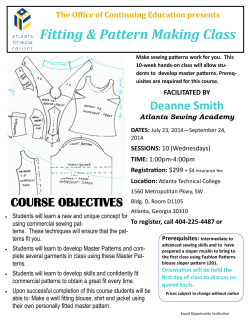

a c c o u n t s