How to write research papers on Labor Economic Modelling

How to write research papers on

Labor Economic Modelling

Research Methods in Labor Economics

and Human Resource Management

Faculty of Economics

Chulalongkorn University

Kampon Adireksombat, Ph.D.

EIC | Economic Intelligence Center

Siam Commercial Bank

Outline

y What should we put in a research paper?

y Example 1: The Effects of the 1993 Earned Income

Tax Credit Expansion on the Labor Supply of

Unmarried Women

y Example 2: The Effects of Decentralized Minimum

Wage Setting on Actual Wages in Thailand:

Unconditional Quantile Regression Approach

y Some research ideas using Thai data

1

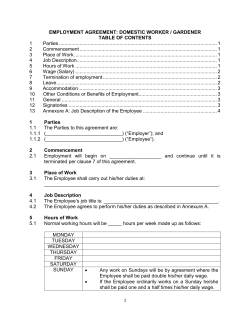

1. What should we put in a research paper?

No definite rules, need to make sure that readers will understand what we write

Introduction

•

Research questions***

•

Motivation

•

Brief summary of what we are writing in this paper

Institutional details

•

Background of what we want to study

Literature review

•

Review what previous work has done

Data

Empirical approach

•

Summary statistics

•

Regression specification

Results

•

Show your results

•

Discuss what you find

Conclusion/policy implication

2

Example 1: The Effects of the 1993 Earned Income Tax Credit

Expansion on the Labor Supply of Unmarried Women

Author: Kampon Adireksombat

Published in Public Finance Review (January 2010)

y Introduction

y Earned Income Tax Credit (EITC):

{

{

{

{

{

a refundable income tax credit

targets low- and middle-income working families in the United States.

the tax credit is paid as a lump sum along with the annual tax return

working as an earnings subsidy

the biggest group of recipients are unmarried women with children (single mothers)

y EITC expansion in 1993

{

Substantially increased the credit available to unmarried women with two or more

children (2+group) relative to those with one child (1 child group) and those with no

children (no children group)

y Motivation and research question

{

Check whether the 2+ group increased their labor supply relative to 1 child and No

children groups

3

Example 1: Institutional details (1)

Maximum credits in 2005 dollars dollars

$

4750

4500

4250

4000

3750

3500

3250

3000

2750

2500

2250

2000

1750

1500

1250

1000

750

500

250

0

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

Year

No Children

One Child

Two Children

4

Example 1 Institutional details (2)

(current prices)

5

Example 1: Literature review

Discuss what previous works examine and find

y Examples of previous works

{

{

{

{

Dickert, Houser, and Scholz (1995)

Eissa and Liebman (1996)

Meyer and Rosenbaum (2001)

Hotz, Mullin, and Scholz (2006)

Contribution

y Check whether the 2+ group increased their labor supply relative to 1

child and No children groups (different identification strategy)

y Use national level data

6

Example 1: Data

y Data: US Current Population Survey

y Sample: Widowed, divorce, separated or never-married women, aged

25-55

y Period: 1991-1993 and 1995-2000

7

Example 1: Empirical Approach: simple check labor force

participation

8

Example 1: Empirical Approach: simple check total hours

worked

9

Example 1: Empirical Approach: simple check hours worked

by those already in the labor force

10

Example 1: Empirical Approach: regression equation for

labor force participation

11

Example 1: Empirical Approach: regression equation for

annual hours worked

12

Example 1: Result (1)

13

Example 1: Result (2)

14

Example 1: Result (3)

15

Example 1: Result (4)

16

Example 1: Conclusion/Policy implication

EITC expansion in 1993

Effective policy

- Increase labor supply of unmarried women with two or more children

- Well-targeted, lower education women increase more labor supply than

higher education women

In 2009, change the threshold to

- No children

(max credit = USD 457)

- One child

(max credit = USD 3,043)

- Two children

(max credit = USD 5,028)

- Three and more children

(max credit = USD 5,657)

17

Example 2

The Effects of Decentralized Minimum Wage

Setting on Actual Wages in Thailand:

Unconditional Quantile Regression Approach

[Work in progress]

Kampon Adireksombat

Economic Intelligence Unit

Siam Commercial Bank

John Giles

Development Research Group

World Bank

18

In Brief

y Research Question:

{

{

What is the effect of the minimum wage on actual wages?

