Unioil Resources 2013 Q1 Quarterly Report SEC Form 17-Q

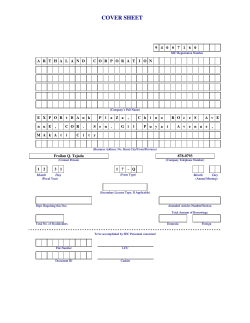

COVER SHEET 1 3 8 8 7 9 S.E.C. Registration Number U N I O I L R E S O U R C E S C O M P A N Y , I & H O L D I N G S N C . (Company's Full Name) 6 T H H V F L O O R D E L A M A K A T I S A G I C O S T A 0 3 I S T S A L C E D O . U S C O N D . V I L L C I T Y ( Business Address : No. Street City / Town / Province ) ATTY. ABELARDO B. ALBIS, JR. Contact Person Month T T A R 3 1 Day (632) 892-7002 Company Telephone Number SEC FORM 1 7 - Q 0 6 FORM TYPE Month Fiscal Year * Day Annual Meeting N/A *2nd Wednesday Secondary License Type, If Applicable N/A Dept. Requiring this Doc. Amended Articles Number/Section Total Amount of Borrowings Domestic Total No. of Stockholders To be accomplished by SEC Personnel concerned File Number LCU Document I.D. Cashier STAMPS ` Remarks = pls. use black ink for scanning purposes N/A Foreign SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-Q QUARTERLY REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODE AND SRC RULE 17(2)(b) THEREUNDER 1. For the quarterly period ended March 31, 2013 2. Commission identification number.138879 3. BIR Tax Identification No. 320-000-508-263 UNIOIL RESOURCES & HOLDINGS COMPANY, INC. 4. Exact name of issuer as specified in its charter Republic of the Philippines 5. Province, country or other jurisdiction of incorporation or organization 6. Industry Classification Code: (SEC Use Only) 6th Floor Sagittarius Condominium, H.V. dela Costa Street, Salcedo Village, Makati City 7. Address of issuer's principal office Postal Code (02) 892-70-02____ 8. Issuer's telephone number, including area code _______________________________ 9. Former name, former address and former fiscal year, if changed since last report 10.Securities registered pursuant to Sections 8 and 12 of the Code, or Sections 4 and 8 of the RSA Title of each Class Common Number of shares of common stock outstanding 1,589,559,997 11. Are any or all of the securities listed on a Stock Exchange? Yes [ x ] No [ ] If yes, state the name of such Stock Exchange and the class/es of securities listed therein: _______________________________ _______________________ 12. Indicate by check mark whether the registrant: (a) has filed all reports required to be filed by Section 17 of the Code and SRC Rule 17 thereunder or Sections 11 of the RSA and RSA Rule 11(a)-1 thereunder, and Sections 26 and 141 of the Corporation Code of the Philippines, during the preceding twelve (12) months (or for such shorter period the registrant was required to file such reports) Yes [ x ] No [ ] (b) has been subject to such filing requirements for the past ninety (90) days. Yes [ x ] No [ ] SEC Form 17-Q 1st Qtr 2013 PART I – FINANCIAL INFORMATION Item 1. Financial Statements Please see attached Financial Statements. Notes to Financial Statements The preparations of the accompanying consolidated financial statements have been prepared in accordance with the Philippines Financial Reporting Standards (PFRS) and the same have been applied consistently on any interim and annual financial statements. 1. The same accounting policies and methods of computation are followed in the interim financial statements as compared with the most recent annual financial statements. 2. There is no seasonal or cyclical element which affects interim operations 3. There are no reversal changes on items affecting assets, liabilities, equity, net income or cash flows. 4. There were no issuance, repurchases and repayments of debt & equity securities. 5. There were no dividends paid in the interim period in question. 