Program Income Reporting: What You Need To Know Coordinator’s Life Easier!”

Program Income Reporting:

What You Need To Know

Or “How to Make Your Regional

Coordinator’s Life Easier!”

Karen Droze, MS

Regional Coordinator, Region IV-South

The Hemophilia Alliance

Membership Meeting, Pre-Conference

October 1, 2008

Baltimore Marriott Waterfront

Goals of Presentation

Provide brief background of 340B Program

Define Program Income

Overview Program Income Reporting

Provide Samples of Reporting

Discuss Appropriate Uses of Program Income

Address MCHB and Grant Requirements

Question/Answer

Overview of 340B Program

340B Drug Pricing Program – PL 102-585,

Veterans Health Care Act of 1992

(aka Section 340B of the Public Health Service Act)

Limits the cost of covered outpatient drugs to certain

federal grantees, federally-qualified health center

look-alikes and qualified disproportionate share

hospitals.

Significant saving on pharmaceuticals may be

What This Means in Plain Language

Section 340B requires drug manufacturers to

provide outpatient drugs to eligible health

care centers, clinics and hospitals (termed

“covered entities”) at a reduced price

The 340B price is a “ceiling price,” meaning it

is the highest price the covered entity would

have to pay for select outpatient and OTC

drugs and minimum savings the manufacturer

must provide

- The PHS Section 340B Drug Pricing Program In Basic Language, Katheryne

Richardson, Pharm.D. (2002)

Examples of Covered Entities

(not an exhaustive list)

Federally-qualified health centers (e.g., Migrant)

Disproportionate share hospitals (DSH)

Comprehensive hemophilia diagnostic treatment

centers (receiving grant $ under section 501 of SSA)

Grantees under Part C of Ryan White

State-operated AIDS Drug Assistance (ADAP)

Black lung clinics

Urban Indian organizations

Native Hawaiian Health Center

HTCs as Covered Entities

Via Federal Maternal Child Health Bureau

(MCHB) funds

Other HTCs exist, but if not federally-funded –

NOT covered as 340B entity

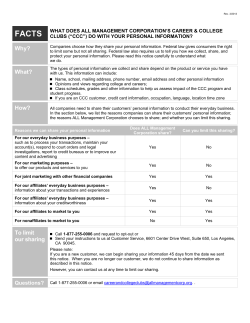

Program Income Definitions

DHS Definition: “Program Income means gross

income earned by the recipient that is directly

generated by a supported activity or earned as a

result of the award”

- 45 CFR 74 (Code of Federal Regulations)

Further, “Costs incident to the generation of program

income may be deducted from gross income to

determine program income, provided these costs

have not been charged to the award”

- 45 CFR 74.24(f)

This results in a net number

Stipulations for Calculating

Administrative Costs

Per MCHB, it is inappropriate to use Factor

Replacement Product (FRP) Costs as part of a

methodology for determining FRP Sales Program

Administrative Costs

The June 17, 2003 Office of Inspector General’s

(OIG) Report “Review of Hemophilia Treatment

Centers’ Disposition of Program Income and Patient

Choice for Factor Provider for Calendar Year 2000

(A-03-01-00350),” stated that “the cost of a drug does

not drive the administrative costs of operating a

pharmacy.”

The Health Resources and Services Administration

(HRSA) concurred with the recommendations

presented in the OIG’s Report

General Calculation

+ Total Revenues

- Less Factor Cost

- Less Contractual Fees, if applicable

- Less Total Pharmacy Operating Costs

- Less Indirects (may be based on:

All/portion of Operating Costs,

Medicare cost report step down, e.g. hospitals,

Various methodologies)

= Net Program Income

General Calculation

+ Total Revenues

- Less Factor Cost

- Less Contractual Fees, if applicable

- Less Total Pharmacy Operating Costs

- Less Indirects (may be based on:

All/portion of Operating Costs,

Medicare cost report step down, e.g. hospitals,

Various methodologies)

= Net Program Income

Pharmacy Operating Costs

Can include:

Pharmacy personnel (on staff or contracted)

Personnel fringe (health/retirement)

Office supplies

Medical supplies

Equipment maintenance and repair

Shipping

IT (consulting, hardware, support)

Insurance (liability, worker’s comp, licenses)

General Calculation

+ Total Revenues

- Less Factor Cost

- Less Contractual Fees, if applicable

- Less Total Pharmacy Operating Costs

- Less Indirects (may be based on:

All/portion of Operating Costs,

Medicare cost report step down, e.g. hospitals,

Various methodologies)

= Net Program Income

Indirect Cost (Overhead) Calculations

Various methodologies apply

May be based on percentage of all/portion operating expenses

May be institutionally driven

Medicare cost report step down, e.g. hospitals

MCHB suggests same indirect cost rate as the

grant (e.g., 8%) versus your institution’s

negotiated indirect cost rate

NO written PHS policy to support this currently.

However, many institutions have this

requirement as part of their program income

policy.

Check with your institution regarding PI policy

Calculation Example #1

Total 340B Factor Sales

Less 340B Factor Cost

Less Direct Pharmacy Cost

Less Indirect Cost Allocation@8%

Program Income

$1,000,000

$ 800,000

$ 40,000

$

3,200

$ 156,800

Determining Allowability For Use

Of Federal Funds

Reasonableness (including necessity)

Allocable to grant goals and objectives

Allowable under the Cost Principles

- “Understanding HRSA Grants Management Requirements,”

Helen Harpold, Health Resources Services Administration (June, 2008)

Allowability

Per CFR 74.2, Project Costs means:

“All allowable costs, as set forth in the

applicable Federal cost principles, incurred by

a recipient and the value of the contributions

made by third parties in accomplishing the

objectives of the award during the project

period.”

