J (COVER STORY )

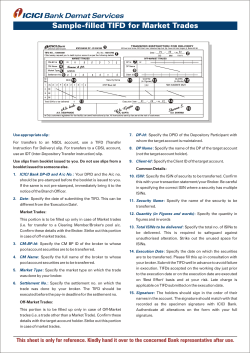

(COVER STORY ) How to (Almost Painlessly) Shop for Business Insurance in the Groundwater Industry Looking for a new policy? Here’s advice on the best strategies for finding the perfect fit for you. By Jill Ross J ust like paying taxes, purchasing insurance is a necessity for most businesses. But wouldn’t it be nice if the process could be as painless as possible? If you arm yourself with the right information and team up with the right people, it can be. Here’s what you need to know before you shop your business policy. Find Someone Who Will Go to Bat for You When it comes to buying insurance, it’s important to have someone on your side who can help you identify the best insurance carriers in the water well inJill Ross is a former editor of Water Well Journal and worked for the National Ground Water Association from 1996 to 2004. Today, she does freelance work from home. She can be reached at [email protected]. NGWA.org dustry, get multiple quotes, maneuver the load of paperwork, and translate the industry jargon common in the contracts. Most likely, this person will be an independent insurance broker. “Unlike an agent (who typically represents one carrier), a broker is independent and is able to represent many different carriers,” explains Tim Sullivan, program administrator for the WellGuard insurance program, which is administered by Willis. Theoretically, this means brokers are usually able to find the best coverage for their clients at the lowest price. However, if a contractor is currently with an agent and is comfortable, that doesn’t always mean it’s a good idea to dump them. “Insurance agents and brokers are like auto mechanics and doctors,” Sullivan says. “If you trust someone, don’t get rid of them for price.” Jason Oswald, an underwriting director for CNA’s program for contractors, agrees. “It all starts with the agent,” he says. “It’s a personal relationship and is someone you should trust.” Agents can still be a good fit for smaller “mom and pop” companies that don’t need a lot of specialized coverage. Also, good agents will often find the best coverage for their clients, even if it is with another carrier. This can be the case in Michigan, explains Jessica Van Sookema, vice president of marketing with VanWyk Risk and Financial Services, an independent insurance agency located in Grand Rapids. The agency has developed a program with the Michigan Ground Water Association that is underwritten by Secura. However, she explains, the program is “open,” which means that a new client can still go through their existing agent and get coverage. So, if you are interested in a new program you’ve heard about, but don’t want to leave your agent, ask your agent if they would be able to obtain a quote for you. BUSINESS INSURANCE/continues on page 22 Water Well Journal March 2010 21/ BUSINESS INSURANCE/from page 21 But, what if you feel you’ve outgrown your current coverage or your current agent, or are dissatisfied with their service? There are a few ways to locate a new broker, according to the experts. Go to the Yellow Pages. Look up insurance brokers and check out the listings. Check to see if they belong to a professional insurance association, and see how many insurance companies they represent. “In this case, the more the better,” Sullivan explains. Check with your professional association. Many groundwater associations offer group insurance plans to their members, which can save you money on rates. “You’ll never get as good a rate as an individual as a group will get,” explains Steve Bleizeffer, program administrator for Lackner McLennan Insurance Ltd. “Go to someone who knows the industry—who understands what you do.” Go online. You can look up and find an independent broker in your area at www.iiaba.net, the Independent Insurers Agents and Brokers of America. Also, many insurance carriers feature agent lookup tools on their individual Web sites. Ask for referrals. Ask people in the same line of work if they are satisfied with the service, coverage, and premium provided by their insurance carrier. If you don’t know anyone else to ask, call your state or national association and ask for a recommendation. In many cases, it makes sense to have at least two brokers—one who specializes in property and casualty, and the other who understands the ins and outs of employee benefits, especially health care. In some cases, you may want to keep your personal policies (home and auto) with an agent, except when it makes sense to combine them for a potential discount. However, you will want to decide on one business insurance agent or broker before you start shopping your policy. “Don’t call five or six brokers who are going to knock on all the same doors,” Bleizeffer cautions. Get the Right Coverage The water well drilling industry is a unique industry with unique insurance 22/ March 2010 Water Well Journal needs, and as such, a handful of specialized programs have sprung into existence across the nation since the early 1990s. The WellGuard program, administered by Willis and underwritten by The Hartford, has worked in partnership with the National Ground Water Association since 1998 to provide a program that is tailor-made for the groundwater contracting business. This program, along with several other regional and national insurers, has identified several areas of coverage that water well drillers may want to look for when shopping for a new policy. Program highlights to look for can include but are not limited to: ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● ● Down the hole coverage Drill rig floater (covers the tools and equipment not permanently installed on the rig or service vehicles) Equipment deductive waiver for antitheft