Are there any differential effects on the actual wages of workers in

formal and informal sectors?

y Sample Group: Female and male workers aged 15-60 years old

y Sample Period: 1999-2007

y Data: Thai Labor Force Survey

y Empirical Method: Kernel Density Function and Unconditional

Quantile Regression

19

Motivation: Dual Sector Model

y In the classical dual sector model: an increase in the

minimum wage in the formal sector results in a decrease in

wages in informal sector

{

Negative relationship between a minimum wage and the actual wages in

informal sectors.

y The Todaro ( AER 1969) model predicts that increases in

minimum wages in the urban area can indirectly raise rural

wages.

{

{

Positive relationship between a minimum wage and the actual wages in

informal sectors.

More recently, McIntyre(2004)’s model predicts that an increase in

minimum wages can increase wages in both sectors.

y Ambiguous theoretical prediction

20

Minimum Wage in Thailand

y 1973-first applied

y 1998-decentralized to provincial levels

{ following a recommendation by the International Labour

Organization (ILO)

{ As a result, there is substantial cross-provincial and cross-time

variation in minimum wages

21

Definition

A minimum wage rate was defined as a wage rate

which an employee deserves and is sufficient for an

employee’s living (Office of National Wage

Committee 1996).

{

{

Unlike other minimum wages in other developing countries,

where minimum wages are defined as the payment sufficient

for the worker and his family members to dwell in the society

(for example, Brazil (Starr 1982)), a Thai minimum wage rate

is defined for an employee only.

makes the minimum wage and individually actual wage more

comparable due to consistent definitions.

22

Bangkok

Central

Northeast

South

North

2008

2006

2004

2002

2000

1998

1996

1994

1992

1990

100 150 200

2008

2006

2004

2002

2000

1998

1996

1994

1992

1990

2008

2006

2004

2002

2000

1998

1996

1994

1992

1990

50

Thai Bahts

50

100 150 200

Minimum Wage (THB) by Region

Year

Graphs by Region

23

Infaltion Rate by Region

Bangkok

Central

North

Northeast

South

0

6

0

2

4

Inflation Rate

2

4

6

Overall

2000

2005

2010

2000

2005

2010

2000

2005

2010

Year

Graphs by Region

24

Real Minimum Wage (in 2007 THB) by Region

Central

Northeast

South

North

2008

2006

2004

2002

2000

1998

1996

1994

1992

1990

2008

2006

2004

2002

2000

1998

1996

1994

1992

1990

2008

2006

2004

2002

2000

1998

1996

1994

1992

1990

140 160 180 200

Thai Bahts

140 160 180 200

Bangkok

Year

Graphs by Region

25

Decentralized Minimum Wage Setting

y Under the 1998 Labour Protection Act, minimum

wage policy is decentralized into 2 levels

{

{

the basic level, set by the National Minimum Wage Committee

the provincial level, set by the Provincial Minimum Wage Sub

–committees,

y The provincial minimum wage must not be below the

basic level.

y In case that no minimum wage is set in a province,

the basic level is mandatory enforced.

y Increased variation in the nominal minimum wage

rates from 3 levels in 2001 to 21 levels in 2007

26

Three institutions of the Thai minimum wagefixing machinery

y National Wage Committee (NWC) : a tripartite

committee

y Provincial Subcommittee on Minimum Wage

(PSMW) : a tripartite committee

y Subcommittee on Technical Affairs and Review

(STAR): NWC appoints 11 members to form the

STAR

27

The Minimum wage setting procedure

y Each PSMW makes a recommendation on its

provincial minimum wage to NWC

y NWC sends a recommendation to STAR for a

technical review

y STAR submits a review back to NWC for a final

consideration and approval

28

Labor Force Survey Data

y LFS includes detailed information on demographic

variables (age, gender, region, marital status,

education) and employment and unemployment

characteristics (work status, hours worked, salary

per month, occupation, industry).

