How to ensure successful PPP procurement Andy Carty 9 May 2012

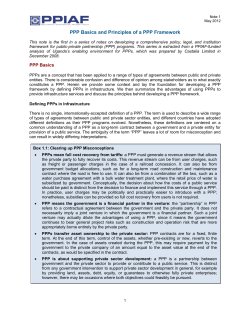

How to ensure successful PPP procurement Investment Summit Croatia-SEE 9 May 2012 Andy Carty How to ensure successful PPP procurement European PPP Market is shrinking? EIB and EPEC Lessons learnt on PPP procurement •2 2 The European PPP Market in 2011 Global Overview Key figures: European PPP Market 2003-2011 by Value Value (EUR billion) Value 35.0 EUR 17.9 billion in 2011 30.0 EUR 18.4 billion in 2010 25.0 Deals 20.0 84 in 2011 112 in 2010 15.0 Average deal value 10.0 EUR 213 million in 2011 EUR 163 million in 2010 5.0 Large deals (>EUR 500 million) 0.0 2003 2004 2005 2006 2007 2008 2009 2010 2011 7 in 2011 10 in 2010 European PPP Market in 2011 In value terms the market in 2011 was in line with that of 2010, but it shrunk significantly in terms of transaction number. Much of the market value is attributable to a limited number of very large transport transactions. Most notably, the EUR 5.4 billion Tours-Bordeaux HSR project alone accounts for 32% of the global market value. Source: EPEC PPP Database •3 3 The European PPP Market in 2011 Country Overview European PPP market 2011 by country Value (€m) Nb of deals 12,000 30 10,000 25 8,000 20 LGV Tours-Bordeaux 6,000 15 4,000 10 2,000 5 0 0 France United Kingdom Germany Italy Belgium Total value Spain Number of deals Finland Denmark Luxembourg France alone accounted for 62% of the overall European market value (the LGV Tours‐Bordeaux alone accounted for 30% of the total market value) The UK still remains the most active market in terms of number of transactions Only 10 countries closed at least one PPP transaction in 2011 (compared to 14 in 2010). Portugal, Sweden, the Czech Republic, Ireland, Lithuania and Bulgaria dropped out of the PPP market in 2011, while Finland and Luxembourg entered it. Source: EPEC PPP Database •4 4 The European PPP Market in 2011 Sectorial Overview Transport represents more than half of the market volume, though outnumbered in terms of deal numbers. Public Order and Safety 12% General Public Services 11% Environment 8% Number of transactions 0 5 10 15 20 25 Education General Public Services Transport Education 6% Healthcare 3% Public Order and Safety Environment Healthcare Other (Housing, Energy) 2% Transport 58% Transaction value (sector breakdown) - Volume in EUR Energy PPP Financing per Sector With 66 projects in 2011, Education and General Public Services PPPs outnumbered Transport PPPs (12 projects). However, in terms of value, with EUR 10.3 million invested, transport still represents more than half of the market volume. Source: EPEC PPP Database •5 5 The European PPP Market in Q1 2012 General trend and country breakdown Transaction value (country breakdown) - Volume in EUR 4,000 3,500 25 23 21 3,000 Belgium 7% (1 deal) 2,500 2,000 Portugal 3% (1 deal) Germany 1% (1 deal) 11 1,500 France 45% (2 deals) 1,000 500 0 Q1 2009 Q1 2010 Q1 2011 Market Value (EURm) Q1 2012 Number of deals Trend In value terms the market is shrinking significantly: only 11 transactions reached financial close, for an aggregate value of EUR 1,5 billion (in Q1 2011, 21 transactions closed for a total value of EUR 3,5 billion). Source: EPEC PPP Database United Kingdom 44% (6 deals) Country breakdown In value terms, France and the UK each account for about 45% of the market. The UK remains the most active PPP market in terms of transactions closed. France closed PPP deals, one of which – the EUR 675 million Tribunal de Grande Instance in Paris – accounts alone for 43% of the total market value. •6 6 The European PPP Market in Q1 2012 Noteworthy transactions and sector breakdown Tribunal de Grande Instance in Paris (EUR 675 million) Largest PPP deal in Q1 2012. Entails the construction of a skyscraper which will host 90 law courts. Transaction value (sector breakdown) - Volume in EUR Recreation and culture (1 deal) University of Reading accommodation PPP (EUR 275 million) Largest ever university accommodation project with a concession period of 125 years. University of Nottingham accommodation PPP (EUR 69 million) First project in the university accommodation sector combining residential and non‐residential elements. Barking and Dagenham housing PPP (EUR 91 million) Innovative social housing PPP which sees private investment being repaid by guaranteed