devices, such as LoJack and National Equipment Register Environmental impairment/pollution liability Flow break-out (containment cost and property damage) Inland marine coverage for drilling rigs Ice/muskeg/soft soil coverage International coverage Loss of use/loss of income coverage Key person coverage Rental reimbursement on equipment Replacement coverage Contract surety bonds Theft Transportation of pollutants Umbrella coverage Dividend/reward programs. Keep in mind, however, that none of these coverages are required to operate in the groundwater industry. “By law, a business owner only needs to carry workers’ compensation insurance and vehicle insurance,” Sullivan says. “In addition, if a building or piece of equipment is financed, the lien holder may require that they also be insured.” If you rent, he adds, the landlord may also require property insurance. Ideally, the insurance policy for your company will land somewhere in the middle between the most basic type of insurance and the most exotic type, depending on the size and nature of your business. So, where is your happy medium? That’s something a good broker will be able to help you figure out. The Next Step: Shopping Your Policy Once you’ve decided on a broker you feel comfortable with, they will take your information to the companies they represent and obtain quotes for you— ideally, at least three. Before you ask for a new quote, however, there are a few things you can do to make the process go more smoothly. “Companies are entitled to get a document called a loss run report from their carrier,” Sullivan says. “Get one every year.” A loss run is a report from an insurance company showing claims you had for a particular policy. It should show the policy number, effective dates, and list a claim number, amount paid, amount reserved, and amount incurred for each claim. It should also show the premium paid for the policy. Also, know your loss ratio, Sullivan advises. It’s the percentage of claim paid over premium. If it’s under 100%, that’s good. If it’s over 100%, on the other hand, that means the insurance company has lost money on you. “If you’re going to shop policies, make sure all your information is in order and provide all information up front,” Oswald advises. In other words, don’t try to withhold any potentially negative information. The insurer will find out. According to the free guide NetQuote Guide to Business Insurance (available at www.netquote.com, an online insurance aggregator service), other documents to gather before you shop a policy include: ● ● Company overview. How many years you have been in business, your projected and current gross annual receipts, and the number and nature of employees. Your address and building specifications. Is your business run from a home or a commercial location? If it’s a commercial location, know the total customer area, the age of the building, and what types of tenants occupy the building. NGWA.org ● ● ● Business vehicles. If you have mobile service vehicles, you will need the names, Social Security numbers, driver’s license numbers, and the VIN numbers from each vehicle. The nature of your business. Chemical storage. If you use chemicals, some carriers will want to know where the supplies are stored. Most insurance policies are written for one year. So how often should you ask your broker to shop for a new rate? “My advice is to get a quote no more often than every three years,” Sullivan recommends. The reason? It’s expensive to write quotes—an insurance company can spend up to $1000 writing a single quote, especially if they send a representative out to a job site to check on the company. If your company continually requests new quotes from an insurance company, but never purchases, you risk getting a reputation as a “shopper”—that is, someone who looks but never buys. Eventually, the insurance company may decline to invest the time and money to write you a new quote. operations that are likely to cause a liability claim. Some companies may offer a discount for using the losscontrol service. You can also look for programs that offer dividends, or “rebates” that reward a company’s good claim history. “If you have good workers’ comp experience, your company might be eligible for a dividend that’s tied to their individual policy,” explains Paul Quirk, sales executive for Capital Bauer, a company offering a well drillers’ insur- ance program in the Northeast and the New England region. If you are finding it hard to keep up with payments, check about available payment plans and look into any discounts given for lump payments, Van Sookema advises. In the end, not all insurance brokers and policies are created equal, and it’s up to you to look out for No. 1. Van Sookema sums it up: “Choose a company and a broker that you believe will serve your best interests.” WWJ Controlling Costs If you don’t want to sacrifice the quality of your coverage but want to keep costs down, the NetQuote Guide to Business Insurance suggests the following steps: ● ● ● ● ● Obtain quotes from at least three companies. Talk with the insurance company about flexibility. Some companies may be more willing than others to tailor your policy to help control costs. Ask about discounts for multiple policies. Remember the old insurance adage: The more risk you assume, the less premium you pay. (Be careful, however, not to raise deductibles to a level you can’t afford to pay.) The best way for every type of business to save on general liability insurance is to maintain a favorable loss history. This means filing few or no claims. Ask if your insurance company provides loss-control services. This service may help you identify areas of your premises or NGWA.org Water Well Journal March 2010 23/

© Copyright 2026