How to increase your income / reduce your expenditure as... patient / carer:

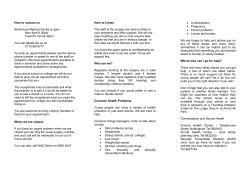

How to increase your income / reduce your expenditure as a cancer patient / carer: Try to plan ahead if you can and think about what your income and spending is and how this will be affected if you have to have time off work. This may be difficult or something that you put off doing but it can help make things easier at a later date and possibly prevent financial difficulties arising. Check your insurance policies / mortgage cover as to whether you are covered for ill health / critical illness. Speak to your Clinical Nurse Specialist to see whether you are able to pay a reduced rate for car parking or for free. Some patients may also be able to access the hospital transport scheme. You may also be able to qualify for a blue badge parking permit – check with your local authority. As a cancer patient you should be eligible for free prescriptions. 1. Have a benefits review This is key. You may be entitled to money, even if you think you are not. Some entitlements are not means tested – so if you meet the criteria you will receive them whether you have savings / income (pensions/ wage) or not. One thing that people sometimes forget is that if you do qualify for some benefits, they can entitle you to other schemes / services. Please do not be put off having a benefits review. It could help pay for other things that may make things more comfortable for you – for instance a taxi instead of waiting for hospital transport. There are lots of organisations locally who offer help in completing the forms too. (Contact your Clinical Nurse Specialist for more information about where these organisations are). Date Published: July 2012 Review Date: June 2013 2. Reducing household bills – gas / water / electricity etc Switch payment method / or switch tarriff Changing payment method can make it easier to manage your energy bills. Also don’t forget that you may be able to reduce your energy bills if you shop around for a better deal for your energy. Winter fuel payments For winter 2011/12, winter fuel payments of up to £200 are paid to people over the age of 60. Those over 80 can claim £300. For a claim form or more information contact the Winter Fuel Payment hotline on 08459 15 15 15. Ask whether you are eligible, as a cancer patient, or carer of a cancer patient, for the “Warm Home Discount (WHD)”. This is a new scheme funded by energy suppliers. It came into force on 1 April 2011 and will provide approx £1.13 billion in direct and indirect financial support to vulnerable energy consumers over the next four years. The WHD replaces social tariffs and voluntary arrangements previously offered by energy suppliers. The following companies are part of this scheme but if your supplier is not listed below check with them as they may recently have joined. British Gas / Scottish Gas / Sainsbury’s Energy EDF Energy E.ON Energy npower Scottish and Southern Energy / Atlantic / Scottish Hydro / SSE / Southern Electric / SWALEC / Ebico (EquiPower and EquiDual) / M&S Energy o ScottishPower o o o o o You can contact either the Energy Saving Trust on 0800 512 012 or the Home Heat Helpline on 0800 336699 (both free phone numbers) for advice on saving energy and grants and schemes available to help make your home warmer and save you money. You may also be eligible through the Warm Front Scheme (0800 316 2805) but need to be in receipt of certain benefits – another reason to have a benefit review. Consumer Focus and Citizens Advice are making people aware of the following 5 top tips if they fall behind with their bills: • • • • • Always contact your energy supplier as soon as you realise you might have trouble with paying. Debts will build-up and be harder to pay off the longer you leave them. Your supplier has a responsibility to help you if you have problems paying your bill. Tell your energy firm what you can afford to pay – they have to take this into account in agreeing repayments of the money you owe. Ask your energy company, your local Citizens Advice Bureau or call the Home Heat Helpline 0800 33 66 99 to find out about other free energy help available. For example you could qualify for a discount off your bill or free insulation to help your home stop leaking heat and cut your bills. Even if you are in debt you may still be able to switch to a cheaper deal with your current supplier, especially if you pay by cash, cheque or pre-payment meter. If you pay by pre-payment meter and have less than £200 of debt you can also switch to a cheaper deal with another supplier. Financial help is available which could make it easier to afford your bills – check you are receiving all of the benefits and tax credits you are entitled to by getting in touch with your local Citizens Advice Bureau or visiting www.adviceguide.org.uk If you get into difficulties A supplier has to make all reasonable attempts to help you pay your bill before