{

{

{

1984-1997, carried out three rounds annually (on February,

May and August)

1998-2000, the fourth round (on November) was added

From 2001, conducted monthly

29

Sample

y Male and female workers at working age (15-60 years

old)

{

{

With no earning information in LBF, the self-employed workers were

excluded from the sample.

The resulting sample is 103,418 observations.

y 9-year data from 1999 (when the LPA fully went into

effect) to 2007

{

{

To capture the full effects of minimum wage changes given the time

that is needed to adjust production process to economize on lowskilled labor.

To keep the sample consistent and avoid the issue of repetitive

sample, we use the first round data for 1999-2000 and February

data for 2001-2007

30

Previous Studies

y A large body of literature on the effect of minimum wage on

actual wages in emerging and developing countries focus on

Latin America and Caribbean countries

{

For example, Bell 1997; Fajnzylber 2001; Lemos 2002; Strobl and Walsh

2003; Maloney and Núñez 2004; Gindling and Terrell 2005.

y They find consistent results that increases in minimum wages

have a positive effects on the wages of formal sector workers

y A pioneer study on the effect of minimum wage on actual

wages in Asia is Rama (2001).

{

Using 1993 aggregate data at the provincial level from Indonesia, Rama

finds that doubling the real minimum wage results in an increase in

average wages by 5 to 15 percent

31

Contribution

y Decreasing real minimum wage

y Stable inflation rate

y Definition of minimum and actual wages are more

comparable

y Exogenous cross-provincial and cross-time variation

in minimum wages

y Unconditional Quantile Regression (Firpo, Fortin,

and Lemieux (Econometrica 2009))

32

How To Define Formal and Informal Sectors?

y I follow Ginding and Terrell (2005) by using firm size and

location.

y Under the 1998 Labor Protection Act (LPA), a firm with 10

employees or more must file a work regulation, including

working conditions with the Ministry of Labor and is required to

make a contribution to the Compensation Fund.

{

Therefore, I define workers who work for a firm with 10 or more workers as

those in the formal sector and workers who work in a smaller firm as those

in the informal sector.

y To define formality by urban/rural dichotomy, I categorize a

firm located in municipal area as an urban firm and a firm

located in non-municipal area as a rural firm.

{

This urban/rural definition is consistent with Thai local administration.

33

How To Define Formal and Informal Sectors?

y As a result there are four sectors in my study

{ Urban Large (Formal)

{ Urban Small (Informal)

{ Rural Large (Informal)

{ Rural Small (Informal)

34

Empirical Method

y Kernel density function of log real wage and analyze

whether there are spikes in a distribution of actual

wage around the minimum wage rates.

y Unconditional Quantile Regression (Firpo, Fortin,

and Lemieux (Econometrica 2009))

{

To test whether there are differential effects of minimum

wages across sectors, I estimate these equations separately for

each sector.

35

Kernel Density : Urban Large Enterprises 1999

0

0

Density

1

Density

1

2

2

Kernel Density : Rural Large Enterprises 1999

0

1

2

3

4

5

Log of Real Daily Wage

6

7

8

0

1

2

3

4

5

Log of Real Daily Wage

Kernel density estimate

6

7

8

Kernel density estimate

Source:

data

fromsurvey

National

Statistic Office

and Minitstry

of Labor

Source:

19991999

Labor

force

of National

Statistical

Office and

Ministry of Labor

Source:

1999

Labor

NationalOffice

Statistical

Office and

Ministry of Labor

Source:

1999

dataforce

from survey

NationalofStatistic

and Minitstry

of Labor

Kernel Density : Urban Small Enterprises 1999

0

0

Density

1

Density

1

2

2

Kernel Density : Rural Small Enterprises 1999

0

1

2

3

4

5

Log of Real Daily Wage

6

7

8

0

1

2

3

4

5

Log of Real Daily Wage

Kernel density estimate

6

7

Kernel density estimate

36

Source:

forceNational

survey of

National

Statistical

Office and

Ministry of Labor

Source:1999

1999Labor

data from

Statistic

Office

and Minitstry

of Labor

Source:

from

National

Statistic Statistical

Office andOffice

Minitstry

Labor of Labor

Source:

