How to Avoid 5 Post-Acquisition-Integration Pitfalls

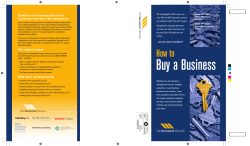

Mergers & Acquisitions Acquisition Advisory June 2014 M&A Newsletter Vol. 1 Doug Lovette Managing Partner [email protected] 312-332-6484 Michael Zycinski Director [email protected] 312-332-6485 Matt Clarke Director [email protected] 480-626-0017 One North Franklin Street Suite 3200 Chicago, IL 60606 www.thirdcoastca.com Recently Closed Transactions: an affiliated portfolio company of Sun Capital Partners Capital Raising Strategic Advisory How to Avoid 5 Post-Acquisition-Integration Pitfalls By: Matt Clarke Let's face it, effective integration is more complicated than getting the deal done. If you haven't been through it yet or might just be interested in a fresh perspective from someone who lives and breathes effective project management, read on. Larry Radowski of Integrated Project Management Company (www.ipmcinc.com) has partnered with Third Coast Capital on this article to share a few thoughts on integration pitfalls—not the obvious pitfalls around team design, communication, and development of the organization—but some pernicious pitfalls that will catch you off guard. Integration Manager Bias (functional and organizational) As an integration manager assumes their responsibility, there may be a natural bias to focus on their legacy function. This can especially be a problem in middle-market companies where managers wear many hats and usually have a day job while they take on the integration manager role. What can often happen in this scenario is that the integration manager doesn’t fully understand and effectively leverage those in the organization (and also those externally) that have knowledge in other functional areas. The key is to establish the team very carefully and recognize the strengths and weaknesses of the team, including the integration manager, and implement a structure that mitigates any risk. This sounds simple but is often overlooked, as quick appointments are made just to get things moving. (continue on page 2) Earnouts Can Bring Value Beyond Filling a Valuation Gap By: Doug Lovette In my experience, earnouts are often used where there is a gap in price between what a buyer is willing to pay and what a seller is willing to accept. In these cases, buyers and sellers can often have legitimate differing opinions as to the current and future value of the target company. Additionally, the metrics of the earnout often require the seller to deliver strong financial results in the future in order to justify the payments on the earnout. has acquired While an earnout remains a valid option to fill a valuation gap, at Third Coast we have worked with our corporate acquisition clients to use earnouts as a form of deferred purchase price instead of a reward for achieving projected future performance. The idea is to make the earnout a part of the purchase price as opposed to being in addition to the purchase price. has been sold The premise is as follows----if the seller delivers financials results that are consistent with the historical performance of the business, the earnout will be paid. To make this straightforward and simple, we typically base the earnout payments on a percentage of the gross profit dollars produced by the business. While EBITDA is also a common metric for earnouts and an appropriate measure given it is the basis for traditional valuation methodologies, we find that sellers are always concerned about the potential for increased operating expenses under new ownership and their related negative impact on EBITDA. The percentage amount applied to gross profit dollars is set at a level that will allow for most of the earnout to be paid over 2-3 years based on achieving the historical level of gross profit. To create an added economic incentive for the seller to help produce strong (continue on page 2) THIRD COAST CAPITAL ADVISORS, LLC Creative Ideas. Customized Solutions. Acquisition Advisory Mergers & Acquisitions Strategic Advisory Capital Raising How to Avoid 5 Post-Acquisition-Integration Pitfalls (cont.) Another related pitfall concerns the unintentional fostering of organizational bias, often seen where the integration manager allows the buying firm to interject its natural prejudice when evaluating people for future roles. This is the "we bought you--so we must be better" mentality. What's the best way to deal with integration manager bias? It is imperative for the integration manager to take an objective posture, look at the integration holistically, and have one eye on longterm sustainability. One simple way to achieve this is to appoint a third party integration manager, one that would not have any preconceived notions, or certain affinity for either company. Lack of Business KPIs before Go-Live Many businesses will wait to establish clear key performance indicators, or KPIs, for the acquired company until after the deal has closed. This does not refer to the projection and associated cost synergies, but rather fundamental business KPIs. Failing to set global business KPIs can be dangerous. Well before the acquisition closes, a governance plan with KPIs in place are needed. Management should keep one eye on the business while keeping the other on the integration process itself. When is the best time to establish these KPI goals? Typically during the last half of due diligence and in coordination with the target's management team. Underestimation of complexity Integrations are inherently complex, and complexity is not germane to the size of the deal or organizations being merged. Integration plans that are designed according to project management best practices to include a sufficiently detailed work plan need to be functionally established and owner sponsored. From day one the integration manager should be hands and should set the expectation that the integration will be complex. One best practice here is to engage the management team before the acquisition closes to review a summary of the integration work plan. The purpose of this summary is to create a mutual understanding of the complexities of the integration. In practice, IPM uses a scale from one to ten to help rank complexities for each part of the project and facilitate discussion. Larry has found this to be effective in preventing surprises and creating a team and sponsor that are cognizant of the "hot spots" in integration. Failure to Plan for Change Management It's not uncommon to get to day one with everyone fired up and ready to go with a detailed work plan to achieve synergies. But many times that work plan excludes the softer side of the integration—the impact to people. It is critical to (continue on page 3) Earnouts Can Bring Value Beyond Filling a Valuation Gap (cont.) future results, we also allow for payments to be in excess of the deferred purchase price (“earnout”) if they exceed historical levels of gross profit. As a protection for the buyer in the event of a large decline in the business, we often put in a minimum level of Gross Profit that must be attained in order for payments to occur. In some cases we have the earnout calculated