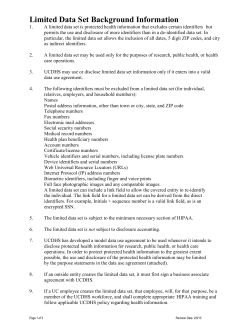

HOW TO OPEN AN ACCOUNT WITH KEYTRADE BANK?

LEGAL ENTITY UNDER BELGIAN LAW1 HOW TO OPEN AN ACCOUNT WITH KEYTRADE BANK? 1. Read the General Terms and Conditions of Keytrade Bank carefully. 2. Complete and sign this ‘Banking relationship application form’. Please answer all the questions. We cannot treat your request if you did not answer all the questions. All data are processed in a confidential way. 3. Return it to us or deposit it in our agency together with a copy of: • the latest coordinated version of the articles of association or the up to date articles of association filed with the Trade Register or published in the Appendixes of the Belgian State Gazette; and • the latest publication in the Appendixes of the Belgian State Gazette of the appointment of the directors or any other document allowing to establish their quality of directors (such as any publication in the Appendixes of the Belgian State Gazette which mentions these persons as directors, or the annual reports filed with the National Bank of Belgium); and • the latest publication of representation power of the mandatory (ies) of the legal entity (deed of appointment of managing director, manager, decision of the board of directors, …) in the Appendixes of the Belgian State Gazette or any other document, such as a proxy of the competent body of the legal entity in favour of the mandatory (ies); and • ID card or passport of the mandatory (ies) AND the economic beneficial entitled owners (see point 3 of the form) of the legal entity: - The copy (both sides, black and white, A4 form) of the ID card or passport of every participant is readable and the photo is clear and recognizable - The validity date of the ID card or passport has not expired. - The addresses and signatures appearing on this application form are the same as the addresses and signatures appearing on the ID card or passport. - If it is an electronic ID card or if the address does not appear on your ID card or passport, please join a copy of another official document on which appears your address (Proof of residence, tax letter, original vignette of mutual insurance company, gas/water/electricity/phone bill, …) Associations without legal form, investment clubs, joint ownerships (including the civil companies without legal personality) and co-ownerships are invited to download a specific application form, available in the Document Centre on www.keytradebank.com. Keytrade Bank sa Bld du Souverain 100 B-1170 Bruxelles - Belgique Tél. + 32(0)2/679 90 00 Fax + 32(0)2/679 90 01 Within a couple of days upon receipt of the application form, and after approval of this, each mandatory will receive: • A user name (logon) sent to the legal address as notified in the present document. • For security reasons, the access password and confirmation code will be sent by separate mail to the same address. [email protected] www.keytradebank.com BIC KEYTBEBB TVA BE 0464.034.340 RPM Brussels FSMA 14 357 (1) Is a legal entity: the 'NV/SA', the 'BVBA/SPRL', the 'SPRLU/EBVBA', the 'VOF/SNC', the 'GCV/SCS', the 'CVBA/SCRL', the 'CVOA/SCRI', the 'VSO/SFS', the 'Comm.VA/SCA', the SE, the agricultural company, the civil company in commercial form, the "ESV/GIE", the 'EESV/GEIE' and the VZW/ASBL. Language : EN NL FR 1. LEGAL FORM AND DENOMINATION (to be completed using capital letters only) Company name Legal form Nationality Sector of activity Description of the activity NACE code Enterprise nr / VAT nr Registered office: Place of business (addressee of Keytrade Bank post) Street Nr Box Postcode City Country Telephone Fax Website Postcode City Country Telephone Fax Street Nr Box 2. MANDATORY (IES) (to be completed using capital letters only) MANDATORY 1 Mr. Mrs. Miss MANDATORY 2 Mr. Mrs. Miss Last Name First Name Single Divorced Civil status Married Separated Widowed Cohabiting Single Divorced Married Separated Last name and first name spouse: Last name and first name spouse: Street Street Widowed Cohabiting Function within the legal entity Legal address Nr Box Nr Box Postcode City Postcode City employee liberal profession retired Sector: worker executive official unemployed no profession Private telephone / mobile Office telephone Fax E-mail address Date and place of birth, Nationality ID / passport nr expires National nr Profession / activity Any revocation of mandate must be addressed to Keytrade Bank by post. independent student employee liberal profession retired Sector: worker official no profession executive unemployed independent student 3. ECONOMIC BENEFICIAL OWNERS (to be completed using capital letters only) The law of 11 January 1993 on preventing use of the financial system for purposes of laundering money and