How to Afford a Christian Education Presented by: Julie Welch

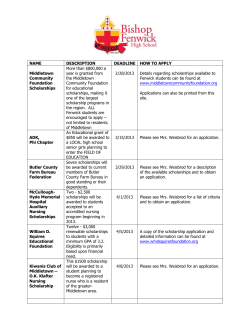

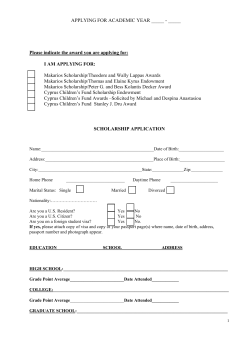

How to Afford a Christian Education Presented by: Julie Welch Admissions Counselor and Financial Aid Consultant Invest today in the Christian leaders of tomorrow! Scholarships, grants, Tax Credits & tuition rebates 1. Is my family eligible to receive a scholarship? 2. How do I apply? Who provides the funding for these programs? Scholarship Funding Sources: School Tuition Organizations -STO Az Lutheran Scholarship Organization- ALSO Az Private Education Scholarship Fund-APESF School Choice Arizona – SCAZ Corporate STO Lutheran Education Foundation, Inc. - LEF & FAIR Institute for Better Education - IBE & CFA Az Scholarship Fund www.AzScholarships.org Thanks to the Arizona Tax Credits Donations! Arizona Tuition Tax Credit Arizona law passed in 1997 Allows taxpayer to recommend tax dollars in name of Specific Student Specific School Dollar for Dollar reduction in AZ taxes Tuition Tax Credit Guidelines Students entering Kindergarten to HS Maximum of $1000 for married/jointly Maximum of $500 for single/head of household Cannot recommend your own child Tax Liability Az Private Education Scholarship Fund APESF Representative: Kristen Adams www.apesf.org Qualified 501 C(3) charity Over 90% of every dollar given goes toward scholarships for K-12th graders. Individual and Corporate tax credit donations are processed at APESF Financial Need Based scholarships are awarded, funded with tax credit donations. APESF Operating since 1999 Among Top 10 largest STO’s (out of 50+) “Boutique” STO with creative solutions for families APESF Website www.apesf.org School Choice/STO Blog with Latest News Donate and Apply Online FASToolkit APESF Individual Tax Credit Program Donors make a tax credit donation to APESF and recommend… Specific Student Specific School (Risen Savior) General Fund Families can apply to APESF and receive scholarships based on… Donor recommendations Financial Need Student Merit APESF The FASToolkit is a series of customizable PDF templates that you can use to communicate the advantages of the Arizona Tuition Tax Credit program to your family, friends and business associates! 1. Go to www.apesf.org and choose one of our many different FASTemplates to create your own Family Page! 2. Customize your Family Page by writing your own letter or paragraph about your child...you can even upload family pictures! 3. Send your Family Page by mail or electronically with a copy of our Donation Brochure to all your family, friends and business associates! APESF Apply Online at www.APESF.org 4 Distributions Per Year February, May, August, November (deadlines are last day of previous month) Awards Needs Based & Merit Based Scholarships in MAY distribution Awards are $500 - $1500 APESF NEW! Redirect your Payroll Tax New law, effective January 1, 2010 Your employer will hold a portion of your withholdings and pay APESF quarterly instead of paying AZ Participation is voluntary Now you can make a donation without having to provide the money up front or in one large sum! Visit http://apesf.org/payrollwithholdings to get started! APESF Corporate Tax Credit Program In 2006, the Arizona Corporation School Tuition Tax Credit Law, A.R.S. Section 43-1183 passed to allow C-corporations to receive a dollar-for-dollar tax credit against their corporate state income tax NO LIMIT to the amount of the tax credit Contributions are subject to a statewide cap of $17.28 million for 2009-2010. This cap increases each year by 20%. Must have the cash flow to make the donation Donors can recommend a school but not a specific student APESF Corporate Tax Credit Program How to Donate Complete a Corporate Donation Form online at http://apesf.org/corporate-donation-form APESF will submit an approval request for the contribution to the AZ Department of Revenue. If the state-wide cap has not been met, ADOR will respond within 20 days approving the contribution. Once APESF receives approval notification, the corporation will have 10 days to make payment to APESF. (If payment is not made within 10 days, the contribution will be taken out of the cap and the process must start all over again.) The corporation will take the credit on its next tax return, but may carry any unused credit forward for up to five years. STO for Risen Savior Everyone connected with ALSO volunteers their time – from the board of directors to our annual planning committee to the people who process donations. We have no payroll overhead expenses. That means that more of your donation goes directly to student scholarships! Students K-6th grades, enrolled for 2010-11 school year are eligible to apply for Financial Need Based scholarships. To apply contact the school office for applications Application deadline – May 15 for Summer Distributions Corporate Scholarship School Choice Arizona, Inc. www.schoolchoicearizona.org New Students Kindergarten-High School 3 Year Renewable Scholarship - $1,000 - $5,600 Criteria Child starting Kindergarten or/ attended a public or charter school as a full-time student for at least the first 100 days of the previous school year. Needs Based – Specific Income Chart *see chart Corporate Scholarship School Choice Arizona, Inc. www.schoolchoicearizona.org Household Size Annual Gross Income ARIZONA CORPORATE TAX CREDIT GUIDELINE 1 $20,036.00 $37,066.60 2 $26,955.00 $49,866.75 3 $33,874.00 $62,666.90 4 $40,793.00 $75,467.05 5 $47,712.00 $88,267.20 6 $54,631.00 $101,067.35 7 $61,550.00 $113,867.50 8 $68,469.00 $126,667.65 Each Additional Person $6,919.00 $12,800.15 The chart above is a duplication of the actual guideline on the eligibility page of the SCAZ Corporate Scholarship application. It is for demonstration purposes only. Please refer to the actual chart to determine your eligibility. The chart above lists the national reduced price lunch guidelines for 2009-10 school year and then the