19991999

Labordata

force

survey

of National

andofMinistry

Kernel Density : Rural Large Enterprises 2007

0

0

1

Density

1

Density

2

2

Kernel Density : Urban Large Enterprises 2007

8

0

1

2

3

4

5

Log of Real Daily Wage

6

7

8

0

1

2

Kernel density estimate

3

4

5

Log of Real Daily Wage

6

7

8

Kernel density estimate

Source:

2007

dataforce

fromsurvey

National

and Minitstry

of Labor

Source:

2007

Labor

of Statistic

NationalOffice

Statistical

Office and

Ministry of Labor

Source:

data

fromsurvey

National

Statistic Office

and Minitstry

of Labor

Source:

20072007

Labor

force

of National

Statistical

Office and

Ministry of Labor

Kernel Density : Rural Small Enterprises 2007

0

0

Density

1

Density

1

2

2

Kernel Density : Urban Small Enterprises 2007

0

1

2

3

4

5

Log of Real Daily Wage

6

Kernel density estimate

Source:

from

National

StatisticStatistical

Office andOffice

Minitstry

Labor of Labor

Source:

2007 2007

Labordata

force

survey

of National

andofMinistry

7

8

0

1

2

3

4

5

Log of Real Daily Wage

6

Kernel density estimate

Source:

2007

data force

from National

Statistic

Office

and Minitstry

Labor

Source:

2007

Labor

survey of

National

Statistical

Office of

and

Ministry of Labor

7

8

37

Kernel Density : Less than Elementary 2007

0

0

.5

.5

Density

Density

1

1

1.5

1.5

Kernel Density : No Education 2007

3

4

5

Log of Real Daily Wage

6

7

3

4

5

6

Log of Real Daily Wage

Kernel density estimate

7

8

Kernel density estimate

Source:2007

2007Labor

data force

from National

and Office

Minitstry

Labor of Labor

Source:

survey ofStatistic

NationalOffice

Statistical

andofMinistry

Source:

from

National

OfficeStatistical

and Minitstry

of and

Labor

Source: 2007

2007 data

Labor

force

surveyStatistic

of National

Office

Ministry of Labor

Kernel Density : Lower Secondary 2007

0

0

.5

.5

Density

1

Density

1

1.5

1.5

2

2

2.5

Kernel Density : Elementary 2007

3

4

5

6

Log of Real Daily Wage

7

3

8

4

5

6

Log of Real Daily Wage

7

Kernel density estimate

Kernel density estimate

Source:

from

National

Office

and Minitstry

of and

Labor

Source: 2007

2007 data

Labor

force

surveyStatistic

of National

Statistical

Office

Ministry of Labor

Source:2007

2007Labor

data force

from National

and Office

Minitstry

Labor of Labor

Source:

survey ofStatistic

NationalOffice

Statistical

andofMinistry

Kernel Density : Diploma 2007

0

0

.5

.5

Density

1

1.5

Density

1

1.5

2

2

2.5

2.5

Kernel Density : Upper Secondary 2007

38

4

4.5

5

5.5

Log of Real Daily Wage

6

6.5

4

4.5

Kernel density estimate

5

Log of Real Daily Wage

5.5

6

Kernel density estimate

Source:2007

2007 Labor

data from

National

Office

and Minitstry

of and

LaborMinistry of Labor

Source:

force

surveyStatistic

of National

Statistical

Office

Source:

20072007

Labor

force

survey

of National

Office

and Ministry

Source:

data

from

National

StatisticStatistical

Office and

Minitstry

of Laborof Labor

0

1

Density

2

3

4

Kernel Density : College 2007

5

5.2

5.4

Log of Real Daily Wage

Kernel density estimate

Source:

2007

data

from

National

Statistic

OfficeOffice

and Minitstry

of Labor

Source:

2007

Labor

force

survey

of National

Statistical

and Ministry

of Labor

5.6

5.8

39

Average Proportion of Workers Earning at and below the Minimum Wage

P roportion Daily Wage

0.95-1.05 of Minimum wage

0.15

0.15

0.24

0.10

0.10

All

Urban large firms

Urban small firms

Rural large firms

Rural small firms

P roportion Daily Wage

below 0.95 of Minimum wage

0.26

0.11

0.23

0.46

0.50

No Education

Urban large firms

Urban small firms

Rural large firms

Rural small firms

0.11

0.19

0.14

0.07

0.09

0.66

0.52

0.65

0.71

0.72

Less than elementay school

Urban large firms

Urban small firms

Rural large firms

Rural small firms

0.14

0.19

0.20

0.09

0.09

0.40

0.26

0.34

0.47

0.52

Elementary school

Urban large firms

Urban small firms

Rural large firms

Rural small firms

0.23

0.33

0.33

0.11

0.11

0.35

0.22

0.25

0.50

0.48

Lower secondary school

Urban large firms

Urban small firms

Rural large firms

Rural small firms

0.22

0.06

0.51

0.37

0.24

0.21

0.11

0.16

0.43

0.41

Upper secondary school

Urban large firms

Urban small firms

Rural large firms

Rural small firms

0.22

0.04

0.53

0.44

0.30

0.15

0.07

0.11

0.37

0.39

Diploma

Urban large firms

Urban small firms

Rural large firms

Rural small firms

0.07

0.02

0.26

0.17

0.56

0.04

0.03

0.05

0.25

0.32

College

Urban large firms

Urban small firms

Rural large firms

Rural small firms

0.01

0.00

0.05

0.06

0.27

0.01

0.01

0.01

0.13

0.23

Note: Author's calculation from 1999-2007 Labor Force Survey data.

40

Summary statistics by e ducation le ve l and s e ctor

Real Daily Wage (in 2007 THB)

Years of work experience

Male

Average weekly hours worked

Urban Large

185.28

24.79

0.54

49.25

No Education

Urban Small

Rural Large

143.69

165.15

27.11

27.37

0.54

0.58

48.37

48.54

Rural Small

138.08

28.57

0.62

45.59

Real Daily Wage (in 2007 THB)

Years of work experience

Male

Average weekly hours worked

Less than Elementary School

Urban Large

Urban Small

Rural Large

254.61

186.82

196.68

29.52

29.37

29.76

0.54

0.54

0.58

49.25

48.37

48.54

Rural Small

163.27

30.50

0.62

45.59

Real Daily Wage (in 2007 THB)

Years of work experience

Male

Average weekly hours worked

Urban Large

223.24

16.15

0.54

50.19

Elementary School

Urban Small

Rural Large

181.46

190.62

15.40

15.17

0.56

0.67

48.97

49.91

Rural Small

160.81

15.15

0.73

46.40

Real Daily Wage (in 2007 THB)

Years of work experience

Male

Average weekly hours worked

Urban Large

223.24

15.79

0.57

48.87

Lower Secondary School

Urban Small

Rural Large

181.46

190.62

13.20

13.00

0.57

0.67

48.76

49.80

Rural Small

160.81

11.32

0.76

46.61

Real Daily Wage (in 2007 THB)

Years of work experience

Male

Average weekly hours worked

Urban Large

304.75

11.02

0.54

48.43

Upper Secondary School

Urban Small

Rural Large

216.25

205.81

8.78

10.12

0.53

0.64

49.18

48.74

Rural Small

169.18

8.47

0.74

46.46

Real Daily Wage (in 2007 THB)

Years of work experience

Male

Average weekly hours worked

Urban Large

459.49

14.34

0.49

41.39

Diploma

Urban Small

Rural Large

391.45

322.60

13.27

12.10

0.50

0.50

42.10

46.98

Rural Small

191.79

7.72

0.65

48.11

Real Daily Wage (in 2007 THB)

Years of work experience

Male

Average weekly hours worked

Urban Large

723.38

13.70

0.49

41.39

College

Urban Small

Rural Large

525.21

447.15

12.32

9.17

0.50

0.50

42.10

46.98

Rural Small

256.57

6.12

0.65

48.11

Note: Data are from 1999-2007 Labor Force Survey, National Statistical Office of Thialand. Means are weighted with sample weights.