terrorism financing requires from the banks to identify the economic beneficial owners of their clients. Are regarded as economical entitled party, within the meaning of the law, the individuals who controls the company, in right or in fact, directly or indirectly, together with the directors of this company even if they are not allowed to represent the company in its relations with Keytrade Bank. If it turns out that an economic beneficial owner is a listed company, it is enough to mention its name, its registered office and the stock exchange of quotation. The mandatory (ies) before identified declare that the economical entitled parties of the legal entity are: Name First Name Name of the company Address of registered office Address Profession Stock exchange of quotation (if applicable) For each entitled party - individual, please join a copy of both sides and in black and white of the identity papers. If the identity papers do not mention the address, please join a copy of another document on which the residence is clearly mentioned (Proof of residence, tax letter, original vignette of mutual insurance company, gas/water/electricity/phone bill, …). If one economic beneficial owner is a “US person”, it is unfortunately impossible to open an account with Keytrade Bank.A “US person” is somebody who has the American nationality and/or resides or resided recently in the United States. The mandatory (ies) before identified commit himself irrevocably to notify Keytrade Bank, in writing and without any delay, any modification in the list of economic beneficial owners of this legal entity and to give a copy of the identity papers to identity the new economic beneficial owner. Keytrade Bank reserves the right to end without allowance nor notice any relation with the legal entity if it were to prove that she was not informed of a modification in the list of economic beneficial owner. 4. POLITICALLY EXPOSED PERSONS (to be completed using capital letters only) Is there among the shareholders, the active or not active leaders of the legal entity, a person who does / did exercise a political mandate or a public office on regional level, national or international level (1)? yes no If yes, please specify: - name and first name of the person: - exact title of the mandate or function: Description and role of the mandate / function: Date of the beginning of the function: Date of the end of the function: (1) As a Head of State, minister, member of Parliament, president of a political party represented within a government, senior official of the State (judicial power or executive - including the army), manager of public undertaking of national importance, high political leader or senior official for international or supranational organizations, such as the European Union, North Atlantic Treaty Organization or United Nations Organization 5. BANKER’S CARDS (only valid for Belgian residents) The card Bancontact / Mister Cash - Proton - Maestro is FREE. I want a banker’s card MANDATORY 1 MANDATORY 2 The Pin code and card will always be sent to the legal address of the mandatory (ies). If you choose a banker’s card by signing this document you declare having read and accepted the General Terms and Conditions of our banker’s cards, available in the Document Centre on our site www.keytradebank.com. For the request of American Express card, please fill in the specific application form. You can download this form on www.keytradebank.com, click on “Banking” and then on “Banker’s cards”. 6. MARKETING Where did you hear from Keytrade Bank? press – publicity radio television internet event word-of-mouth mailing Do you wish to be kept informed about the promotions, new services and products of Keytrade Bank? yes no 7. DECLARATIONS AND SIGNATURES Exemption from Belgian withholding tax and tax on stock exchange transactions The undersigned declare(s) for the legal entity: that the registered office is established in Belgium (and is thus not entitled to the exemption); that the registered office of the legal entity is not established in Belgium. Declaration related to the American taxation Signature on the form W-8BEN as required by the IRS permits Keytrade Bank to assure the American corporations, that the holder or economic beneficial owner is not an American entity, a U.S. resident, or persons subject to any possible recovery of favourable treatment relating to withholding tax on dividends derived from American origin. The undersigned hereby declare(s), on behalf of the legal entity, that the undersigned is aware that failure on the part of the parties economically entitled to the account to sign the ad hoc form in due and proper manner will prevent any possible recovery of American advance