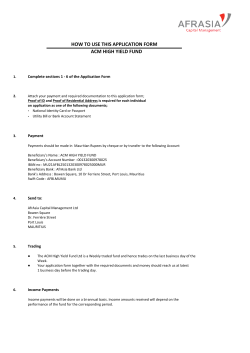

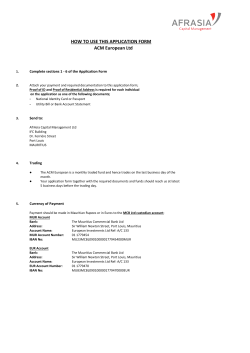

e we hy ar W ng