Game theory and mathematical economics enter the scene for defining optimal strategies

Created by the famous mathematician of

Hungarian origin John von Neumann in the

years 1920-1940, in collaboration with the economist of Austrian origin Oskar Morgenstern,

game theory examines strategic interactions

of the players. It deals with any situation where

each player must make a decision which determines the outcome of the situation. Game

theory thus applies to many scenarios of the

economic, political, diplomatic or military

world. But let us return to our biddings. When

a bidder has to decide what to bid, he asks

himself what the behaviour of his competitors is going to be, and each bidder does this.

An equilibrium of this situation indicates for

the specialists a rather complex object: it is a

method of bidding - in other words a relation

between the valuation v of the bidder and his

bid b - which is the best way for the bidder to

bid taking into account what he anticipates

are the bidding strategies of the other actors

and his guess about their valuations. For

example, in a symmetrical situation where the

expectations of all the actors are the same,

the strategy of a bidder must maximise his

profit expectancy knowing that all the others

are using the same strategy as he is.

The concept, which we have just evoked,

is a generalisation of Nash equilibrium, adapted to the context of incomplete information

about the bids. What is it all about? The

American mathematician John Nash (Nobel

Prize for Economics in 1994) had proposed

around 1950 a very natural concept of equilibrium which generalises the one given in 1838

by the French mathematician and economist

Antoine Cournot. Given a set of actions from

L’explosion des mathématiques

which the players can choose, these actions

form a Nash equilibrium if the action each

player chooses is the best possible one for him,

knowing that the other players also are choosing the actions specified by the Nash equilibrium. In a Nash equilibrium no one finds it

beneficial to unilaterally change his action.

The particular difficulty in auctions is that

each bidder is the only one who knows his

own valuation of the goods to be sold and

that he does not know the valuations of other

The American mathematician John Forbes Nash, born in 1928,

received the Nobel Prize for Economics in 1994, in particular for

his work on game theory. Around the age of thirty, Nash started suffering from serious mental disorders from which he made a spectacular recovery in the middle of the 1980’s. His life was the subject

of a biography ``A beautiful mind'', which inspired a film of the

same title. (Photo University of Princeton)

How to rationalise auction sales

potential buyers. It is thus necessary to generalise the concept of the Nash equilibrium to

this situation where information is incomplete.

This is what was carried out intuitively by

Vickrey in 1961; the American of Hungarian

origin John Harsanyi did it more precisely

around 1967-1968, which won him as well the

Nobel Prize in 1994. One thus arrived at the

notion of a Bayesian Nash equilibrium, a

concept of equilibrium which allows one to

put forward a conjecture about the way in

which rational bidders must bid in an auction.

In the context of auctions, a strategy from

the mathematical point of view is a function

S which associates to a bidder's valuation his

corresponding bid. In other words, for any

particular valuation v, this function must specify the bid b* = S(v) which maximises his profit expectancy as calculated from the rules of

the auction, supposing that the other players

use the same strategy. That means that in a

symmetric Bayesian Nash equilibrium, if the

others bid in the same way, employing the

same strategy, this way of bidding is optimal.

Why have we used the adjective Bayesian?

Because the player calculates his profit expectancy starting from his beliefs about the valuations of the other bidders (in probability and

statistics, the Bayesian point of view - named

after Thomas Bayes,a British mathematician

of the 18th century - consists in evaluating probabilities on the basis of the available partial

information and on a priori beliefs).

When theory confirms and extends

the utility of sales methods arrived at

intuitively...

In the auction field mathematics makes it

possible to model the behaviour of bidders,

59

which leads to a prediction about their way

of bidding. That has led to progress in two

directions. On the level of positive knowledge,

it has become possible to compare the data,

i.e., the bids of the players in different types

of auctions, with those predicted by the theory.

The theory thus acquires a scientific status:

one could reject it if one finds data which

contradict the predictions; the theory is thus

refutable..

At the level of establishing standards, the

consequences have been even more important. Within the framework of the assumptions of the theory of auctions thus constructed, one could prove a rather fascinating

theorem: the revenue equivalence theorem.

Without going into the details, this theorem

shows that the first-price or second-price (the

winning bidder pays only the second-highest

price, not the highest price) sealed-bid auctions, ascending (English) or descending

(Dutch) oral auctions are equivalent for the

seller and they are, moreover, often optimal.

Thus, sales methods which were used pragmatically in particular cases have turned out

to be, in the light of theory, the optimal ways

to allocate scarce resources. Hence the new

enthusiasm for extending these methods to

all kinds of economic activities. Finally, in more

complex circumstances than the sale of a

simple object, theory makes it possible to

conceive generalisations of simple auctions in

order to optimise even more the seller's

income, or social well-being if the organiser

of the auction is a State concerned with this

aspect of things. Thanks to mathematics, it

has been possible to understand the meaning

and the importance of an ancestral practice

and thereafter to transform human intuition

into a true tool for economic development.

With the emergence of the Internet and

L’explosion des mathématiques

60

the new communication technologies, auctions have found an immense field for experimentation. The Internet offers new possibilities for this system of selling, which theory

will help to evaluate and to exploit. For

example, in an auction an anonymous seller

should a priori suffer from the asymmetry of

information - he is the only one who knows

the quality of the goods he is selling - and

would therefore manage to obtain only a very

low selling price; but by repeated sales of quality objects to a priori unknown potential

buyers, he can build a reputation little by little,

thanks to the satisfied comments of his previous buyers. The quality of the transactions

can thus be improved by creating a place

where one can build a reputation for quality

and honesty, something to which an Internet

site lends itself easily.

Jean-Jacques Laffont

Institut d’économie industrielle,

Université des sciences sociales,

Manufacture des tabacs, Toulouse

Some references:

• I. Ekeland, La théorie des jeux et ses applications

à l’économie mathématique (P.U.F., 1974)

• A. Cournot (1838), Recherche sur les principes

mathématiques de la théorie des richesses

(Calmann-Lévy, Paris, rééd. 1974).

• J. Crémer et J.-J. Laffont, « Téléphonie

mobile », Commentaire, 93, 81-92 (2001).

• L. Friedman, « A Competitive bidding strategy »,

Operations Research, 4, 104-112 (1956).

• J. Harsanyi, « Games with incomplete information

played by bayesian players », Management Science,

14, 159-182, 320-134, 486-502 (1967-1968).

• J.-J. Laffont, « Game theory and empirical economics : the case of auction data », European

Economic Review, 41, 1-35 (1997).

© Copyright 2026