and paid quarterly (as opposed to annually) and allow a second chance at the earnout if the company failed to achieve the minimum level in any given quarter. In this scenario, a missed payment could be made up at the end of the year if the annual gross profit dollars exceed the annual minimum levels in the calculation. The advantages of this structure to the buyer include: 1) an incentive for the selling owners to successfully transition the business and the clients; The advantages of this structure to the seller include: 1) an opportunity to earn more than the original purchase price for the business; 2) the ability to improve company performance by being part of a larger organization with greater resources; and 3) a chance to continue in a prominent role at the company to ensure continuing success. This type of structure does not fit all situations and all types of businesses, but it does work particularly well in services businesses or at companies where management continuity and client retention is critical to the success of the acquisition from the buyer’s point of view. 2) downside protection in the event that the business performs poorly in the first few years; and 3) an opportunity to pay for some of the purchase price over time. THIRD COAST CAPITAL ADVISORS, LLC Creative Ideas. Customized Solutions. Mergers & Acquisitions Acquisition Advisory Strategic Advisory Capital Raising Middle Market M&A Update During the first quarter U.S. Middle Market M&A activity dropped roughly 25%, while total disclosed deal value remained flat. The primary area of decline for both was transactions with values less than $50 million. The upper-end of the Middle Market with values between $250M-$750M exhibited the strongest growth with both the number of deals and deal values increasing approximately 10%. Despite statistical declines, our client activity supports a more favorable view and we believe that the M&A market is poised to grow in 2014 due to many favorable macro-economic trends. Product Line Expansion – A greater product offering allows a company to leverage its distribution systems and supplier and customer relationships. First, favorable credit markets and lending environment have enabled higher leverage levels for acquirers. Second, historically low interest rates are motivating management teams to utilize available capital for acquisitions. Lastly, private equity funds are sitting on a large inventory of companies and are looking to monetize many of their legacy investments. Enhanced Profitability – Leverage scale through more efficient sourcing and better utilization of overhead expenses. We believe that the outlook for deal activity in 2014 will be strong and the fundamental motivations for strategic M&A activity remain intact. Private companies are continuing to remain active acquirers, representing nearly half of the middle market M&A activity in the U.S. through 2014. Strategic buyers continue to be driven by revenue and cost synergies which are gained through market consolidation. The rationale for pursuing strategic acquisitions has not changed and includes many of the following: We believe that strategic consolidators will continue to leverage their improving balance sheet and make acquisitions for the foreseeable future. Sellers have yet to fully embrace the improving M&A market and have generally sat quietly on the sidelines biding their time. Through a proactive acquisition approach, strategic acquirers can offer a compelling value proposition which can often motivate a potential business owner into selling their business. U.S. Middle Market M&A Activity(1) U.S. Middle Market M&A Activity by Acquirer < $50M $50M‐$250M 7,000 $250M‐$750M 4,548 $500 5,155 4,203 4,144 3,964 $400 4,000 $300 3,000 Foreign Public 40.0% 35.0% 30.0% 25.0% 20.0% $200 2,000 $100 1,000 15.0% 10.0% 5.0% 0 $0 2006 (1) Private Equity 50.0% 45.0% 4,766 5,000 Vertical Integration – Down or upstream integration enables companies to provide turnkey solutions to customers or provide a captive material supply. Private $600 5,360 4,537 Market Position – Increased share creates a more defensible market position. Deal Value 6,224 6,000 Geographic /International Expansion – Limits a company’s exposure to regional cycles and enhances growth opportunities. 2007 2008 2009 2010 2011 2012 2013 LTM The Middle Market is defined as transactions less than $750 million and excludes real estate related transactions. 0.0% 2007 2008 2009 2010 2011 2012 2013 LTM Source: Dealogic Source: Dealogic THIRD COAST CAPITAL ADVISORS, LLC Creative Ideas. Customized Solutions. Acquisition Advisory Mergers & Acquisitions Capital Raising Strategic Advisory How to Avoid 5 Post-Acquisition-Integration Pitfalls (cont.) understand how organizational cultures will be merged; How will I be treated? Will I lose my job? Will I be asked to do something I can’t? Will I get a new boss? Etc. Without a solid change management plan, fear and de-motivation will creep in and undermine a successful integration. Since one of the most important assets in many transactions is the know-how of the people, it’s important to get this right. The following resources can be helpful when considering what questions to ask regarding change management and how to incorporate change management practices into your integration: www.prosci.com, www.ipmcinc.com, and www.lamarsh.com. Planning for Unachievable Synergies There are synergies you plan for that have a clear path to realization and then those that are either hard to achieve or are unachievable. Many companies plan for these unachievable synergies. This can be avoided or minimized by taking an up-front hard look at the assumptions built into the plan. Since the integration manager is responsible to help achieve these synergies, it makes sense to get them involved early enough in the modeling stage, so that they can understand and buy-in to the synergy objectives and assumptions. The integration manager should have the purview to question and develop an understanding of how the synergies were derived, what the tolerance is, if any, in achieving the quantitative goals, and also to get a jump on thinking about risk mitigation strategies. This vetting of synergies early on, will help the integration manager to confidently drive the project and also provide an additional perspective to prevent chasing a misaligned synergy and to ensure that the integration team is not embarking on an “eyes wide shut” venture. Integration issues can be thorny, particularly the less obvious ones. I appreciate Larry’s contributions to this article. If you’re comfortable responding in the blog, please share any relevant thoughts and experiences, or if you have questions, we'd be happy to get back to you. Third Coast Capital Advisors LLC is a full service financial advisory firm that serves the unique needs of corporate clients involved in M&A related transactions. Third Coast Capital Advisors is exclusively dedicated to advising companies on acquisitions, sales, divestitures, mergers and capital raising. THIRD COAST CAPITAL ADVISORS, LLC Creative Ideas. Customized Solutions.

© Copyright 2026