6. There were no material events subsequent to the end of the interim period that have not been reflected in the financial statements for the interim period. 7. There were no changes in the composition of the issuer during the interim period. 8. There were no changes to contingent liabilities or assets since the last annual balance sheet. 9. There are no material contingencies or other event that maybe material to the understanding of the current interim period. 10. Net loss per share is computed by dividing the net loss during the period by the total shares outstanding equivalent to 1,548,824,027. SEC Form 17-Q 1st Qtr 2013 Item 2. Management’s Discussion and Analysis of the Financial Condition and Results of Operations For the first quarter of year 2013, the Company’s consolidated revenues based on interim financial statements, is registered at P913,234 consisting mainly of interest, rental income and other income. The same quarter of last year posted revenues amounting to P1,154,755. Costs and expenses on the other hand had decreased by P1,724,977 or almost 8% from P1,878,793 of the same quarter last year. Consolidated total assets as of March 31, 2013 amounted to P313,564,991 while December 31, 2012 had balance amounting to P314,399,152 resulting to a decrease of .3% equivalent. Total consolidated liabilities amounted to P855,746,485 of which 96% or P822,238,237 equivalent represents advances from related parties. Compared to the balance of consolidated liabilities as of December 31, 2012, there was a decrease of 22,418 due to payments of advances from related parties. There are no known trends that affect the liquidity of the Company other than the ability to liquidate its current assets. Neither is there any commitment for capital expenditures by the Company. Further, there are no known trends, events or uncertainties that would reasonably have an impact on the revenues of the Company and its subsidiaries. Lastly, the Company is not dependent on any seasonal aspect that would affect its financial condition and operations. There are no material changes, events or uncertainties known to management that would address the past or would have an impact on future operations that may cause one or more items in Unioil’s financial statements. The Registrant continues to find solutions to its overdue loans from investors brokered by Wincorp. This may include selling and converting into cash its stake in one of its subsidiaries (BU Properties). Likewise, there are no off-balance sheet transactions, arrangements, obligations (including contingent obligations) and other relationships of the Registrant with unconsolidated entities or other persons created during the reporting period. Since the parent company is inactive in its operation, it has no accounts receivable balance as of the reporting period. Thus, there was no schedule of aging of accounts receivables prepared and included to this report. SEC Form 17-Q 1st Qtr 2013 Financial Soundness Indicators Consolidated 03.31.13 12.31.12 Parent 03.31.13 12.31.12 Current liquidity ratio 0.017 0.017 0.014 0.014 Solvency ratio 0.366 0.367 0.788 0.792 Debt-to-equity ratio -1.539 -1.541 -4.719 -4.809 Asset to equity ratio -0.56 -0.57 -3.72 -3.81 Key Performance Indicators On Sales The Registrant together with its subsidiaries is generating very minimal amount of revenues. The condominium unit owned by the Registrant has been utilized as office of the Registrant and one of its subsidiaries, Wincorp. Part of the unit is being rented out and in the recent information from the tenant, they will surrender portion of the rented premises. Since May 2000, one of the wholly owned subsidiaries of