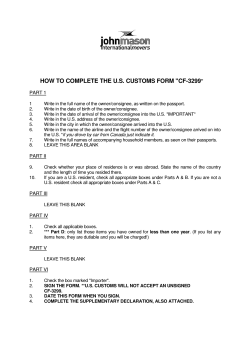

Importation of Commercial Samples What Every Member of the