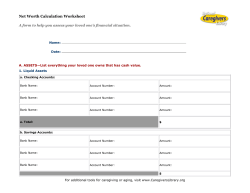

Document 180858