rent over 60 years. Source: EPEC PPP Database Education (3 deals) Public order and safety (1 deal) Energy (1 deal) Environment (1 deal) Transport (1 deal) Housing and community services (3 deals) •7 7 The European PPP Market in Q1 2012 Conclusions • The European PPP market is shrinking: • Fiscal and financing constraints • UK and Spain, two of the most important national PPP markets, are currently revising their PPP initiatives • Natural contraction of the French PPP market • Only one transport PPP in Q1 2012: • A limited number of major transport PPPs are likely to close in 2012 (e.g. the Nimes‐Montpellier HSR and the A355 in France) • Non‐transport PPPs will probably account for more than 50% of the total PPP market at the end of 2012 •8 8 How to ensure successful PPP procurement European PPP Market is shrinking? EIB and EPEC Lessons learnt on PPP procurement •9 9 PPPs are contributing to investment and curtailing the risks borne by public authorities • Need to grow the volume of PPP transactions across the EU • • • The investment requirements of the transport, energy and digital broadband sectors are approximately EUR 2 trillion over the next decade. Around 75% relates to transport PPPs only presently finance a small share of EU infrastructure investments Financing needs for major transport infrastructure investments go well beyond the means of national budgets • Investment needs are so significant that they will require smarter use of public finance • • Innovative financial instruments to leverage private finance to complement grant funding of projects Co‐financing with banking and capital market institutions – the EU capital markets are a significantly under‐utilised source of finance for infrastructure, particularly large transport • Strategic benefits of PPP: better value money & risk management for the public sector • • • The value for money case (on time / on budget delivery) for private financing has been clearly demonstrated The ability to accelerate investments by attracting risk capital from equity, bank lending and capital market finance Developing a competitive market in infrastructure provision, both in Europe and outside 10 Promoting PPPs • EIB’s ‘crisis’ period lending was a key source of medium and long term debt for the European PPP market • Development of financial instruments is a key part of EIB’s support of the Europe 2020 Agenda • • • • Loan Guarantee for TEN‐Transport Project Bonds initiative Infrastructure Funds (more than 20 funds to date) Dedicated financial instruments to finance combating climate change • Technical and Financial Advisory services to the public sector • To help improve investment decision making, project implementation and better leverage of national and EU budgetary funds • The European PPP Expertise Centre, a core and unique initiative to support Member States in all aspects of PPP development and delivery •11 11 EIB PPP Financing EIB lending volume to PPP transactions by year – EUR billion EIB has provided substantial policy support and organisational capacity to foster the development of PPP markets and investments since the 1990s Population = 535 000 (266 000 premises incl. 25 000 businesses) Since 1990, EIB has progressively broadened geographic and sector spread of its PPP lending. The Bank is now one of the major funders of projects in Europe with a portfolio of about 140 projects and investment of around EUR 30 billion. Annual signatures averaging above EUR 2.5 billion since 2000, reaching EUR 3.8 billion in 2010 with EUR 2.6 billion in the transport sector. In 2011 signatures reached EUR 3.6 billion of which EUR 2.7 billion in the transport sector. EIB lending has been a key source of medium and long term debt for the European PPP market since 2007 •12 12 EIB PPP Financing Some PPP transactions closed in 2010 financed by the EIB GSM–R rail communication PPP in France Innovative transaction for the implementation of a mobile telephone network on 14,000 Km of French railways Pinhal interior highway in Portugal In this EUR 1.4 billion project the shadow toll model has been replaced with a user-pay scheme due to the financial difficulties faced by the Government Barcelona Metro line 9 in Spain Construction and operation of 51 stations of the new metro Line 9 in the city of Barcelona New Karolinska hospital in Sweden This EUR 1.1 billion project is