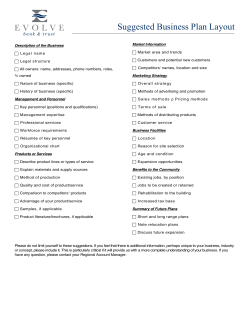

Courtesy of CFO Capital Partners.com