How to read your payslip

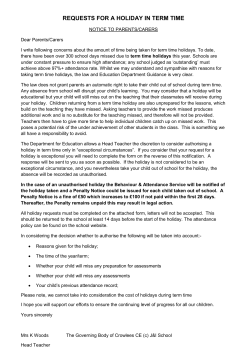

w w w . 1s tco nta ct. c om How to read your payslip Employer Employee Employee No Date 1st Contact Payroll Limited 1 Mrs Jo Bloggs 2 W1423 3 22/11/2013 4 Payslip No NI No Tax Code Frequency Tax Period 634875 5 YY000000B 6 944L 7 WEEKLY 8 201333 9 Year to Date Description Payment Deductions Amount Total Pay Taxable Pay Tax Paid 10 7,228.09 Basic Pay 11 4,946.22 Holiday Pay 12 0.00 NIable Pay Employees NI 13 4,946.22 14 351.83 Holiday Year To Date 29 Accrued Paid 15 16 760.59 760.59 Balance 17 0.00 18 285.31 Tax Paid 24 19 116.32 EE NI Contribution 25 Total Taxable Pay 20 354.62 Company Expensess 21 678.37 Total Non-Taxable Pay 22 678.37 Total Pay 23 1,080.00 Employers NI Weekly Fee 26 27 0.00 24.67 28.51 18.50 Deduction 28 71.68 NET PAY 29 1,008.32 Payment details 1008.32 will be paid to your account. Description Amount Company Expenses allocated: 678.37 Pay rate breakdown 30 Units Rate Name 40 Hours £27.00 Pay 27.00 See next page for key. 44688 Total 1 1080.00 21 w w w . 1s tco nta ct. c om How to read your payslip 1. Our Company: The name of the company responsible for processing your pay 2. Employee name 3. Employee number: The employee number that you’ve registered on our database 4. Date that your payslip will be available online 5. Number of the payslip issued to you 6. Your National Insurance (NI) number 7. The tax code used for your payment 8. Your payment frequency, i.e. weekly, monthly, fortnightly 9. The tax period during which your payment was processed 10. Total of gross pay processed in the current financial year 11. Total taxable pay for the current financial year 12. Total tax paid for the current financial year 13. The year-to-date amount that your National Insurance contribution is calculated on 14. The amount of employees National Insurance paid during the current financial year 15. The amount of holiday pay accrued during the current financial year 16. The amount of holiday pay paid during the current financial year 17. The balance of your holiday pay not yet paid to you 18. The portion of your basic pay not affected by company work-related expenses claimed or holiday pay 19. The portion of your total pay that relates to your holiday pay 20. Your taxable pay, i.e. the amount you pay that your PAYE contribution is calculated on 21. The amount of business-related expenses claimed and allowed under HMRC’s regulations 22. Your non-taxable-pay, i.e. the amount of your pay that PAYE was not calculated on 23. Total amount we received from your agency and processed for you 24. Total PAYE deducted based on your taxable pay and tax code 25. Employee’s National Insurance contributions, based on the HMRC rate 26. The Employer’s National Insurance contributions based on HMRC rate 27. The 1st Contact fee for processing your timesheet 28. The total deductions processed 29. The amount to be paid into your account 30. Breakdown of various rates (if applicable) that you may have been paid for the pay period Contact details Tel: Email: 0207 759 7535 Address: 1st Contact, Castlewood House, 77-91 New Oxford Street, London, WC1A 1DG [email protected] 2

© Copyright 2026