Registrant, WINCORP, has been issued a Cease and Desist Order by the Securities and Exchange Commission while the other one (B. U. Properties) continues to operate at a loss. While WINCORP no longer operates as it used to, three (3) subsidiaries are non-operating. Options being considered are the increase in capitalization through the call of subscriptions and sale of acquired assets. Conversion of Non-Current Assets to Cash To cover the shortcomings, the Company plans to convert some of its noncurrent assets into cash and embark on a program to liquify potential assets. SEC Form 17-Q 1st Qtr 2013 Liquidation of Non-Performing Assets/ Companies The company also plans to convert or sell its interest in one of its profitgenerating subsidiary to raise the much-needed cash. It also plans to liquidate nonperforming assets/companies e.g. Wincorp, by spinning it off from Unioil. The aforementioned programs are expected to generate sufficient cash to answer for its current obligations. Cost Reduction Scheme The Registrant’s majority-owned subsidiaries reduced the number of their staff to save on cost. Wincorp has only (1) one staff and an Officer who act as consultant of the company while B.U. Properties reduced its staff component to only (1) one and (4) four officers to continue its operation. As a result of trimming down the staff of Wincorp, it also reduced the area it was previously being occupied to save on rent. Other Income B. U. Properties, one of the Registrant’s majority-owned subsidiaries, mainly relies on its minimal rental income to answer for its current obligations. SEC Form 17-Q 1st Qtr 2013 UNIOIL RESOURCES AND HOLDINGS COMPANY, INC. CONSOLIDATED BALANCE SHEETS March 31, 2013 (With Comparative Figures for December 31, 2012) Consolidated 03.31.13 Parent 12.31.12 03.31.13 12.31.12 ASSETS Current assets Cash and other cash items P Accounts receivable Trading account securities Other current assets Total current assets 6,425,041 P 7,204,801 1,209,506 1,209,506 1,171,773.00 1,171,773.00 5,179,060 13,985,380 P 5,149,546 14,735,626 Non Current assets Equity investments and advances 100,821,338 100,821,338 Allowance for probable losses (54,651,384) (54,651,384) Property and equipment - net 5,271,611 25,436,377 Investment Property Other non current assets Total non current assets P 222,701,669 299,579,611 TOTAL ASSETS P 313,564,991 P 24,918,079 P P P 99,209 P 96,167 - - - - 454,105 553,313 P P 448,105 544,272 62,356,340 62,356,340 - - 5,355,526 142,070 225,985 25,436,377 1,326,052 1,326,052 222,701,669 299,663,526 130,169 63,954,630 P P 130,169 64,038,546 314,399,152 P 64,507,944 P 64,582,818 24,887,998 P 4,394,053 P 4,394,053 LIABILITIES AND STOCKHOLDERS' EQUITY Liabilities Current liabilities Accounts payable and accrued expenses Advances from related parties Other Current Liabilities Total current liabilities P 822,238,227 P 124,600 847,280,906 822,290,726 P 124,600 847,303,324 35,966,405 P Non current liabilities Interest payable Subscription payable 8,147,177 8,147,177 124,600 40,485,058 35,652,438 P 124,600 40,171,091 32,901,993 32,901,993 8,147,177 8,147,177 Other non current liabilities Total non current liabilities P 318,402 8,465,579 P 318,402 8,465,579 P 318,402 41,367,572 P 318,402 41,367,572 TOTAL LIABILITIES P 855,746,485 P 855,768,903 P 81,852,630 P 81,538,663 Minority interest Stockholders' Equity Capital stock - P1 par value Authorized - 5 billion shares Issued and outstanding - 1,548,824,027 shs Subscribed - 40,735,950 shares (subscriptions receivable on which amount to P23,979,350) Deficit Net Stockholders' Equity ( Capital Deficiency) P 14,025,765 14,025,765 - - 1,548,824,027 