levy on income derived from securities withheld at source on dividends from American securities and interest income. The undersigned furthermore certifies/certify: - that the assets to be deposited in the account arise from a legal activity and that the above-mentioned accounts shall not be used for money laundering, - that the information appearing on the present document is complete, correct and truthful, - to have received and read the General Terms and Conditions and the Characteristics and essential risks of financial instruments, which he (they) will respect and accept in all their clauses, - to assume the responsibility for all the risks related to the orders which will be transmitted to Keytrade Bank, being understood that Keytrade Bank could not be held responsible for the investment decisions and the financial consequences of the orders, - to act in name of the legal entity, and if not, to declare to Keytrade Bank the identity of the third party on behalf of which he (they) is (are) acting, - to commit himself to announce immediately any modification to one of the provided information that this declaration can be transmitted to any competent authority. If you have a PROMO CODE , fill it in here: Read and approved Date and signature of MANDATORY 1 Read and approved Date and signature of MANDATORY 2 DID YOU ANSWER ALL THE QUESTIONS AND JOINED ALL THE NECESSARY DOCUMENTS? YOUR REQUEST CAN ONLY BE TREATED IF YOUR APPLICATION FORM IS COMPLETE. Data of a personal nature collected in this document will be processed by Keytrade Bank for account management purposes, operations management, the management of contractual relations, commercial canvassing, and direct marketing in relation to banking, financial and insurance products, or other products promoted by Keytrade Bank. Your data can also be used for marketing products and services offered by third parties, however these data will not be communicated to these third parties. Information related to the collection, recording and processing of your data even as your right to object are indicated in the article 17 of the General Terms and Conditions of Keytrade Bank. Form W-8BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding (Rev. February 2006) Department of the Treasury Internal Revenue Service OMB No. 1545-1621 Section references are to the Internal Revenue Code. See separate instructions. Give this form to the withholding agent or payer. Do not send to the IRS. Do not use this form for: A U.S. citizen or other U.S. person, including a resident alien individual A person claiming that income is effectively connected with the conduct of a trade or business in the United States A foreign partnership, a foreign simple trust, or a foreign grantor trust (see instructions for exceptions) A foreign government, international organization, foreign central bank of issue, foreign tax-exempt organization, foreign private foundation, or government of a U.S. possession that received effectively connected income or that is claiming the applicability of section(s) 115(2), 501(c), 892, 895, or 1443(b) (see instructions) Note: These entities should use Form W-8BEN if they are claiming treaty benefits or are providing the form only to claim they are a foreign person exempt from backup withholding. A person acting as an intermediary Note: See instructions for additional exceptions. W-8ECI W-8ECI or W-8IMY W-8ECI or W-8EXP W-8IMY Identification of Beneficial Owner (See instructions.) Part I 1 Name of individual or organization that is the beneficial owner 3 Type of beneficial owner: G ra ntor trus t Central bank of issue 2 Country of incorporation or organization Individua l C orpora tion Disregarded entity P a rtne rs hip Complex trust E s ta te Government International organization Tax-exempt organization Private foundation S imple trus t Permanent residence address (street, apt. or suite no., or rural route). Do not use a P.O. box or in-care-of address. 4 C ity or town, s ta te or provinc e . Inc lude pos ta l c ode whe re a ppropria te . 5 C ountry (do not a bbre via te ) Mailing address (if different from above) C ity or town, s ta te or provinc e . Inc lude pos ta l c ode whe re a ppropria te . 