the first healthcare PPP in the country Irish Schools Investment Programme (PPP) in Ireland Financing of a PPP programme entailing the DBFO of 23 post-primary and 4 primary schools •13 13 EIB PPP Financing Some PPP transactions closed in 2011 financed by the EIB LGV Tours-Bordeaux in France With its capital value of EUR 5.4 billion this can be considered one of the largest PPP transaction ever LGV Bretagne-pays de la Loire in France The second HSR PPP project reaching FC last year in France A-63 PPP motorway in France This EUR 1 billion project is the largest motorway PPP reaching FC in 2011 Nottingham Express Transit in the UK The only transport PPP inPopulation = 535 000 the UK an its largest project to close in 2011 (266 000 premises incl. 25 000 businesses) E-18 Koskenkylä-Kotka motorway in Finland First PPP in Finland since 2005 and one of the largest infrastructure projects in the country A-8 motorway in Germany This EUR 400 million project continues the A-modell series London Gateway in the UK (PF transaction, not a PPP) This EUR 400 million project continues the A-modell series •14 14 The European PPP Expertise Centre • Established in September 2008 • A unique cooperative initiative of the EIB, the European Commission and EU Candidate and Member States • International team of 18 professionals • Membership: Initially 20, EPEC now numbers 35 Members • Excellent engagement from Members with more than 120 participations annually in EPEC working groups •15 15 EPEC’s Mission: To help the public sector deliver more, and better, PPP deals EPEC’s activities: EPEC works by: Collaborative Working – Information sharing through member working groups. Sharing information, experience and expertise Institutional Strengthening – Policy and programme support through bilateral working with member organisations. Strengthening the organisational capacity of public authorities to develop PPP programmes Promoting good practice across the public sector Helpdesk – Service offered to members providing rapid responses to enquiries. •16 16 How to ensure successful PPP procurement European PPP Market is shrinking? EIB and EPEC Lessons learnt on PPP procurement •17 17 Successful PPP procurement Some lessons learned PPP deals are more complex than the traditional procurement route. A long‐ term coherent policy is key for capturing their advantages: • The challenges brought about by PPPs (e.g. fiscal risk, complex procurement and contract management, lack of flexibility) require a gradual approach: • The risks posed by the long‐term nature of PPP obligations for the public sector has to be well understood • The development, management and retention of PPP expertise in the public sector is easier when a clear, long‐term PPP policy is in place • Think of PPP programmes, not just PPP projects! • Concentrating purely on single projects will disperse the potential benefits from the identification and systematic reiteration of successful experiences (e.g. encourage private sector engagement, foster competition and efficiency, etc…) • The ‘balance sheet treatment’ of PPP is politically controversial – and not a valid guide to the economic merit of the investment •18 18 Successful PPP procurement Some lessons learned A well run PPP unit is one of many requisites to successfully launching and implementing a PPP programme: • PPP unit is a response to institutional gaps: • One size does not fit all • PPP unit(s) must reflect gaps in existing institutions to manage PPP programme • Must take into account the needs, capacity, culture, legal and administrative traditions • The PPP Institutional framework: an iterative process • Concentrating purely on policy, approvals or project delivery is insufficient • One needs to look at the entire institutional framework for delivering PPP •19 19 Successful PPP procurement Some lessons learned The PPP route brings comparative advantages to the various partners involved when: • Beneficial (and realistic!) risk allocation between the public and the private sector partner is provided • Proper risk management throughout implementation and operation should be ensured as well • The public sector and the private partner each focus on their core functions •20 20 Thank You! Andy Carty, Special Advisor EPEC - European PPP Expertise Centre [email protected] [email protected] www.eib.org/epec •21

© Copyright 2026