Standard Deviations are in parenthesis. Sample includes female and male work ers aged from 15-60 years old.

41

Estimation Method

y In Thailand, the effect of minimum wage on actual wages

is likely to be different at different points of the wage

distribution

y We need estimation methods that “go beyond the mean”

y Conditional quantile regression

{ Limitation: do not average up to their unconditional population

counterparts.

{ As a result, cannot be used to estimate the impact of an explanatory

variable on the corresponding unconditional quantile.

{ In other words, cannot be used to answer a question as simple as

“what is the effect on the actual wages of increasing minimum wage

by one dollar, holding everything else constant?”

42

Unconditional Quantile Regression

y Proposed by Firpo, Fortin, and Lemieux (Econometrica 2009)

to estimate the impact of changes in the explanatory variables

on the unconditional quantiles of the outcome variable.

y First, running a regression of the Recentered Influence

Function (RIF) of the unconditional quantile dependent

variable on the explanatory variables. Second, running OLS

regression of the dependent variable on covariates [Stata

command: Rifreg]

y As a result, we yield RIF-OLS estimate, allowing us to

estimate the marginal effects of changes in the distribution of

an independent variable on a given quantile of the

unconditional distribution of Y, all else equal.

43

Regression Equation

ln(w it) = β0 + β1ln(MWipt) + Xitβj + βj Occupation dummies + βk Industry dummies

+ βt Year dummies + βp Province dummies + βr Region dummies + εit

Note: Xit is a vector of demographic characteristics, including age, marital status,

education, and potential work experience

44

Elasticities of Real Daily Wage wrt. Real Minimum Wage

At each quantile

Quantile

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

Urban Large

2.875***

(0.294)

1.115***

(0.154)

0.395***

(0.153)

0.181

(0.217)

0.205

(0.272)

-0.436*

(0.236)

-0.110

(0.258)

-0.030

(0.281)

-0.129

(0.317)

Observations 47,665

Baseline (General CPI)

Urban Small Rural Large

0.882**

0.293*

(0.437)

(0.172)

1.390***

0.463**

(0.215)

(0.184)

1.208***

0.512***

(0.213)

(0.145)

0.746***

0.734***

(0.286)

(0.179)

0.874***

0.578***

(0.208)

(0.142)

0.770***

0.187

(0.258)

(0.138)

0.245

-0.109

(0.239)

(0.223)

0.764**

-0.279

(0.307)

(0.393)

-0.463

0.321

(0.417)

(0.635)

Rural Small

0.400

(0.345)

0.877***

(0.116)

1.128***

(0.118)

0.767***

(0.217)

0.858***

(0.178)

0.916***

(0.220)

0.506***

(0.177)

0.802***

(0.232)

0.684***

(0.240)

21,087

14,617

20,049

Notes: Estimated from the 1999-2007 Labor Force Survey sample weighted data.

Robust standard errors are in parentheses. * (**, ***) signifies statistical significance at the 1 (5,10) percent level.

All regressions include experience, province, region, occupation, industry and year dummies.

45

Quantile

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

General CPI with Bootstrap Std. errors

Lag of real minimum wage and General CPI

Quantile

Urban Large Urban Small Rural Large Rural Small

Urban Large Urban Small Rural Large Rural Small

2.875***

0.882*

0.293

0.400

0.1 2.454***

1.094**

-0.103

0.065

(0.324)

(0.459)

(0.178)

(0.354)

(0.315)

(0.450)

(0.181)

(0.347)

1.115***

1.390***

0.463**

0.877***

0.2 1.015***

1.355***

0.516*** 0.518***

(0.165)

(0.194)

(0.217)

(0.153)

(0.160)

(0.232)

(0.200)

(0.117)

0.395***

1.208***

0.512*** 1.128***

0.3 0.378**

0.887***

0.195

0.752***

(0.147)

(0.237)

(0.129)

(0.142)

(0.160)

(0.227)

(0.157)

(0.117)

0.181

0.746**

0.734*** 0.767**

0.4 -0.126

0.421

0.589*** 1.209***

(0.232)

(0.332)

(0.189)

(0.305)

(0.225)

(0.298)

(0.189)

