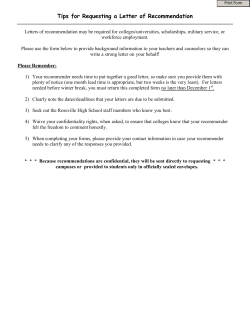

HOW TO SEND YOUR CHILD To College Without Going Broke