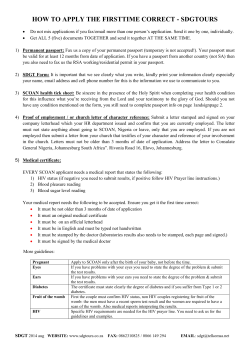

GLOBAL LABOUR UNIVERSITY, GERMANY