considering disconnection. It must not disconnect consumers in winter (1 October - 31 March) if: • they are pensioners who are disabled or chronically sick • they are pensioners and live alone or only with other pensioners or children under 18 Your energy company has to help you to repay the amount owed at a rate that’s affordable to you. The customer service contact details for different energy companies are below: • British Gas Tel: 0800 048 0202 • EDF Energy Tel: 0800 096 9000 • E.ON Tel: 0845 059 9905 • npower Tel: 0845 070 4851 (monthly direct debit) 0845 070 4850 (cash, cheque or quarterly direct debit customers) 0845 070 4853 (pre-payment meter customer) • SSE Group Tel: 0845 7444 555 (SSE and Southern Electric) 0845 300 2141 (Scottish Hydro) 0800 052 5252 (SWALEC) 0845 073 3030 (Atlantic) • Scottish Power Tel: 0845 270 0700 • Co-operative Energy Tel: 0800 954 0693 • Ebico Tel: 0800 458 7689 • Ecotricity Tel: 0845 555 7100 (domestic customers) • First Utility Tel: 0845 215 5000 • Good Energy Tel: 0845 601 14104 • Green Energy Tel: 0800 783 8851 • Ovo Tel: 0800 5996 4440 • Spark Energy Tel: 0845 034 7474 • Utilita Tel: 0845 450 4357 • Utility Warehouse Tel: 0844 815 7777 United Utilities - are assisting those clients who are struggling to pay their water bills by transferring them onto a lower tariff. At present Clients cannot be home owners and have to be on a qualifying benefit. They can be contacted on 0845 3094095 – payments assistance team. 3. Possible grant funding – there will be others: Some examples of grant funding that may be available to you: Denny Fund (for brain tumour patients). The maximum £500 which can be used against any debts / purchase of white goods or towards a holiday. Carer’s grants – “Time for Me” Grant (check that your local carers organisation offers this – it is not available in the Blackpool area) – offers up to £350 to be spent on yourself. Macmillan grants – speak to Macmillan (0808 808 00 00 - go through their helpline) Social fund grants - When you are on a low income, it is very difficult to budget for emergency expenses, funeral costs, the costs of a new baby or one-off payments for large items, such as furnishing a home. You could also be in a situation where you have no money coming in at all. There is money available for these situations, although it is limited. Community care grants Community care grants are intended to help with expenses so that people can live in the community and families can stay together. Community care grants are discretionary, which means that even if you are eligible you will only get one if the benefit office decides that your need is important and there is enough money left in the district Social Fund budget. Community care grants do not have to be repaid, so you should always check if you are eligible to claim one when you have expenses you cannot meet. If you have internet access the following sites may be of assistance: Macmillan Cancer Support http://www.macmillan.org.uk/Home.aspx Directgov – list of lots of public sector resources http://www.direct.gov.uk/en/index.htm Citizen’s Advice Bureau http://www.citizensadvice.org.uk/index/getadvice.htm Also see the attached diagram – there may be other areas that you haven’t thought about where you are entitled to credit / reductions / access other services to support you. Housing o o o o o o o o o o o Mortgage – arrears Insurance Tenant Re-housing Rent arrears Gardening Adaptation for disability Maintenance Going into residential care Household bills Council tax o o o o Policies Credit Agreements Welfare benefits Joint property/ investments o o o o o o o o o o o o o o Hair loss Difficulty swallowing Sickness Feeling cold Weight loss Weight gain Difficulty writing Risk of infection Incontinence Pain Body Image Loss of speech Tiredness Depression Employment o o o o o o o o o o o o o Quality of Life Time off Occupational Pension Death in service pay Unfair dismissal SSP Terminate employment Tax rebate Industrial disease Discrimination Contract of Employment Self employment Reduced hours / phased return Career change o o o o o o o o o o o o o Blue Badge scheme Holiday/convalescence Motability Scheme Aids and adaptations National Key Scheme Telephone Support Groups Communication Respite care Equipment (OT) Treats Loss of speech Liquid diet Financial and Legal LONG TERM ILLNESS AND POSIBLE CONCERNS Side Effects o o o o o o o Family and Personal Partner / spouse Child Care Helping children cope Dependant parents Friends and work colleagues Pets Fertility costs Death and Dying o o o o o o o o o o o Funeral costs Memorial stone Will Grant of Probate Letters of administration Guardianship Marriage (invalidates earlier will) Responsibility for children Responsibility for debts Power of attorney Planning a funeral Insurance Protection Check if insured for: o Mortgage o Credit Cards o Loans o Medical costs o Inpatient /day patient o Holiday (Adapted from source Macmillan Voice - Summer 2006)

© Copyright 2026