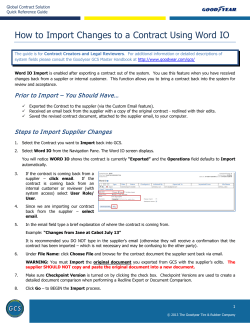

Control and Synergies in the Outsourced Supply Chain –