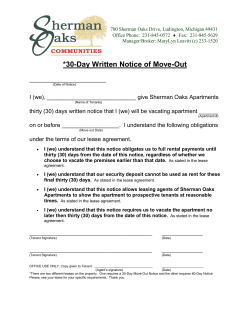

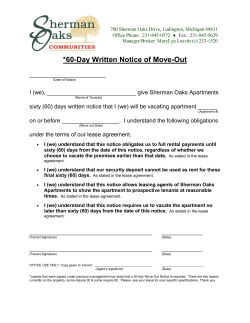

COVER SHEET