Monday Money Money advice if you are renting Money

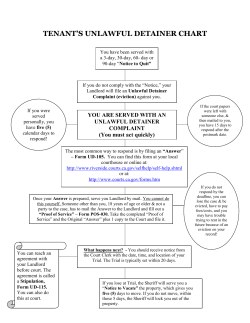

18 gloucestershireecho.co.uk Gloucestershire Echo, Monday, July 22, 2013 GEC-E01-S2 Monday Money Money Matters With TV and radio money expert Martin Lewis Money advice if you are renting IF you live in rented accommodation, you don’t need your landlord’s permission to save money. There are many things you can do to slash bills around the house. With the number of tenants rising, rents are fiercely expensive in many areas, so never has it been more crucial. Here are my top tips for renters: Renters have a right to switch and save on energy (even prepaid) If you pay the gas and electricity bill directly (not via the landlord), and it isn’t specifically banned in your tenancy agreement, you can and should compare and switch. Don’t stick with the previous tenants’ supplier, as it can be costly. Always do a meter reading as soon as you move in. You don’t need your landlord’s permission to do this. Even if your contract says you can’t switch, you may be able to challenge it. Communicate with the landlord, and get in touch with Citizens Advice for help. To find your cheapest deal, use an Ofgem Confidence Code comparison site, where you simply plug your details in and it gives you the answer. Beware joint bank accounts with flatmates Shared bank accounts for bills can mean you’re credit-linked, even if you hardly know each other. Then, when applying for products, their history can be taken into account. If it’s poor, it hits you. So keep things separate. If you used to have a joint account, but don’t any longer, apply for a notice of ‘disassociation’ to ensure you’re not still linked. Is your deposit protected? According to Shelter, a fifth of private renters don’t know if their deposit’s been protected. By law, from April 6 2007 in England and Wales most private landlords must use a Government-backed deposit protection scheme, giving you rights. Cheap contents insurance If you rent, your landlord is responsible for buildings insurance, so you only need contents cover. As for what each covers, a quick way to picture this is to think of all the stuff that’d fall if you turned your home upside down. If only you and/or your family live in the home then getting the cheapest cover is quite simple. Simple combine Confused.com and Comparethemarket.com to bag the maximum number of quotes in the minimum time. Then check aviva.co.uk and Directline.com, which they miss. How to improve the returns on savings My Money THE value of savings are being steadily eroded warns James Swaby, an international investment specialist with Cheltenham-based wealth management firm, Attivo Group. Interest rates have been at an historic low of 0.5 per cent for over four years, with inflation quietly eroding the purchasing value of deposit account savings. If people continue to sit on their hands then someday they’ll get a nasty shock when they realise how much value has been drained away in real terms, by which time it could be too late to rectify. I think it’s an important period now, for all investors to take time to reflect on what they require from their savings and investments, which have usually taken years to accumulate. They also need to consider the benefits of adding shares or bonds of companies who receive their revenues internationally, not just from the UK. That doesn’t necessarily mean looking for companies no one has heard of listed on exotic stock exchanges, some of the best run international companies are based right here on our doorstep in the UK. Investors must adopt a global perspective to maximise the returns on their portfolio. His tips to all investors, regardless of their age, or the size of their portfolio: ■ Don’t put all your eggs in one basket, spread your risk by including different assets such as bonds and shares. ■ Include exposure to developed markets overseas such as the US and emerging markets like Asia and Latin America. ■ Reinvesting dividends forms a ■ ADVICE: James Swaby, an international investment specialist with Attivo Group. strong part of your overall return. For example, if you invested £10,000 ten years ago in the FTSE 100, the UK’s leading index of shares, and spent the dividends, your money would have grown to just under £15,000. But had you reinvested those dividends your money would have grown to £22,700. Apps service extended MOBILE ‘instant messaging’ apps are already more popular than traditional texts – but interest is set to soar higher with BlackBerry expanding its service for smartphones. BlackBerry Messenger is one of the most popular apps but until now was confined to users with BlackBerry phones. It is extending the free service to iPhone and Android. Instant messaging apps such as BBM and the even more popular WhatsApp appeal to smartphone users who can download the software from the internet. It is important to bear in mind that the capital would have fluctuated considerably in that time and so would the income but it is not such a bad result considering half of that period includes the worst financial crisis since the Great Depression of the 1930s. Remember that investing in anything other than cash should be viewed as long term. James worked in the high-growth region of South East Asia, before returning to the UK, and joining Attivo. He is now an investment manager and a member of his organisation’s investment committee. Switch and save Subaru’s safe drivers THE average bill is at a record £1,352 a year, compared to £819 just five years ago. Switching energy provider can save you up to £310 a year, according to Energyhelpline.com. However, this level of saving is only likely if you’ve never switched and are not signed up to a duel fuel, online tariff paying by direct debit. If you already do this then the saving will be much smaller. OWNERS of a Subaru have helped shake-off their ‘boy racer’ tag as drivers of the Japanese brand are the least likely to make a claim for an ‘at fault’ accident on their car insurance, research has found But fellow motorists might want to avoid any Seat drivers in Watford, with the Spanish car maker and Hertfordshire town topping the league of shame for claims by manufacturer and location, respectively. gloucestershireecho.co.uk GEC-E01-S2 Gloucestershire Echo, Monday, July 22, 2013 19 Monday Money Students urged to get advice to manage finances PARENTS in Gloucestershire are being urged to speak to their children about looking after their money as more than 4,000 people in the county are expected to leave for university this summer. Financial education charity pfeg (Personal Finance Education Group) is encouraging parents to “seize this last chance” to discuss with their sons and daughters how they will manage their student finances, in a bid to prevent them falling into financial difficulty. Around 4,005 people in the county’s local authority unitary areas accepted university places last September, according to information obtained from Cheltenham-based university admissions service UCAS, with new official figures suggesting a three percent rise in applications in England this year. This