1,548,824,027 1,548,824,027 1,548,824,027 16,756,600 16,756,600 16,756,600 16,756,600 (2,121,787,886) (556,207,259) 313,564,991 P NOTE The company discontinue applying the equity method of carrying investment in shares of stock of Westmont Investment Corporation as the balance of its cost of investment was already reduced to zero. This resulted to differences in the deficit between the consolidated and parent company financial statements. (2,120,976,143) (555,395,516) 314,399,152 P (1,582,925,314) (17,344,687) 64,507,944 P (1,582,536,473) (16,955,846) 64,582,818 UNIOIL RESOURCES AND HOLDINGS COMPANY, INC. AND SUBSIDIARIES STATEMENTS OF INCOME FOR THE THREE MONTHS ENDED MARCH 31, 2013 (With Comparative Figures for the period ended MARCH 31, 2012) Consolidated Jan to March 2013 Parent Company Jan to March 2012 Jan to March 2013 Jan to March 2012 REVENUES Interest income P 41 P 276 P 41 P 276 Equity share in net income of a subsidiaries Rental Income Investment and other income 3,000 29,786 910,193 1,124,693 3,000 29,786 913,234 1,154,755 3,041 269,558 1,724,977 1,878,793 391,882 407,443 - - - - 1,724,977 1,878,793 391,882 407,443 811,743 724,038 388,841 137,885 - - 239,496 EXPENSES Operating Interest and other charges Equity in net losses of subsidiaries NET LOSS/(INCOME) BEFORE MINORITY INTEREST LOSS APPLICABLE TO MINORITY INTEREST - IN CONSOLIDATED SUBSIDIARIES NET LOSS (INCOME) DEFICIT AT THE BEGINNING OF PERIOD 811,743 724,038 388,841 137,885 2,120,976,143 2,114,243,321 1,582,536,473 1,581,677,699 PRIOR PERIOD ADJUSTMENT - DEFICIT AT END OF PERIOD LOSS/(INCOME) PER SHARE 2,121,787,886 P 0.00052 - 2,114,967,359 P 0.00047 - 1,582,925,314 P 0.00025 (0) NOTE The company discontinue applying the equity method of carrying investment in shares of stock of Westmont Investment Corporation as the balance of its cost of investment was already reduced to zero. This resulted to differences in the deficit between the consolidated and parent company financial statements. - 1,581,815,585 P 0.00009 UNIOIL RESOURCES AND HOLDINGS COMPANY, INC. AND SUBSIDIARIES STATEMENTS OF INCOME FOR THE THREE MONTHS ENDED MARCH 31, 2013 (With Comparative Figures for the period ended DECEMBER 31, 2012) Consolidated 03.31.13 Parent Company 12.31.12 03.31.13 12.31.12 REVENUES Interest income P 41 P (5,626,389) P 41 P 483 Equity share in net income of a subsidiaries Rental Income Investment and other income 3,000 2,963,232 910,193 239,496 913,234 3,000 117,643 239,496 (2,423,661) 3,041 357,622 EXPENSES Operating 1,724,977 7,709,630 391,882 1,204,563 - - - - 1,724,977 7,709,630 391,882 1,204,563 811,743 10,133,290 388,841 846,940 - 2,056,651 - - - 2,375,639 - - 811,743 5,701,000 388,841 846,940 Interest and other charges Equity in net losses of subsidiaries NET LOSS BEFORE MINORITY INTEREST LOSS APPLICABLE TO MINORITY INTEREST IN CONSOLIDATED SUBSIDIARIES PROVISION FOR INCOME TAX- DEFFERED NET LOSS EXPIRED PORTION OF DEFERRED CHARGES MCIT DEFICIT AT THE BEGINNING OF PERIOD (83,615) 2,120,976,143 2,115,191,528 PRIOR PERIOD ADJUSTMENT 1,582,536,473 2,121,787,886 P - 0.00052 2,120,976,143 P 0.00368 - 1,582,925,314 P 0.00025 *Net loss per share is computed by dividing the net loss during the period by the total shares outstanding equivalent to 1,548,824,027. NOTE The company discontinue applying the equity method of carrying investment in shares of stock of Westmont Investment Corporation as the balance of its cost of investment was already reduced to zero. This resulted to differences in the deficit between the consolidated and parent company financial statements. 