corresponding corporate tuition tax credit guidelines (Column 2 x 185%). Tuition Rebates Tuition Rebates are through a gift card program. which means….. “Substitute Money” Tuition Rebates using Fry’s Grocery Gift Cards Hundreds of retailers to choose from….here’s how it works. Purchase gift cards to places you already shop and use the cards as your form of payment. • Rebates go towards your tuition costs. • REGISTER TODAY and begin earning your rebates! • Grocery Gift Cards • Earn rebates up to 6% on purchases at Fry’s Grocery Stores, including gas stations and Kroger locations. • Link Gift Card to VIP Cool Cash and earn up to 2% for the school/organization. Increase your rebate earnings by combining 2 types of substitute money. • Reload your Fry’s Grocery Card and use it to by other retailer Gift Cards at the service desk in Frys. (i.e. Target, Southwest Airlines) * Be aware of activation fees that some retailers charge on gift cards like phone cards & credit cards. Order Your Card! $5.00 Required to activate card, will be loaded onto the card for purchases. Other STO Grants For Kindergarten to 6th grade students enrolled for 2010-11 school year at RSLS Letter of Circumstance Start by writing a letter to the Scholarship Committee 1. Explain your situation 2. Provide details about your financial hardship, personal sacrifices, income or expense changes. 3. Share about your child - Academic achievements, school involvement, &/or personal growth. Remember the committee does not know you – provide details to help them understand you. You are the voice for your child ~ share your heart! Lutheran Education Foundation, Inc. About LEF - Lutheran Education Foundation (LEF) provides scholarships to needy children in K-12th grades, enabling them to attend a Lutheran school of their choice in Arizona. Arizona legislation enacted in 1997 permits individuals to reduce their Arizona income tax liability for contributions to certain entities known as “school tuition organizations” (STO’S). LEF was incorporated in response to this legislation and is a 501(c)3 non-profit “STO”. To date, LEF has designated 100% of the donations received toward scholarships, with no amounts used for administrative costs. LEF awarded scholarships to students representing 14 Lutheran schools throughout Arizona. To ensure that only the most needy students receive funds, donors may not name recipients, however designation can be made to specify a qualifying Lutheran School. LEF awards scholarships solely on the basis of financial need. Parents submit applications to an independent outside evaluation service, FAIR, which computes the suggested scholarship amount. The LEF Board of Directors makes the final determination. www.FAIRAPP.com Apply Online www.fairapp.com School Code 600 Password lef600 Welcome to Financial Aid Independent Review • We are currently accepting online applications for the 2010 - 2011 school year. FAIR provides objective, comprehensive and affordable financial need analysis services to private and parochial schools. In order for families to apply online, you will need the following: • 1. A valid email address. 2. A credit card to complete payment processing - $25 .00 fee per application. 3. Most recent Federal Income tax return with all schedules and most recent W-2's and/or 1099 forms. Once you have created your user account and signed in you will be able to complete the FAIR application online. To begin the application process click on the "Online Application" link. Application Deadline 4/15/10 Institute for Better Education Apply Online at www.ibescholarships.org Financial Need Based Assistance Step 1: Fill out Application. This Assistance requires an evaluation of your family’s need; 1. IBE Application. (One per student) Contact your school for this application, or you can locate this on line at www.ibescholarships.org to submit electronically 2. Financial Analysis Application (one per family) must be completed. This can be done online at www.cfslogin.com or contact your school for this application. 3. A copy of last year’s IRS form 1040 4. A letter of explanation if you believe you have unusual or extenuating circumstances that you would like the Scholarship Committee to consider. Step 2: Review by the Scholarship Committee. They will review your processed application in light of the assistance you qualify for and the amounts available for distribution. The personal information that you are required to provide for application is kept confidential within this committee. Step 3: Decision. IBE’s Scholarship Committee begins meeting in April and continues monthly till all funds are dispersed. IBE will inform you of the committee’s decision. After the IBE application go to CFA www.cfslogin.com Institute for Better Education After the IBE application go to CFA www.cfslogin.com We also require a Confidential Financial Analysis (CFA) be completed online at www.cfslogin.com. There is a $20 fee for the CFA, and you will need to set up a username and password in order to complete the analysis. School Code : 60099 The deadline to submit ALL paperwork is April 15, 2010 Financial Analysis Application Arizona Scholarship Fund Arizona’s CHOICE in Education K-12 Private School Scholarships & Tuition Assistance Apply Online at www.AzScholarships.org Provides Needs Based and Merit Based Scholarships No Deadline Date and No Application Fees RSLS Tuition Assistance If additional assistance is still needed after scholarship award determinations are received, then: • Internal tuition assistance may be available. Please make an appointment with the Principal to discuss your options. •Scholarships provided are funded by multiple sources including ALSO scholarships. •An application with ALSO and tax documents may be required in order to be eligible. Contact the school office for application deadlines How to Afford a Christian Education “We’ve got scholarships, yes we do! I applied for a grant, how ‘bout you?”

© Copyright 2026