(0.225)

0.205

0.874***

0.578*** 0.858***

0.5 0.002

0.587***

0.554*** 0.856***

(0.253)

(0.211)

(0.157)

(0.200)

(0.282)

(0.218)

(0.151)

(0.185)

-0.436*

0.770***

0.187

0.916***

0.6 -0.571**

0.560**

0.215

0.835***

(0.252)

(0.266)

(0.148)

(0.240)

(0.250)

(0.267)

(0.144)

(0.226)

-0.110

0.245

-0.109

0.506**

0.7 -0.367

0.412*

-0.055

0.236

(0.282)

(0.245)

(0.231)

(0.197)

(0.270)

(0.240)

(0.234)

(0.187)

-0.030

0.764*

-0.279

0.802***

0.8 -0.016

0.861***

-0.385

0.523**

(0.290)

(0.423)

(0.404)

(0.246)

(0.295)

(0.307)

(0.425)

(0.235)

-0.129

-0.463

0.321

0.684***

0.9 -0.058

-0.632

0.168

0.352

(0.309)

(0.540)

(0.708)

(0.250)

(0.331)

(0.425)

(0.685)

(0.245)

46

Conclusion

y What is the effect of the minimum wage on actual

wages?

{

A decline in real minimum wage are associated with a decline

in the actual wages, especially for workers the lower quantile

of wage distribution

y Are there any differential effects on the actual wages

of workers in formal and informal sectors?

{

Yes, the effects are more economically and statistically

significant in informal sectors, especially workers in small

firms

47

Limitation and Future Research

y Include self-employed and foreign workers into the

sample

y Compare results from pre- and post-decentralization

periods

y Effects on employment and income

48

Some research ideas using Thai data

Data sources

• Bank of Thailand

•http://www.bot.or.th/THAI/STATISTICS/Pages/index1.aspx

• National Economic and Social Development Board

•http://www.nesdb.go.th/Default.aspx?tabid=92

• National Statistical Office

•http://service.nso.go.th/nso/nso_center/project/search_center/23project-th.htm

49

Average actual wages in many provinces are lower than the

existing minimum wages

Actual daily wages and provincial minimum wages in 2010*

Unit: THB

Average actual daily wage

300

250

Existing provicial minimumwage

268

Proposed new minimum wage: country-wide THB250 259

206

205

200

151

150

152

111

120

Phayao

Sisaket

142 151

100

50

0

Note:

Source:

Maehongson

Nontaburi

Bangkok

Actual daily wages are calculated from 2010 Labor Force Survey (LFS) data, using only the first quarter data (most updated data available)

SCB EIC analysis based on data from Labor force survey (National Statistical Office) and Ministry of Labor

50

Sluggish labor force growth in the next decade

2000 - 2010

2010F – 2020F

Unit: % compound annual growth rate

Unit: % compound annual growth rate

Philippines

2.6%

Malaysia

2.3%

Vietnam

2.5%

Indonesia

1.6%

Singapore

1.6%

Thailand

Korea

1.0%

0.4%

2.1%

1.6%

0.9%

1.1%

- 0.4%

0.2%

- 0.4%

Source: SCB EIC analysis based on data from International Data Base (IDB) of US Census Bureau; National Economic and Social Development Board (NESDB)

51

Low formal workforce

Unit: Million persons

38

17

9

Note:

Source:

Monthly wage

Labor force

21

Wage

8

Non-wage

Daily wage

and others

Employees are those employed by private and public sector. Non-employees include own account workers, unpaid family workers, employers and

unemployed persons. Unemployed persons include seasonal inactive labor force as well.

SCB EIC analysis based on data from Labor Force Survey (National Statistical Office)

52

While GDP has grown, wages have not

Unit: Index 2001=100

148 Real GDP

100

2001

Note:

Source:

102 Real wage

2004

2007

2010F

2010 GDP is from SCB EIC forecast. Wage data are calculated from Labor force survey data, using full-year data, with the exception of 2010 data, using

only the first quarter data.

SCB EIC analysis based on data from Labor Force Survey (National Statistical Office); National Economic and Social Development Boards

53

© Copyright 2026