That is, do the costs further the goals and

objectives of the grant?

Allowability: Cost Principles

Program Income outlined in the Code of

Federal Regulations (CFR) 74.24

Allowable Costs, CFR 74.27

“For each kind of recipient, there is a particular

set of Federal principles that applies in

determining allowable costs. Allowability of

costs shall be determined in accordance with

the cost principles applicable to the entity

incurring the costs.”

Allowability: Cost Principles

(Continued)

Cost Principles per Entity Type:

Educational Institutions OMB Circular A-21

Non-Profit Organizations OMB Circular A-122

(cross references Circular A-110)

Hospitals 45 CFR 74 (Appendix E)

-Prepared by George M. Uber, Cost Allocation and Indirect Cost Specialist,

prepared for The Hemophilia Alliance, Inc.

Suggested Uses of Program Income

HTC core center and support staff salary

Outreach staff salary

Consultant fees (e.g., Ortho, PT)

Chapter support (made in form of financial assistance

agreement - “donations” are not allowable)

Staff travel/training

Client Assistance/Uninsured support

Community education

Patient activities and educational materials

Association Dues

“Public Relations” (per A-122 guidelines)

Unallowable Uses of Program Income

Endowments

Salary for personnel already covered by grant

Travel expenses already covered by grant

Clinical Research (may be considered)

Donations to chapters, unless in form of

financial assistance agreement

Sample Financial Assistance

Agreement

FINANCIAL ASSISTANCE AGREEMENT

THIS FINANCIAL ASSISTANCE AGREEMENT, dated the ___ day of ___________, 20__, by and between (INSERT HTC NAME

HERE, a (INSERT STATE NAME HERE) non-profit corporation (“INSERT ANY ABBREVIATION OF HTC HERE”) and

______________________, a (INSERT NON-PROFIT’S STATE OF INCORPORATION HERE) non-profit corporation

("Corporation").

Recitals:

WHEREAS, Corporation is engaged in the provision of services to support the needs of hemophilia patients and their families;

and

WHEREAS, (HTC ABBREVIATION OR NAME) desires to provide financial assistance to Corporation to assist Corporation in the

furtherance of these goals upon the following terms and conditions.

NOW THEREFORE, in consideration of the mutual covenants contained herein and intending to be legally bound hereby, the

parties agree as follows:

1.

Charitable Service. The parties agree that (HTC ABBREVIATION OR NAME) shall provide financial assistance to

Corporation in order to provide needed funding for the Corporation to undertake a charitable endeavor(s) to be provided to

persons with or affected hemophilia or related bleeding disorder and described at Schedule 1, attached hereto.

2.

Financial Assistance. (HTC ABBREVIATION OR NAME ) shall provide financial assistance (the “Financial

Assistance”) to Corporation in the amount set forth at Schedule 2, attached hereto, and pursuant to the payment terms provided

therein.

3.

Terms of Agreement. This agreement shall commence as of _____________, 20__, and shall continue in effect for one

(1) year until ______________, 20__. Notwithstanding the foregoing, either party may terminate this agreement at any time upon

giving the other party hereto at least thirty (30) days’ prior written notice.

4.

Oversight. (HTC ABBREVIATION OR NAME) shall have the right to receive an accounting of the Financial Assistance

to ensure that the funds received by Corporation are actually utilized for the charitable purposes for which they were provided.

Corporation shall provide (HTC ABBREVIATION OR NAME) with a full accounting of the Financial Assistance. Upon reasonable

notice, (HTC ABBREVIATION OR NAME)’s auditors will be provided with the accounting to confirm and verify that the Financial

Assistance was utilized properly.

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed the day and year first above

written.

(HTC ABBREVIATION OR NAME):

CORPORATION:

By __________________________________

By _________________________________

__________________________________

_________________________________

TITLE

TITLE

Calculation Example #2

Revenue

- Factor

- Contract Fees

- Pharmacy Cost

Personnel ($44,500)

Fringe ($8,900)

Supplies ($1,800)

Printing ($504)

- Indirects (8% of $55,704)

Program Income

$1,500,000

$1,173,000

$ 50,000

$ 55,704

$

4,456

$ 216,840

Calculation Example #2 (Continued)

Program Income

$216,840

$150,000

$ 10,000

$ 6,000

$ 5,000

$ 2,000

$173,000

Staff Salaries

Association Dues

Staff Travel

Chapter Support

Patient Educational Activities

Total Program Income Used

Fund Balance

Previous Fund Balance

Total Balance Available

$ 43,840

$ 50,000

$ 93,840

MCHB and Grant Timelines

MCHB grant runs June 1 – May 31

Subgrantee Financial Status Report (FSR)

due with or shortly after final invoice

Grantee FSR due 90 days after close of grant

period (usually August 31)

Program Income back-up not consistently

required in years past

Moving forward, back-up will be required

u

a

l

Financial Status Report

(Long Form 269)

FSR: Program Income Fields

MCHB suggests Additive Method, found on Line r., rather

than Deduction Method

MCHB Data Collection Form

MCHB Data Form Submissions

Recently passed OMB clearance process

Likely required as back-up with 08/09

program income report

Become familiar with form

Direct questions to your regional coordinator

and host institution

Other Federal Audit Requirements

OMB Circular A-133

Applicable to:

Educational institutions

Non-profit organizations

Hospitals

Can be required per consortium agreement

Part of regional core center oversight

Summary

Understand 340B enabling legislation

Know program income definition, regulations

Be prepared to demonstrate methodology utilized in

calculating program income, including institutional

policies

Maintain all back-up information

Be aware of both allowable and unallowable uses of

program income

Be mindful of regional and federal timelines

Keep your regional coordinator happy…

He or she is your best ally!

© Copyright 2026