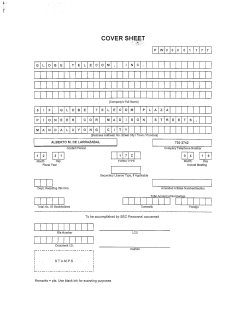

Document 255966