6 U . S . ta x pa ye r ide ntific a tion numbe r, if re quire d (s e e ins truc tions ) 8 Reference number(s) (see instructions) SSN or ITIN C ountry (do not a bbre via te ) 7 F ore ign ta x ide ntifying numbe r, if a ny (optiona l) EIN Claim of Tax Treaty Benefits (if applicable) Part II I certify that (check all that apply): 9 10 Instead, use Form: W-9 a The beneficial owner is a resident of b If required, the U.S. taxpayer identification number is stated on line 6 (see instructions). within the meaning of the income tax treaty between the United States and that country. c The beneficial owner is not an individual, derives the item (or items) of income for which the treaty benefits are claimed, and, if applicable, meets the requirements of the treaty provision dealing with limitation on benefits (see instructions). d The beneficial owner is not an individual, is claiming treaty benefits for dividends received from a foreign corporation or interest from a U.S. trade or business of a foreign corporation, and meets qualified resident status (see instructions). e The beneficial owner is related to the person obligated to pay the income within the meaning of section 267(b) or 707(b), and will file Form 8833 if the amount subject to withholding received during a calendar year exceeds, in the aggregate, $500,000. Special rates and conditions (if applicable—see instructions): The beneficial owner is claiming the provisions of Article of the treaty identified on line 9a above to claim a % rate of withholding on (specify type of income): Explain the reasons the beneficial owner meets the terms of the treaty article: Notional Principal Contracts Part III 11 . I have provided or will provide a statement that identifies those notional principal contracts from which the income is not effectively connected with the conduct of a trade or business in the United States. I agree to update this statement as required. Part IV Certification Under penalties of perjury, I declare that I have examined the information on this form and to the best of my knowledge and belief it is true, correct, and complete. I further certify under penalties of perjury that: 1 I am the beneficial owner (or am authorized to sign for the beneficial owner) of all the income to which this form relates, 2 The beneficial owner is not a U.S. person, 3 The income to which this form relates is (a) not effectively connected with the conduct of a trade or business in the United States, (b) effectively connected but is not subject to tax under an income tax treaty, or (c) the partner’s share of a partnership’s effectively connected income, and 4 For broker transactions or barter exchanges, the beneficial owner is an exempt foreign person as defined in the instructions. Furthermore, I authorize this form to be provided to any withholding agent that has control, receipt, or custody of the income of which I am the beneficial owner or any withholding agent that can disburse or make payments of the income of which I am the beneficial owner. Sign Here Signature of beneficial owner (or individual authorized to sign for beneficial owner) For Paperwork Reduction Act Notice, see separate instructions. Date (MM-DD-YYYY) Cat. No. 25047Z Printed on Recycled Paper Capacity in which acting Form W-8BEN (Rev. 2-2006) DECLARATION BENEFICIAIRE(S) EFFECTIF(S) Numéro d'entreprise B Adresse du siège social D Qualité de bénéficaire effectif 3 Bourse de la cotation Profession Si applicable, bourse de la cotation Diverses réglementations dont la loi anti-blanchiment impose aux banques l'obligation d'identifier le(s) bénéficiaire(s) effectif(s) des comptes ouverts au nom des personnes morales. Le document en annexe donne plus d'informations à ce sujet. Le(s) soussigné(s) Qualité1 Nom et prénom Signature A C A B C D agissant en qualité de représentant(s) de Dénomination du client Adresse du siège social Déclare(nt) qu'à la date du …../…../20…. le(s) bénéficiaire(s) effectif(s) est(sont) les personnes physiques suivantes: Date de Lieu de Adresse du domicile naissance naissance (rue, numéro, commune, éventuellement pays) Nom et prénom 2 … ou que le bénéficiaire effectif est la société cotée suivante: Nom de la société Indiquez la fonction exacte des personnes qui ont pouvoir de représenter la personne morale (administrateur, président, gérant, …). Veuillez joindre une copie recto-verso de la carte d'identité ou d'une autre preuve d'identité (passeport), si la personne concernée n'est pas belge. Veuillez ajouter une preuve d'adresse si elle n'est pas renseignée sur le document d'identité. Indiquez la qualité du bénéficiaire effectif (actionnaire, administrateur, …). Le client confirme que toutes les informations communiquées sont exactes et correctes et s'engage irrévocablement à informer la banque, par écrit et immédiatement, de tout changement à la liste de(s) bénéficiaire(s) effectif(s) et à lui faire parvenir copie des pièces d'identité des nouveaux bénéficiaires effectifs. La banque se réserve le droit de cesser la relation avec le client, sans mise en demeure préalable ni indemnisation, s'il apparait qu'elle n'a pas été avertie d'un changement dans la liste des bénéficiaires effectifs. Dans ce cas le client sera averti par courrier ordinaire. 1 2 3

© Copyright 2026