includes 650 in Gloucester, 735 in Cheltenham, 555 in the Cotswolds, 480 in Tewkesbury, 735 in Stroud and 425 in the Forest of Dean. Next year, it is estimated 670 in Gloucester, 757 in Cheltenham, 572 in the Cotswolds, 494 in Tewkesbury, 757 in Stroud and 438 in the Forest of Dean will apply. Anna Hay, head of Student Advice and Guidance at the University of ■ SHOULD IT BE THE PARENT’S RESPONSIBILITY? Former student Niall Mann. My Money Gloucestershire, said the university was committed to supporting students through its Money Advice Team. She said: “We can help them explore bursaries, loans and grants and offer information on how to find work and how to budget. Our student finance advisers offer confidential and free advice on everything from fees to Access to Learning Funds, benefits advice and emergency funding.” Niall Mann, who recently graduated from the University of Gloucestershire, said more support could be given but questioned whether it ought to be the responsibility of parents to help students manage their money. But pfeg, which offers free financial education resources and support to schools in Gloucestershire, said that parents had a “key role to play” in teaching their children about how to manage their money at university. Tracey Bleakley, pfeg chief executive, said: Probe into legal cover UNWITTING motorists are forking out for cover they wrongly believe will pay all their legal fees if they are involved in a crash. So-called motor legal expenses cover is a huge money-spinner for insurers, who typically rake in an estimated £17 to £21 for it from each policy they sell. Nearly half of all motorists take it out — many believing it will save them from big bills if they are sued or taken to court if they have a crash. The Financial Conduct Authority has launched a probe into how the cover is sold. “It is really important that parents in Gloucestershire seize this last chance to sit down with their children before they go off to university and help them think ahead to how they are going to manage their student finances. “For most new students, university is the first time they will have managed their own money – and it’s crucial that they know how to make their first student loan last the entire term. “In the longer term, we need to ensure that financial education is taught in all schools in Gloucestershire and across the UK, to equip school leavers with the skills they need to manage their money as they enter adult life.” Five top tips from pfeg for Gloucestershire’s university-goers 1. Budget your student loan payments: It can be all too easy to blow your first student loan Flight delays claims A LANDMARK ruling opened the doors for travellers who have holidays or business trips hit by long flight delays to claim compensation. Last October the European Court of Justice ruled that delays, caused by events such as lack of flight crew or even technical faults, merited compensation. However, while passengers have been able to make claims against airlines, the rule had not been implemented legally until earlier this year. instalment in the first few weeks of term. Make sure you plan ahead. 2. Prioritise your spending: Once you know how much you have coming in and what you will need to pay for, it is crucial to prioritise your expenditure. 3. Don’t get trapped by problem debt: It might seem tempting to take out a loan or use an overdraft if you find yourself short of funds before the end of term, but be extremely careful about any borrowing you do as a student. 4. Get the best deals: Be a savvy student! There are lots of offers out there if you take the time to look, compare prices and find the best deal for you. 5. Seek free advice: If you need help with managing your money or you are worried you are getting into difficulty, don’t hesitate to seek free advice. All universities have Student Money Advisors who are there to help. Bankruptcy down 27% IMPROVED fortunes for young couples and families have been the driving force behind the fall in personal insolvencies since the turn of the year, according to credit reference agency Experian. The first three months of 2013 saw the number of people going bust fall to its lowest level in five years with Insolvency Service figures earlier in the week showing bankruptcy dropped by 27 per cent compared to 2012. Lifestyle pension funds concern CONCERNS have been rising about the effectiveness of ‘lifestyled’ pension schemes, which move the bulk of pension pot investments from more volatile equities into the supposed safe haven of bonds, the closer a person gets to retirement to safeguard the value. The value of lifestyle pension funds invested in bonds are estimated to have fallen by five per cent since the beginning of May, so do those approaching retirement with lifestyled pots need to act, and what are the options? As the value of government bonds – known as gilts – fall, annuity rates should rise as the yield on these bonds should increase. But annuity rates are not informed by gilt yields alone and insurers are notoriously slow at passing on yield rises to customers – much in the same way petrol stations treat drivers. Nonetheless, those whose investments have suffered from a fall in bond prices should make it back up when they come to buy an annuity – even if the recent fall in bond values hasn’t yet been followed by a marked rise in annuity rates. Who might this strategy not be right for? Around 90 per cent of defined contribution pension holders are estimated to buy annuities that provide level incomes with their pension pot, but that still leaves a good portion who don’t. In particular, those who are leaving their pension pot invested in retirement – whether through income drawdown or via an investment-linked annuity – have little to gain from shifting their pension savings into bonds as they near retirement. What are the alternatives if you don’t fancy bonds? Those considering switching out of lifestyling should get in touch with the trustees or insurer who run their workplace pension scheme. In terms of where to invest instead, the safest bet to ensure the amount in your pot doesn’t go down would be to invest a portion of your money in cash. Whatever you do, nothing is without risk Although bonds have taken a bit of a beating over the last couple of months, it still comes after years of unprecedented rises as a result of economic stimulus measures. The bursting of the bond bubble remains uncertain for now, and other investments are not risk-free either – even saving in cash will leave you vulnerable to inflation. For more, visit ThisisMoney.co.uk. Savings raided for hols SUMMER savings are being raided to pay for holidays and weekend breaks, with the average amount withdrawn from savings accounts standing at more than double the average amount deposited, according to a bank review. More than three quarters of people (77 per cent) managed to save something over the last three months, putting away an average of £829, Halifax research shows. However, over a third of people (35 per cent) have raided their savings over the same period, taking out an average of £1,824.

© Copyright 2026