1,581,677,699 - DEFICIT AT END OF PERIOD LOSS PER SHARE* (11,833) - 1,582,536,473 P 0.00055 UNIOIL RESOURCES AND HOLDINGS COMPANY, INC. AND SUBSIDIARY STATEMENTS OF CASH FLOWS FOR THREE MONTHS ENDED MARCH 31, 2013 (With Comparative Figures for Three Months Ended March 31, 2012) Consolidated 03.31.13 Parent 03.31.12 03.31.13 03.31.12 CASH FLOWS FROM OPERATING ACTIVITIES Net income (loss) P (811,743) P (724,038) P (388,841) (137,885) Adjustments for: Interest expense 0 Depreciation 83,915 Interest income 0 Operating income (loss) before working capital changes - - 83,915 - - 83,915 - (727,828) (640,122) Installment Receivables 0 0 Loans 0 Advances and Other Receivable 0 83,915 - (304,926) (53,970) Decrease (increase) in: Prepaid expenses and other current assets (29,514) - - - 0 (120,315) 0 0 (6,000) 0 Increase (decrease) in: 0 - - - Interest received Deposit liabilities 0 - - - Interest expense 0 - - - Accounts payable and accrued expenses 30,081 Other Liabilities - Net cash provided by (used in) operating activities 37,777 (7,799) (727,260) (730,459) - 38,659 (310,926) (15,311) CASH FLOWS FROM INVESTING ACTIVITIES Decrease (increase) in other noncurrent assets - Proceeds from (acquisition of) property and equipment (295,225) - Net cash from (used in) investing activities - (295,225) - - - - - CASH FLOWS FROM FINANCING ACTIVITIES Minority Interest Proceeds from advances from other related parties Net Cash from (used in) financing activities INCREASE (DECREASE) IN CASH & CASH EQUIVALENTS CASH & CASH EQUIVALENTS, JANUARY 01 CASH & CASH EQUIVALENTS, MARCH 31 P - - - - (52,499) 52,441 313,967 0 (52,499) 52,441 313,967 0 (779,759) (973,243) 3,041 - - - - 7,204,801 6,865,524 96,167 0 6,425,041 5,892,280 99,209 NOTE The company discontinue applying the equity method of carrying investment in shares of stock of Westmont Investment Corporation as the balance of its cost of investment was already reduced to zero. This resulted to differences in the deficit between the consolidated and parent company financial statements. (15,311) (15,311) UNIOIL RESOURCES AND HOLDINGS COMPANY, INC. AND SUBSIDIARIES STATEMENTS OF CHANGES IN EQUITY FOR THE PERIOD ENDED MARCH 31, 2013 (With Comparative Figures for March 31, 2012) Consolidated Amount Balance as of December 31, 2011 No. of shares Issued & Outstanding Subscribed 5,000,000,000 1,548,824,027 16,756,600 Net Loss for the quarter - - - Balance as of March 31, 2012 5,000,000,000 1,548,824,027 Balance as of December 31, 2012 5,000,000,000 - Net loss for the quarter Balance as of March 31, 2013 5,000,000,000 P Deficit Total (2,114,243,321) (548,662,694) (724,038) (724,038) 16,756,600 (2,114,967,359) (549,386,732) 1,548,824,027 16,756,600 (2,120,976,143) (555,395,516) - - (811,743) (811,743) 1,548,824,027 P 16,756,600 P (2,121,787,886) P (556,207,259) Parent Company Amount Balance as of December 31, 2011 No. of shares Issued & Outstanding Subscribed 5,000,000,000 1,548,824,027 16,756,600 Net Loss for the quarter - - - Balance as of March 31, 2012 5,000,000,000 1,548,824,027 Balance as of December 31, 2012 5,000,000,000 - Net loss for the quarter Balance as of March 31, 2013 5,000,000,000 P Total (1,581,677,699) (16,097,072) (137,885) (137,885) 16,756,600 (1,581,815,585) (16,234,958) 1,548,824,027 16,756,600 (1,582,536,473) (16,955,846) - - (388,841) (388,841) 1,548,824,027 NOTE The company discontinue applying the equity method of carrying investment in shares of stock of Westmont Investment Corporation as the balance of its cost of investment was already reduced to zero. This resulted to differences in the deficit between the consolidated and parent company financial statements. Deficit P 16,756,600 P (1,582,925,314) P (17,344,687)

© Copyright 2026